A Comprehensive Guide To Student Loan Forgiveness

Updated June 2024

Are you drowning in student loan debt and feeling like there’s no way out?

You’re not alone.

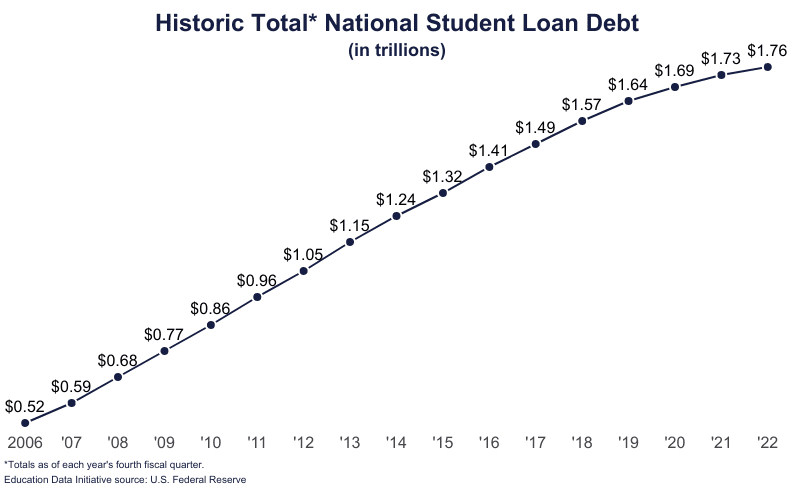

Student loan debt is increasing every year across all age groups.

If you’re part of the above graph…take a deep breath and relax.

The Ultimate Guide to Student Loan Forgiveness is here to help you unlock your financial freedom. In this comprehensive guide, we’ll walk you through the various forgiveness programs available, helping you navigate student loan forgiveness.

Whether you’re a recent graduate struggling to make ends meet or have been carrying the burden of student debt for years, this guide has got you covered.

From Public Service Loan Forgiveness to Income-Driven Repayment plans, we’ll break down each program, providing you with step-by-step instructions on how to qualify and apply.

Say goodbye to sleepless nights spent worrying about how you’ll ever pay off your student loans. With the valuable information and expert advice found in this guide, you’ll gain the knowledge and tools necessary to take control of your financial future.

Don’t let student loans hold you back any longer. It’s time to unlock the freedom you deserve.

As graduates head out into the workforce, many find that they cannot find jobs which will allow them to pay off their loan via the borrowing terms.

More and more people are turning to student loan forgiveness to ease the burden.

What is student loan forgiveness and who qualifies for it?

Let’s dive deeper into it and get all of your questions answered right here.

- Understanding Student Loan Forgiveness?

- Types of Student Loan Forgiveness

- So Who Qualifies?

- Federal Student Loan Forgiveness

- State-Based Student Loan Forgiveness Programs

- Teacher and Veteran Student Loan Forgiveness

- When To Consolidate Your Federal Student Loans

- Top Advantages to Student Loan Consolidation

- Top Disadvantages of Student Loan Consolidation

- Other Ways To Get Student Loan Forgiveness

- Top FAQs about Student Loan Forgiveness

Understanding Student Loan Forgiveness?

Student loan forgiveness is a program that allows borrowers to have a part or all of their student loans forgiven or canceled.

These programs are designed to help individuals who are struggling with the burden of student debt by providing a pathway to financial relief. Understanding the various types of student loan forgiveness programs available is crucial in determining the best course of action for your specific situation.

Student loan forgiveness can be achieved through different avenues.

Specific careers and programs such as working in public service, teaching in underserved communities, or enrolling in income-driven repayment plans can help you achieve forgiveness.

By exploring these options and understanding their eligibility requirements, borrowers can take the necessary steps towards freeing themselves from the constraints of student loan debt.

Types of Student Loan Forgiveness Programs

There are several types of student loan forgiveness programs available to borrowers, each catering to different professions and circumstances.

Some of the most common programs include Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Income-Driven Repayment Plans.

These programs offer varying levels of forgiveness based on factors such as the type of loan, repayment plan, and length of service.

Public Service Loan Forgiveness is a federal program that forgives the remaining balance on Direct Loans after making 120 qualifying payments while working full-time for a qualifying employer.

Teacher Loan Forgiveness, on the other hand, provides loan forgiveness for teachers who work in low-income schools or educational service agencies.

Income-Driven Repayment Plans adjust monthly payments based on income and family size, with any remaining balance forgiven after a certain repayment period.

So Who Qualifies?

Public Service Loan Forgiveness

If you have a public service sector job, you have a good chance of getting federal student loan forgiveness. Fields include nonprofit organizations, government, nurses, police officers, etc.

You can find the list of student loan forgiveness careers here.

The Public Service Loan Forgiveness (PSLF) program allows borrowers who work in a designated field to have the balance of the student loans waived after 120 consecutive payments (10 years).

Example:

You work for the government. You graduate with $40,000 in student loan debt.

At a 6% interest rate you consolidate your student loans under a Direct Loan, this extends your repayment to 30 years, but you only have to pay 10 years of that note.

Each month, your payments goes towards your 120 payments required to have your student loans forgiven.

After you make your 120th payment, you’re eligible to have your loan forgiveness kick in and the balance waived.

Pretty nice benefit, right?

Here how that can go sideways real quick

Before you consolidate your student loans you want to be sure you understand the potential consequences.

Let say you’ve graduated college and you’ve been making payments.

If this is true you’ve likely had several different loans and you’re making several different payments towards those loans.

While it can be stressful maintaining all these payments, it may make sense to consolidate them into one low payment…

If you’re under an income-driven repayment plan or have made qualifying payments toward PSLF, consolidating your loans will cause you to lose credit for those payments.

For example, if you’ve has 3 years of consecutive payments before consolidating your federal student loans, those payments will not count after consolidation.

The clock starts over.

When To Consolidate Your Federal Student Loans

Consolidate your loans is a good idea even if you’re pursuing Public Service Loan Forgiveness (PSLF).

- Do this while you’re in your grace period

- As soon as you graduate and you know you’re in a field that qualifies, it makes sense to consolidate. This way you don’t make a single payment without it counting towards your loan forgiveness.

- You want an Income Driven Plan

- Some federal loans do not qualify for student loan forgiveness. To get around this red-tape, you can consolidate all your loans into a Direct Consolidation loan, then apply for an income driven plan.

- You can’t afford the monthly bill

- With all the expenses that come up in life, sometimes you simply can’t afford the payments. If you need to lower your payment, student loan consolidation is a good idea.

Federal Student Loan Forgiveness Programs

The federal government offers several student loan forgiveness programs designed to assist borrowers in managing their debt obligations.

One of the most well-known programs is Public Service Loan Forgiveness (PSLF).

PSLF forgives the remaining balance on Direct Loans after meeting specific criteria. Borrowers must work full-time for a qualifying employer, such as government organizations or non-profit entities, and make 120 qualifying payments to be eligible for forgiveness.

Another federal program is Teacher Loan Forgiveness, which provides loan forgiveness for teachers who work full-time in low-income schools or educational service agencies.

This program offers forgiveness of up to $17,500 on Direct Subsidized and Unsubsidized Loans or Subsidized and Unsubsidized Federal Stafford Loans after completing five consecutive years of teaching.

In addition to these programs, federal student loan forgiveness options also include income-driven repayment plans such as Income-Based Repayment (IBR) and Pay As You Earn (PAYE).

(Revised Pay As You Earn or REPAYE is no longer an active repayment plan.)

These plans adjust monthly payments based on income and family size, with any remaining balance forgiven after a certain repayment period.

State-Based Student Loan Forgiveness Programs

In addition to federal programs, many states offer their own student loan forgiveness initiatives to support residents in managing their educational debt. These state-based programs often target specific professions or industries that are deemed essential for the community. By participating in these programs, borrowers can receive financial assistance in the form of loan forgiveness or repayment assistance.

State-based student loan forgiveness programs vary by state and may include opportunities for healthcare professionals, teachers, lawyers, and other professionals to receive assistance with their student loans.

Eligibility requirements and benefits differ depending on the program, so it’s essential for borrowers to research and understand the options available in their state. By taking advantage of state-based forgiveness programs, individuals can alleviate the financial burden of student debt and focus on building a secure financial future.

Forbes has a comprehensive state based resource here.

Top Advantages to Student Loan Consolidation

1. Pay Less Interest

Prior to 2006, the Federal Government was issuing variable rate student loans.

When you consolidate your loans, you have the option to switch out variable-rate loans for one fixed rate loan. This can protect you from having to pay higher interest in the future if interest rates go up.

The lower your interest rate, the more of your payment goes towards principal.

2. Reduce Monthly Payments

If you feel suffocated by your monthly payments, you can lower them by negotiating a lower interest rate or increasing your repayment term. If you increase your payment term, you will increase how much you spend in interest, but lowering your payment can give you important breathing room each month.

You can also reduce the number of monthly payments you’re making on multiple loans by consolidating into one loan – which means only one payment each month.

3. Eliminate a Cosigner

When you took out your loans, you were likely a young student with no income and limited credit history, which didn’t make you attractive to lenders. You may have needed a cosigner with credit and income history just to take out your loans.

By consolidating into a new loan, you can remove co-signers and their responsibilities from your loans.

Top Disadvantages of Student Loan Consolidation

1. Large Taxable Income

Most student loan forgiveness plans require the borrower to be on a student loan repayment plan. You’ll reap the most benefit on an income-driven plan, which allows you to make lower payments and have more of your loan forgiven. However, once you’ve made your final payment, the forgiven amount can become taxable income.

So while you may dodge a major bullet of paying tens of thousands of dollars, you will still pay taxes on those tens of thousands of dollars.

You will need to be prepared for your surprise tax bill at the end of your loan term.

2. Limiting Career Tracks

Public Service Loan Forgiveness is limited to certain career tracks, namely those in government organizations, not-for-profit organizations, and certain qualifying public services.

It’s not the specific job you do that matters, but who your employer is.

3. Annual Re-certification and Paperwork… Can’t Miss

Public Service Loan Forgiveness requires a lot of paperwork, and servicers are not anxious to help you with it. Because they are earning less on your loan, you are not a priority to them. You must submit an annual re-certification form each year, and missing one can be costly.

This is very under utilized…In a recent post by USA Today almost a fourth of all Americans who attended college qualify for this, and yet hardly anyone knows to try this loan repayment approach.

Let’s Lower Your Student Loan Payment

It’s super simple to see what you’re eligible for, and our trusted team can get you set up today

Other Ways To Get Student Loan Forgiveness

You don’t have to work for the government or a nonprofit to qualify for this kind of loan repayment program.

One of the more popular strategies includes switching your loans over to an Income-Based Repayment Plan (IBR).

Here’s some more info to check out:

When it comes to Teacher Student Loan Forgiveness

Teachers can qualify for 4 types of Federal Student Loan Forgiveness: Federal Teacher Cancellation for Perkins Loans, Teacher Loan Forgiveness, Public Service Loan Forgiveness, and State-Sponsored Student Loan Forgiveness.

Only teachers in extreme hardship will receive Cancellation for Perkins Loans, which forgives 100% of the debt after 5 years. However, teachers must qualify by teaching at a low-income school, teaching special education, teaching math, science, a foreign language, or bilingual education, or teaching a subject that has a state shortage.

Teacher Loan Forgiveness can only be applied for after teaching for 5 years, but up to $17,500 can be forgiven. You must hold a state license for teaching, and only special education and secondary mathematics or science teachers may qualify for up to $17,500 in forgiveness. Other teachers may qualify for $5,000 in forgiveness.

With Public Service Loan Forgiveness, your loan balances are completely forgiven after 120 on-time payments, and the balance of the loan is not taxed.

State-Sponsored Student Loan Forgiveness is offered by individual states if you teach in a “high-need” area. There is a searchable database that allows you to find local forgiveness programs you could qualify for.

When it comes to Veteran Student Loan Forgiveness

Any person who served in our armed forces or national guard without being dishonorably discharged can qualify for Public Service Loan Forgiveness. You will still need to make the 120 on-time payments before the loan is forgiven.

Disabled veterans with a service-connected disability can take advantage of a program that can cancel Perkins Loans, FFEL, and Direct Loans.

If you’re a veteran who served in an area of critical danger or fire, you can qualify for the National Defense Student Loan Discharge, which forgives Stafford and Perkins Loans.

There are also programs for Army Reserve soldiers, and private organizations that will help veterans pay their loans. Veterans have a number of avenues available to them for loan forgiveness and decreasing their interest rates.

When it comes to Student Loan Forgiveness for Military Spouses

There are currently no programs that specifically forgive loans for military spouses, despite increasing interest in creation of these programs.

However, military spouses can take advantage of Public Service Loan Forgiveness by taking a job with the government on-base or with a non-profit organization. You will still need to make your 120 on-time payments while working 30+ hours each week, but after 10 years, your balance will be forgiven.

During times of hardship, you can request a forbearance or deferment. This is not a direct solution, but can remove your loan payments from your monthly bills at a time when it is helpful to do so.

When it comes to Non-Profit Employee Forgiveness

Nonprofit workers at a traditional 501(c)(3) organization qualify for Public Service Loan Forgiveness. You must work at least 30 hours each week at a qualifying institution, or work at 2 qualifying jobs for a combined 30 hours each week. Only federal direct loans are forgiven under this program. Other loans, such as Perkins loans, Stafford loans, and PLUS loans, do not qualify for forgiveness under this program.

There is no limit on how much of your loan can be forgiven. All you have to do is make 120 consecutive, on-time payments. You can even do so on an income-driven plan, to lower each payment amount. After 10 years, your loans will be forgiven.

When it comes to Student Loan Forgiveness for the Disabled

Student loan forgiveness is granted to people with Total and Permanent Disability, or TPD. TPD means you are unable to work due to a serious illness or long-term injury. The loans that can be forgiven are: FFEL Program loan, Federal Perkins Loan Program loan, Direct loan, and TEACH Grant service obligation.

One downside to disabled loan forgiveness is that the forgiven balance is considered taxable income. Be prepared for a large tax bill the year that your loans are forgiven.

You will also have to prove your disability status and notify your lender that you are filing for TPD discharge. Disability Discharge will send you the required documentation and determine if your loans are eligible to be forgiven. Disability Discharge will also contact your lenders for you, and at a minimum your loan payments will be delayed for 120 days while you complete the application.

Keep in mind that not everyone with TPD has their loans forgiven.

We recommend consulting with an expert to ensure you enter into the right repayment and understand your options.

Let’s Lower Your Student Loan Payment

It’s super simple to see what you’re eligible for, and our trusted team can get you set up today

Top FAQs about Student Loan Forgiveness

Q: Does my income level determine my eligibility for PSLF?

There is no income requirement to quality for PSLF. However, your income may be a factor in if you have a remaining loan balance after 120 payments.

Q: Can I be certain that the PSLF Program will exist by the time I have made my 120 qualifying payments?

We can’t make any guarantees about the future availability of PSLF. The PSLF Program was created by Congress, and Congress could change or end the PSLF Program.

Q: What counts as a government employer for the PSLF Program?

Any U.S. federal, state, local, or tribal government agency is considered a government employer for the PSLF Program.

This includes employers such as the U.S. military, public elementary and secondary schools, public colleges and universities, public child and family service agencies, and special governmental districts (including entities such as public transportation, water, bridge district, or housing authorities).

A government contractor isn’t considered a government employee.

Service as an elected member of the U.S. Congress is not qualifying employment for PSLF.

Q: Which not-for-profit organizations qualify as eligible employers for the PSLF Program?

Eligible not-for-profit organizations include most private elementary and secondary schools, private colleges and universities, and thousands of other organizations. Link to IRS’s searchable database of tax-exempt organizations.

If the NFP organization is not tax exempt, it must provide one of the following public services:

- Emergency management

- Military service: service on behalf of the U.S. armed forces or National Guard

- Public safety

- Law enforcement: crime prevention, control or reduction of crime, or the enforcement of criminal law

- Public interest law services: legal services provided by an organization that is funded in whole or in part by a U.S. federal, state, local, or tribal government

- Early childhood education: includes licensed or regulated childcare, Head Start, and state-funded kindergarten

- Public service for individuals with disabilities and the elderly

- Public health: includes nurses, nurse practitioners, nurses in a clinical setting, and full-time professionals engaged in health care practitioner occupations and health support occupations, as such terms are defined by the Bureau of Labor Statistics

- Public library services

- School library or other school-based services

Q: I’m employed full-time by a qualifying NFP organization, but my job duties include religious activities. Does my employment qualify for PSLF?

It depends on how much of your job is related to religious activities. Your employer cannot include the time you spend participating in religious instruction, worship services, or any form of proselytizing.

Q: What is Total and Permanent Disability Discharge (TPD)?

TPD discharge is a program that forgives the remaining balance of federal student loans if the borrower is totally and permanently disabled. Borrowers must provide documentation from a physician, the VA, or the SSA to qualify.

Q: What types of public service jobs will qualify me for loan forgiveness under the PSLF Program?

The specific job you perform doesn’t matter, as long as a qualifying employer employs you.

For example, if you’re a full-time employee of the pubic school system, your employment meets the requirement of PSLF regardless of your position (teacher, administrator, support staff, etc.).

Q: I am a teacher who does not teach over the summer break. If I make payments during the summer, do those payments count towards PSLF?

Payments you make during the summer will count if you have a contract for an employment period of at least eight months and you work an average of 30 hours per week during that period, and if your employer still considers you to be employed full-time during summer break.

Of course, the payments must otherwise meet all PSLF requirements. In this circumstance, your employer should include the dates of the summer break when reporting your dates of employment, even though you weren’t actually teaching during that period.

Q: I’m working for more than one employer during the same period of time, but I’m not employed by either on a full-time basis. Will my combined employment be considered full-time for PSLF?

Yes, as long as combined your hours reach 30 per week and each employer is a qualifying employer.

Q: Can I receive PSLF if I have more than one employer over the course of 10 years?

Yes, as long as you can show that you were employed by a qualifying employer at the time you made each of the 120 qualifying payments.

Q: Can private student loans be forgiven?

Private student loans are generally not eligible for federal forgiveness programs. However, some private lenders may offer their own forgiveness or repayment assistance programs under certain conditions, such as disability or death.

Q: I’m employed by a 501©(3) organization, but I work outside of the United States. Does my employment qualify?

Yes, you can perform your work anywhere.

Do you have any tips on student loan forgiveness? Let us know in the comments section.

Up Next: College Loans Guide | Your Key Guide to Student Loans

Editor’s Note – This post was originally published in January 2017 and has been updated in 2018 2021 and 2024 for quality and relevancy.

I received a call from 702-931-9876

Regarding my loan is this a number associated with your center?

Hey Fatana,

That number is not associated with our association. If you’d like help navigating the payback of your loans please feel free to give us a call! You can speak with an experienced student loan consultant by giving us a call at 877.433.7501, we’d love to help!

I have work for the government for more than 8 years but I haven’t been doing income-based payments to my student loans, do I still qualify? As I understand, the forgiveness plan only applies if you are doing income-based payments. Can you clarify that please?

Hey Lina,

That is a great question! There are a few factors that determine eligibility for forgiveness. Please give one of our experienced student loan consultants a call at 877.433.7501. They’ll be able to talk with you about your specific circumstances and what options may be available to you.

I need to stop repaying my student loans. I have been doing so ever since I graduated (2005). Back then, my spouse was still working so we did not have problems to repay them, but now, that he passed away last year. I am in a limited income system, getting a monthly survivor pension from his Social Security and it is really very difficult for me to continue with this plan. I have been a housewife ever since I came to live in the US as a lawful resident, that is why I do have my late husband’s reduced pension as his survivor spouse. I am 76 years old and I try to do my best in managing my limited income. I hope you can help me solve this problem. I prefer to speak to a counselor in Spanish because in spite of being able to speak English, I feel more comfortable discussing certain subjects in my mother tongue.

Thanks for your interest in helping me, Katie!

Hey Olga,

My deepest condolences for the loss of your husband! Our experienced Student Loan Consultants would love to see what they can to help you with lowering that payment & fitting it into your current budget. Please give us a call at 877.433.7501- we will be able to speak to you in Spanish!

Hi Kathi,

How about garnishments on my salary. Would I be able to solve the issue?

Yes I want to apply for this what do I do next

Hi Angie! Thank you for your message. The best way to get you signed up for the program (**if you qualify**) is by calling on of our student loan counselors today! Call 877.433.7501 and tell them you are interested in public service loan forgiveness. They will be happy to assist you!

Need help with my student loan. I’m behind, and can’t catch up.

Good afternoon Clara!

thank you for your message. Please give us a call at 877.433.7501 at your earliest convenience. You will be able to speak to an experienced student loan counselor about your situation, and they will ask you a few several questions to get to know more about you and which possible repayment programs you could qualify for (if any…) but the best way is to talking to us on the phone.

Hopefully we will be able to provide some assistance. Thank you

I need more information on loan forgiveness and how it works.

Hi Enjoli, please contact one of our experienced student loan counselors today. Call us at your earliest convenience at 877.433.7501 and say that you are calling about public service loan forgiveness, one of our reps will be asking you a few personal questions to get to know more about you, your loans, your career and about your current employer. Based on your answers they will be able to tell you if you qualify to receive forgiveness, and if you are not eligible they may still be able to help you enroll in an income based repayment program… We do our best to help people lower their monthly payments. So call us! 🙂 you will be happy to get to know your options.

I have been hurt on the job twice and been out of work for years off and on.

I need to have my loans forgiven. Have a permanent disability and am retired and my income is very low. Do I qualify for loan forgiveness?

Thank you

Madeline Larson

Hi Madeline, the best way to find out if you qualify for forgiveness is by calling us and speaking to an expert student loan counselor about your case. They will ask you a few simple quick questions and depending on your answers they will be able to tell you if you qualify for forgiveness or not, and they would even be able to enroll you and take care of all the paperwork and application process for you. Please call us at your earliest convenience at 877.433.7501

Thank you!

I need real information about forgiveness. I have been active in public safety campus. How can i apply for these benefits.

Good morning Ramon, thank you for your message. From what you have told us, you may be able to qualify for public service loan forgiveness, but the best way to know if you can apply for these benefits it is by calling and speaking to a loan counselor directly. They will ask you a few questions about your work, loans, income, etc… Then they will be able to better assist you and let you know in what kind of program you qualify, and will even be able to process your application for you and get you enrolled and all set.

Please call us at 877.433.7501 and tell one of our reps you’re calling about public service loan forgiveness.

Thank you

Pleae I need someone to help me i need a loans forgiveness . I need someone in Spanish.

I would like to get started paying back some of my student loans. I do not make much ,but I loved to get started.

I need my student loans forgiven.

I would like information about this program.

I am a private school teacher, my 7th year there. I make very little. Do I qualify?

I work for a nonprofit right now have for years how does that work to get loan forgiveness?

How do I start the process to be forgiven.

I still owe money and have been teaching 17 years. I work in a low income school.

Hey Sandra… it sounds like there definitely could be help for you just based on that information alone. Have you checked it out at all? Teacher Forgiveness programs are becoming more and more popular and there’s a good chance you could take advantage of them.

Check them out here: https://usstudentloancenter.org/loan-forgiveness-program/teacher-loan-forgiveness/

or give us a to speak to a consultant for a few minutes to see how you could utilize the programs to your benefit. Reach us at 877.433.7501 or visit https://usslc.as.me

Cheers!

I was attached through a loan from a college that was rename several times and was not accredited by a lot of other school loan balloon from $8,000 to now $43,000 and still no degree that’s accredited this student loan has plagued me since 1988

Wow, Gloria… I’m so sorry to hear that. Unfortunately, that’s a common situation among college students from all across the nation.

I’d love to see how we can help you find relief from the student loan debt you’ve accumulated. Whether that mean student loan forgiveness programs or just a way to reverse the ever-growing amount you’ve accumulated, I encourage you to check it out.

Feel free to give us a call at 877.433.7501 to speak to a consultant or visit https://usslc.as.me

Cheers!

Hi. Need help on that. Im dont have a Job at the moment.

Need someone that speaks spanish

My Phone number is 7872180855

Hey Richard!

I’ve sent your information to our Consulting Manager and a member of our Spanish team will reach out to you about your situation. We’re looking forward to helping you!

Cheers!

Been spinning my wheels for years with this stuff.

My loans were spousal consolidated and even though I am a teacher and my ex lost her job 3 years ago, nothing!

We have deferred for 3 years. We are in a dead black hole.

Sorry to hear you’ve been dealing with this, Lee … You have to be careful with deferments as they run out eventually plus interest continues to accrue- which can make things worse. With teachers there are several options for forgiveness aside from the most popular PSLF depending on the type of school you work for.

I know the feeling of being trapped in a “black hole” as you say… it sucks!! So I encourage you to find out your options.

You can go here: https://usstudentloancenter.org/loan-forgiveness-program/teacher-loan-forgiveness/

or here: https://studentaid.ed.gov/sa/repay-loans/forgiveness-cancellation/teacher#teacher-cancellation

Or you can just give us a call at 877.433.7501 option 3 to speak to a consultant for a few minutes and see how you may be able to get out of this black hole.

Hope this helps. Cheers!

I would like for you to call me at 773-876-0783

Sure thing, Michael! I’ve forwarded your information to our Consulting Manager and you should be hearing from a member of our team to discuss your student loans with you.

Cheers!

I gota my loans no default Since 2008. My gross income si 18000 thousand a year. My debt si 40000 plus

Hey Admar,

Based on the information you just gave me, there could be several options that you can take advantage of. Please give our offices a call at 877.433.7501 option 3 to speak to one of our Student Loan Counselors. We would love to speak with you more about it. Hablamos Espanol!

Cheers!