Are you wondering what happens to your student loans when you drop out?

You’re not alone. Let’s take a look at a few statistics.

Just 56% of people who enter an American college will graduate within 6 years.

29% of people who enter two-year programs graduate within 3 years.

Do these dropout rates seem outrageously high to anyone else?

There are a couple of reasons behind these numbers being so high. Tuition at American colleges is expensive, and it’s only increasing.

Students are having trouble paying for their education. They feel forced to leave the program because they can’t receive financial aid.

But Do You Know What Happens to Your Student Loans When You Drop Out?

In this article, you’ll read:

- Disadvantages of Dropping Out

- Repaying Your Loans

- Differences between Private and Public Loans

- What are Your Options?

(Pro Tip: Need some tips for paying off your student loans the best and easiest ways possible? Take 10 of these tips for free here. 10 Things To Know About Your Student Loans is the ulitmate student loan library every student loan borrower needs in order to pay off loans the simplest and fastest way possible. Learn more and get your free extra tips here.)

Beware, dropping out does not make your student loans disappear. You will have to repay both your federal student loans and private loans, and the first step to doing this is finding out exactly how much you owe.

Once you find out exactly how much student debt you have, you’ll be able to look at your options to repay it.

Disadvantages of Dropping Out

Over 50% of college graduates struggle to find jobs when they leave. This is because degrees have become far more common. In the past, a degree equated to a certain distinction.

However, since almost everybody has a degree now, they have very little impact on whether somebody receives a job offer or not.

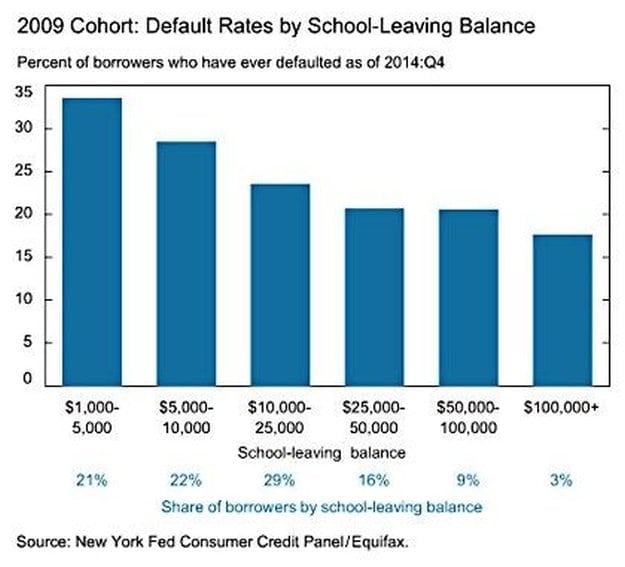

Take a look at this chart:

As you can see, the more money you borrow for tuition fees and other education-related expenses, the less likely you are to default on your loan.

People who barely borrow anything have a 35% chance of defaulting on their student loan.

This is probably because they’re most likely the ones who end up dropping out. If they are dropping out, they’re probably having difficulty finding a job, which would explain the high default rate.

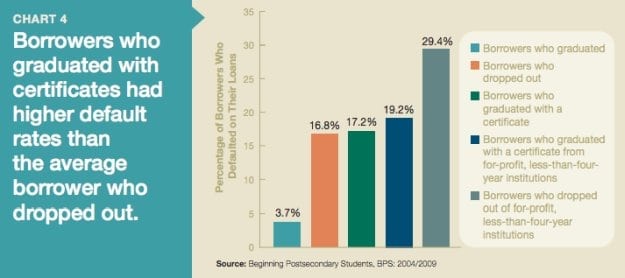

Take a look at these statistics:

Repaying Your Loans

You’re probably wondering, what happens to student loans if you withdraw?

Unfortunately, if you drop out, your student loans are not just going to disappear. You are going to need to pay them back.

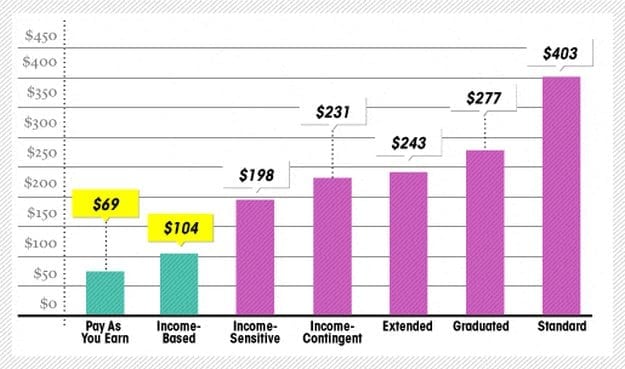

The graph below will give you a rough idea of how much you might expect to pay under different plans.

Obviously, your repayment plan will be based on your specific circumstances. What the graph does show is that a decent chunk of cash is going to come out of your account each and every month.

Even paying $100 per month is going to cripple you on a financial level when you’re unemployed.

Remember, you still have plenty of other expenses that you need to tackle. It really doesn’t come as a surprise that so many people end up defaulting on their loans when they borrow even the smallest amounts.

Differences between Private and Public Loans

We already know that you still have to pay your loans back, even if you drop out. But how much you pay back will be dependent on when you dropped out of college.

If you have a private loan, then the money will be sent directly to the college at the start of a semester.

So you might think to yourself, “What happens if I drop out of college mid-semester?”

If you drop out halfway through the semester, then you may receive some of it back.

However, there is absolutely no guarantee that this will happen. If you do, then that is great. Your monthly student loan payments are going to be trimmed, and this will save you some money.

If you drop out at the end of a semester, then the money is not going to be returned to you. But the lender will not send any money to the college for the next semester.

Again, this means that you are going to save some money.

If you have borrowed any money for living expenses and the like, then it is important that you stop spending it. This is not ‘free’ money just because you have dropped out of college. You are going to need to pay it back. If you can hand it back to your lender then, once again, you are going to be able to able to reduce how much money you have to pay back on your loan.

Unfortunately, many people forget this.

It is these people who are more likely to default on their loans.

To prevent this from happening to you, check out this guide for “10 Things You Should Know About Student Loans,” which will explain how defaulting on your student loans can be ultimately avoided!

(Pro Tip: Need some tips for paying off your student loans the best and easiest ways possible? Take 10 of these tips for free here. 10 Things To Know About Your Student Loans is the ulitmate student loan library every student loan borrower needs in order to pay off loans the simplest and fastest way possible. Learn more and get your free extra tips here.)

Federal loans (i.e. public loans) are going to be slightly different when it comes to repayment.

According to federal government laws, the school must return a portion of the loan if the borrower has not completed 60% of the loan period. This will normally be the academic year, although it can vary so look at your loan details.

Just because the federal loan has this stipulation, it does not mean that the school does. The school may return your federal loans, but you will still owe them cash for the rest of the academic year.

What are Your Options?

When it comes to repaying your student loans after dropping out, we like to think of there as being three different options:

- Research and pick a repayment plan.

- Stay in school for half-time enrollment.

- Get a job in public service.

Repayment Plans

Student loan companies want you to pay back your loan and avoid default. So if you drop out of college, talk to them. Most of them will be able to work with you to come up with a repayment plan which will be mutually beneficial.

You might benefit from an Income Driven Repayment Plan which bases your monthly payment off of your income.

- Income-Based Repayment Plan (IBR)

- Income-Contingent Repayment Plan (ICR)

- Pay As You Earn Repayment Plan (PAYE)

- Revised Pay As You Earn Repayment Plan (REPAYE)

In some cases, you may be able to get approved for deferment for short period of time.

Be careful though.

If you defer your student loan, the interest on the loan is not going to stop accumulating. This means that, in the long run, you will end up paying more back on your loan.

Obviously, you do not want to default on your loans either. If you default, then your credit rating is going to be hit hard for a few years. If this happens, then you are going to have difficulty borrowing money in the future.

On the other hand, if you keep up with your repayments, no matter how minimal they are, then you should be more than fine! You can always ramp up the amount of money that you are paying back when you can afford it. This will ensure that your loans will be paid off quicker and you will be accumulating less interest.

Stay in School Part-time

If you can stay in school, then do so.

Most people do not drop out of college because they find it difficult. They drop out because they can’t afford to be a full-time student. If you are in the same boat, then you have some options at your disposal.

You are not going to need to pay back your student loans while you are still in school.

You started attending college because you wanted to receive an education, right?

Well, consider staying in college part-time

If you can do that, then you will be able to take a small part-time job as well. Doing this will ensure that you can continue to afford your education.

This is a brilliant route to go down. Of course, it will take you longer to get your degree, but you’ll still end up with a degree. You’re going to be paying for your loans either way, so you might as well see it through.

By doing it this way, you’ll give yourself a better chance of getting a great job offer when you have completed your degree. Additionally, you won’t have to worry about loan repayment in the short term. By having a part-time job, you’ll be able to build up your savings so can afford the repayments once you graduate.

Public Service Jobs and Loan Forgiveness

The final option is to get a job in the public service sector so you can qualify for loan forgiveness.

This option will only be available to you if the following conditions are met:

- You have made 120 successful repayments on your loan.

- You work with a qualifying employer.

This option only works if a public service job includes the career path you have chosen. A public service job includes government organizations, both federal and state. Or you could qualify by working for a non-profit company. Basically, anybody who is tax exempt or a public body will qualify you for loan forgiveness.

This is only going to apply to federal loans.

Want to pay off your student loans early? Check out this video by the Wall Street Journal:

Dropping out of college should always be a last resort.

However, it is nice to know that if you do run into any difficulties when it comes to paying college loans back, or perhaps if you just find that the college life is not for you, then you are going to have options at your disposal.

Hopefully now you have a better idea of what happens to your student loans when you drop out, as well as the best path you can take to begin repaying them.

Editor’s Note: This post was originally published on February 2017 and has been updated for quality and relevancy.

Do you have advice you can share with student loan borrowers who are planning to drop out of college? Let us know in the comments below!

Up Next:

- How to Apply for a Student Loan with No Cosigner from Sallie Mae

- What Is Student Loan Forgiveness?

- Student Loan Repayment Plan Comparison

(Pro Tip: Want even more tips to pay off your student loans the best and easiest ways possible? Take 10 more tips for free here. 10 Things To Know About Your Student Loans is the ulitmate student loan library every student loan borrower needs in order to pay off loans the simplest and fastest way possible. Learn more and get your free extra tips here.)

Editor’s Note: This post was originally published on February 2017 and has been updated for quality and relevancy.

This was really helpful, thanks!