What’s going on with Coronavirus & student loans?

The Coronavirus pandemic has forced many businesses, including schools and universities, to operate differently than they used to. Some schools have closed, and others have turned to virtual learning options.

Many recent graduates have lost their jobs, had their hours cut, or accepted lower wages.

But what does this mean for your student loans?

With nearly 30 million Americans still collecting unemployment, those with student loans have questions on how to pay their bills.

Let’s take a look at what’s going on and what you can do to put yourself in a better position through all this craziness.

Newly Updated as of 1/14/2021

Since our last report in August, there have been additional updates in the ongoing Coronavirus pandemic situation, as it impacts student loans. President Donald Trump had signed an executive action that extended the interest-free pause on payments through December 31, 2020; this was later extended again by then-Education Secretary Betsy DeVos to last until Feb. 1.

With President-Elect Joe Biden expected to enter office on January 20, there have been calls for action on student loans to be a top priority for the incoming administration.

Without further action, interest accrual and full payments would begin again on February 1st – despite the fact that job losses from the Coronavirus pandemic are ongoing.

There is also a push from Democratic lawmakers to overhaul the current student loan system, as well as act by executive order to make large debt cancellations.

David Kamin, a New York University law professor, will be deputy director of the National Economic Council in the Biden administration. Kamin said in a briefing that Biden supports asking Congress to erase $10,000 from the debt of all borrowers, extend the pause in payments (although for how long was not revealed), expand income-based repayment plans, and reform the Public Service Loan Forgiveness program to encourage more widespread use.

While none of the stimulus packages passed in 2020 included student loan forgiveness, it will still be up for discussion in 2021. Democrats will be in control of the House of Representatives, the Senate, and the White House, paving the way for possible student loan forgiveness.

A few changes have already occurred in 2021, which may or may not impact you as a student loan borrower:

Changes Regarding Coronavirus & Student Loans

1. Student Loan Repayment by Employers Won’t Be Taxable

Increasingly, employers are including student loan repayment as part of benefits packages when hiring new employees. Thanks to the most recent stimulus package, employers can now treat up to $5,250 per employee in student loan payments as a deduction. This allows borrowers to receive the money tax-free. This will continue for five years.

2. Emergency Financial Help for College Students

$23 billion was recently allotted to colleges and universities, some of which must be used by the schools to provide emergency financial help to students. Due to changes in state budgets, as well as pandemic-related expenses, colleges are expected to raise tuition costs yet again – but some of this funding could help the most financially needy students.

3. Simplification of the FAFSA

The FAFSA (Free Application for Federal Student Aid) will now be easier to fill out. Students can also find out as early as 9th grade if they qualify for the full Pell Grant amount, which may influence their decision to attend college. The FAFSA will also no longer ask about drug convictions or selective service status.

4. Incarcerated Students Can Qualify for Pell Grants

The Pell Grant will now be available to incarcerated students, which repeals a ban that had been in place since 1994.

Additionally, students who were defrauded by their colleges will have their full Pell Grant eligibility restored.

5. Access to Subsidized Loans Lengthened

Students are no longer limited to 150% the length of their program for use of subsidized loans. Now, that limitation has been removed, and students can access and use subsidized loans for longer.

6. Access to Additional Financial Aid

Until recently, a student’s financial aid was capped at the full cost of tuition and expenses. Now, in cases of extreme need, a student can be eligible for up to $1,500 in financial aid that exceeds the cost of attendance to college. This can help make college accessible to students whose families have no amount of discretionary income that can be allotted for higher education.

7. Additional Student Income Will be Shielded from Aid Eligibility

The most recent aid bill also allows for up to $9,410 of student income to be shielded when determining their aid eligibility. This is an increase from the previous amount of $6,840. This reflects the growing trend of student income contributing to household expenses as young adults remain at home with their parents.

8. More Accurate Cost Analysis at Colleges

Colleges are also now obligated to provide more accurate cost analysis of attendance at their schools. Where they previously could report only the lowest possible cost on elements of attendance such as dining plans, they will now be required to report an average cost, giving students more clarity on how much they will pay if they choose to attend.

Proposed Future Changes

The student loan crisis has been at the forefront of political discussion, as 45.5 million Americans have now borrowed $1.56 trillion that is stifling their ability to buy homes and further contribute to the economy.

Proposed future changes include up to $50,000 of student loan cancellation for every borrower of federal student loans, and $10,000 for borrowers of private student loans.

Additional changes up for consideration include:

- A repayment plan that automatically sets payments and interest rates to zero for borrowers earning $25,000 or less.

- The standard repayment plan would be changed to 5% of discretionary income after the first $25,000, and tax-free forgiveness on the remaining balance after 20 years.

- Streamlining of Public Service Loan Forgiveness to increase the number of eligible borrowers who receive forgiveness.

While none of these changes are guaranteed, lawmakers and advocacy groups are placing pressure on Biden to prioritize dramatic changes to student loans.

With other elements of Coronavirus-related relief up for discussion, such as $2,000 stimulus payments, it remains to be seen if additional relief will be provided to student loan borrowers beyond the minimal-impact changes already passed in late 2020.

August 2020

What’s Going On: The CARES Act

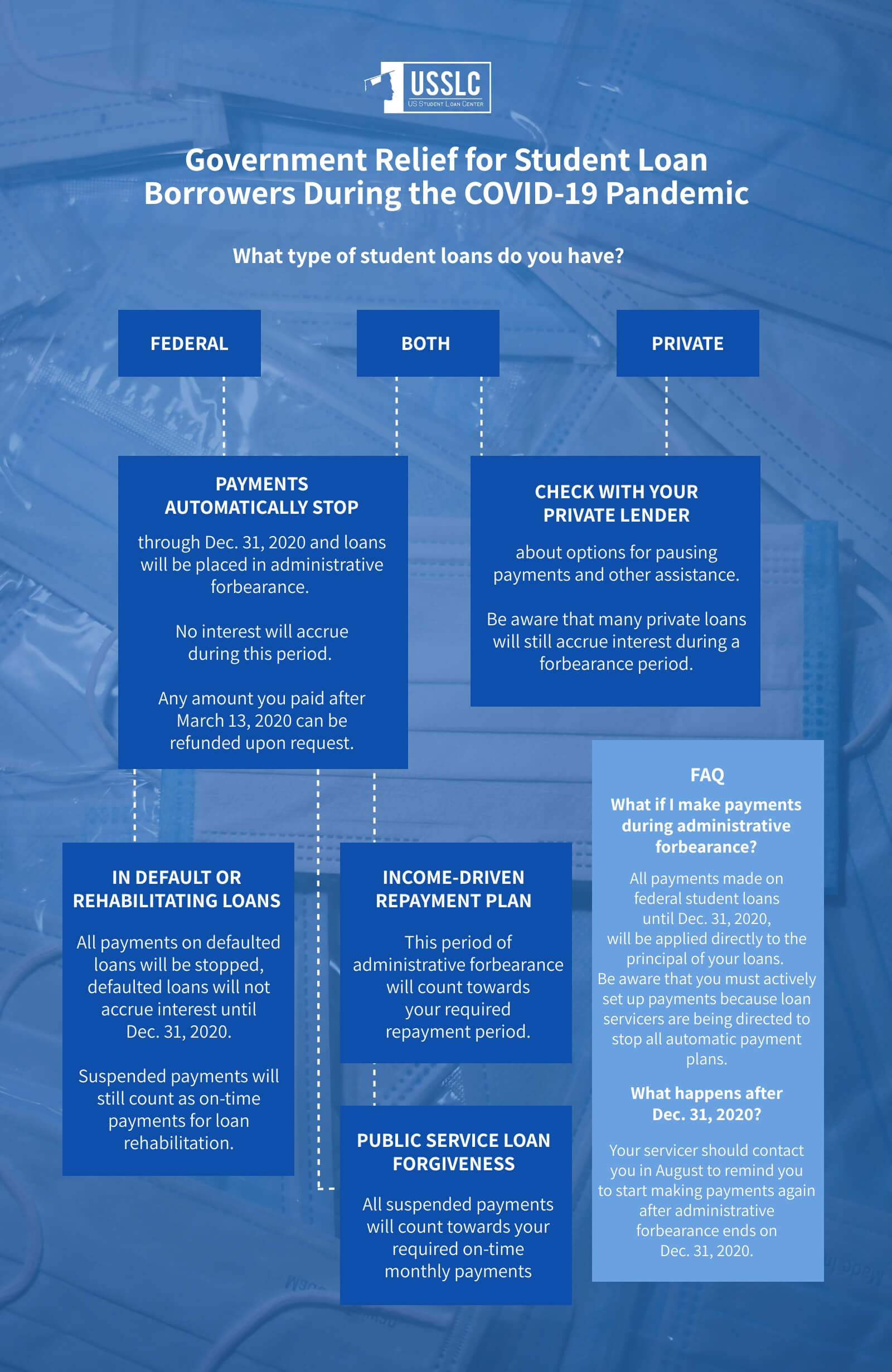

When Congress passed the CARES Act in March 2020, they included suspension of student loan payments and a temporary 0% interest on loans owned by the Department of Education. That means you don’t currently have to pay your federal student loans, and no interest will be accrued during this time. Your balance and what you owe will remain the same.

Private loans issued by banks were not addressed in the CARES Act. The approximately 9 million borrowers with private student loans will not get relief with their loan payments.

The CARES Act took effect in March and was scheduled to expire on September 30, 2020. After Congress failed to pass an additional stimulus package in August, President Trump signed an executive action that extends student loan relief efforts until December 31, 2020.

The more than 35 million people with federal student loans will not need to resume payments until January 2021. People who are able and would like to keep making payments can do so. The entire loan payment will go towards principal.

“Currently, many Americans remain unemployed due to the COVID-19 pandemic, and many more have accepted lower wages and reduced hours while states and localities continue to impose social distancing measures,” wrote the President. “It is therefore appropriate to extend this policy until such time that the economy has stabilized, schools have reopened, and the crisis brought on by the COVID-19 pandemic has subsided.”

As part of the CARES Act, if you have a Direct Loan and were on a qualifying repayment plan, and continue to work full-time for a qualified employer during the suspension period, you will receive credit towards Public Service Loan Forgiveness (PSLF) as though you made on-time monthly payments.

When the CARES Act expires on September 30, this will no longer be true. Suspended payments will not count towards PSLF.

Any auto-debit payments that you made will be suspended during the administrative forbearance. If you made a payment during this time, you can have that payment refunded to you.

What’s Next

While President Trump took an important step towards protecting those with student loan debt, his executive action will not provide relief for as long as is necessary for the economy to recover. Additional relief will be necessary after the December 31 deadline.

“We are heartened to see that the Trump administration has provided additional relief to some student loan borrowers by suspending student loan payments through December 31, however, more relief is needed,” says Nancy Conneely, director of policy at AccessLex Institute, a legal education nonprofit. “The pandemic will not end in December when this payment suspension ends, and we are hopeful that Congress and the administration can come together on a relief package that provides more sustained support for student loan borrowers as they continue to weather the economic fallout of the pandemic.”

Conneely continues, “We also urge the administration to count suspended payments toward Public Service Loan Forgiveness and income-driven repayment, as the CARES Act does. Counting suspended payments toward PSLF recognizes the vital work being done by our public servants, such as nurses, doctors and other essential workers, which is needed now more than ever. These Americans should not lose progress toward forgiveness due to circumstances outside of their control.”

While the paused payments do not count towards PSLF, they do still count towards the 20 or 25-year forgiveness at the end of an income-driven repayment plan.

A coalition of 29 attorneys general across the United States have sent a letter to the U.S. Senate seeking relief for all federal student loan borrowers. They are asking that borrowers of Perkins loans and FFEL loans (Federal Family Education Loan) also have their payments delayed and interest deferred. Although these loans are not owned by the federal government, they are guaranteed by them.

The attorneys general are also seeking extended relief and consideration of income-driven repayment plans for all borrowers once they resume payments.

What You Need To Do When It Comes To Your Student Loans

If you have federal student loans, you should not have to contact your lender to pause payments. If you had an automatic payment set up and would like to receive a refund on payments made during the pandemic, you can contact your specific lender to do so.

If you continue to make payments during this time, the entire balance of your payment will be put towards principal, since interest is currently at 0%.

It’s a good idea to follow up with the balances of your loans and confirm that they have not changed each month, as lenders have been known to make mistakes in the past.

If you’ve lost your job or taken a pay cut due to the pandemic, you have several options available to you as well. You can apply for an unemployment deferment or an economic hardship deferment.

You can also switch to an income-driven repayment plan, which bases your monthly payment on your income and family size. If you are currently unemployed, your payment will be $0 until you find new employment.

If you have Private student loans, you will not receive relief on payments through the CARES Act, or through President Trump’s executive actions.

However, many private lenders are offering their own forbearance and reduced payment options due to the pandemic. Each lender is handling the situation in their own way, so you will want to contact your lender to explore your options.

If you have Private student loans, now is a good time to consider refinancing. Interest rates are at an all-time low, and you could save a lot of money in interest in the coming years. A fixed-rate refinance would lock in these interest rates. Those with federal student loans should not be considering refinancing; there are too many options available for forbearance, 0% interest, and forgiveness programs.

What Should You Do With the Extra Money?

How you should handle the additional money each month will depend on your specific situation. If you need the money for essentials like food or rent, put it towards things you can’t live without.

But if you are able to use the money elsewhere, pay down high-interest debt you’ve incurred, like credit card debt.

If you aren’t carrying balances on your credit cards, starting or supplementing your emergency savings account is a good idea. While you will not earn much interest on the money, you will have it accessible to you if you need it in the future. It will still be some time until the economy recovers from the effects of the pandemic, and you may need access to the money in the near future.

Investing the money is also a wise use, especially in a retirement account or in the stock market. When the market rebounds, you are likely to see a great return on your investment.

Because interest rates on federal student loans are set at 0% right now, it’s also not a bad idea to continue with payments at this time if you can. You will see the full payment go towards your balance.

FAQs about Coronavirus & Student Loans

Q: Will student loan Covid forbearance be extended?

President Trump signed executive actions that pick up on October 1, where the CARES Act leaves off. Forbearance and 0% interest on federal student loans will continue through December 31, 2020. It is believed that additional assistance will be needed into 2021, but action has not been taken yet.

Q: Will there be student loan forgiveness for Covid healthcare workers?

Not specifically, no. While there was interest in a proposal for student loan forgiveness for frontline healthcare workers, these were not incorporated into relief bills or passed by Congress. However, healthcare workers may still qualify for forgiveness through Student Loan Forgiveness for Doctors, Student Loan Forgiveness for Nurses, or Public Service Loan Forgiveness.

Q: What can I do about my private student loans?

Private student loans are not eligible for the government’s forbearance. However, private lenders are offering a variety of hardship accommodations. Borrowers facing hardships should reach out to their lenders for forbearance and lowered payment options.

Q: What if I was behind on my student loans?

If a borrower is 31 days or more past-due on their student loans, their debt will be placed in the coronavirus forbearance and interest won’t accrue. This should occur automatically. The government is also stopping the garnishment of wages, Social Security checks and tax refunds from defaulted student loan borrowers at this time.

Q: What if I’m pursuing public service loan forgiveness?

Even if you don’t make payments until October, the time will still count toward the public service loan forgiveness program, in which the Department of Education forgives the student debt of people who work for the government or at a non-profit for 10 years. You must still be employed full-time by a qualifying employer for the missed payments to count towards your forgiveness. This accommodation will end on October 1.

Up Next:

I need to talk to someone bout my student loans

Hey Ciera,

We’re always available to chat about student loans & the options that may be available for you! 🙂

Please give our experienced Student Loan Consultants a call at 877.433.7501

I have outstanding student loan and have not been able to pay, because I’m on fix income and all I get a month is gone as fast I get it.

Hey Arthur,

We totally understand how hard that can be in your situation! Have you explored the different repayment plans available that might be able to lower your monthly payment?

Give one of our experienced Student Loan Consultants a call at 877.433.7501, we’d love to see how we can help you!