PNC student loans are provided by The PNC Financial Services Group. It’s one of the largest private lenders and providers of various forms of financial assistance and loan options in the country, including private loans.

PNC student loans are popular among private student loans options for its wide range of services.

Here is all you need to know about PNC student loans.

- How Do PNC Student Loans Work?

- PNC Student Loan Rates and Limits

- PNC Student Loan Repayment Options

- Eligibility & Requirements To Get Loan

- Is A PNC Student Loan The Right Choice For Me?

- Benefits & What To Watch Out For

- How To Apply For A PNC Student Loan

- Refinancing With PNC

- FAQs About PNC Student Loans

- Should You Consider PNC Student Loans?

How Do PNC Student Loans Work?

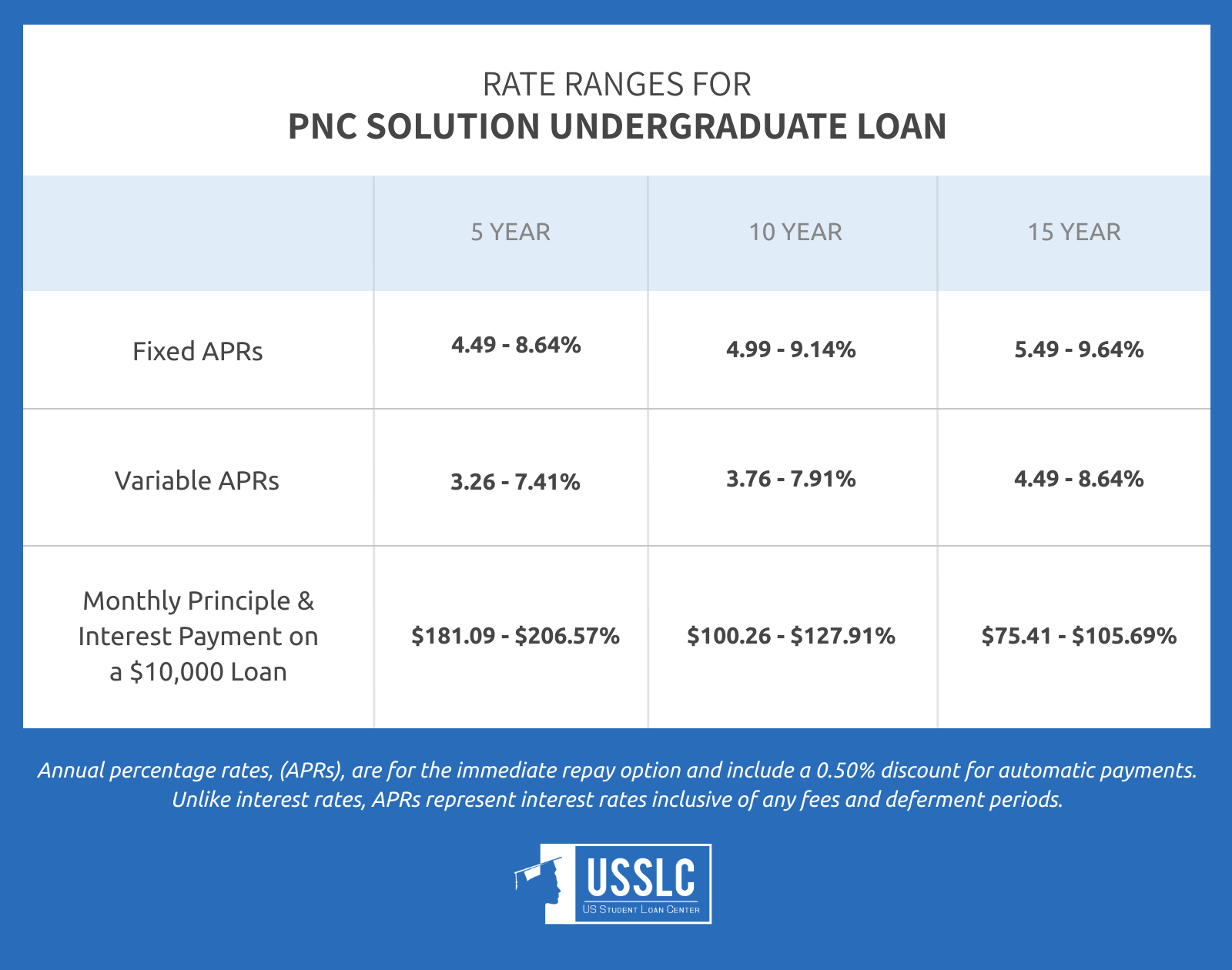

PNC Bank offers all types of financial products to their customers, including private student loans and student loan refinancing, with a multitude of options. You can choose from 5, 10, and 15 year repayment terms, as well as fixed or variable APRs.

PNC offers a very generous 0.5% rate discount for setting up automatic payments, and they do not have any application or origination fees.

They also have some unique loan options depending on your course of study. These include Undergraduate loans, Graduate or professional loans, Health and medical professional loans, Health professions residency loans, Bar study loans, and Refinancing loans.

Unlike other lenders, PNC sends your loan funds directly to your school. They will not be deposited into your bank account.

If you require a cosigner to qualify for your loans, they do offer a cosigner release option after 48 consecutive on-time payments.

PNC Bank student loans are considered to be fairly competitive with other private lenders.

Here is a breakdown.

PNC Student Loan Rates and Limits

PNC student loans offer fixed and variable rates.

They have a fixed interest rate of 4.49% to 9.64% and a variable interest rate of 3.26% to 8.41%. It is up to you to choose which one you prefer.

The difference is the variable rate changes according to the economic state of the market.

The borrower gets a 0.5% discount if the monthly payment is set to auto-debit.

As for loan limits, PNC student loans offer a loan limit of up to $50,000 for undergraduates.

Graduate students may secure a loan of up to $65,000.

A borrower is required to have a cosigner to secure a loan. The co-signer, of course, must be credit-worthy.

If a borrower has no cosigner, he or she must have a good credit score and a financially stable job for two years.

PNC Student Loan Repayment Options

If you’d like to pay your loans off quickly and with a lower interest rate, you can opt for a 5-year repayment term.

If you would like more time to pay, with a lower monthly payment, you can select a 10- or 15-year payment term. This is one of the longest repayment duration among private student loans.

PNC’s private student loan is a preferred option for borrowers who will start repayment while in school. PNC offers immediate and interest-only payment plans. If you choose to defer payment, repayment begins six months after you graduate or cease to be enrolled in school at least on a half-time basis.

PNC does not disclose information about its forbearance policy, nor does it offer any alternate repayment options for borrowers struggling with payments.

If you would like more flexibility in your loan, you will want to consider other lenders.

RELATED: Should I Defer My Student Loans?

Eligibility & Requirements To Get Loan

To qualify for a PNC Bank student loan, the student must be enrolled in an undergraduate degree program and enrolled at least part-time as determined by your school. Both the student and cosigner (if any) must be U.S. citizens or permanent residents and have resided in the U.S. for the last 2 years.

Both the student and cosigner (if any) must have “satisfactory” credit and proof of employment and income history, have been in business for at least two years if self-employed, and meet debt-to-income requirements.

A credit-worthy cosigner is required for 17-year old students.

Is A PNC Student Loan The Right Choice For Me?

A PNC loan is not right for everyone.

The people who should consider a PNC loan are creditworthy borrowers who require additional financial aid.

Loans can be used for all costs incurred due to education, including supplies and room & board.

If you are considering refinancing your student loans with PNC Bank, consider keeping your federal loans separate, so that you do not give up your opportunities for forgiveness, income-driven repayment options, or forbearance.

Benefits & What To Watch Out For

The benefits of a PNC Bank private student loan are:

- No application or origination fees

- Applying online is easy, with a preliminary decision given within a few minutes

- Option to defer payments until 6 months after graduation

- Option for interest-only payments while in school

- Can begin repayment immediately after school

- Choose between 5, 10, and 15 year repayment terms

- Select from fixed or variable interest rates

- Borrowers who sign up for automatic payments from their checking or savings account get an additional 0.50% interest rate deduction

Here’s what you will want to watch out for:

- No option to get personalized rate estimates via a soft credit check

- No flexible repayment options for borrowers struggling with payments

- No formal forbearance policy

- There is no credit score specified for applicants

- If you don’t have 2 continuous years of income and employment history, you will likely need a qualified cosigner

How To Apply For A PNC Student Loan

You’ll need to provide the following information when you submit an application with PNC:

- Social Security number

- Driver’s license or state ID

- School enrollment date and expected graduation date

- Income information

- Employment information (including annual salary)

You can apply here.

Refinancing With PNC

In addition to applying for a new student loan with PNC, you can also apply to refinance your student loans with them. Doing so can lower the number of payments you make each month, shorten the term in which you pay them off, or lower your payment each month – it all depends on your goals.

When you refinance with PNC, you can choose between fixed and variable rates, as well as repayment terms.

All interest rates include a 0.5% discount for setting up automatic payments.

Borrow from $10,000 to $75,000 at a 5-year, 10-year or 15-year repayment term:

- 3.44% to 4.74% Fixed APR at a 5-year repayment term

- 4.69 % to 5.99% Fixed APR at a 10-year repayment term

- 4.94% to 6.24% Fixed APR at a 15-year repayment term

- 1.46% to 2.76% Variable APR at a 5-year repayment term

- 2.71% to 4.01% Variable APR at a 10-year repayment term

- 2.96% to 4.26% Variable APR at a 15-year repayment term

By refinancing, you may be able to release previous cosigners from your loans.

To qualify for a refinance with PNC Bank, you must have:

- At least 24 months of repayment history for federal or private student loans

- A satisfactory credit profile

- Being a U.S. citizen or permanent resident.

- Lived in the U.S. for the previous two years.

- Two years of continuous income or employment history

If you refinance your federal loans through the PNC Education Refinance Loan, you will lose or not be able to select other payment plans available to federal student loan borrowers, such as income-contingent repayment or income-based repayment.

In addition, federal student loans offer deferment, forbearance and loan forgiveness options that may not be available under a PNC Education Refinance Loan. Please compare your current benefits with this program to ensure any loss of existing benefits is fully understood.

PNC does refinance loans for borrowers who did not graduate, which not all lenders do. You must have repaid for at least 24 months before you can refinance your loans with PNC.

FAQs About PNC Student Loans

Q: Does PNC Bank offer student loans?

Yes, they offer private student loans of up to $65,000.

Q: Does PNC Bank refinance student loans?

Yes, you can refinance up to $75,000 in loans with PNC Bank.

Q: Does PNC Bank consolidate student loans?

“Consolidation” is a term for federal student loans. “Refinancing” is the term used for private student loans, which PNC does offer, for up to $75,000 in loans.

Q: What are PNC student loan requirements?

To qualify for a PNC Bank student loan, the student must be enrolled in an undergraduate degree program and enrolled at least part-time as determined by your school. Both the student and cosigner (if any) must be U.S. citizens or permanent residents and have resided in the U.S. for the last 2 years.

Both the student and cosigner (if any) must have “satisfactory” credit and proof of employment and income history, have been in business for at least two years if self-employed, and meet debt-to-income requirements.

A credit-worthy cosigner is required for 17-year old students.

Q: How are PNC student loan rates?

Student loan rates with PNC are generally considered comparable to competitors.

Should You Consider PNC Student Loans?

Student debt is becoming the next financial crisis. Private student loans are often the last resort for borrowers.

If you’re seeking financial aid for your college education, consider applying for an alternative loan first, like a federal student loan.

While PNC student loans are great, federal financial aid such as federal loans are still ideal.

Assess your needs carefully. Find out exactly how much you will need and figure out how you will be able to pay for them.

Then, you can make the right decision.

Are you considering PNC student loans? Let us know in the comments below.

Up Next:

- What Is Student Loan Forgiveness?

- Student Loan Repayment Plan Comparison

- Scholarships for Moms | How to Go Back to School & Better Support Your Family

Editor’s Note: This post was originally published on July 26, 2017 and has been updated for quality and relevancy.

Leave a Reply