If you left college with a lot of student loans, and have started to struggle keeping up with payments along with daily expenses, you may be wondering if you can skip a few payments – or stop paying on your loans altogether.

For some college graduates, their loan payments are so high that they are nearly equal to their rent or mortgage payment each month.

The average borrower is now leaving college with $32,731 in federal student loans. While the Standard Repayment Plan allows borrowers to pay back their loans in 10 years or less, the average repayment term is actually 21.1 years.

10.8% of the 45 million student loan borrowers are delinquent or in default, or 5.5 million borrowers. Another 2.8 million borrowers are currently in a forbearance. Every single day, 3,000 people default on their student loans.

Of the $1.56 trillion currently loaned out by the Department of Education, only $291.1 billion is expected to be paid back in 10 years or less.

If you have a multitude of loans that you are paying back, keeping them organized and paying on time can also become an issue. While this may be an honest mistake, it can have pretty disastrous consequences.

Even one late payment can cost you more money.

Unfortunately, federal student loans are not a payment you want to miss. Unlike other forms of debt, they are very rarely discharged, even if you declare bankruptcy.

Federal student loan debt can follow you and create more problems for you financially.

Let’s take a look at what happens if you don’t pay your student loans. Then we’ll talk about how to avoid default and get you into a situation that’s more manageable for you and your current finances.

What Happens If You Don’t Pay Federal Student Loans

First, They Become Delinquent

Private student loans do vary from federal student loans, so if you have missed a payment on your private student loan, check your contract or contact your financial institution for how you will be affected.

But for federal student loans, as soon as you have missed a due date for a payment, your account status will be updated from “current” to “delinquent.” You will remain in delinquent status until you contact your loan servicer to make a payment, or request a deferment or forbearance (both of which give you an official break from payments).

Once you’ve missed the payment, expect your balance to go up – you will be charged a late fee immediately. This could be 5% of your monthly payment amount.

Each month that you miss payments, you will be assigned additional late fees.

Even one missed payment is a big deal, since your loan servicer can report that missed payment to the credit bureaus. You may not be approved for new credit cards or loans, and your credit card interest rates may rise.

It’s possible that you will have trouble borrowing money in the future due to your missed payment.

Federal student loan servicers report late payments to the three major credit bureaus after 90 days.

Then, They Go Into Default

Federal student loans are updated from “delinquent” to “default” 270 days after your missed payment. If you have private student loans, you are typically considered to be in default even sooner.

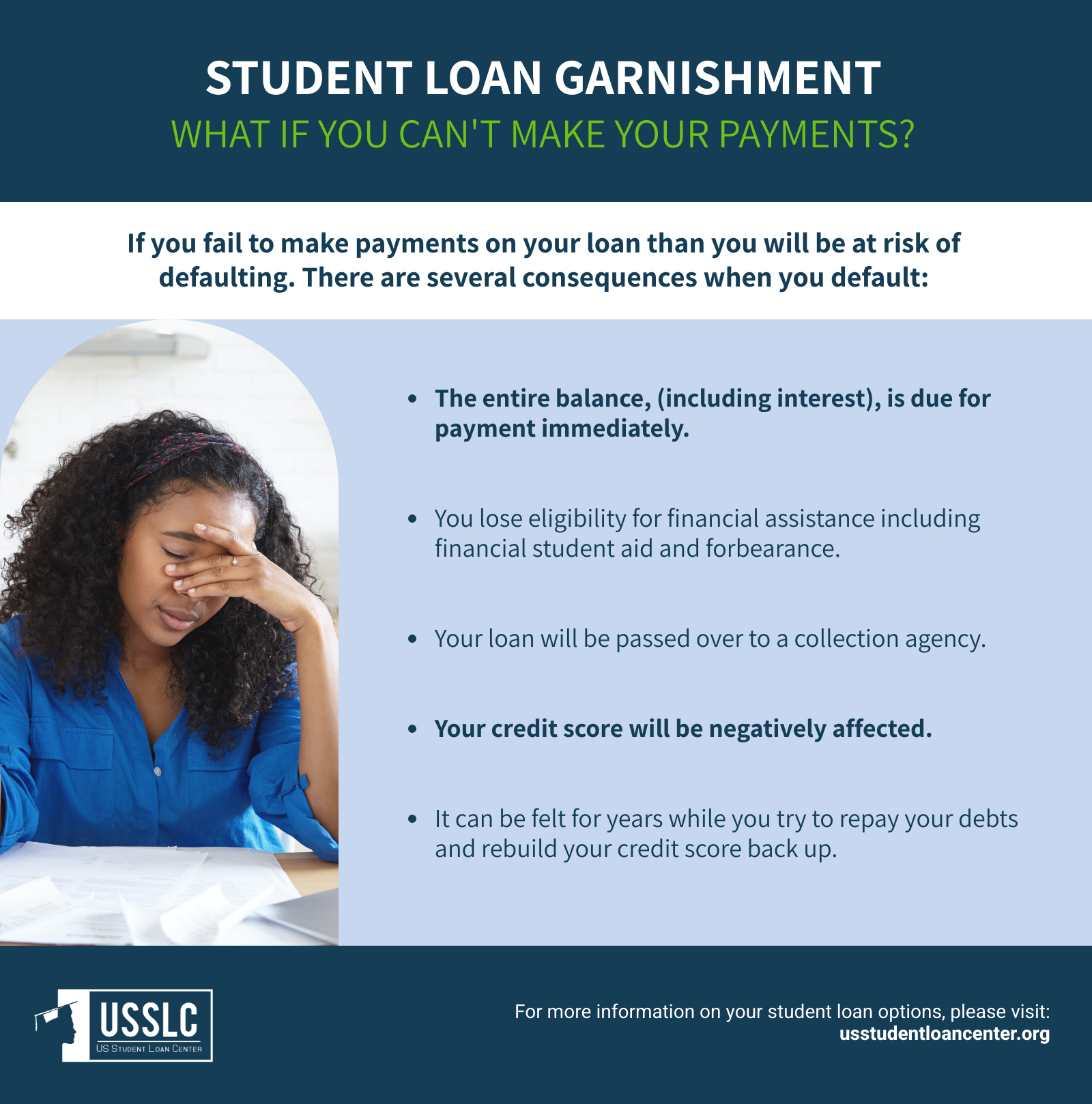

If you reach the stage where your student loans are in default, expect a major monetary penalty: your missed payments, total balance, late fees, accrued interest, fines, and penalties all due at once.

Collection agencies will be involved in trying to recoup your payment(s), and their fee falls on you to pay.

The Department of Education will take some pretty drastic measures to force you into paying your federal student loans. They can garnish your wages, take your tax return or Social Security payments, and even sue you.

Once you are in default, your credit score will also continue to drop. This can have long-lasting effects on your ability to borrow money or access low interest rates.

Your defaulted loan status will also affect any cosigners that you may have. If a family member cosigned on your loan, they will also be subject to bad credit and calls from collections.

What Happens If You Don’t Pay Private Student Loans

Defaulting on a private student loan can happen faster than defaulting on federal student loans. Private loans can go into default or collections status earlier, at 120 days late.

Once you default on a private student loan, the balance of the loan becomes due immediately. Your loan goes into collections and your credit score is affected.

Private lenders can also take you to court to get an order that allows them to garnish your wages.

What You Should Do If You’re Having Trouble Repaying

Rather than default on your federal student loans, your best course of action is to contact your loan servicer at the first sign of trouble with payments.

There are several options you can choose from that can lower or delay your payments without losing your “current” status:

- You can choose an income-based repayment plan that lowers your monthly payment in exchange for a longer repayment term.

- Consider consolidating your loans into one new loan that simplifies payment.

- You can request a deferment or forbearance.

- If you are late on payments due to a qualifying emergency, your lender may have different options for you.

- If you are late on only one or two payments, speaking with your loan servicer directly will allow you to find out exactly how much you need to pay to achieve “current” status again.

- Set up Auto-Pay or change your due date if remembering when to pay is part of your problem in keeping up with payments.

What You Should Do If Your Loans Go Into Default

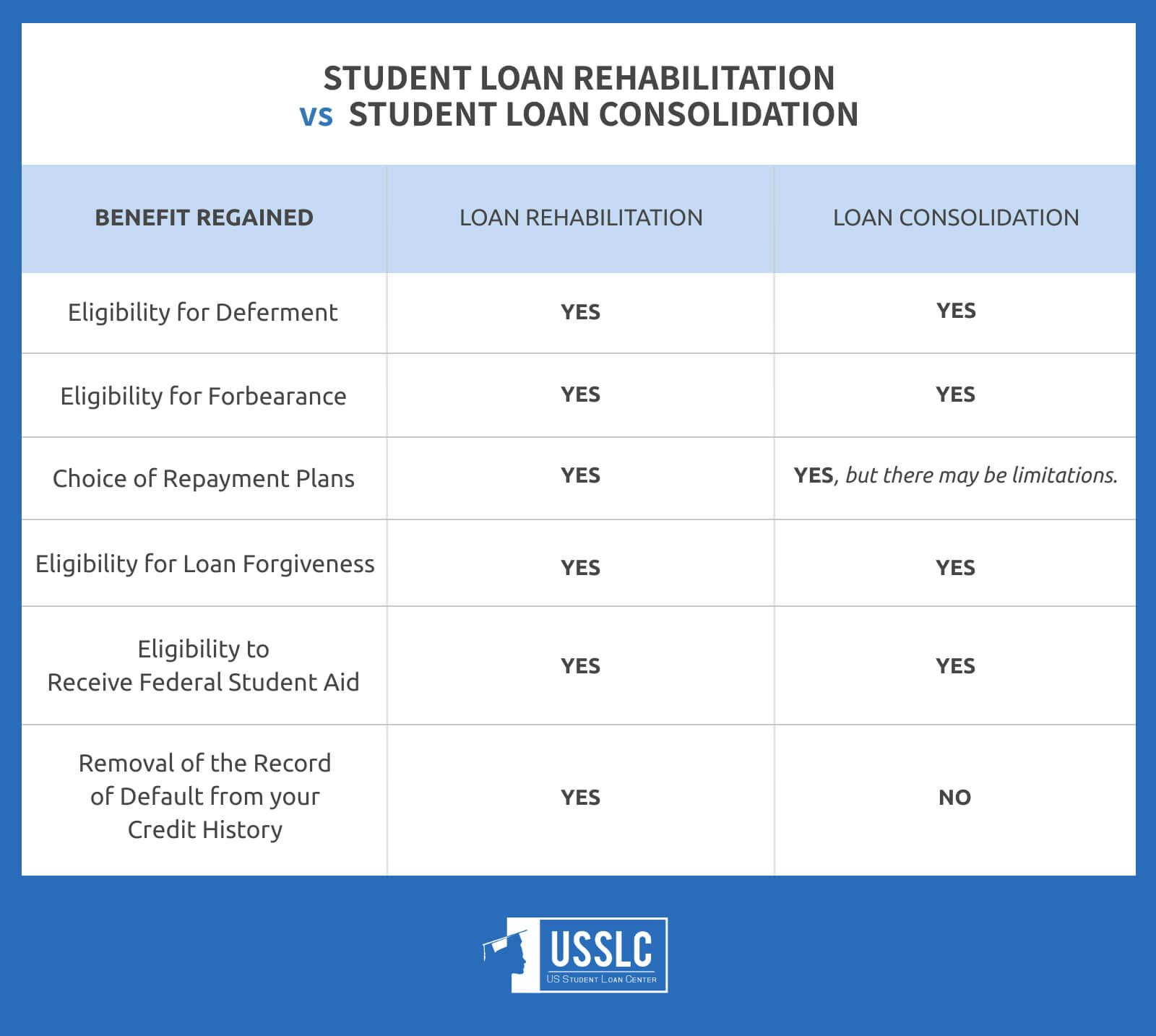

If you have already allowed your loans to go into default, you will be given two options for getting out of default. The first option will be Consolidation of all of your current loans into one new loan.

The second option is Rehabilitation, in which you make 9 on-time payments of an amount that you and your lender agree upon. After those 9 on-time payments, your loan will be out of default and back in good standing.

Not sure whether you should do a consolidation or rehabilitation?

There are a few key differences between the two that you’ll want to take a look at:

Once you are out of default, you will be able to access different repayment plans and can choose an income-driven one, with payments that are affordable to you.

But the first step is to contact your loan servicer so that they can explain all of your options to you.

The Bottom Line

Not paying on your federal student loans will not make them go away.

If you find that you are struggling to make payments or keep up with all of your loans, your best course of action is to contact your loan servicer immediately to explore all of your options.

Missing even one payment can have long-lasting consequences for your financial health.

FAQs on What Happens If You Don’t Pay Student Loans

Q: What happens if you don’t pay your student loans and leave the country?

There is no statute of limitations on federal student loans. This means that collections efforts can be continued indefinitely. If you plan to never return to the country, you can potentially dodge your student loan debt. But if you do return, you can expect your credit to be in shambles, making life very difficult.

Q: What happens if you don’t pay private student loans?

Private lenders can take you to court to get an order that allows them to garnish your wages. But unlike federal student loans, private student loans do have a statute of limitations. After a period of time, they must cease collections efforts – unless they can prove you’ve left the country. In that case, they can pick back up on collections efforts when you return.

If you had a cosigner on your loan, the burden of paying the debt will fall on them.

Q: Can you go to jail for not paying student loans?

No, you cannot go to jail for failing to pay either federal student loan or private student loan debt. But you can go to jail for failing to comply with a court order, such as a summons for a hearing on your case. If you are being sued by your loan servicer or a collections agency, you must be sure you show up to any court dates to avoid going to jail for being in contempt of court.

Q: What happens if you pay less than the minimum payment on student loans?

If you start making lower payments than are due, without consulting with your loan servicer, you will still end up defaulting on your loan. You are much better off contacting your loan servicer and selecting a different repayment plan, or choosing a deferment or forbearance.

Up Next:

Leave a Reply