What’s the difference between subsidized vs. unsubsidized student loans?

When it comes time to pay for college, most Americans will seek out financial assistance. Whether this is in the form of scholarships, grants, loans, and/or work-study programs, each helps to provide the opportunity for higher education. When it comes to loans, you can apply for federal and/or private student loans; within federal student loans, there are both Direct Subsidized and Direct Unsubsidized loans.

The things that Subsidized and Unsubsidized loans have in common are:

- Low interest rates

- Issued by the federal government

- Payment can be fully deferred for up to six months after you leave school

- Both qualify for Income-Driven Repayment Plans

- Both qualify for federal forgiveness programs, including Public Service Loan Forgiveness

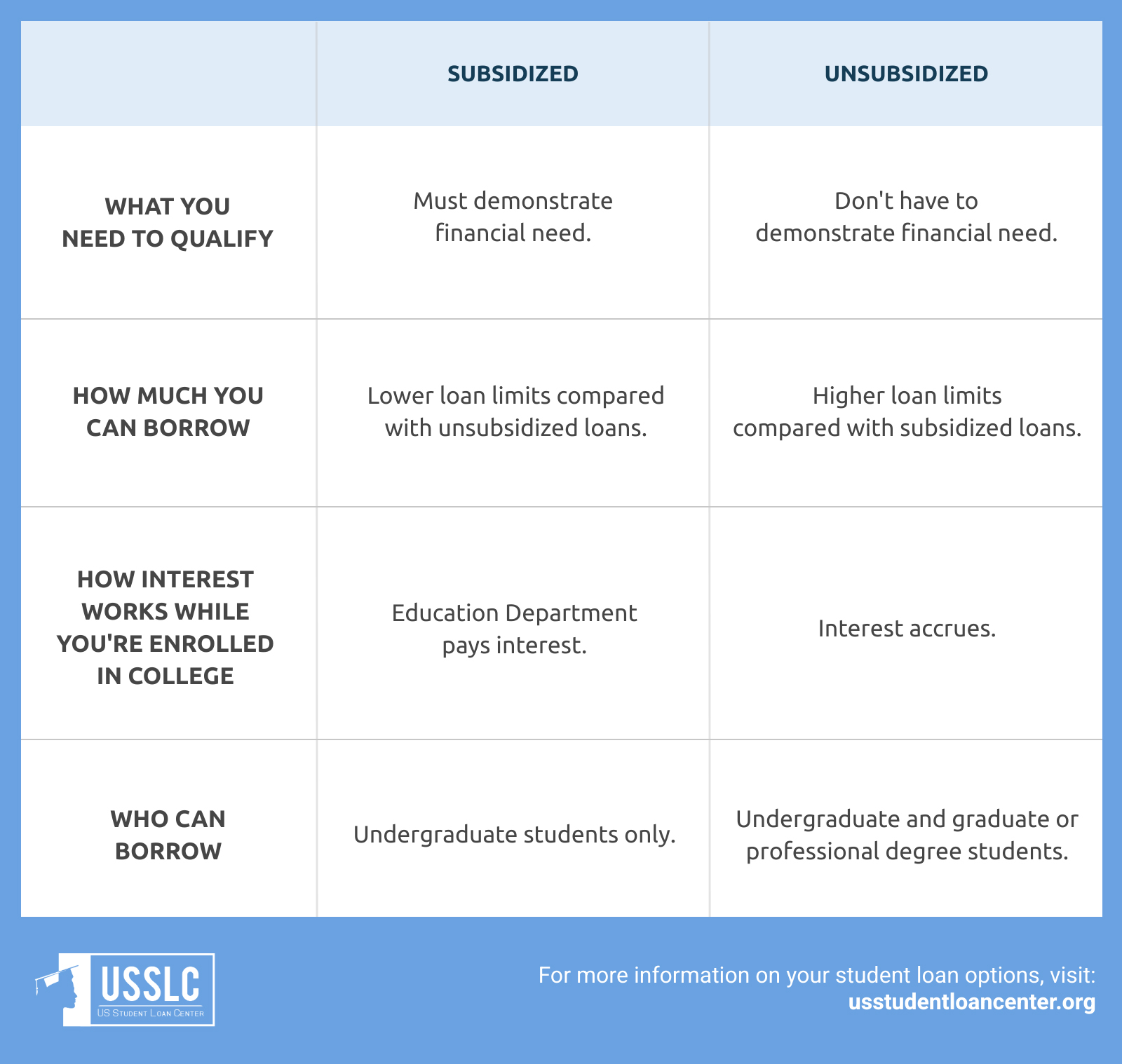

But for all of their similarities, there are some very important differences between Subsidized and Unsubsidized loans.

We’ll discuss the main points of subsidized vs. unsubsidized and their pros and cons below.

Subsidized vs. Unsubsidized Student Loans

One of the most common federal loans is the Direct Loan that comes as subsidized and unsubsidized.

These words can be new and intimidating, but knowing what kind of student loan you have or will have will benefit you a lot.

In fact, knowing the kind of loans you have will open up more repayment options, lead to cost-effective payments, and give you the reassurance of knowing you’re in the best possible student loan situation.

(How To Find Out How Much Student Loan Debt You Owe In Under 10 Minutes: The step-by-step guide with pictures showing you exactly how to find out the amount you’re responsible for paying back Click Here to get your free step-by-step guide!)

Subsidized Loans

Subsidized loans offer a very special benefit: The Department of Education will pay the interest on your loans while you’re enrolled in school at least half-time, during your grace period, and during any period of deferment. That means that when you begin payments, the amount you originally borrowed will match the amount you owe at that time. This can add up to a huge savings on interest.

This fact makes Subsidized loans preferable to Unsubsidized loans, but there are also additional limitations on who can take out Subsidized loans, and for what amount.

Only undergraduate students qualify for Subsidized loans, and you must be able to demonstrate a need for financial aid. You will not be awarded a loan amount that exceeds your need requirement.

This means that after you fill out the FAFSA, and the Department of Education determines how much your family can contribute towards your education, your loan amount will be determined by how much money is needed to make up the difference.

There is a good chance that your Subsidized loans will not be enough to finance your entire education, as there are maximum amounts that you can borrow each year.

- First-year: $3,500

- Second-year: $4,500

- Third-year and beyond: $5,500

- Maximum amount you can borrow: $23,000

There are also time limits for how long you qualify to receive Direct Subsidized loans. You can apply for and receive Subsidized loans for 150% the time of your desired degree program. That means for a four-year degree program, you can take out Subsidized loans for six years; for a two-year degree program, you can take out Subsidized loans for three years.

Interest rates for Direct Subsidized and Direct Unsubsidized loans are the same for undergraduate students. The Department of Education is currently charging 2.75% for loans taken out before July 1, 2021. This is the lowest interest rate they have ever charged.

If you qualify for Direct Subsidized loans, it is recommended that you borrow the maximum amount that you qualify for each year.

Pros:

- Students get financial aid from the government in the sense that the interest will be paid for until they are enrolled or at a half-time status.

- If the loan is under deferment or a repayment plan, the interest is also paid for.

- The borrower will only start making payment and accrue interest after the grace period, which is six months after graduation.

Cons:

- This type of loan is specifically designed for undergraduates so graduates and professional degree students are not qualified.

- The amount students can borrow for a school year is lower compared to an unsubsidized loan.

- Students may not borrow in excess of their financial need which will be assessed by the college or university you are enrolled in upon the loan application.

Unsubsidized Loans

Direct Unsubsidized loans will begin to accrue interest as soon as you take them out. That means interest will accrue the entire time that you are in school, and during your grace period. You can elect to make interest-only payments during school in order to maintain the same starting balance, but if you defer these payments, your balance will increase.

The good news about Unsubsidized loans is that both undergraduate and graduate students can qualify, and it is not necessary to demonstrate a financial need.

The limitations on how much you can borrow in Unsubsidized loans are also higher, and Independent students that file their own taxes (not claimed as a dependent by anyone) can qualify for more money.

- First-year undergraduate: Dependent Student $5,500; Independent Student $9,500

- Second-year undergraduate: Dependent Student $6,500; Independent Student $10,500

- Third-year and beyond undergraduate: Dependent Student $7,500; Independent Student $12,500

- Graduate/Professional: $20,500

- Maximum amount you can borrow: Dependent Student $31,000; Independent Student Undergraduate $57,500, Independent Student Graduate/Professional $138,500

There is also no time limit on how long you can apply for and receive Unsubsidized loans. As long as you are enrolled part-time or more in a higher education program, you can continue to utilize Unsubsidized loans.

While the interest rate on undergraduate loans is 2.75% until July 1, 2021, the interest rate for graduate or professional students is currently 4.30%.

Unsubsidized loans are a great tool for students, allowing you to take advantage of low interest rates and the benefits that come with federal student loans, like flexible repayment plans and eligibility for forgiveness programs.

Pros:

- Both undergraduates, graduates and professional degree students are eligible to apply for this type of student loan.

- Demonstrated financial need is not required upon loan application.

- Students can borrow more than their financial need.

Cons:

- The government will not pay any part of the interest accrued on the loan. The borrower will pay all interest accumulated even during the six-month grace period.

- The amount of interest will capitalize and accumulate in the event of deferment, grace period or if you opt not to pay the interest while studying.

Now you know how subsidized vs. unsubsidized student loans fair, you also have to know that for both these loans your college or university will determine the loan amount you’ll be approved of.

These Direct Loans also have a “maximum eligibility period” of 150 percent of the program you are enrolled in. If you are enrolled in a two-year associate degree program, then 150 percent of that will be three years.

As for the interest rate, it varies depending on when the loan was disbursed and the education level of the student. This goes the same for the loan fee.

The good thing about these Direct Loans is though they both have the standard repayment term of 10 years, you may qualify for a longer term if you have more that $30,000 in federal student loans or consolidate your loans.

Both are also eligible for the different types of repayment plans offered by the U.S. Dep. of Education.

Am I Eligible for a Direct Subsidized Loan or a Direct Unsubsidized Loan?

The best way to find out what types of financial aid that you are qualified for is to fill out the FAFSA. You can also use the FAFSA4caster tool to make early predictions on which types of loans you qualify for. Make sure you use numbers that are as close to real as possible to obtain usable results.

How Do I Apply for a Loan?

Once you submit the FAFSA to the schools you’re choosing between, they will create an aid report for you. This report will include all of your options for scholarships, grants, work-study programs, subsidized loans, and unsubsidized loans. You can review all of the options they send, and accept or decline whichever parts you like.

How Will I Receive My Loan?

With federal student loans, the full amount of the loan will be sent to the school that you will be attending. The necessary amount will be used for tuition and any other fees, and any remaining balance will be sent directly to you. You can use that money for books, living expenses, etc., or you can choose to return the extra amount to avoid paying interest on it.

What are the Current Interest Rates?

While the interest rate on both subsidized and unsubsidized undergraduate loans is 2.75% until July 1, 2021, the interest rate for graduate or professional students taking out unsubsidized loans is currently 4.30%.

How Interest Accrues on Unsubsidized and Subsidized Loans

With Subsidized student loans, no interest will accrue while you are in school, during your grace period, or during any deferments that you take from making payments on your loans.

With Unsubsidized student loans, interest begins to accrue as soon as you take the loans out, and continues to accrue even if you take a deferment from payments. The interest is calculated by multiplying the loan balance with the annual interest rate and the number of days since the last payment divided by the number of days in the year.

Is There a Time Limit on How Long I Can Receive Loans?

Yes, for Subsidized loans there is a time limit. You can apply for and receive Subsidized loans for 150% the time of your desired degree program. That means for a four-year degree program, you can take out Subsidized loans for six years; for a two-year degree program, you can take out Subsidized loans for three years.

For Unsubsidized loans, there is no time limit. As long as you are enrolled at least half-time at a college or university, you can apply for and receive Unsubsidized loans.

Other Than Interest, is There a Charge for This Loan?

Yes, there is a loan origination fee on all Direct Subsidized Loans and Direct Unsubsidized Loans. The loan fee is a percentage of the loan amount and is deducted from each loan disbursement. The percentage varies depending on when the loan is first disbursed, but has typically been around 1.07% in recent years.

When Do I Have to Pay Back My Loan?

How long you take to pay back your student loans depends on what type of repayment plan you choose, any forgiveness options you pursue, and any deferments or forbearances you enter into.

If you are unsure about your repayment terms, you can contact your loan servicer for more information.

The standard repayment plan requires 10 years of on-time monthly payments, but some income-driven plans can lower your monthly payments by extending repayment terms to 20 or 25 years.

What Types of Loan Repayment Plans are Available?

You can continue with the Standard Repayment Plan that you will be automatically placed on after graduation, or you can choose from four government income-driven repayment plans: Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), Pay As You Earn (PAYE) and Revised Pay as You Earn (REPAYE).

FAQs about Subsidized vs. Unsubsidized Student Loans

Q: Are Subsidized or Unsubsidized Student Loans Better?

Because of the delayed accrual of interest, Subsidized loans are significantly better if you qualify for them.

Q: Subsidized vs Unsubsidized Student Loans: Which to Pay Off First?

This really depends on your specific situation. Depending on when you took out each loan, your interest rates will likely vary. Because interest rates are fixed on both Subsidized and Unsubsidized loans, you will want to pay off the loans with the highest interest rates first.

If, for argument’s sake, all of the interest rates are the same, you can pay off the Unsubsidized loans first while possibly deferring the Subsidized loans without penalty.

Q: Can You Consolidate Subsidized and Unsubsidized Student Loans?

As long as you have received all of your loan funds and graduated from school, you can consolidate both your Subsidized and Unsubsidized loans into one federal Direct Consolidation loan.

Q: How Do Subsidized and Unsubsidized Student Loans Differ?

The main differences between the loans are:

- Who qualifies to receive the loan

- When interest begins to accrue on the loan

- The total amount that can be borrowed

- How long you qualify to receive the loan

The kind of student loan you have will have an impact as to how you will repay it. It’s a good thing that there are several painless ways to pay off student loans.

Do you have any thoughts on subsidized vs. unsubsidized student loans? Share it with us in the comments below!

(How To Find Out How Much Student Loan Debt You Owe In Under 10 Minutes: The step-by-step guide with pictures showing you exactly how to find out the amount you’re responsible for paying back Click Here to get your free step-by-step guide!)

Up Next:

I’m wondering how I can go about getting the loan payment lower. I have a home based business and it will be hard to try and pay over $200 a month. Is there anyway of getting lowered?