How to pay off student loans, you ask?

There’s no one canned response because each student loan and financial situation is different, however, there are many right approaches that we recommend based on your needs here at US Student Loan Center.

Below you’ll find a series of common questions and answers to guide you on this long dreaded paying back-your-student-loan-journey.

How To Pay Off Student Loans: Everything You Need To Know Before, During, And After You Have Student Loans

Over the years, we’ve helped more than 25,000 student loan borrowers pay off student loans in a way that doesn’t put a financial burden on them.

Now, we’ve collected the most frequently asked questions about how to pay off student loans and we’ve included everything you need to know about paying them off:

- Before you have student loans

- While you have student loans

- After you have student loans

In fact, I’ll give you 10 categories that sequentially go in order of pre-graduate, college attendee, and post graduate.

So you can scroll to the section that affects you most wherever you are currently at.

10 Frequently Asked Questions on How To Pay Off Student Loans:

Click to scroll to section

- Are Student Loans Worth The Money?

- What IS a student loan (in the government’s eyes)

- Do You Pay Off Student Loans While In School?

- When do I have to start paying on my student loans after I graduate?

- What student loans to pay off first?

- How student loans affect your credit score?

- What to do if you can’t afford your student loan payments

- What to do if you default (or are going to default) on your student loans?

- Can you file bankruptcy on Student Loans?

- How student loans affect your taxes?

Are Student Loans Worth The Money

Truthfully, this is now a matter of opinion. No longer are the days where it is step 1: go to college, step 2: You have a 95% chance of getting a good job. That was pretty much true until 2000.

If you’re a millennial, ask your parents if the statement below is true and they’ll likely confirm the following:

If you obtained a 4-year degree, were hard working, got decent grades, had a solid resume, and got at least 3 job interviews, you were pretty much guaranteed a job.

That’s not true anymore.

In fact, AdvisorPerspectives.com has an excellent write-up of age groups broken down by labor force participation and unemployment. This is the first sentence of that article:

“Millennials make up the largest percentage of our population today, yet have seen some of the lowest labor force participation growth and highest unemployment out of all age groups since the turn of the century.”

But there’s more:

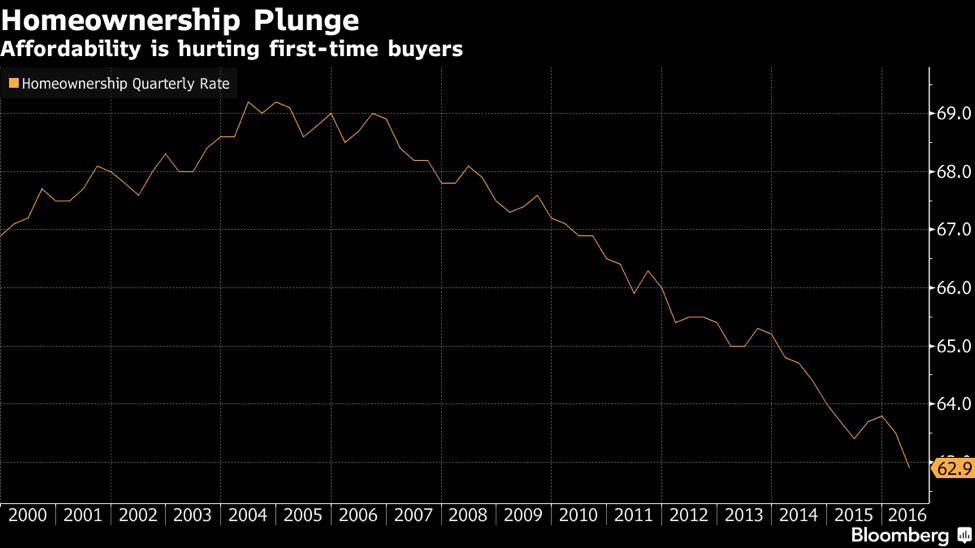

As of May 2017 1 in every 3 Millennials still live at home with mom and dad. As of 2017 we have the lowest home ownership since 1965

This starkly contrasts with the fact that more than 60% of millennials have attended college according to a press release in 2014 on ObamaWhiteHouse.gov

So we have some facts to consider:

- #1 The largest percentage of the population in attending college

- #2 That same group has the lowest labor force participation rate

- #3 The average student loan borrower graduates with more than $30,000 in debt

Does that mean college isn’t worth it? Not necessarily.

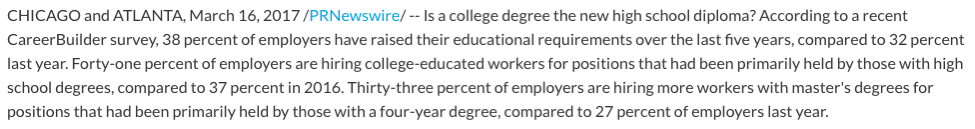

Statistics on CareerBuilder.com show more and more employers are requiring employees to have a 4-year degree.

Here’s a snippet from that article:

The truth is some degrees payoff more than others when it comes to answering the question, “Are student loans worth it”

According to the National Association of Colleges and Employers (NACE) here’s a breakdown of the degrees you can get while in college that gives you the highest chance of employment:

- Finance: 25%

- Accounting: 23.6%

- Computer Science: 22.9%

- Information Sciences & Systems: 18.8%

- Computer Engineering: 18.1%

- Management Information Systems: 15.3%

- Marketing: 15.3%

- Electrical Engineering: 15.3%

- Mechanical Engineering: 15.3%

Straighter Line, an online college course prep program, had a study as of 2016 that cites the college majors with the highest and the lowest unemployment rates.

The top 3 highest employment rates:

- Agriculture and Natural Resources

- Physical Sciences

- Education

The bottom 3 are:

- Architecture

- Social Sciences

- Arts

You can see the full list here.

So before you decide to take out student loans, make sure you can get a return on them.

We believe aspiring college students need to consider college student loans as an investment with an expected return. It doesn’t make much sense borrowing $30,000+ to obtain a philosophy, women’s studies, or music degree.

If you do, just understand the unemployment rate is north of 10% for all those degrees and the starting salary is no more than $30,000. That’s only $2,500 a month, and that’s not bad if you’re starting out in a career with growth potential, but unless you obtain more college debt and earn a Master’s degree in these areas, there’s little room for advancement.

So are student loans worth the money?

Only if you treat them as an investment with an expected return.

Be smart and go to college for something you love… but also something that you can earn a decent wage. It’s also important to note that scholarships are available. FastWeb.com is a great resource for scholarships.

2 – What IS a student loan (in the government’s eyes)

For the purpose of this section, we’re focusing only on Public Student loans. For private student loan information, you can check out this post.

Public student loans are federally backed loans, which mean Mr. Tax Payer is responsible for your loans should you default or decide not to pay.

The Department of Education has two student loan programs:

- The Direct Loan Program

- The Federal Perkins Loan Program

The Direct Loan Program has 4 different types of loans that you can read about here.

Federal Perkins Loan Program is a program that is done within the school.

Contacting your University’s financial aid office is a good place to start with that program. The loan programs are different, but all require certain things and have certain effects that students cannot avoid.

They also offer two types of loans:

- Subsidized – The government pays your interest while you’re in school

- Unsubsidized – Your interest does accrue in college.

You can find out all the differences between the two types of loans here.

First, understand there’s no such thing as a free lunch.

You probably learned this in your high school economics class, and our government does its best make sure student loan borrowers know this.

But, when you’re 18 years old and entering college, many pre-grads don’t understand the full implications of getting into a legally binding contract with the US Government.

The idea of getting $4,000 a semester plopped into their bank account sounds like a dream come true, but over several semesters that really adds up. So here’s a few “must knows” about what a student loan is:

i. Master Promissory Note

When you obtain a college loan you must sign a Master Promissory Note (MPN).

MPN’s are legally binding contracts that allow student loan borrowers to take out multiple student loans over the course of several years. Every school has you sign one of these things before you receive your student loans.

ii. Interest Rate On Student Loans

While it’d be nice to think that the US Economy can afford to send everyone to college, we can’t.

Student loans are designed to be an asset to the US Government, and they make money on that asset by charging interest.

The interest rate is a certain percentage of the principal of the loan that’s added to your balance. The interest rate is set by Congress, and right now the rate is 4.29%. Interest rates on student loans are typically compounded daily.

For a quick example:

Let’s say you borrow $30,000 and your interest rate is 4.29%. If this were compounded annually, 4.29% of $30,000 or $1,287 would be added to the balance, but because they compound daily, it looks more like this:

Five percent divided by 365 (days a year) is 0.0118% per day.

Assuming a $30,000 balance, that’s $3.54 per day. If you make your payment each month, your daily interest is added up, and payment is applied to the accrued interest, which is about $106.20 a month. Anything over $106.20 goes towards your balance.

iii. Repayment term

Repayment term is the payback period of the student loan.

Typically students are enrolled in the Standard Repayment Plan that has a repayment period of 10 years.

To find out how much you owe in student loans and what your costs will be we wrote a great article titled “how much do I owe in student loans” you can read or get the free step by step guide below.

How To Find Out How Much Student Loan Debt You Owe In Under 10 Minutes

Step-by-step guide with pictures showing you exactly how to find out the amount you’re responsible for paying back

You can use several methods including consolidation to extend your repayment plan, which will lower your monthly payment.

iv. Grace Period

Most federal student loans offer a grace period.

A grace period is a set amount of time upon graduation, dropping out, or attending college below half-time enrollment, you’re allotted before you a required to start making payments. Usually, grace periods are for six months.

v. Student Loan Servicer

While the government holds your student loan notes, the US Department of Education contracts out the billing, collection, and handlers to 3rd party companies called Student Loan Servicers.

There are several but here are some of the largest:

- Navient

- Great Lakes

- Nelnet

- Fedloan

Be advised, these student loan servicers are collection agencies.

The Department of Education won’t be calling you 6 months after graduation if you haven’t paid, it will be your student loan servicers. They only make money if they collect money to send to the Government.

3 – Do You Pay Off Student Loans While In School?

Thinking of paying your student loans down while in college? It’s a good idea. Here’s why:

Regardless of whether your student loans are subsidized or unsubsidized, paying down your student loan debt while you’re in school will help you in the long run.But, if your loans are subsidized you get an even bigger benefit:

Reasons why it’s a good idea to pay your student loans while you’re in school

- Your total interest paid will be lower.

- There’s no pre-payment penalty

- Your monthly payment will be lower

- Your total payback will be lower

- Because a subsidized loan doesn’t accrue interest while you’re still in school, when you do graduate, the balance on your loans will be lower.

If your balance is lower, there’s less principal to attach interest to.

Let’s look at an example:

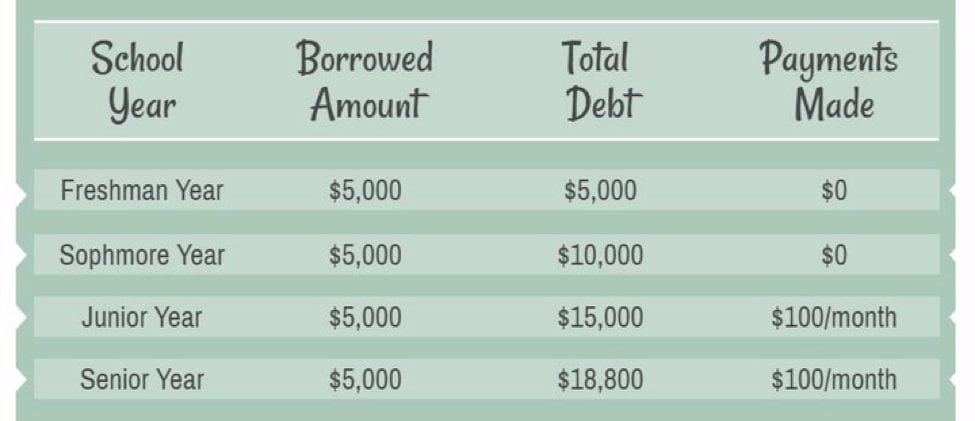

Let’s say you’re a junior in college and to date, you’ve got $15,000 in student loans.

First, understand it’s not one loan.

Every time you borrow money or get a lump sum dropped into your bank account, it’s a separate note. So let’s assume you’ve got 3 loans, each at $5,000.

During school you haven’t accrued any interest on that $15,000. You know next year (senior year) you’re going to need another $5,000 loan so you’ll be graduating with $20,000 in student loan debt in total. If you make just a $100 payment from this point forward let’s analyze the interest saving over the course of the loan.

Post Graduate Debt: $17,600 ($20,000 less 2 years of $100 monthly payments). If you started making payments the beginning of your junior year you would have made $2,400 in student loan payments while you’re still in school, leaving you with a balance of $17,600. But let’s say during your 6 months’ grace period you continue your payments. This would leave you with $17,000 once your grace period ends.

On a standard repayment plan (10 years) and a rate of 4.29%, here’s what your repayment would look like if you make payments versus not making payments:

Option A: Don’t Make Any Payments

- Initial Principal $20,000

- Monthly Payment: $205.26

- Total Interest: $4,630.98

- Total Payback $24,630.98

Option B: Make $100 a month Payments During School

- Initial Principal $17,000

- Monthly Payment: $174.47

- Total interest: $3,936.34

- Total Payback: $20,936.34

When you include the $3,000 in payments you made during your schooling and grace period that’s a total payments made of $23,936.34.

- Your principal is lower

- Your total interest paid is lower

- Your monthly payment required is lower

- Your total payback on the student loans is lower

It’s a win across the board.

Unlike many other loan types, there is no prepayment penalty as well, which means the lender does not charge a fee for you paying back on your loan early.

Why would they do this?

Well, lenders make money by charging interest and if there a lower balance to attach interest to, they make less money for the same amount of risk (upon the loan being issued).

But you don’t have to worry about that here.

It’s a big benefit for student loan holders.

Now… if you’re asking the question, Do I have to pay your student loans off while in school? The answer is no. You do not… which leads us to…

4 – When do I have to start paying on my student loans after I graduate?

Student loans do not require a repayment until 6 months after graduation.

Upon graduation, leaving school, or dropping below half-time enrollment, you enter into something called a “Grace Period.”

It’s the amount of time you have before a repayment must begin. This is true for most federally and privately held student loans.

You need to check with your private lender though, as they can have different rules for each loan.

HOWEVER, If your loans are unsubsidized, it’s highly recommended to make at least the interest payment in school, because unsubsidized student loans build interest while you’re still in school.

This means if you borrow $5,000 your interest starts accruing immediately.

According to student loan servicer Nelnet, “If you don’t pay it while in school, it is added to your principal balance (capitalized) when it’s time to repay your loan.”

So your balance will be the $5,000 plus all the interest that has accrued over 4 years of schooling. If you’re not careful with this it can really add up. It’s also important to note that most federal student loans do accrue interest in the grace period.

5 – What Student Loan To Payoff First?

Pay off Private Student Loans first.

As a borrower, you should focus on paying off private student loans first. Private student loans offer far less flexibility in how they can be managed. This truth becomes particularly clear when you look at repayment options, which often dictate a fixed minimum payment without any flexibility.

Plus, private loans don’t come with the same benefits as federal loans, including income-based repayment and loan forgiveness.

It’s smart to make private loans your priority and to pay them off as quickly as possible.

Even though you’re making your private loans a priority, do not put off paying off your federal loans. You might consider paying the minimum on your federal loans until your private loans are completely paid off.

Then, you should put money toward your federal loans that you would have otherwise put toward your private ones. If you only have federal loans, there

If you only have federal loans, there happen to be two great ways to help you better tackle your debt –the snowball method and the avalanche method.

The Avalanche Method

You sort your loans from highest interest rate to lowest and pay them in that order.

For example, if you had:

- A) $5,000 loan at 7 %

- B) $2,500 loan at 5.2 %

- C) $1,000 loan at 6.4 %

If this were the case, you’d start paying the $5,000 one first, regardless of the balance. You’ll save the most money by paying off your loans with the highest interest rate first. Personally, we recommend doing that.

But if you are looking for other options there’s something called the Snowball Method that speaker, author, and financial enthusiast Dave Ramsey talks about. This has been proven to be the best at getting people to actually stick with paying back their loans not by using math, but by modifying your behavior.

The Debt Snowball Method

This method involves paying off the loan with the smallest balance first and paying the minimum amount on the rest. If you have loans of $2,000, $8,000, and $13,000, then focus on the $2,000 loan first.

Once the one with the smallest balance is paid off, you move on to the $8,000 and so on. This method is praised by personal finance guru Dave Ramsey for the psychological wins that you gain, in the sense that paying off the smallest balance first helps to build momentum, which can be highly motivating.

Which method is right for you?

Are you a disciplined and patient person who values saving as much money as possible?

Then the avalanche method could be right for you. It requires someone who is content with waiting longer to knock out loans for the simple reward of paying less interest.

Are you an eager person motivated by results rather than wait time?

Then the snowball method is for you. This method of paying off debt is great for people who need small victories to keep going along their path. It provides rewards and incentives to people who might feel overwhelmed and tired of paying off debt.

Whichever method you go with — remember that neither one is wrong.

The avalanche method saves you more money, but the snowball method is proven to be helpful in assisting people to pay off their debt by getting results quicker. “This one is done, move on to the next one” type of thought process. My advice is to consider the amounts and interest rates of your loans, as well as consider the kind of personality you have. You’ll know which loan to pay off first.

6 – How Student Loans Affect Your Credit Score

Student loans are affecting more and more people every day. As a basis consider this; 44.2 Million people in the United States have student loans. And it’s growing…

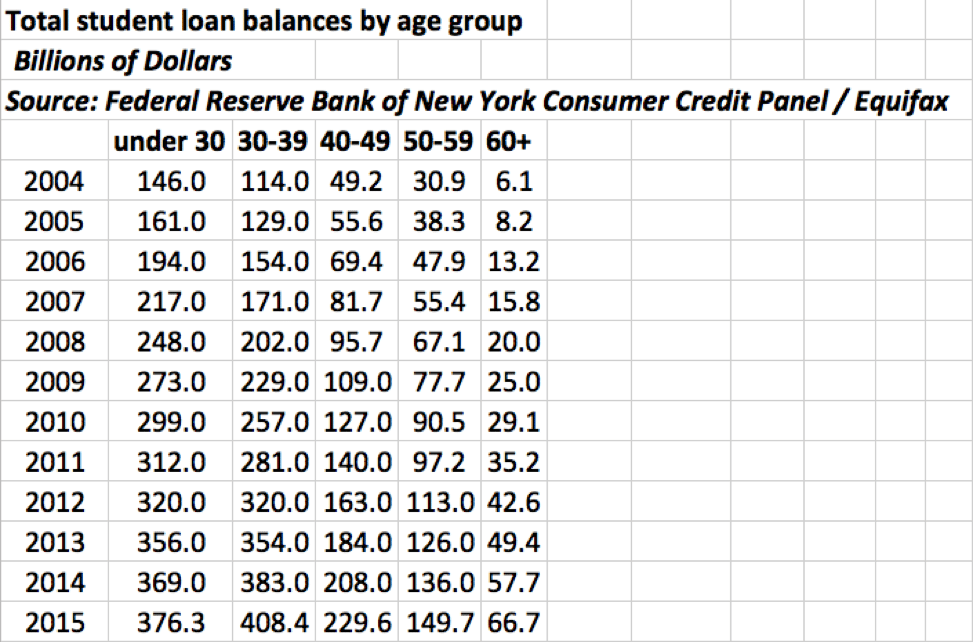

Take a look at the Federal Reserve Bank of New York excel on student loan balances by age group.

In just 10 years the number of people under 30 with student loans has nearly tripled. Between ages 30-39, it’s increased four times.

People over 60….10 fold.

It’s insane.

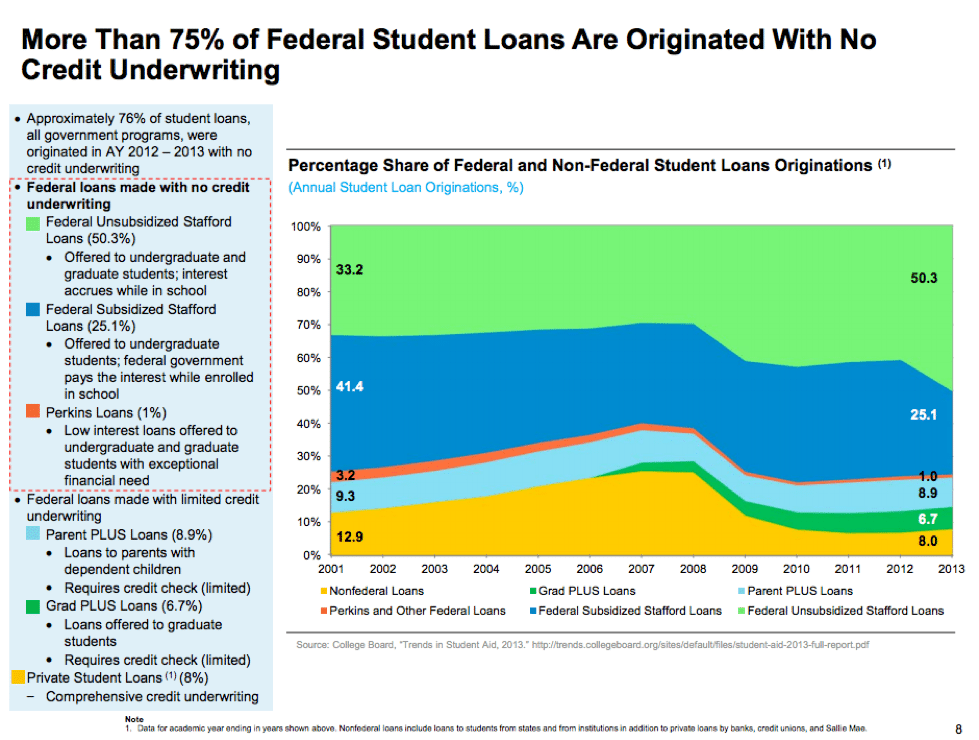

What’s even more troubling is that more than 75% of Federal Student loans are originated with no credit underwriting.

Take a look at this chart from treasury.gov.

On slide 8 they depict the types of loans and what credit underwriting was done:

So all these debts are given out without credit underwriting. Meaning the Federal Government has more than $1 Trillion dollars in issued student loans without any risk evaluation being done, and all this debt that so many Americans have affects them in other ways, primarily in their credit score.

Your credit score is used as a financial measure of “risk attractiveness.”

In other words, how likely are you to pay back your debts and how responsible are you as an American financial consumer.

It’s a score, called a FICO score, given to you between the range of 300 and 800.

-300 being the worst

-800 being the best

And your student loans affect your credit scorescore in many ways, but depending on where you’re at in the process it can be different.

We’ve broken down student loans and their affect on your FICO score based on timeframe:

During School

According to National Credit Federation, a National consumer credit restoration company, your student loans typically start your credit profile.

This means student loans are usually the first thing the 3 credit agencies (Experian, Equifax, and TransUnion) have to report about your financial picture.

It opens up what is called an installment Tradeline. It reports the date the loan was taken, the balance, and the status of the account. Typically, when you incur new debt, it initially will hurt your score because there is no payment history, but as payments on the account are made timely, it will help your score.

After School

One of the main factors of a credit score is the length of credit history. So if you took out student loans at 18 years old, by the time you graduate you’ll have 4 years of “seasoning” on that tradeline.

This is helpful, But it really comes down to payments: Are they on time, or do you miss them?

Good/Timely Payments

On-time payments have the largest impact on your credit score. There are five factors:

- Payment History 35%

- Amounts Owed 30%

- Length of Credit History 15%

- Types Of Credit 10%

- Credit Inquiries 10%

On-time payments fall into the payment history category of the FICO credit algorithm. On time payments of your student loans will help your credit scores grow steadily over time.

Missed Payments

Alternatively, missing your payments can quickly tank your credit score.

This is even truer because it’s your first shot at proving you’re an “attractive lending risk” as many times your student loans are your first tradeline. However, it’s important to note that most student loan servicers won’t report a payment as late until you’re 60 days past due.

So, you typically have a little more wiggle room with your student loans then say, your auto payment.

7 – What to do if you can’t afford your student loan payments

If you miss your payments, it’s likely a case of not being able to afford the payments.

There are millions of people missing their student loans payments. In fact, the Federal Reserve recently cited 11.2% of student loans are in default.

You don’t want this to happen.

If you know you can’t afford your student loan payments there are a few things you can do.

Option A) Consolidation and/or Public Service Loan Forgiveness

In 2010, President Obama signed the William D Ford Direct Loan Program.

These programs were designed to help Americans afford their repayment on their student loans and award public service employees.

Student loan consolidation is the process of taking all your student loans: the balances, the rates, and the payments, and making them one loan, with (hopefully) a lower payment.

You can check all of in income drive repayment plans here.

Public student loan forgiveness (PSLF) allows several different public sector employees to have their student loan discharged or forgiven after a period of 120 payments.

There are so many different loan programs out there that can help.

You can view a repayment plan comparison guide here

Option B) Deferment/Forbearance

A deferment or forbearance allows you to temporarily cease making payments on your federal student loans.

There is a qualification process you have to go through for this.

- Deferment – Deferment is typically based on employment status. If you’re unemployed you can qualify for deferment, or if you go back to school your student loans can be deferred.

- Forbearance – Forbearance is a temporary stop on payments. Every student loan borrower is given 24 months of forbearance. But they’re typically granted in 30-90 day periods.

When you consolidate your student loans, the forbearance period starts over and you get another 24 months.

The main difference between the two is that in deferment, your student loans usually do not accrue interest. During a forbearance your student loans do accrue interest.

Note: Just because you miss a payment doesn’t mean you’re in forbearance. You’ll need to do this via your student loan servicer and fill out an eligibility form.

It’s important to note that deferment and forbearance do not affect your credit score.

Consolidation does affect your credit in the sense that it’s a newly issued loan. Your old loans are marked as paid in full and the new tradeline will report for your student loans and their status.

8 – What to do if you default (or are going to default) on your student loans?

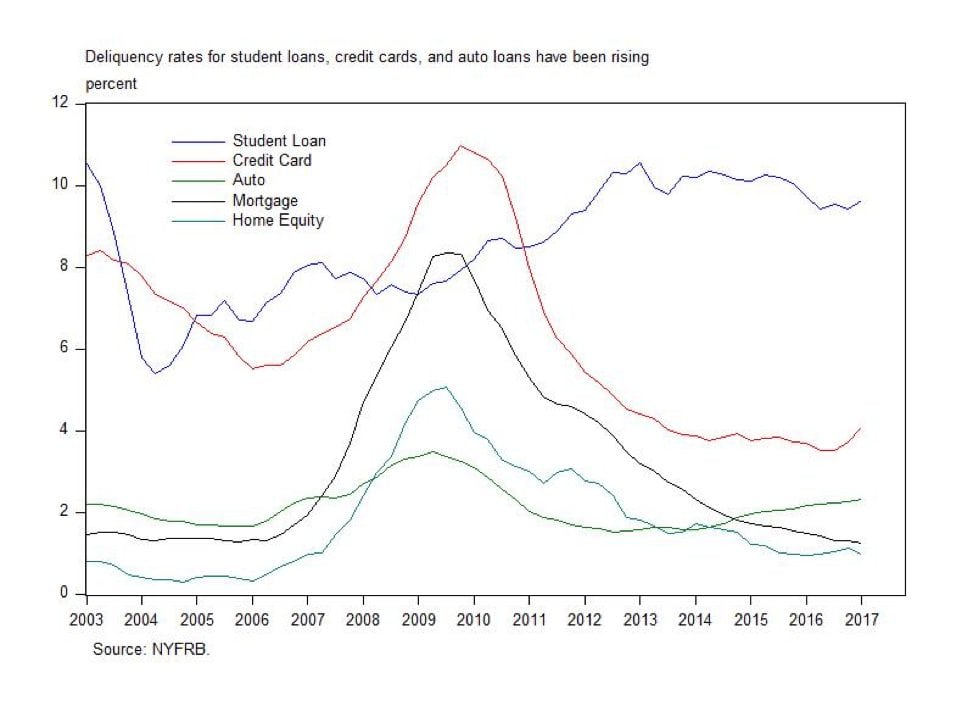

If you’ve decided not to pay your student loans, you will default on your student loans. And you’re not alone. In fact, Student loan debt is the #1 debt that we as Americans default on. More than credit card, auto, mortgage, and home equity…combined.

Take a look at the chart from the New York Federal Reserve Bank:

In fact, their 2017 quarter 1 report shows that “total household debt achieved a new peak in the first quart of 2017 rising by $19 billion to 12.73 trillion, $50 billion above the previous peak reached in the third quarter of 2008.”

Well, that’s scary… And a big culprit is student loans.

A student loan typically defaults when you’ve gone 270 days late on your student loan payment.

Your debt will be put into collections and payment will be required to be made to the collection agency.

Defaulting on your student loans will ruin your credit.

If you’re about to default on your student loans, the worst thing you can do is hide. Ignoring the phone calls and letters are only going to make it worse.

Remember, the student loan servicers are collection agencies and they want to get paid, so calling them and telling them you’re about to default is something we recommend as they may be willing to work with you.

If you’ve defaulted on your student loans, there is a program called the Rehabilitation Program you’ll want to enter.

You can read all about using a student loan rehabilitation here. Here’s what you need to know.

- You are only able to rehabilitate one loan at a time.

- You will need to make 9 on-time payments, over a ten month period. If you miss a payment you won’t be able to remove the default status.

- The amount of money that you need to pay will be dependent on your discretionary income. Usually 15% of discretionary income.

- These payments must be voluntary (not wage garnishment)

- Successful completion of your rehabilitation will remove default status (huge for your credit score)

- You will never be able to apply for deferment, forbearance, or the other student loan programs the government offers in the future

- You can only go through rehabilitation one time during your life

Keep this in mind:

- You must be able to make the agreed monthly repayments every time.

- You should only be using loan rehabilitation as a last resort.

- Inform the lender as soon as possible that you may be defaulting on your loan.

If you default on your student loans, you’ll incur interest and fees from the collection companies, your tax refund will likely never come to you but rather be applied to your student loans, and your wages will be garnished to the tune of 15% of your paycheck.

The government can also sue you at any time after your student loans are in default status, including seizing assets like your home.

Though this is rare, we believe you’ll start to see this happen more and more. Just check out this article from ameritechfinancial.com. More than 20 federal district courts have rolled out lawsuit programs going after the 4 million student loan borrowers in default. And the government doesn’t lose these lawsuits.

9 – Can You File Bankruptcy On Student Loans?

Bankruptcy is tricky when it comes to public student loans. Considering bankruptcy and want to know what will happen to your student loans? Will The Bankruptcy Discharge Them?

Is this a realistic way to get rid of student loans?

Let’s start with understanding what bankruptcy is and where student loans fall.

There are two types of bankruptcy:

- Chapter 7

- Chapter 13

Chapter 7 is a liquidation of all property, meaning your property will be seized and any unsecured debts you have will be wiped out. The only exceptions are student loans (typically), child support, taxes, and alimony payments. Before you can file Chapter 7 you must qualify and show you cannot make any payments like you do in a Chapter 13.

Chapter 13 allows you to repay secured debts, even if you’re behind on payments, without having your property seized. Your debts are not eliminated.

Both will ruin your credit (but it was ruined on the way to bankruptcy already).

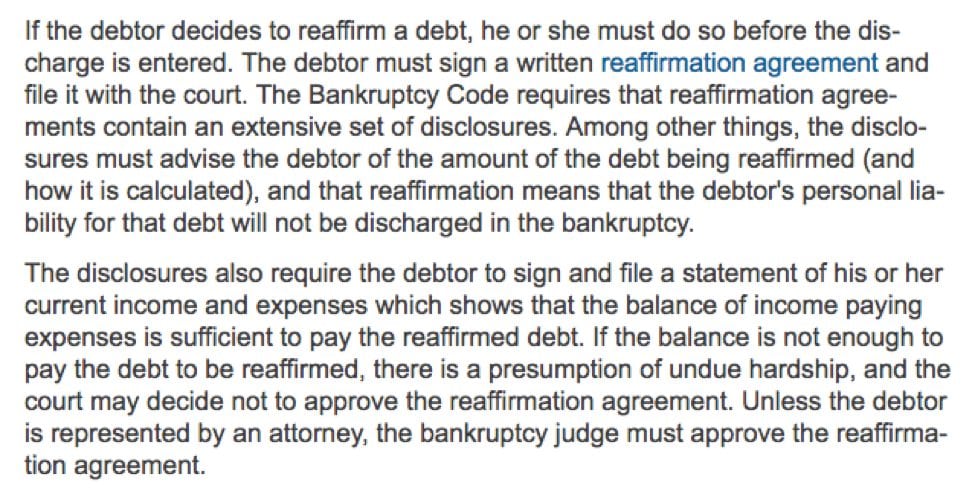

According to Findlaw.com, student loans are not generally discharged in a Chapter 7. The court must find that paying off the loan will impose an “undue hardship” on the debtor and his/her dependents.

It gets pretty technical with what “undue hardship” is, but here’s what they say:

Source: Findlaw.com

For Chapter 13 Bankruptcy, student loans are considered as Nonpriority unsecured debts. This means you are not required to pay them in full, but filing a Chapter 13 will not get rid of your student loans. However, you will not have to pay off the full balance, and your student loan servicer does not decide a number of payments.

Either bankruptcy you fall into, an Automatic Stay is put in place meaning your creditors, including your student loan servicers, cannot attempt to collect on a debt.

Remember your interest on your student loans will still accrue even if your disposable income is such that you won’t have to pay anything or very little during your repayment plan.

We recommend speaking with an attorney about your specific situation as we didn’t go to law school.

10 – How Student Loans Affect Taxes? Student Loan Interest Deduction and Taxes

When it comes to paying taxes, your student loans can help you. They can hurt you as well.

To start we need to talk about how you file taxes:

- Single

- Married Filing Separate

- Married Filing Jointly

How you file your taxes can have a significant impact on your student loans. When you use income driven student loan repayment plans and file jointly, your monthly payment will be based on your two incomes combined as these plans put your monthly payment as a percentage of discretionary income. This could disqualify you from certain programs if you make too much.

When you file separately the Income-Based and the Pay As You Earn Repayment plan your payments are calculated based on the student loan borrower’s income alone. The downside of filing Married filing separately is that it won’t allow you to make deductions like your student loan interest deduction. If you are married filing jointly this can help you with that. They help you in the fact that you can deduct up to $2,500 of student loan interest payments in a fiscal year.

There are some income limitations that come with this though:

- Income cannot be higher than $80,000 ($160,000 if filing jointly)

- If you earn between $65,000 and $80,000, the deduction is reduced

If you file jointly, be aware that you can still only deduct a total of $2,500, not $2,500 per spouse. A student loan interest deduction is not a tax credit. This means it only comes out of the taxable amount, it doesn’t fall to the bottom line in totality. So if you owed $10,000 and you had student loan interest as a deduction, it would not be $7,500 owed. It falls into the number that got you to $10,000. You can read more at the IRS.gov site here.

Student loan forgiveness and taxes

If you use the Public Service Loan Forgiveness Program (120 timely payments) or the Income-Driven Repayment Plans (240-300 timely payments), your student loans may be forgiven.

For Public Service Loan Forgiveness as is stands now your forgiven student loans will not be taxed.

Not true for Income-Driven borrowers. This means graduates with large loan balance will be taxed heavily and become a tax liability in the future. It’s a good idea to set aside money to handle this tax that will upcoming.

The government and IRS always are making changes and because the program is so new, this isn’t a large problem, yet… Either way, just know that as it stands today it’ll be a big problem for people with large loan balances that are forgiven.

Student loans and Wage Garnishment

Remember, the IRS is a collection agency as well. And they are ruthless… If you default on your student loans, you’ll want to check out the Student Loan Rehabilitation program, to avoid having your wages garnished. But if you default and do nothing, your wages will likely be garnished. The federal government can contact your employer and legally take out 15% of your paycheck before you ever see it.

We do expect the federal government do something about this when the time comes. With the Income-Driven plans requiring the forgiven amount to be taxed, we wouldn’t be surprised if good ole’ Uncle Sam comes up with another program to handle those tax payments so wages won’t be garnished.

Conclusion

If you’re wondering how to pay off student loans, know there are a lot of options for you. Here at US Student Loan Center we think it’s important to understand the entire picture pre-grads and grads face. Because it’s not just about going to school and earning a degree…

10 FAQ How To Get Rid Of Student Loans:

- Are Student Loans Worth The Money?

- What IS a student loan (in the government’s eyes)

- Do You Pay Off Student Loans While In School?

- When do I have to start paying on my student loans after I graduate?

- What student loans to pay off first?

- How student loans affect your credit score?

- What to do if you can’t afford your student loan payments

- What to do if you default (or are going to default) on your student loans?

- Can you file bankruptcy on Student Loans?

- How student loans affect your taxes?

After going through this post you should have a great understanding of how to pay off student loans and know everything you need to know before, during, and after, college.

Let us know what you think of if you have any thoughts.

I have been paying on my student loan since about 2001. I was paying over $200 a month. It doesn’t seem to be going down. It seems like I am going to be paying for the rest of my life. I can’t afford it anymore. About a year ago I started paying $100 a month. It is hard to afford that to. I just need to stop paying it. I can’t afford it. I have been paying about 16 years and nothing has gotten accomplished. I need to just get it forgiven.

Hey Tom,

I understand your frustration. Unfortunately, a lot of your monthly payments go towards the interest on your loans, and not towards the actual balance.

If you’re interested in seeing if you qualify for student loan forgiveness, or want to see if you can get on a better repayment plan please give us a call at 877.433.7501. Best of luck to you, Tom!