Are you considering doing a student loan consolidation?

If so, you’re in the right place. We’ll give you the lowdown on consolidation, when it’s a good idea and even show you how to consolidate student loans.

Here’s what we’ll cover:

- What is Student Loan Consolidation?

- When is Student Loan Consolidation a Good Idea?

- Should You Consolidate Your Student Loans?

- What Types of Loans Can be Consolidated?

- What are the Requirements to Consolidate a Student Loan?

- What Will the Interest Rate Be on My Consolidated Loan?

- How to Consolidate Student Loans

- How is Student Loan Consolidation Different From Refinancing?

- FAQs on How To Consolidate Student Loans

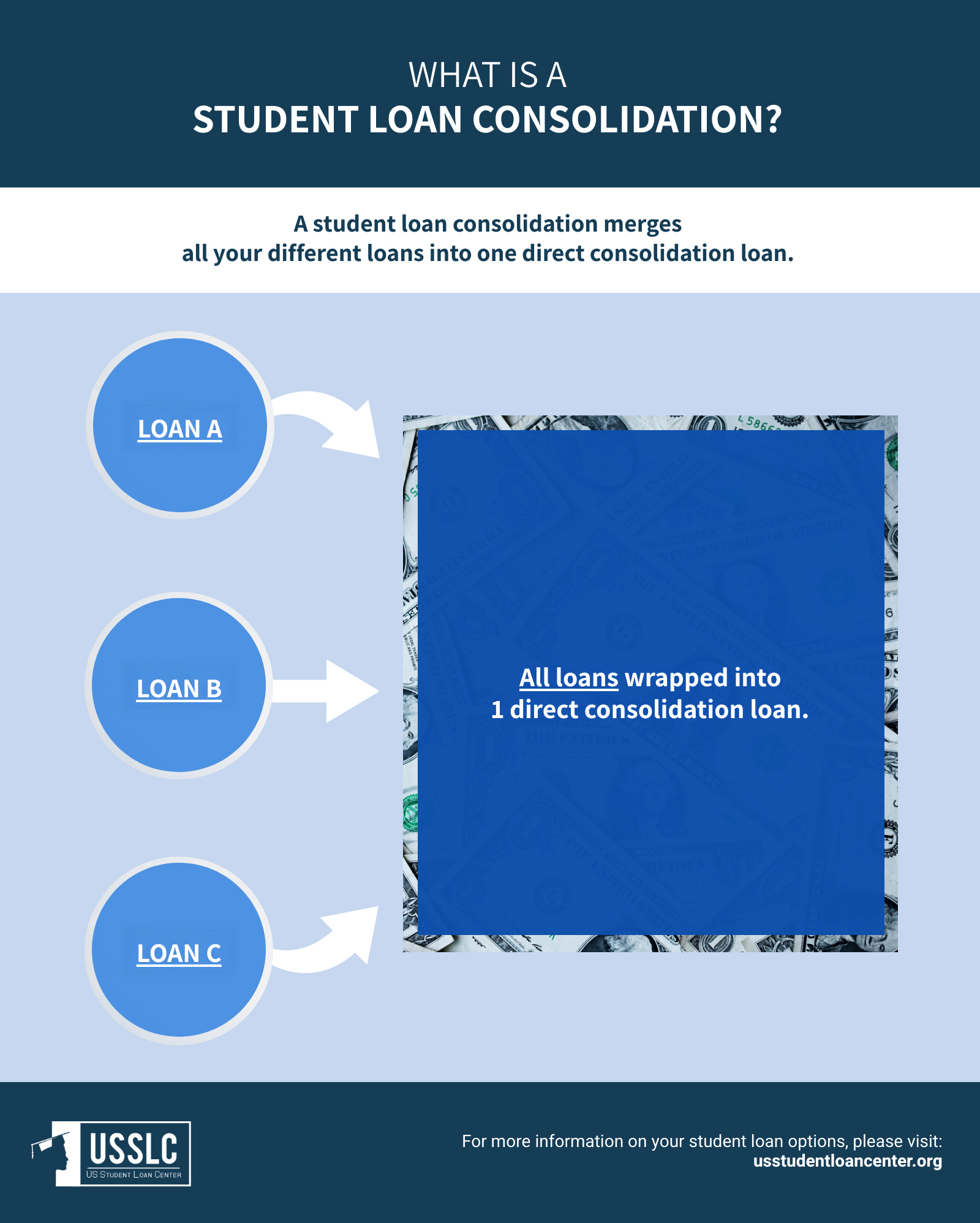

What is Student Loan Consolidation?

Student Loan Consolidation is the process of taking out one new loan that pays off and encompasses all of your existing student loans. When you consolidate your student loans, you move from multiple payments and servicers down to just one monthly payment.

Federal student loans can be consolidated, while private student loans can only be refinanced.

When you consolidate your federal student loans, your new loan will also be with the Department of Education. The new loan will not lower your interest rate, but it can lower your payments by extending your repayment term.

If your current monthly payment is too high for you, consolidation can allow you to lower it, if you are willing to pay on your loan for longer.

For some repayment plans, you will need to consolidate your loans in order to qualify for the plan.

With private student loans, combining all of your loans into one loan is called refinancing. If you qualify with a private lender, refinancing allows you to turn existing loans into one new loan while also lowering your interest rate and saving you money.

You will not be able to consolidate federal and private loans together into a new Direct loan with the Department of Education. However, you may be able to with a private lender – if you choose to.

When is Student Loan Consolidation a Good Idea?

Student loan consolidation is not always a good idea, but can be the right choice for you if:

- You currently have federal student loans that are with several different loan servicers. Consolidation simplifies your repayment down to one servicer and one monthly bill.

- You would like to lower your monthly payment amount by increasing the time you repay your loans. Consolidation loans offer you up to 30 years to repay your loans.

- You would like access to additional income-driven repayment plan options and Public Service Loan Forgiveness (PSLF). Loans that did not previously qualify for PSLF can be consolidated into a Direct Consolidation Loan that can be forgiven under PSLF.

- You would like to switch any variable-rate loans you have to a fixed interest rate.

Should You Consolidate Your Student Loans?

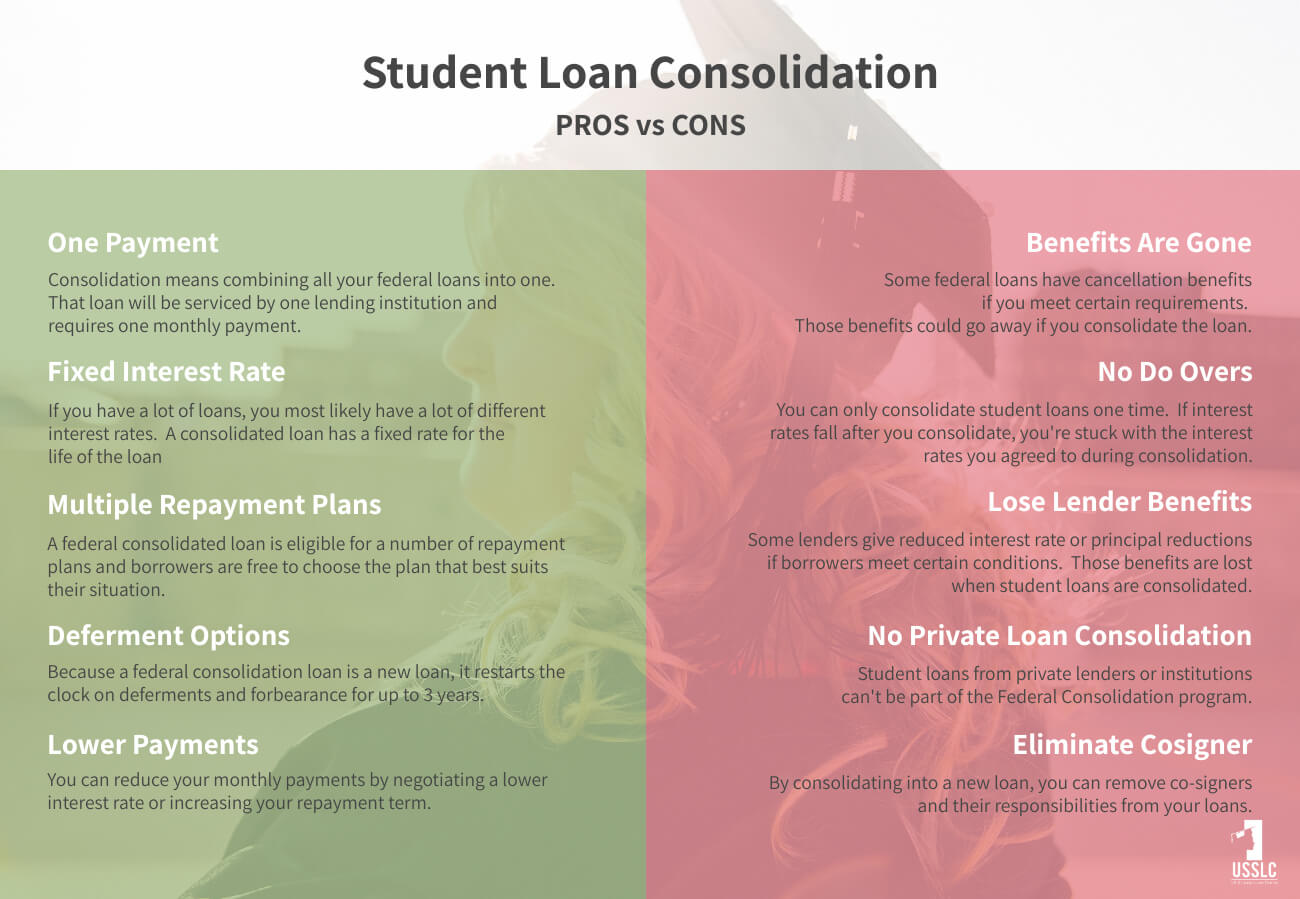

If you are on the fence about consolidating your federal student loans, consider the Pros and Cons:

Pros

- Streamline your bill paying process into one monthly payment

- Lower your monthly payments by extending your repayment term

- In some situations, lower your interest rate

- Switch from a variable-rate to a fixed-rate loan

- Gain access to a different repayment or forgiveness plan

- Gain access to graduated repayment options, with lower payments now and higher payments later

- Can improve your credit score in the long run by making it easier to keep track of payments

Cons

- Consolidation usually increases the repayment term of your loan, meaning you will likely make more payments and pay more in interest than if you didn’t consolidate.

- Consolidation includes any outstanding interest on the loans that you consolidate as part of the original principal balance on your consolidation loan. More interest may accrue on a higher principal balance than if you had not consolidated.

- Consolidation can cause you to lose certain borrower benefits, like interest rate discounts, principal rebates, or some loan cancellation benefits, that are associated with your current loans. You will want to be sure that you are not forfeiting benefits that are important to you.

- If you are currently paying your loans under an income-driven repayment plan, or if you’ve made qualifying payments toward Public Service Loan Forgiveness, consolidating your loans will cause you to lose credit for any payments made toward income-driven repayment plan forgiveness or PSLF. You can, however, choose to consolidate some loans, and leave out others that qualify for PSLF.

What Types of Loans Can be Consolidated?

Most federal student loans are eligible for consolidation, including:

- Subsidized Federal Stafford Loans

- Unsubsidized Federal Stafford Loans

- PLUS loans from the Federal Family Education Loan (FFEL) Program

- Supplemental Loans for Students

- Federal Perkins Loans

- Nursing Student Loans

- Nurse Faculty Loans

- Health Education Assistance Loans

- Health Professions Student Loans

- Loans for Disadvantaged Students

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans

- FFEL Consolidation Loans and Direct Consolidation Loans (only under certain conditions)

- Federal Insured Student Loans

- Guaranteed Student Loans

- National Direct Student Loans

- National Defense Student Loans

- Parent Loans for Undergraduate Students

- Auxiliary Loans to Assist Students

Direct PLUS Loans that your parents took out to help pay for their dependent student’s education cannot be consolidated with federal student loans that you received directly.

What are the Requirements to Consolidate a Student Loan?

In order to consolidate your federal student loans, you must have graduated, left school, or dropped below half-time enrollment.

Consolidation does not depend on your credit score, but there are other requirements:

- The loans you will be consolidating must already be in repayment or in the grace period. The grace period is typically six months after you graduate, but can vary depending on the type of loan.

- Typically, you cannot consolidate a loan for a second time – unless you are consolidating it with another eligible loan.

- If you are in default on your loans, you cannot consolidate them. You must agree to make three consecutive monthly payments on the loan prior to consolidation, or choose one of several income-related repayment plans to repay your new direct consolidation loan under.

- If your defaulted loan is being collected through wage garnishment, or in accordance with a court order, you won’t be able to consolidate unless the garnishment order is lifted or the judgment vacated.

What Will the Interest Rate Be on My Consolidated Loan?

There is no set answer to this question.

Your federal student loan consolidation interest rate is the weighted average of your federal loans’ interest rates, rounded up to the next one-eighth of one percentage point. That means the interest rates on larger loans will factor more significantly into your final interest rate.

You can calculate how much your interest rate will be by following these steps:

- Multiply each loan amount by its interest rate to obtain the “per loan weight factor.”

- Add the per loan weight factors together.

- Add the loan amounts together.

- Divide the “total per loan weight factor” by the “total loan amount,” and then multiply by 100 to calculate the weighted average.

- Round Step 4’s result to the nearest higher one-eighth of one percent if it’s not already on an eighth of a percent.

How to Consolidate Student Loans

You can log in to your Federal Student Aid account to begin your application for a Direct Consolidation loan. You can fill out the application on your own, which must be done during one session, and takes approximately 30 minutes.

In order to complete the application, you will need all of your education loan records and personal income information. You will also need contact information for two references who have known you for at least three years, including one parent or legal guardian.

You must be prepared to choose a loan and loan servicer, as well as a repayment plan. This is where working with a reputable company, like USSLC, can come in handy. Not only will USSLC ensure that your application is filled out correctly the first time, but our experts can help you select the best repayment plan or loan servicer for your particular situation.

Consolidation should make your life easier, and we can help!

Give USSLC a call at 877.433.7501 or send an email to consulting@usstudentloancenter.org

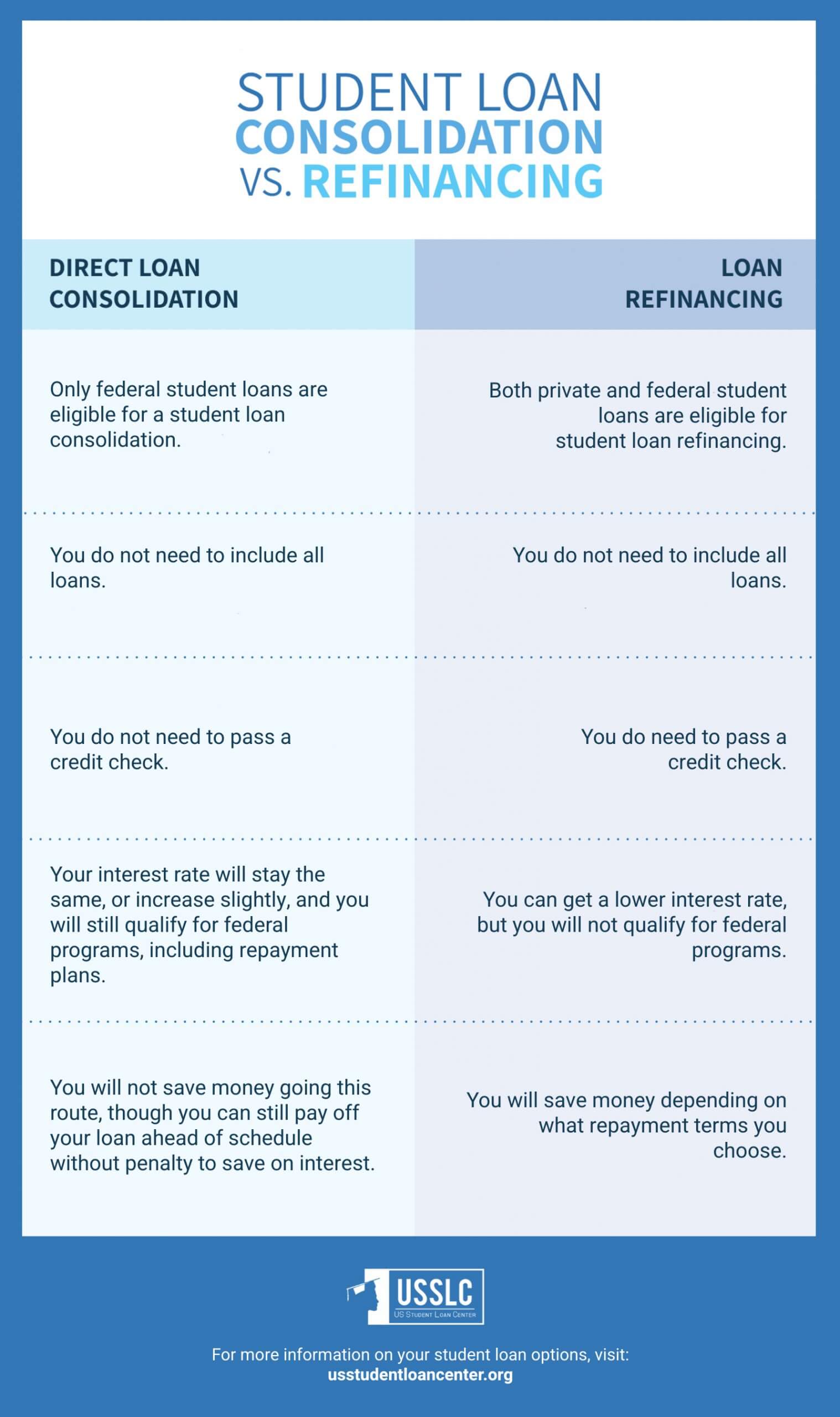

How is Student Loan Consolidation Different From Refinancing?

Student Loan Consolidation is an option for federal student loan borrowers to combine all of their loans into one new loan with the Department of Education. It does not necessarily lower your interest rate, but can lower your monthly payments by extending your loan repayment term.

Direct Consolidation loans can also qualify for repayment plans and forgiveness programs that your previous loans did not. Consolidation does not depend on your credit score for approval.

Student Loan Refinancing is a financial choice you make when working with a private lender. You can take advantage of lower interest rates, and if you choose to, you can consolidate both your federal and private student loans into one loan. Refinancing can specifically save you money by lowering your interest rate. I

f you combine your federal and private loans together into one private student loan, you do lose access to federal protections and repayment options. Your entire financial history and your credit score will be considered when you apply to refinance, and used to determine your interest rate.

Student Loan Consolidation is not the right choice for everyone, but if you are struggling to keep up with many loan payments, or want access to new repayment plans, contact USSLC to discuss your options!

FAQs on How To Consolidate Student Loans

Q: How to consolidate student loans in default?

If you are in default on your loans, you cannot consolidate them. You must agree to make three consecutive monthly payments on the loan prior to consolidation, or choose one of several income-related repayment plans to repay your new direct consolidation loan under.

If your loans are in default, but you are not yet in wage garnishment, the fastest way to get out of default is to consolidate your loans, which gives you a fresh start.

Q: Can you consolidate student loans more than once?

Typically, you cannot consolidate a loan for a second time – unless you are consolidating it with another eligible loan.

Q: Can you consolidate student loans with your spouse?

You cannot consolidate federal student loans with your spouse. If you would like to combine your loans, you would have to do so by refinancing with a private lender.

Q: Can you consolidate student loans in collections?

If your defaulted loan is being collected through wage garnishment, or in accordance with a court order, you won’t be able to consolidate unless the garnishment order is lifted or the judgment vacated. If either of these are the case, you should look into Student Loan Rehabilitation.

Q: When to consolidate student loans?

The best times to consolidate student loans are during your grace period, or right after you have begun repayment. This will give you access to the lowest interest rates possible. It will also eliminate any chances of you missing payments if you have several different loans to keep track of.

Q: Who is best to consolidate student loans with?

The online application for loan consolidation is free to fill out on your own. However, working with an established company can streamline the process and ensure that all of your paperwork is in order. They can also provide you with counseling on different repayment plans and loan servicers, making sure that consolidation truly simplifies your life. USSLC is a well-respected company with great reviews and years of consolidation experience!

Up Next:

Leave a Reply