The Parent PLUS Loan is one of the hardest student loans to understand.

There aren’t very clear instructions on the best way to handle this loan.

But, never fear!

That is exactly why we’ve put this together.

Are you a student who is looking for another way to pay for college?

Are you considering the Parent PLUS Loan?

Or

Are you a parent who took out a Parent PLUS Loan?

Has your student graduated and now it’s time for you to pay it back?

If so, you’ve definitely come to the right place.

Let’s take a look at everything that goes into qualifying for, managing and paying back your Parent PLUS Loan.

Here is what we will go over:

- What is the Parent PLUS loan?

- Do I Qualify for the Parent PLUS Loan?

- Should I Apply for the Parent PLUS Loan?

- What should I watch out for with the Parent PLUS Loan?

- What are the Repayment Options for the Parent PLUS Loan?

- Should I Consolidate my Parent PLUS Loans?

- The Parent PLUS Loan: Key Points

- Top 15 FAQs About The Parent PLUS Loan

Let’s get started!

What Is The Parent PLUS Loan?

The Parent PLUS Loan (PPL) is a federal student loan available to the parents of dependent undergraduate students.

This loan is the complete responsibility of the parent. The student is not responsible for paying the loan back.

PPLs CANNOT be transferred over to the name of the student, before or after graduation.

This is by far the biggest misunderstanding when it comes to the PPL.

The PPL is not a loan signed under the student’s name, cosigned by a parent or guardian.

Simply put, the Parent PLUS Loan is Direct PLUS loan applied for by the parent of the student.

Direct PLUS Loan

This is a loan for parents of dependent undergraduate students or graduate/professional students. The application will provide the appropriate information required by the school used to determine how much the student is eligible to receive.

Interest Rate of The Parent PLUS Loan

As of 2018, the interest rate for the Parent PLUS Loan is 7.0%. This is a fixed interest rate for the entire life of the loan.

Fixed Interest Rate

The rate you start with is the rate you’ll have throughout the term of the loan. Therefore, the monthly payment throughout the life of the loan will remain the same unless the borrower is put into an income-driven repayment plan.

(Credible: Fixed vs Variable Interest Rates)

For example, let’s say you took out a total of $30,000 in PPLs with an interest rate of 7.00%.

If you paid it off on the 10-year Standard Repayment Plan, you’d pay a total of $11,799 in interest by the end of the loan, totaling $41,799.

Shake off the hassle of finding a cosigner with these private #studentloans. #RT to help a friend or two out! https://t.co/EVvw1KV31g#tips #loan #debt #education #USSLC pic.twitter.com/KJEChmG8WG

— USStudentLoanCenter (@USSLC1) April 3, 2018

Do I Qualify for the Parent PLUS loan?

According to the US Department of Education, in order to qualify for the PPL, the applicant must be:

- The biological parent, adoptive parent, or step-parent of the student

- In good credit standing

- A U.S. Citizen

- Enrolled at least half-time

(Note: Before applying for a Parent Plus Loans, a borrower needs to understand the best ways to pay back the Plus Loan. If you intend on applying, you need to go through this short 8-Plan Repayment Guide first. It’s the best way to make sure you’re armed and ready for when the time comes to pay back your loan. Get the free 8-Plan Repayment Plan Guide here.)

Should I Apply for the Parent PLUS loan?

When it comes to federal loans, there are loan limits on how much you can borrow per year. Often times, it’s not enough to cover the full cost of attending college.

If worse comes to worst, the parent of the dependent student may consider and apply for these loans.

Parents will apply for the Parent PLUS Loan to fill the gap between the federal loan amount already given and the actual cost of attendance.

If the parent is denied the loan, the dependent student is then offered a Direct Unsubsidized Loan.

Students in their first and second year are granted $4,000 or higher, third years and beyond are granted $5,000 or higher.

The Parent PLUS Loan can also be used to cover the extra fees that come with the Cost of Attendance. This may include:

- Room and board

- Books

- Supplies

- Equipment

- Transportation

- Other necessary expenses

Parents! You must also keep in mind that there are several other loan options available to you and your child.

The PPL is an option, but it is not your only option.

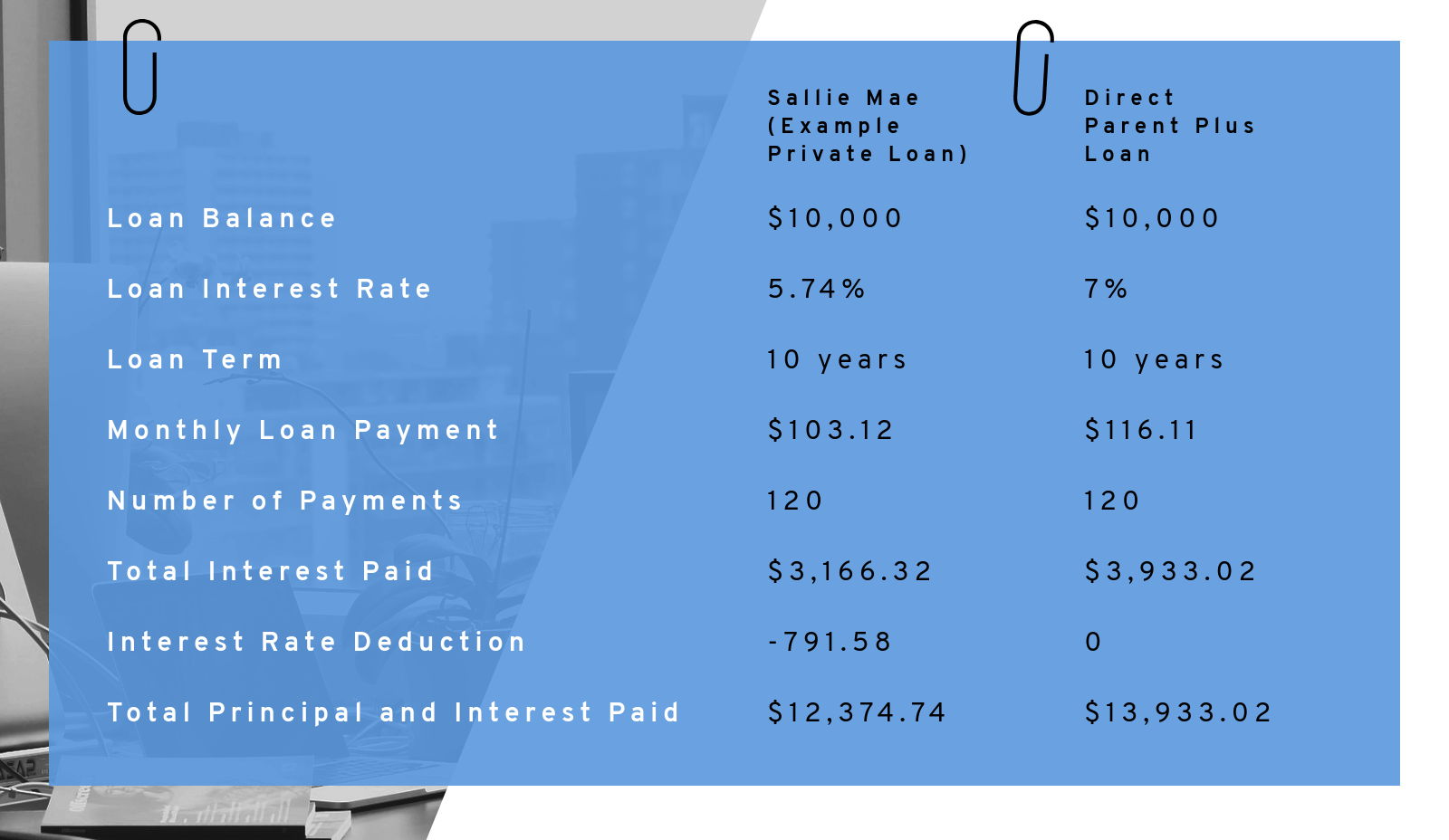

There are many Private loans out there that can offer you better interest rates for the same loan amount! Some private loans such as Sallie Mae offer a 0.25% interest rate deduction if you chose to auto-pay every month.

Take a look at this comparison chart:

What Should I Watch Out For With The Parent PLUS Loan?

Warning #1: The Parent PLUS Loan CANNOT Be Signed Over To The Student

This type of loan will always be under the parent’s name.

Many people believe that after graduation, the student will be able to transfer the loan to their own name.

Unfortunately, this is not the case.

At the end of the day, the parent who signed for the loan is solely responsible for paying back the loan.

Warning #2: The Big Problem With Consolidating All Of Your Loans Together

You should NEVER consolidate your PLUS loans with other federal student loans!

Here’s why:

Parent PLUS loan is only eligible for the Income-Contingent Repayment plan.

The Income-Contingent Repayment plan is NOT a good option for borrowers with a lower income.

So beware, by consolidating your PLUS Loans with additional Federal loans, you will be paying more than you have to.

Instead, consolidate all your loans except for your Parent PLUS loan.

Your servicers will try to consolidate all of your federal loans (including your PPLs) because it will make your monthly payments “easier.”

This is NOT the case!

*Do NOT consolidate your federal loans with your PLUS Loans*

This WILL give you a higher overall monthly payment.

Instead, pay for your Parent PLUS Loan separate from the rest of your loans.

This will give you the lowest monthly payment.

Warning #3: Watch Your Servicers Closely

Your servicers want you to consolidate your PPLs with all of your other loans.

Why?

Because they want all of your loans to be in the Income-Contingent Repayment Plan. As a result, 20% of your income is required to payback your student loans.

Seems like they don’t have your best interest in mind…

They will tell you it is your best option.

They will tell you it is your only option.

Instead, do your own research before making any important decisions with your loans. Furthermore, speak with a specialist who understands the red tape.

Almost 100% of students who contact their servicer get duped.

You can read about some class action lawsuits here.

(Borrower Notice: Consolidation isn’t the only option, even though your servicers may tell you it is. Use this 8-plan Cheat Sheet to find out the best option that you can use to repay your student loans. Find out more and get the free guide, here.)

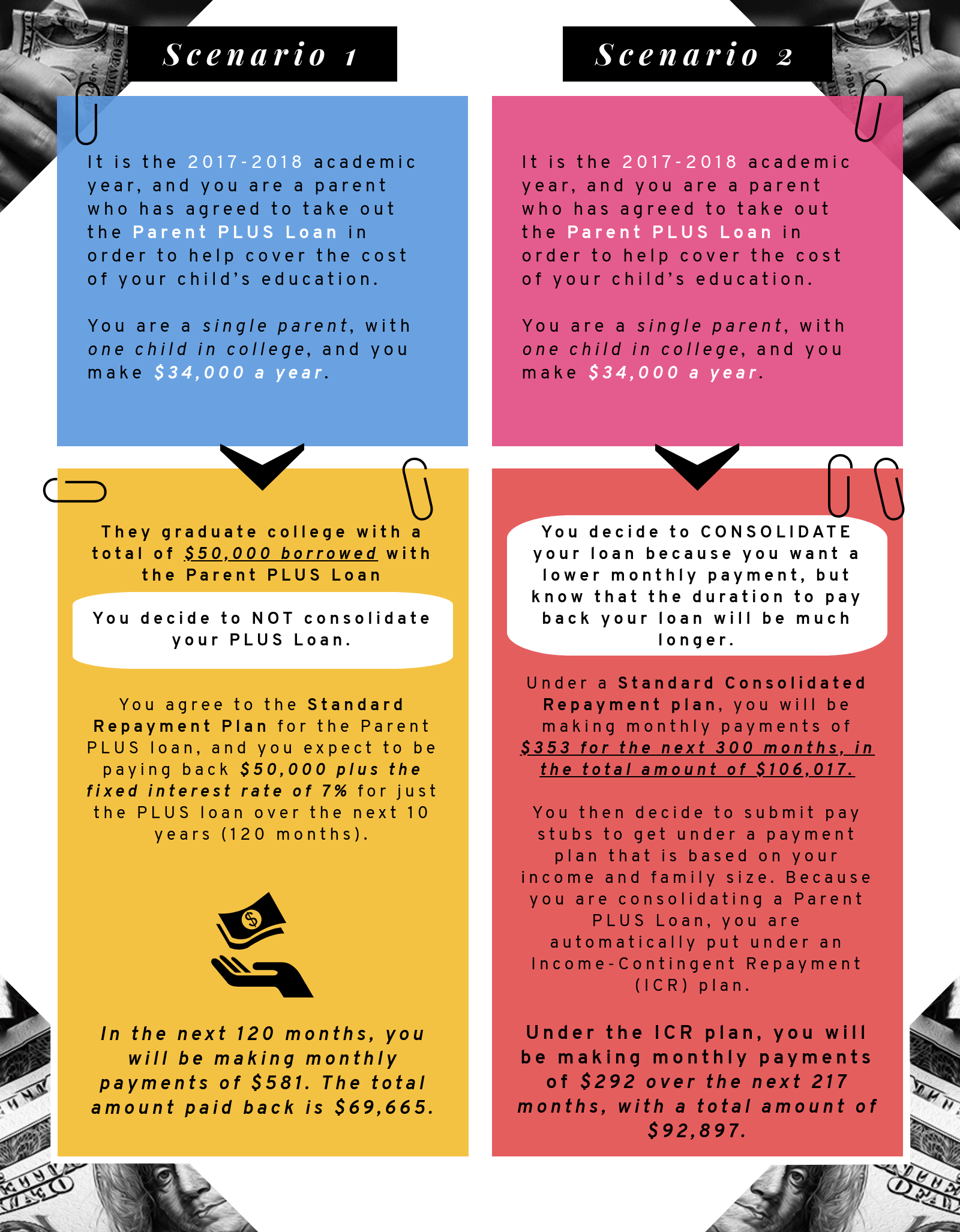

Warning #4: Be Careful When Consolidating The Parent PLUS Loan By Itself

It is true, consolidating your PLUS Loans can give you a lower monthly payment.

But, you must also think about how long it is going to take for you to pay back the loan in full.

In the end, you must keep in mind how much more you will be paying back due to the interest accrued.

Consolidating your PPLs may be easier for your budget now. But, will you be able to afford it in the long run?

Need us to put it into perspective for you? Let’s take a look at these two scenarios:

What Is The Best Repayment Option For Me?

Good news!

It is definitely possible to find a repayment plan that works within your personal budget. You just have to make sure that you’re checking off the right boxes.

When you take out Parent PLUS Loans, upon graduation you are automatically put into a Standard Repayment Plan.

The Standard Repayment Plan has a payback of 10 years or 120 consecutive payments.

You could also be eligible for the Graduated Repayment Plan.

In the Graduated Repayment Plan, you start off with lower monthly payments that gradually increase over the next 10 years.

The Extended Repayment Plan is also an option for PLUS borrowers.

The Extended Repayment Plan allows you to repay your loans over an extended period of time, which can lower the monthly payment amount.

To be eligible for this repayment plan, you must have more than $30,000 in Direct Loan debt.

And lastly, there is consolidation.

(Need more information on the best repayment option for you? We wrote the book on how to pick the best repayment plan for you and your wallet, so you can skip the guesswork. Click here to learn more and to get your free download of the book.)

Should I Consolidate my Parent Plus Loans?

As mentioned before, you should always be careful when consolidating this type of student loan.

What is a consolidation, exactly?

A consolidation combines multiple loans into one monthly payment with a fixed interest rate. It’s easier to track your monthly payment if you only have one loan.

However, there are some HUGE disadvantages that come with consolidating PLUS Loan with your federal loans.

For example:

- Higher risk of paying more each month

- Only having one repayment option

- Paying back a higher interest rate on the loan.

- Losing the chance to defer your loans after graduation.

Just keep in mind!

It is always important to evaluate all your options before making any important financial decisions.

Look into different repayment plans.

Find out what you are eligible for.

Be sure to make smart financial decisions that will help you in the long run.

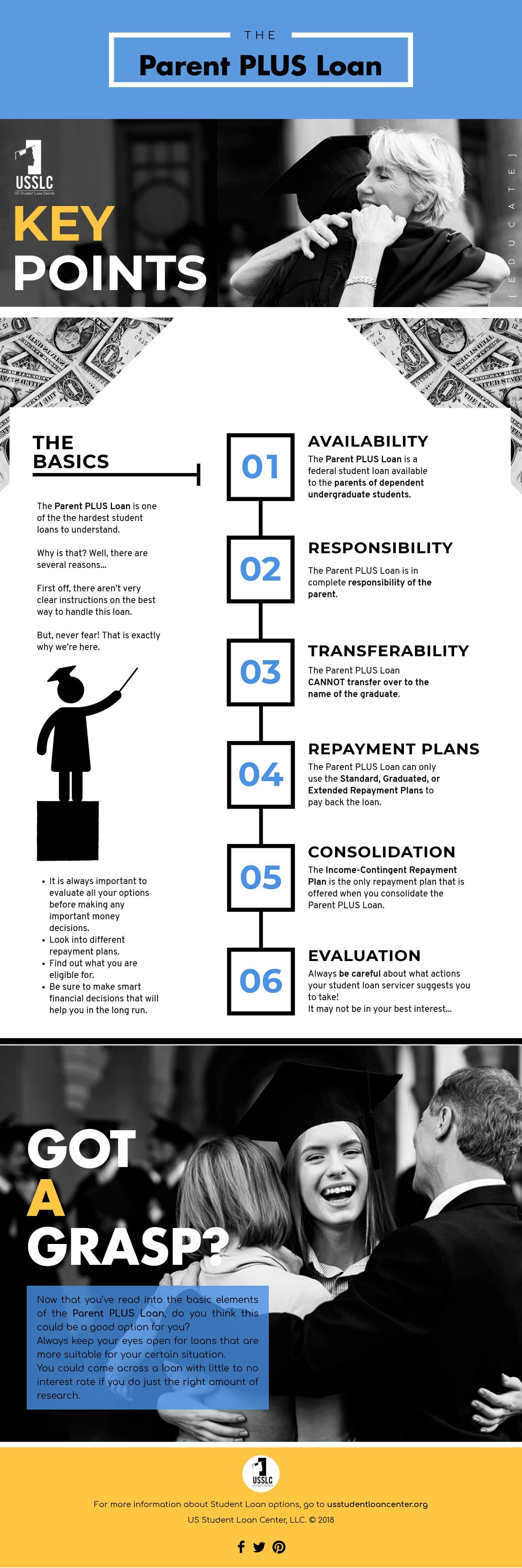

The Parent PLUS Loan: Key Points

Think you’ve got a good grasp on the Parent PLUS Loan?

Share this Image On Your Site

Here are a few things you should take away from this:

- PPLs are federal student loans available to the parents of dependent undergraduate students.

- Parents have the full obligation to repay the loan

- The PPL CANNOT be transferred over to the graduate.

- The PPL can only use the Standard, Graduated, or Extended Repayment Plans to pay back the loan.

- The ICR is the only income-driven repayment plan that is offered when consolidating PLUS Loans.

- Always be careful about what actions your student loan servicer suggests you take! It may not be in your best interest…

Top 15 FAQs About The Parent PLUS Loan

Question #1: What is the Parent PLUS Loan?

It is a federal student loan available to the parents of dependent undergraduate students.

Question #2: Who can apply for the Parent PLUS Loan?

In order to apply for the PLUS Loan, you must be the biological parent, adoptive parent, step-parent of the student in need of the loan.

Question #3: Can a dependent student apply for the Parent PLUS Loan and use their parent as a cosigner?

No. The student cannot apply for the loan underneath their name.

Question #4: Can I take out the Parent PLUS Loan if I am the legal guardian or foster parent of a dependent student?

No.

Question #5: Who is responsible for paying back the Parent PLUS Loan?

The person who signed the loan is legally responsible for paying back the loan.

Question #6: Can I transfer the Parent PLUS Loan over to my child’s name?

No.

Question #7: When do you start paying back the Parent PLUS Loan?

60 days after disbursement of the loan.

Question #8: Are Parent PLUS Loans tax deductible?

The most you can deduct is either $2,500 or the total amount of student loan interest you paid, whichever is less. The amount of the deduction you’re eligible for is based on your income.

Question #9: How much can you take out with the Parent PLUS Loan?

The full annual cost of attendance (COA) minus other financial aid received.

Question #10: What does the cost of attendance (COA) include when applying for the Parent PLUS Loan?

The cost of attendance includes tuition and fees, room and board, books, supplies, equipment, transportation, and other necessary expenses.

Question #11: What happens if I am denied the Parent PLUS Loan?

If you are denied the Parent PLUS Loan, the dependent student is allowed to take out a Direct Unsubsidized Loan with the same limits that are available to independent students. (First years and second years are granted $4,000 or higher, third years and beyond are granted $5,000 or higher.)

Question #12: Who is my Parent PLUS Loan servicer?

Log in to the National Student Loan Data System with your FSA ID.

Here you will find a summary of all of your loans including the types of student loans you have, loan amounts, as well as outstanding balances and interest.

Question #13: Can the Parent PLUS Loan affect my credit?

If you do not pay your Parent PLUS Loan monthly payment on time, you will start to build a late payment history which can affect your credit. If your payments are directed to collections, your credit can be negatively affected as well.

Question #14: Can the Parent PLUS Loan be forgiven?

The Parent PLUS Loan can be forgiven after 25 years under consolidation if the borrower can make their consecutive monthly payments.

Question #15: Is there a job that will help me get my Parent PLUS Loan forgiven?

Parent PLUS borrowers who work in an eligible public service job or employer may be eligible to have the forgiveness kick in, and be tax free, after only 10 years. Eligibility for this program is 100% based on the actual parent borrower.

So, if only one parent works in a qualifying job please make sure that this parent is listed as the borrower for the PLUS loans.

(NOTE: Still have questions about how to repay Parent Plus Loans? No need to worry. Take this free download on the best repayment options available, or simply give our helpful student loan counseling team a call at 813-775-2058.)

Do you have a Parent PLUS Loan? What did you do to make the repayment more manageable? Let us know in the comments!

Leave a Reply