With the rise in college tuition, it’s no surprise that more and more students are defaulting on their loans…

Defaulting means that you’re unable to make payments on your student loans.

Usually, your loan will be considered to be in default status after 270 days of not making any payments.

This can cause a ton of different issues, and all of them are bad.

For instance, did you know that defaulting on your loan, even for a couple of months, can completely ruin your credit history?

This means that you may find it difficult to obtain a mortgage in the future. In other cases, you may find that you won’t qualify for a credit card. In extreme situations, you may even find that you are unable to obtain certain jobs or apply for a mortgage.

(NOTE: Defaulted loans can lead to lower credit scores, pestering collections, and a worried mind. Avoid default and learn how to turn a “Default” status into a “Current” status in under 90 days by using our Road Map to Getting Student Loans Out of Default. Click here to learn more and get the free map – before your next payment date!)

When a student defaults on their loan, they have two ‘main’ options at their disposal:

- Consolidation: This is where all of your debts will be consolidated into a single payment each month. This is the ideal route to go down if you have multiple student loans. The amount of money that you will be paying back each month will be less. However, in the long run, you will be paying more in interest.

- Debt rehabilitation: For many people, this is the best option, and we’ll show you why.

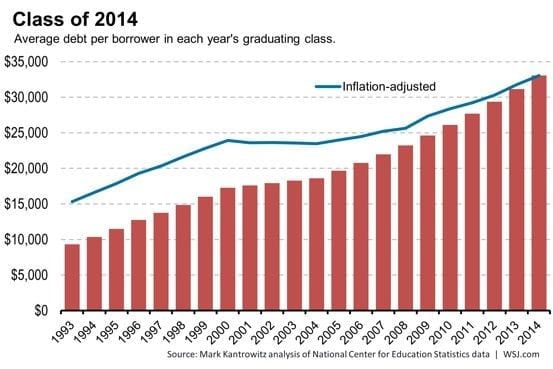

The number of people defaulting on their loans has risen sharply over the past couple of years. Along with the rising default rate, the average amount of debt that a student graduates with has risen as well.

These go hand in hand.

As the average amount of debt increases, it’s likely that the default problem is going to spiral out of control. This means more and more people will need to look into options like rehabilitation.

So how does rehabilitation work?

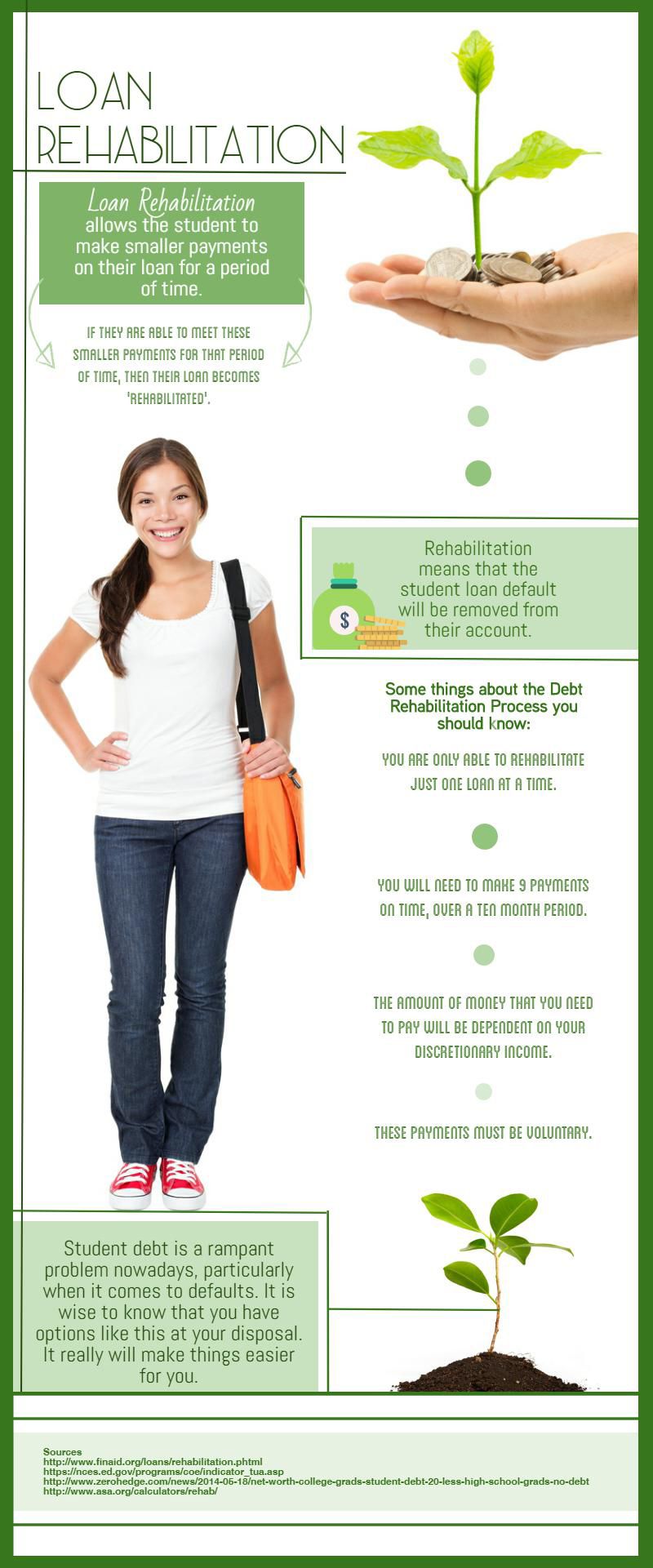

So, what is loan rehabilitation?

Loan rehabilitation allows the student to make smaller payments on their loan for a certain period of time. If they are able to meet these smaller payments, then their loan becomes ‘rehabilitated.’

This means that the default status will be removed from their account.

It is worth noting that if you go down the route of consolidation, then there will be no removal of the default.

That will stick with you.

There are a few guidelines that you will need to know about the rehabilitation process.

Don’t worry, we are going to cover these in more depth, we just want to give you a brief overview:

- You are only able to rehabilitate just one loan at a time.

- You will need to make 9 on-time payments, over a ten month period.

- The amount of money that you need to pay will be dependent on your discretionary income.

- These payments must be voluntary.

Let’s cover the first point. There are many people out there who will graduate with a couple of loans under their belts. However, if you are struggling to repay them, you will only be able to rehabilitate one of the loans at a time.

If you have more debts than you can handle, and you do not feel like rehabilitating just one of them is going to help, then you may want to look into consolidation instead. This is not going to have that default removed from your account, but at least you will be able to make sure that the problem does not become too difficult to handle.

(NOTE: Are your student loans giving you a default headache? Avoid default and learn how to turn a “Default” status into a “Current” status in under 90 days by using our Road Map to Getting Student Loans Out of Default. Click here to learn more and get the free map – before your next payment date!)

If you are struggling to make payments on your account and you really do not feel like rehabilitation is going to help, then never go down that route because you will be required to meet payments on time. This leads us to our next point.

You will need to make 9 on-time payments over a 10 month period.

If you miss more than one payment, then the default is not going to be removed from your account.

It is worth highlighting the final point here.

The payments must be completely voluntary.

They cannot be taken from wage garnishment. You need to pay them yourself. So make sure that you know when the payment is due. It is also worth pointing out that you have to make monthly payments. While the amount of money that you will need to pay will be drastically reduced, you are not going to be allowed to make a single lump sum payment.

The amount of money that you need to pay will be dependent on your discretionary income. Typically, your payments will be equal to 15% of your discretionary income.

The cost of rehabilitating your student loan will be no more than 16% of the unpaid principal and the amount of interest that you have accrued. Of course, the amount of money that you will need to pay back each month will be highly dependent on your income and the amount of your loan that you still need to pay back. It is common for some people to pay as little as $5 per month, although you probably will be paying back a bit more than this.

What are the benefits to rehabilitation?

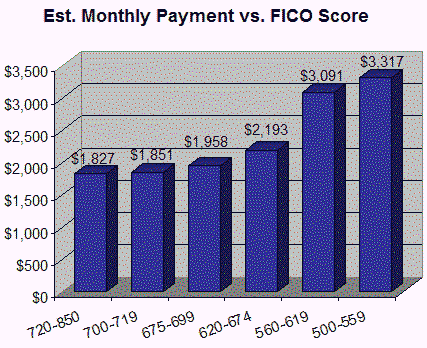

Before we dive into the benefits of rehabilitation, look at the chart below. It shows you a comparison of how much you can expect your mortgage payment to be in relation to your credit score.

Source: https://www.mymoneyblog.com/effect-of-credit-score-on-mortgage-rates-and-monthly-payments.html

Obviously, this is a ‘guideline’ image. However, it goes to show you that even the smallest nudge in your credit rating can drastically increase your mortgage payment. Therefore, if you do have a blip in your credit score, then this is a problem which is going to need to be rectified.

When you ‘default’ on your student loan, your credit score is going to take a hit.

The major benefit of going through student loan rehabilitation is that you are going to be able to remove that default status.

It’s imperative that you remove the default status as it will impact your credit score for 7 years. That means you may find it almost impossible to get a mortgage during that time.

It is worth noting that if you do default on a loan, then you are not going to be able to apply for financial aid again. This is because you will now have been deemed to be ‘untrustworthy’. Obviously, this is not ideal if you are in the midst of studying. By defaulting on your loan, you may completely eradicate any hope of following the career path that you want.

(NOTE: Are your student loans giving you a default headache? Avoid default and learn how to turn a “Default” status into a “Current” status in under 90 days by using our Road Map to Getting Student Loans Out of Default. Click here to learn more and get the free map – before your next payment date!)

However, when that default is removed through the process of rehabilitation, then you will be able to reapply for student aid in the future.

Finally, if you do not remove the default status, you will never be able to apply for deferment or forbearance in the future. This means that you will have fewer options available to you should there be a time where you are struggling to make payments on your loan.

Of course, this will make it even more difficult to keep your credit score in check. Many people who default on their loan time and time again may not even be able to rent a property because their score is so low. Obviously, this is not something that you are going to want to have happened!

Are there any downsides to rehabilitation?

It does sound like student loan rehabilitation is a great idea, right?

Well, to some extent, it is.

However, it is worth pointing out that there will also be a few drawbacks to this system. You are going to need to consider those drawbacks before you determine whether this is the right choice for you.

First, if you are not going to be able to make those 9 payments each month, then your account is going to remain in default.

You will not be able to remove the default either.

As we mentioned previously, the payments shouldn’t be too high. They will vary based on your discretionary income. However, the discretionary income is not going to take into account any expenses that you will have leaving your account. This means that you may not actually have the money needed to meet your loan repayments.

If you can make a budget work for you, then brilliant.

However, if you can’t make it work for you and you are not 100% certain that you will be able to meet your loan repayments each month, then you will want to hold off loan rehabilitation. It may not be the right option for you.

Finally, you are going to only be able to rehabilitate a loan once.

Once those ten months are up, that is it. You will never be able to rehabilitate it again.

Therefore, it is going to be in your best interest to make sure that you can genuinely not afford to meet your loan repayments each month. In many cases, people will find that some savvy budgeting is all that they need to do in order to not default on their loans.

It is important that you make loan rehabilitation a last resort.

This isn’t a way to give yourself some extra cash to play with for a period of time. It should be a method that you use only when you realize that you are unable to meet those loan repayments any other way. If you do not use it like that, then you are just going to be causing yourself issues in the future.

Conclusion

As you can see, student loan rehabilitation is going to be a great method for ensuring that you do not have defaults on your credit report. However, it is not going to be a method for everybody out there.

Make sure that you meet the following criteria:

- You must be able to make the monthly repayments each month. If you do not, then this process is not ideal.

- You should only be using loan rehabilitation as a last resort. If you can find other methods that you can use to avoid a default on your loan, then make sure that you do that first as you are only going to be able to go through this process once.

- Inform the lender as soon as possible that you may be defaulting on your loan. They want to get paid, so they will do everything in their power to make sure that you don’t default. Many people find that by talking to their lender, they may not even need to go through the rehabilitation process.

Remember, student loan debt is a rampant problem nowadays, particularly when it comes to default.

It is wise to know that you have options like this at your disposal. It really will make things easier for you.

(NOTE: Defaulted loans can lead to lower credit scores, pestering collections, and a worried mind. Avoid default and learn how to turn a “Default” status into a “Current” status in under 90 days by using our Road Map to Getting Student Loans Out of Default. Click here to learn more and get the free map – before your next payment date!)

Hello I graduated 2014 BSN/RN start to work as a RN from 2015 to 2019. Also I was LPN for 13 years work in nursing homes in Colorado. Now I am asking students loan forgiveness due to I am not working at this point because my husband with health issue.

Hey there!

the best way to find out if you qualify for forgiveness is by calling us and speaking to an expert student loan counselor about your case. They will ask you a few simple quick questions and depending on your answers they will be able to tell you if you qualify for forgiveness or not, and they would even be able to enroll you and take care of all the paperwork and application process for you. Please give us a call at your earliest convenience at 877.433.7501