Coming out of college can leave you with a significant debt burden. As tuition and living costs spiral, students are finding themselves weighed down by more debt than ever before.

The average graduate from the class of 2016 graduated with a colossal $37,172 of debt.

That’s a 6% increase from the year before.

With a growth rate like that, it’s no wonder that most graduates make paying their debt off a priority.

And the first step to paying off your student loans is to get on a repayment plan that works for you. Why pay more per month than you have to?

But, only focusing on paying your student loan debt can hinder other areas of your life. Sure it’s great to be on the road to paying off your student loans, but what about other goals?

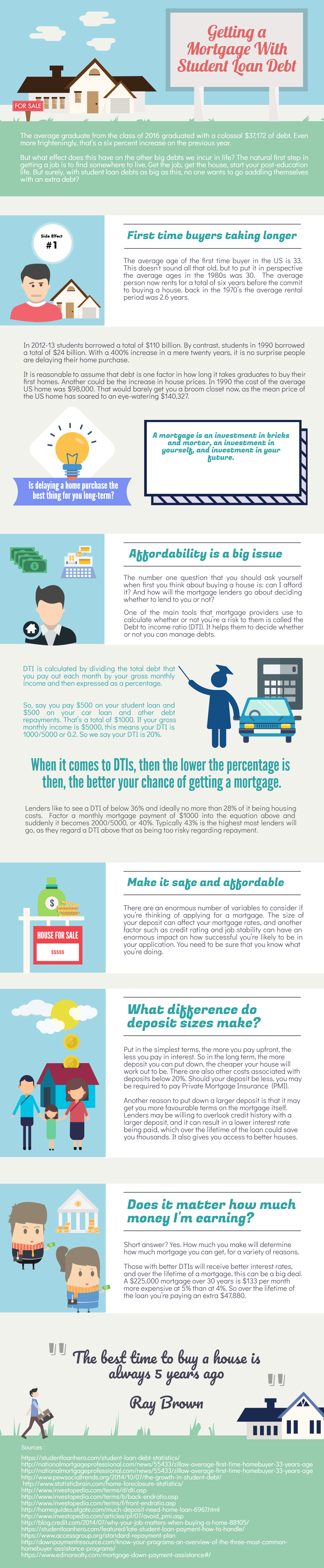

Are you concerned that you can’t get a mortgage because of student loans?

First time buyers are taking longer to purchase their first homes

The average age of the first time buyer in the US is 33.

This may not seem that old to you, but let’s put it into perspective. In the 1980’s, the average age of a first time buyer was 30.

Now, the average person rents for a total of 6 years before they’re ready to commit to buying a house. Back in the 1970’s, the average rental period was 2.6 years.

These figures go along with the trend of millennials taking their time with big decisions.

But is this just a generational choice, or is there more to it than that?

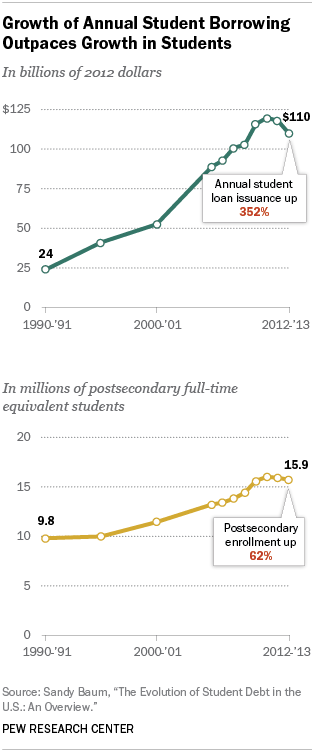

It’s certainly accurate to say that student loan debt has been increasing. In 2012-2013, students borrowed a total of $110 billion. In contrast, students only borrowed a total of $24 billion in 1990.

With a 400% increase in a mere 20 years, is it any wonder that people are waiting until later to buy their homes?

With these numbers, it seems reasonable to assume that debt is one factor in how long it takes graduates to buy their first homes.

Another could be the increase in house prices. In 1990, the cost of the average U.S. home was $98,000. That would barely get you a broom closet now, as the mean price of a home in the U.S. has soared to an eye-watering $140,327.

Given the increased levels of debt paired with higher costs of living, it doesn’t come as a surprise that people are waiting longer and longer to buy their first house.

But is delaying this milestone the best option when it comes to the long term?

The longer you stay in the rental sector, the more of your money is disappearing into landlord’s pockets. A mortgage can be seen as a concrete investment. But, if you cannot realistically afford a mortgage, is the additional debt going to pull you down?

It’s a tightrope that you walk when you decide whether or not to buy. So let’s look at a few of the issues surrounding home purchases.

Can you afford a house?

The number one question that you should ask yourself when you think about buying a house is: Can I afford it?

In 2015, nearly a million mortgages were foreclosed or homes repossessed.

That’s a lot of people whose numbers ultimately just didn’t add up. But how do you go about making sure that your numbers do? And how will the mortgage lenders go about deciding whether to lend to you or not?

Here’s how lenders decide if you’re worthy of a loan

One of the main tools that mortgage providers use to calculate whether or not you’re a risk to them is called the Debt to income ratio (DTI). It helps them to decide whether or not you can manage your debts.

DTI is calculated by dividing the total debt that you pay out each month by your gross monthly income.

Say you pay $500 on your student loan and $500 on your car loan and other debt repayments. That’s a total of $1000. If your gross monthly income is $5000, this means your DTI is 1000/5000 or 0.2. So we say your DTI is 20%.

But that’s before you’ve gotten a mortgage

When it comes to DTIs, the lower the percentage is, the better your chance of getting a mortgage. Lenders like to see a DTI of below 36% and ideally no more than 28% of it being housing costs.

Factor a monthly mortgage payment of $1000 into the equation above and suddenly it becomes 2000/5000, or 40%. Typically 43% is the highest most lenders will go, as they regard a DTI above that as being too risky regarding repayment. But the DTI is just one of the metrics used by mortgage providers to calculate your suitability.

Wait… What’s a front end ratio? Why is it important?

The front end ratio is used to calculate how much of your income will be used to repay your mortgage. It’s computed as the amount of money you spend on housing costs (your principal, plus any taxes and interest) divided by your monthly income.

In the example above your Front-end Ratio would be calculated as 1000/5000 or 20%. As we’ve seen, lenders don’t like a Front End Ratio to go above 28%, so our exemplar’s looking pretty good for his or her mortgage application.

Let’s put it all together and see if you’ll qualify

So, all in all, you don’t want the total debt that you pay out each month, including your student loan and your mortgage, to exceed 43% of your income at the absolute outside, and the mortgage cost exceeding 28% of your income is a no-no too.

Break either of these marks, and there’s a good chance that this mortgage is not one that you can afford. So add all your debts up, be honest with yourself, and work out your DTI.

This will be an excellent indicator of whether or not you can afford a mortgage.

What difference do down payment sizes make?

When it comes to buying a house, how much you’re able to put down up front can make a big difference further down the line.

The magic number used to be 20%. As house prices have increased, that number has come to be seen as unrealistic by the industry. You can get a mortgage with a 0% down payment, but what you need to consider is the overall affordability.

Put in the simplest terms, the more you pay upfront, the less you pay in interest. So in the long term, the more of a down payment you can put down, the cheaper your house will work out to be.

There are also other costs associated with down payments below 20%.

Should your down payment be less, you may be required to pay Private Mortgage Insurance (PMI). There are a few reasons you want to avoid PMI.

Not only can it add up to 1% to the overall cost annually, but you will have to continue to pay it until the equity in your home reaches at least 20%. If you’re starting out with a 0% down payment, that could mean a long time of paying over the odds.

Another reason to put down a larger down payment is that it may get you more favorable terms on the mortgage itself. Lenders may be willing to overlook a poor credit history with a larger down payment, and it can result in a lower interest rate being paid.

Over the lifetime of the loan, you could save you thousands.

Don’t forget that front end ratio, the amount of your income being used to pay the mortgage. With a small down payment, you’ll be paying more in the form of a mortgage. With a larger down payment, you’d be paying proportionately less, so you’ve got more of that ratio to play with, giving you access to bigger, more expensive houses.

Only if that’s what you want though, let’s not forget what we said about affordability.

Does it matter how much money you’re earning?

Short answer?

Yes.

There’s no getting around it.

How much you make will determine how much of a mortgage you can get, for a variety of reasons.

First, mortgage lenders will use back end and front end ratios to calculate your eligibility for a mortgage. These calculations will also have an effect on how much interest they’ll charge you.

As with all finance other than student loans, the higher a risk a lender deems you to be, the more they’ll charge you. They’re covering themselves in the event of you defaulting.

Those with better DTIs will receive better interest rates.

Over the lifetime of a mortgage, this can be a big deal.

Let’s say you get a 30 year mortgage for $225,000. You might think there’s not a big difference between a rate of 4% versus 5%.

But, that 1% difference will end up costing you $133 per month.

So over the course of the loan, you’re paying an extra $47,880.

The difference is HUGE!

So it needs stressing… get those ratios to where they need to be!

Still confused? Check out this handy infographic….

How about if you’re just about to change jobs?

There’s a lot of old wives tales about how changing your job can blow your chances of a mortgage right out of the water. It is mostly a lot of hot air.

It’s entirely possible to get a mortgage having recently changed jobs. But, job stability does make the process easier.

Mortgage lenders will use your income over the last 24 months to calculate your DTI. It’s much easier to do if you can show a steady 24 months of the same money coming in, and the same bills going out.

It also helps with your credit rating if you’ve been paying your bills on time, with no fuss, for two years. And an excellent credit rating can go a long way towards getting you a good mortgage.

Lenders like to see stability, and if you’ve had a job change recently, that implies a lack of stability (even if you’ve traded up to a better position). So you’ll have a few more hoops to jump through and a bit more documentation to provide (such as an offer letter and proof of your new payment).

Life is harder for those on an hourly wage, as even if you have set hours, any fluctuation will raise a flag with the lender. Plus if your wage has changed, they’ll average them out.

If you recently had a pay rise you need to prove this to your lender to get them to calculate your DTI at the better rate.

So in a perfect world, you’d have the same job for two years before applying for your mortgage. But if you haven’t, it’s not the end of the world.

So, you still have student loans… Can you qualify for a mortgage?

Now we get down to it.

There’s no getting away from it; outstanding student loans will affect your chances of getting a mortgage.

Pure and simple, they’ll affect your DTI.

The more you’re paying out on your student loans, then the worse your back end ratio is going to be.

The more debt you’re paying out on, the higher a risk a lender is likely to see you as.

But don’t be discouraged.

This doesn’t mean that you can’t buy a house because of student loans.

If you’re on a standard repayment plan, repayments are as low as $50 per month. That’s not going to make a huge difference to your DTI.

The downside is that, as interest accrues, these student loans prove more expensive over time.

But they don’t have to be a barrier to you getting a mortgage now (once you’ve got then mortgage, then you can look at ways of making the student loan cheaper).

Is there any other help out there?

The good news is that it’s possible to get help to get your first house. Housing associations, State, and County schemes are all in place to help you if you need.

Many sources offer down-payment assistance programs. These are systems designed to help you get on the housing ladder; they can take a variety of forms from money to cover outlay costs, to silent 0% mortgages payable after you’ve paid your principal mortgage off. Many housing associations offer mortgages at below market rate. There are also federal grants available to help you get the money for a down payment together.

Do your research, see what you qualify for. It may be easier to buy a house than you think.

Conclusion

Buying a house is scary business.

Getting a mortgage with student loan debt is more difficult, but it’s in no sense a deal breaker.

Factor the loans into your calculations; if you work out your DTI before you go to a mortgage lender and you know that you’re below 36%, then that’s already half the battle.

Be realistic about what you can afford, work out your budget, and don’t go higher. There’s no sense asking for a mortgage for $200,000 if you can only afford $150,000.

There’s money available to help you, but you have to go and look for it. No one’s going to come to you with a hand-out.

Try to get as large a down payment as you can. The more money that you can put down at the start, the more you’re going to save in the long run.

Above all, don’t worry. You haven’t signed anything yet; just make sure that when you do, you’re as well informed, well organized and well financed as you can be, and the whole thing will be a lot less scary than you expected.

Leave a Reply