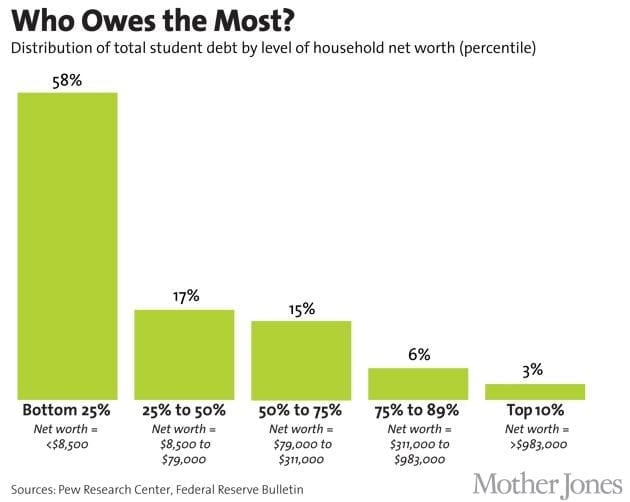

It is well-known by now that the American university system gives students an incredibly high debt burden upon graduation.

Unfortunately, as tuition and cost of living rises, but young people’s income stagnates, students are graduating with more and more debt each year.

In 2012, students who graduated and had taken out loans owed $25,000 on average!

However stressful debt can be, it is not the end of the world.

Look at it this way: you have your degree, so you’re already a step in the right direction and closer than you used to be to paying them off!

When confronted with student loan debt stress, it is critical to step back, take a moment to assess your situation, and plan for the future.

Here are 7 ways to deal with student loan debt stress:

1. Be Familiar with all of your Potential Options!

Often time, students struggle to pay their debt because they are simply not aware of all the possible payment strategies and tools available to help them.

Government loans often offer many different payment plans and are usually open to rate renegotiation if you absolutely need it.

Private loans aren’t always so forgiving, but banks usually want to keep their customers and maintain a good reputation.

This means even private banks sometimes offer some flexibility.

You can’t be afraid to step up, be confident, and approach your lender to explain your situation and ask for new terms.

2. Keep a good grasp on reality

It is important not to blow your debt out of proportion; after all, it’s not the end of the world.

However, it is important to be realistic with yourself, too.

Don’t be in denial of your debt, because then you will not have the opportunity to work on it.

Start small by trying to remain calm and do some research on your potential options.

Planning to pay off small amounts over time at a decent interest rate is much more conceivable than thinking about the huge, scary lump sum of your entire debt.

3. Plan Long Term!

It can be easy to think of your small repayments every month as accomplishments because they are!

It is important that you plan your loan payments at a level that you know you will be able to maintain in the long term.

Don’t try to pay too much, too soon, and risk putting yourself in even more financial stress.

Damaging strategies stress over the current situation and forget about the future.

Good strategies make sure they are maintained, realistic, and helpful over multiple years.

There are ample debt repayment planning tools on the web, both privately and through the federal government website that can help you make realistic plans based on your income.

4. Set a strong Budget

Part of planning for the future is controlling your current actions.

It doesn’t matter if you are making your monthly payments if you have consistently poor spending habits in other areas of your finances.

You must make sure your spending is under control, so you can avoid future debts and short-term debts like credit cards.

These can lead you into a cycle of debt, where you can be trapped into paying off other debts rather than your student loans.

Try to plan out how much every aspect of your life will cost, and try to estimate high.

When budgeting, we tend to assume we will spend less than we usually actually need to.

It’s best to budget on your current income and plan where the extra money will go if you get a raise.

5. Get excited about something you love

Your debt does not define you.

Try to remember why you went to college and got all those loans in the first place.

It was probably because you wanted to accomplish something important, so get out there and do it!

Remember that the point of your career isn’t just to pay back your loans.

It’s the other way around!

If you remember what you are working towards and do something you love, you can make money to pay back your loans and still enjoy your life without allowing yourself to be overwhelmed with stressful thoughts.

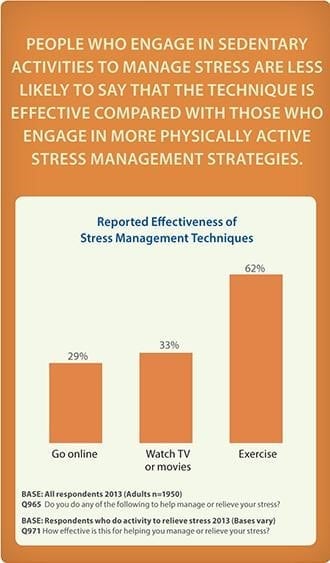

6. A sound body leads to a sound mind

It may sound strange, but one of the most important ways to manage your stress is keeping your body physically healthy.

It has been proven that regular exercise has a wealth of benefits for a person’s mental health.

Getting regular cardio makes you energized in your daily life, and clamping down on your lethargy makes you ready to take on the task of working towards becoming debt-free.

Exercise both distracts you and clears your mind.

A healthy diet is also crucial.

Don’t let your low spending allow you to buy food lacking nutrition.

Cooking nutritious meals at home is more cost-efficient than eating out at unhealthy restaurants, and it gives you another thing to be passionate about.

What goes into your body affects your stress levels more than you would think.

7. Keep a perspective on what really matters.

Once you make a plan for paying off your debt, stick to the plan, but stop worrying about it and live your life!

Remember when you are stressing that, if you have made your plan, there is nothing else you can do to magically solve all your problems in the current moment.

Spend time with friends, keep up with your hobbies, and do other things to make sure you stay happy.

If you are happy, you will be more motivated to work to pay off your debt, leading to nothing but more rewards down the line.

Your financial health is important to your future, but more important is your mental, physical, and emotional health!

Without maintaining your happiness, you can’t carry out an effective plan for debt management.

Leave a Reply