Are you struggling to keep up with your student loan payments?

Wondering if there’s a way to ease that struggle?

You’re not alone.

Millions of students deal with the same struggles. And if this is you, forbearance might be the solution you’ve been looking for.

In this article, we will explore the benefits of forbearance on a student loan and how it can help you manage your financial challenges with ease.

What is Forbearance on a Student Loan?

Forbearance is a temporary pause or reduction in your student

loan payments granted by your lender.

It allows you to take a break from making payments or reduce the amount you owe for a set period of time. This can be incredibly helpful if you’re facing unexpected expenses, a job loss, or a decrease in income.

By understanding the benefits of forbearance, you can make informed decisions about managing your student loan debt and alleviate some of the financial stress.

So… let’s get started. First…

Let’s make sure this isn’t you LOL

Benefits of forbearance on student loans

One of the key benefits of student loan forbearance is the ability to temporarily reduce or suspend your monthly payments. This can provide immediate relief for borrowers experiencing financial hardship. It can be particularly advantageous during times of economic uncertainty or personal financial crises, allowing borrowers to prioritize other essential expenses while keeping their student loan debt in check.

Additionally, forbearance can help protect your credit score by preventing missed or late payments from being reported to credit bureaus. By proactively seeking forbearance when facing financial challenges, you can avoid the negative repercussions of defaulting on your student loans.

This ensures you maintain a more favorable credit history.

Types of forbearance options available

There are generally two types of forbearance available for student loans:

- Discretionary forbearance

- Mandatory forbearance.

Discretionary forbearance is granted at the discretion of the lender or servicer, typically in cases of financial hardship or illness.

Mandatory forbearance, on the other hand, is required by law in specific circumstances, such as serving in a medical or dental internship, participating in a teaching program, or qualifying for the Department of Defense Student Loan Repayment Program.

Understanding the differences between these types of forbearance can help you determine which option is best.

It is important to carefully review the terms and conditions of forbearance to ensure you fully understand your rights and responsibilities as a borrower.

Eligibility criteria for student loan forbearance

The eligibility criteria for student loan forbearance vary depending on the type of forbearance you are seeking.

Generally, borrowers must demonstrate a valid reason for requesting forbearance, such as experiencing financial hardship, serving in a qualifying program, or undergoing a period of unemployment. Lenders may require documentation to support your request, such as proof of income, medical records, or program certification.

It is important to communicate openly and honestly with your lender or loan servicer about your financial situation. This will help them better determine your eligibility for forbearance.

By providing accurate information and following the necessary procedures, you can increase your chances of obtaining forbearance and effectively managing your student loan debt.

How to apply for forbearance on your student loan

The process of applying for forbearance is simple, but many people don’t qualify. It typically involves contacting your loan servicer directly and submitting a forbearance request.

If you’re a client of USSLC, be sure to contact your Client Success Manager

because approval can be tricky.

You may be required to complete a forbearance application form and provide supporting documentation to verify your circumstances. It is essential to follow the instructions provided by your lender and meet any deadlines to ensure your request is processed in a timely manner.

Once your forbearance request is approved, you will receive confirmation from your lender outlining the terms and duration of the forbearance period.

Be sure to review this information carefully to understand how forbearance will impact your loan payments and overall repayment strategy.

If you have any questions or concerns about the forbearance process, don’t hesitate to seek clarification from a team member here. In addition it may make more sense to do a deferment rather than a forbearance. You can read about deferment vs forbearance here.

Managing your finances during forbearance

While forbearance can provide temporary relief from student loan payments, it is important to continue managing your finances responsibly during this period.

Take the opportunity to assess your budget, prioritize essential expenses, and explore other options. It’s important to look for chances to increase your income or reducing your expenses.

Consider reaching out to a financial advisor or counselor for personalized guidance on managing your finances effectively.

It is also advisable to stay informed about your student loan status. This includes any changes in interest rates, repayment terms, or eligibility for loan forgiveness programs. By staying proactive and engaged in your financial planning, you can make informed decisions about repaying your student loans and achieving your long-term financial goals.

Potential drawbacks of student loan forbearance

While forbearance can offer valuable benefits for borrowers facing financial challenges, it is important to be aware of potential drawbacks associated with this option.

One of the primary drawbacks is the accrual of interest during forbearance, which can increase the total amount you owe on your loan over time. If possible, consider making interest-only payments during forbearance to minimize the impact on your overall loan balance.

Another consideration is the potential extension of your loan term due to forbearance. This can lead to a longer repayment period and higher total interest costs. It is important to weigh the benefits of forbearance against these potential drawbacks. There may also be explore alternative repayment options that may better suit your financial situation and goals. You can read about all the student loan consolidation programs and compare them here.

Alternatives to student loan forbearance

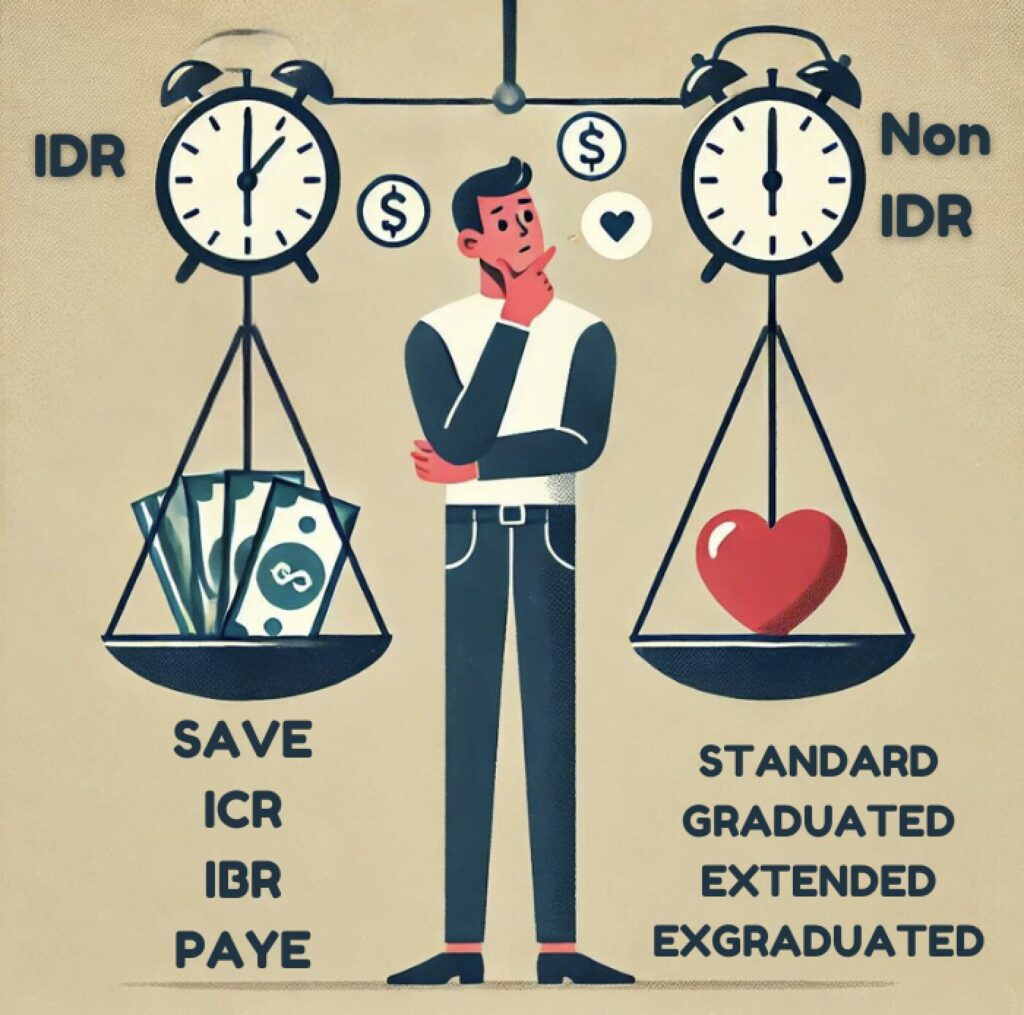

If forbearance is not the most suitable option for managing your student loan debt, there are alternative solutions available to help you stay on track with your payments.

Income-driven repayment plans, loan consolidation, and loan forgiveness programs are some of the options you may consider. Each of these aim to reduce your monthly payments, lower your interest rates, or qualify for loan forgiveness.

Exploring these alternative repayment options can help you find a solution that aligns with your financial goals and circumstances. It is recommended to research and compare the terms of each option carefully to determine which strategy may offer the most benefits and flexibility for your specific needs.

Tips for effectively managing your student loan during forbearance

To make the most of forbearance and maintain control of your student loan debt, consider implementing the following tips:

- Monitor your loan status regularly to stay informed about any changes in repayment terms or eligibility for loan assistance programs.

- Create a budget that reflects your current financial situation and allows you to prioritize essential expenses while managing your student loan payments.

- Explore opportunities to increase your income through part-time work, freelance projects, or other sources of additional revenue.

- Seek guidance from financial advisors, loan counselors, or online resources to gain insights into effective debt management strategies.

- Stay proactive in communicating with your lender or loan servicer to address any concerns or questions about your student loan forbearance.

By following these tips and staying informed about your options, you can navigate the challenges of student loan repayment with confidence and make progress toward achieving your financial goals.

Conclusion: Making informed decisions about forbearance on a student loan

In conclusion, understanding the benefits of forbearance on your student loan can empower you to manage your financial challenges with ease and confidence. By exploring the different types of forbearance available, determining your eligibility criteria, and applying for forbearance strategically, you can effectively navigate your student loan repayment journey and stay on track with your financial goals.

Remember to weigh the potential drawbacks of forbearance against its benefits. Explore alternative repayment options, and seek personalized guidance on managing your student loan debt effectively. With careful planning, proactive communication, and a clear understanding of your financial situation, you can make informed decisions about how to best utilize forbearance and achieve long-term financial stability.

By doing this, you can overcome financial challenges with resilience and determination. Stay informed, stay engaged, and stay focused on your path to financial success.

You’ve got this!

Leave a Reply