Understanding the Saving on a Valuable Education (SAVE) Repayment Plan: A Comparative Analysis

The Saving on a Valuable Education (SAVE) Repayment Plan is a relatively recent addition to the suite of income-driven repayment (IDR) plans available for federal student loan borrowers in the United States.

Designed to make student loan repayment more affordable, the SAVE Plan adjusts monthly payments based on the borrower’s income and family size, ensuring that payments remain manageable.

This detailed analysis will compare and contrast the SAVE Plan with other IDR plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR), and provide examples of who might benefit from each plan.

The Saving on a Valuable Education (SAVE) Repayment Plan was created to address several issues inherent in the federal student loan system and to provide more affordable, manageable repayment options for borrowers.

Today, I'm proud to announce a new student debt repayment program called the SAVE Plan.

— President Biden (@POTUS) August 22, 2023

It's the most affordable student loan plan ever. And a promise kept in fixing the existing student loan program.

Let me explain how it works: pic.twitter.com/sXGdUPoOcb

Here are some of the primary reasons for its creation:

1. Addressing Financial Hardship

Affordability:

- The SAVE Plan aims to make student loan payments more affordable by tying monthly payments to a borrower’s income and family size. By capping payments at 10% of discretionary income, the plan ensures that borrowers are not overburdened by their loan payments, especially those with lower incomes.

Preventing Default:

- High monthly payments can lead to financial strain and an increased risk of default. The SAVE Plan helps mitigate this risk by lowering payments to a manageable level, thereby reducing the likelihood that borrowers will default on their loans.

2. Simplifying Repayment Options

Streamlining IDR Plans:

- The federal student loan system offers multiple income-driven repayment plans, which can be confusing for borrowers to navigate. The SAVE Plan was created to simplify the landscape by providing a straightforward, easy-to-understand option that meets the needs of a wide range of borrowers.

Reducing Complexity:

- By offering a plan with clear terms and benefits, the SAVE Plan reduces the complexity and administrative burden for both borrowers and loan servicers. This simplification makes it easier for borrowers to choose and stay on a repayment plan that works for them.

3. Enhancing Borrower Protections

Interest Subsidies:

- One of the key features of the SAVE Plan is its generous interest subsidies.

If a borrower’s monthly payment does not cover the accruing interest, the government will pay the remaining interest on certain loan types for a specified period. This prevents the loan balance from ballooning due to unpaid interest, offering significant protection to borrowers.

Loan Forgiveness:

- The SAVE Plan offers loan forgiveness after 20 years for undergraduate loans and 25 years for graduate or professional loans. This feature provides a clear endpoint for borrowers, ensuring that they are not trapped in perpetual debt.

4. Promoting Educational Attainment and Economic Mobility

Encouraging Higher Education:

- By making student loan repayment more manageable, the SAVE Plan encourages individuals to pursue higher education without the fear of insurmountable debt. This can lead to greater educational attainment and improved career prospects.

Supporting Economic Stability:

- Affordable repayment options help borrowers maintain financial stability, which can have broader positive effects on the economy. When individuals are not overburdened by debt, they are more likely to invest in homes, start businesses, and contribute to economic growth.

5. Responding to Public Concerns and Policy Recommendations

Addressing Public Demand:

- There has been significant public demand for more manageable student loan repayment options.

The SAVE Plan was created in response to these concerns, offering a solution that addresses the financial realities faced by many borrowers.

Policy Recommendations:

- Various policymakers and advocacy groups have recommended reforms to the student loan system to make repayment more manageable and to protect borrowers from excessive debt. The creation of the SAVE Plan aligns with these recommendations, reflecting a commitment to improving the federal student loan system.

Let’s See If You Qualify For The SAVE Program

It’s super simple to see what you’re eligible for, and our trusted team can get you set up today

Just take a look at our National student loan debt in the bottom left corner of the image below:

Current US Debt Clock

With the average student loan debt north of $38,000 it’s been a struggle for borrowers to get on their feet.

6. Supporting Equity and Inclusion

Helping Vulnerable Populations:

- The SAVE Plan is particularly beneficial for low-income borrowers, first-generation college students, and other vulnerable populations who may struggle with higher debt burdens. By providing more affordable repayment options, the plan promotes equity and inclusion in higher education.

Reducing Disparities:

- By capping payments based on income and offering generous interest subsidies and forgiveness terms, the SAVE Plan helps reduce disparities in student loan repayment outcomes. This can contribute to greater financial equity among borrowers of different socioeconomic backgrounds.

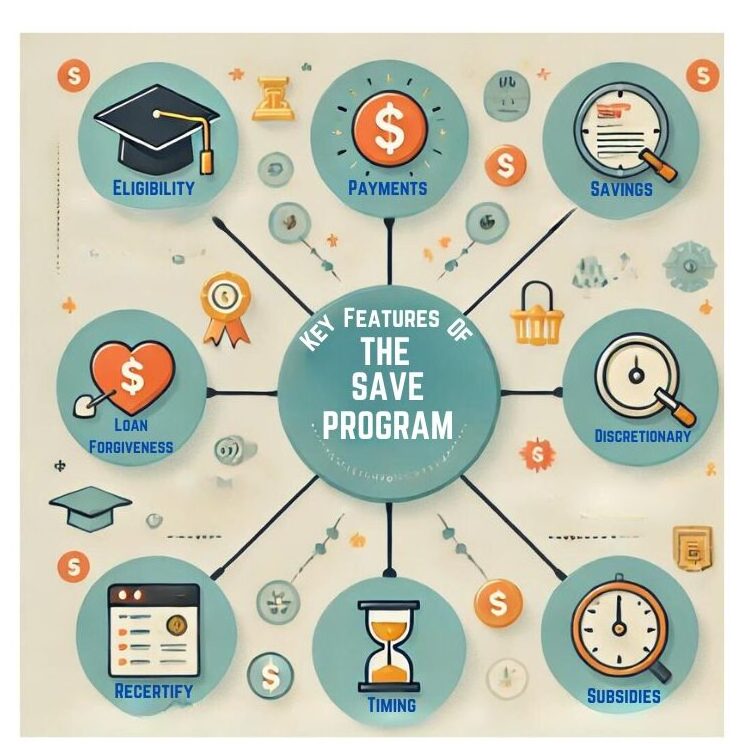

Key Features of the SAVE Repayment Plan

Before delving into comparisons, it’s essential to understand the SAVE Repayment Plan’s primary features:

- Payment Amounts:

- Payments are typically set at 5-10% of the borrower’s discretionary income. Discretionary income is calculated as the difference between the borrower’s annual income and 150% of the poverty guideline for their family size and state of residence.

- Eligibility:

- Borrowers with Direct Loans, including Direct Subsidized and Unsubsidized Loans, Direct PLUS Loans made to students, and Direct Consolidation Loans (excluding Direct PLUS Loans made to parents), are eligible for the SAVE Plan.

- Borrowers must demonstrate a partial financial hardship, meaning the payment they would make under the SAVE Plan is lower than what they would pay under the Standard Repayment Plan.

- Loan Forgiveness:

- After 20 years of qualifying payments for undergraduate loans, or 25 years for graduate or professional study loans, any remaining loan balance may be forgiven.

- Interest Subsidy:

- If the monthly SAVE payment doesn’t cover the interest that accrues on the loans, the government will pay the remaining interest for certain types of loans for a specified period.

- Annual Recertification:

- Borrowers need to recertify their income and family size annually. If a borrower fails to recertify, their payments may revert to what they would have been under the Standard Repayment Plan, and any unpaid interest may be capitalized (added to the loan principal).

Comparison- SAVE vs. Other IDR Plans

To provide a comprehensive understanding, let’s compare the SAVE Repayment Plan with other prominent IDR plans: IBR, PAYE, REPAYE, and ICR.

A) Income-Based Repayment (IBR) Plan

Overview: The IBR Plan caps monthly payments at 10% or 15% of discretionary income, depending on when the borrower first took out their loans. Payments are recalculated annually based on income and family size.

Eligibility:

– Borrowers must demonstrate partial financial hardship.

– Applies to both Direct Loans and Federal Family Education Loan (FFEL) Program loans.

Loan Forgiveness:

– After 20 years of qualifying payments for new borrowers (on or after July 1, 2014).

– After 25 years of qualifying payments for older borrowers.

Interest Subsidy:

– Provides interest subsidy on subsidized loans for the first three years of repayment if payments don’t cover the accruing interest.

Comparison with SAVE:

- Both plans cap payments at 10% of discretionary income for new borrowers, but IBR can be higher (15%) for older loans.

- The SAVE Plan provides more generous forgiveness terms (20 years for undergraduate loans) compared to 25 years for some IBR borrowers.

- SAVE’s interest subsidy is more extensive, potentially making it more attractive for borrowers with high-interest loans.

Who Might Use IBR:

- Borrowers with older federal loans who want lower payments and have a partial financial hardship.

- Borrowers seeking forgiveness after 20 or 25 years.

B) Pay As You Earn (PAYE) Plan

Overview: The PAYE Plan caps monthly payments at 10% of discretionary income and offers forgiveness after 20 years of qualifying payments.

Eligibility:

– Borrowers must demonstrate partial financial hardship.

– Available to Direct Loan borrowers who were new borrowers on or after October 1, 2007, and received a disbursement on or after October 1, 2011.

Loan Forgiveness:

– Any remaining loan balance is forgiven after 20 years of qualifying payments.

Interest Subsidy:

Provides interest subsidy on subsidized loans for the first three years if payments don’t cover the accruing interest.

Comparison with SAVE:

- Both PAYE and SAVE cap payments at 10% of discretionary income and offer forgiveness after 20 years.

- SAVE provides a broader interest subsidy, potentially reducing overall interest costs for borrowers.

- PAYE is limited to newer borrowers, while SAVE has broader eligibility.

Who Might Use PAYE:

- Newer borrowers with high debt relative to their income.

- Borrowers seeking lower monthly payments and loan forgiveness after 20 years.

C) Income-Contingent Repayment (ICR) Plan

Overview: The ICR Plan sets monthly payments at the lesser of 20% of discretionary income or the amount a borrower would pay on a fixed 12-year repayment plan, adjusted for income.

Eligibility:

-Available to all Direct Loan borrowers.

-No requirement for partial financial hardship.

Loan Forgiveness:

-Any remaining loan balance is forgiven after 25 years of qualifying payments.

Interest Subsidy:

Does not provide interest subsidies.

Comparison with SAVE:

- ICR’s payment cap (20% of discretionary income) is higher than SAVE’s (10%).

- SAVE offers forgiveness after 20 or 25 years, depending on the type of loan, while ICR requires 25 years for all borrowers.

- ICR does not offer interest subsidies, making SAVE more advantageous for those concerned about accruing interest.

Who Might Use ICR:

- Borrowers with Parent PLUS Loans consolidated into a Direct Consolidation Loan.

- Borrowers who don’t qualify for other IDR plans but need income-adjusted payments.

Practical Examples of Borrowers and Their Best Fit IDR Plan

To illustrate the nuances of these plans, let’s consider examples of borrowers with different financial situations:

- Emily, a Recent Graduate:

- Situation: Emily recently graduated with a degree in social work and has $30,000 in Direct Subsidized and Unsubsidized Loans. Her starting salary is $35,000.

- Best Fit:SAVE Plan

- Reason: Emily’s moderate income and recent graduation make her a good candidate for the SAVE Plan, which offers lower payments (10% of discretionary income) and generous interest subsidies. The 20-year forgiveness term for undergraduate loans is also advantageous.

- Reason: Emily’s moderate income and recent graduation make her a good candidate for the SAVE Plan, which offers lower payments (10% of discretionary income) and generous interest subsidies. The 20-year forgiveness term for undergraduate loans is also advantageous.

- Situation: Emily recently graduated with a degree in social work and has $30,000 in Direct Subsidized and Unsubsidized Loans. Her starting salary is $35,000.

- Michael, a Mid-Career Professional:

- Situation: Michael has $60,000 in graduate student loans and earns $50,000 a year as a public school teacher. He’s been making payments under the Standard Repayment Plan but struggles with high monthly payments.

- Best Fit:PAYE Plan

- Reason: PAYE cap payments at 10% of discretionary income, which would significantly lower Michael’s payments compared to the Standard Plan. PAYE might be more beneficial if Michael qualifies, but REPAYE is an excellent fallback with similar terms.

- Reason: PAYE cap payments at 10% of discretionary income, which would significantly lower Michael’s payments compared to the Standard Plan. PAYE might be more beneficial if Michael qualifies, but REPAYE is an excellent fallback with similar terms.

- Situation: Michael has $60,000 in graduate student loans and earns $50,000 a year as a public school teacher. He’s been making payments under the Standard Repayment Plan but struggles with high monthly payments.

- Sarah, a Parent with PLUS Loans:

- Situation: Sarah took out Parent PLUS Loans to help her children through college. She now has $40,000 in Parent PLUS Loans and earns $45,000 annually.

- Best Fit:ICR Plan

- Reason: Since Parent PLUS Loans are not eligible for most IDR plans, Sarah’s best option is to consolidate them into a Direct Consolidation Loan and repay under the ICR Plan. Although the payment cap is higher (20% of discretionary income), it offers manageable payments adjusted for income.

- Situation: Sarah took out Parent PLUS Loans to help her children through college. She now has $40,000 in Parent PLUS Loans and earns $45,000 annually.

Conclusion

The SAVE Repayment Plan was created to provide a more affordable, manageable, and equitable repayment option for federal student loan borrowers.

By addressing financial hardship, simplifying repayment options, enhancing borrower protections, promoting educational attainment and economic mobility, responding to public concerns, and supporting equity and inclusion, the SAVE Plan represents a significant step forward in improving the federal student loan system.

It offers clear benefits to borrowers, helping them manage their debt more effectively and achieve greater financial stability.

Leave a Reply