Cash rewards for good grades? Shouldn’t the value of hard work be enough? Well, do you work for free?

Even students with good grades discover that hard work isn’t nearly enough, especially when you’re dealing with loans, working while studying, and a bunch of other responsibilities.

The costs of college can be staggering. So, breaks are always welcome. Here’s how you can earn good grade rewards!

(Did You Know? There are two types of “breaks” borrowers can take from having to make student loan payments each month. One is forbearance and the other is a deferment, but which is the right choice? Download this free guide to find out if you must take a forbearance or a deferment if you need to delay your payments. Click here to learn more.)

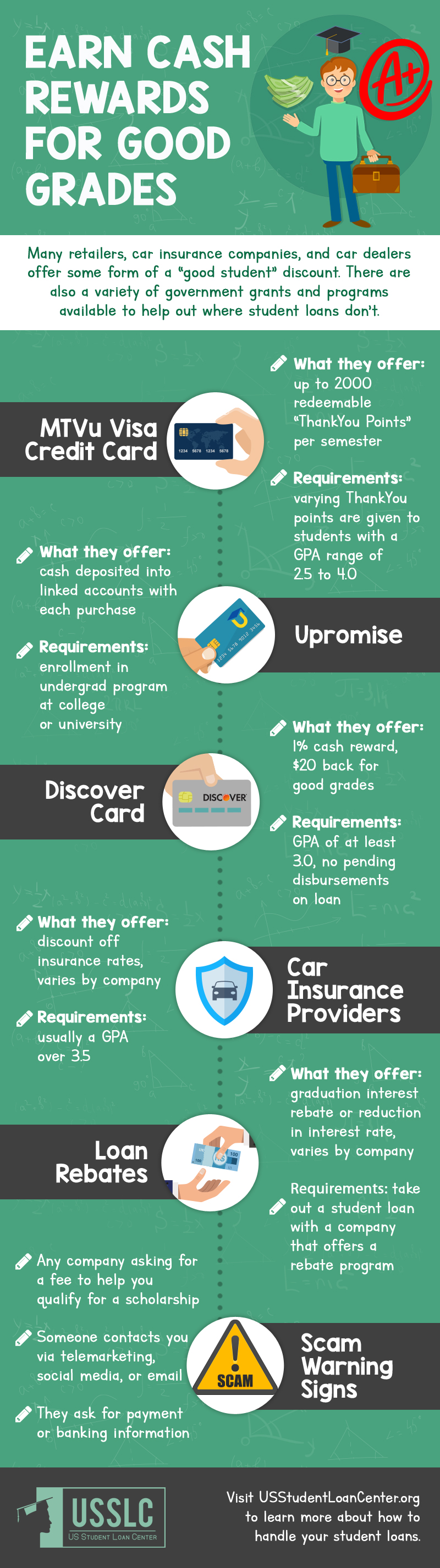

How to Earn Cash Rewards for Good Grades

In this article:

- MTVu Visa Credit Card

- Upromise

- Discover Card

- Car Insurance Providers

- Loan Rebates

- Scam Warning Signs

MTVu Visa Credit Card

Citibank offers the MTVu Visa Credit Card as one of its starter credit cards for students.

The card gives students reward points for high GPAs, with up to 2,000 points per semester. You can exchange these points for gift cards, MTV merchandise, and other rewards.

A fair annual percentage rate (APR) at 6% and no yearly fees make this a great starter card for any student!

Also, Citibank offers other student credit cards if you feel this isn’t a good fit for you.

Upromise

Sallie Mae created Upromise to help out anyone struggling with paying tuition fees.

It not only gives cash rewards for good grades but incentives for just being a student! For purchases like books, Upromise will deposit some cash back into your linked accounts.

And, you can then invest that cash so it’ll grow even more!

Discover Card

If you have a student loan with Discover Card and have at least a 3.0 GPA, you are eligible to receive a 1% cash reward for good grades based on the principal of your loan.

They also offer a great good grades cashback bonus of $20 per school year.

So, what’s a better motivation to hit the books? Check their terms and conditions to see if you qualify for their monetary rewards for good grades.

Car Insurance Providers

Did you know those card insurance providers give rewards for good grades? Studies found students with good grades have less risk when it comes to car accidents.

So, car insurance providers give discounts from 10% to 25% to students with good grades!

Loan Rebates

In addition to incentives, some private companies even offer loan rebates to well-performing students.

As mentioned before, Discover offers a cashback on the principal of your loan, if you get good grades.

The University Credit Union also gives you the option to apply for the Good Grades Rebate. This loan rebate gives you 0.50% of your of your loan balance while you’re still studying.

So, talk to your school’s financial administrator about your options. They might know some good private lenders who offer great loan rebates or interest reductions for good grades.

Scam Warning Signs

Whatever you do, avoid “scholarship scams” and any company asking for a fee to help you qualify for a scholarship.

Some companies ask for $1,000 and then “find” a $200 scholarship. Is that worth the fee?

If any company contacts you via telemarketing, social media, or email, be wary of scammers. No legitimate company will ask for payment or banking information.

The financial office at your college or university shall have resources available to help you find as much money as they can. Many states offer all kinds of grants and scholarships particular to their regions and the various needs of their residents.

Plus, the U.S. Department of Labor offers a comprehensive scholarship search for free!

BONUS TIP!

Other Companies

In addition to Discover’s rewards for good grades, other companies also offer perks for a high GPA. Here is a list of establishments that’ll give you prizes for good grades, which usually come in the form of food.

So, you can get a full stomach just from hitting the books!

Financial Aid

While most federal student aid programs don’t give much consideration to a high GPA, it still pays to get good grades.

In addition to needs-based student aid, there’s also merit-based student aid for well-performing students. This aid can take the form of grants or scholarships to lessen the burden of a college education.

So, find that merit-based scholarship now! And while you’re at it, don’t forget about the Free Application for Federal Student Aid (FAFSA)!

They say there are no steak sandwiches for a nickel. That may be true, but we can still be smart when discovering what’s out there for just a bit more.

(Did You Know? There are two types of “breaks” borrowers can take from having to make student loan payments each month. One is forbearance and the other is a deferment, but which is the right choice? Download this free guide to find out if you must take a forbearance or a deferment if you need to delay your payments. Click here to learn more.)

Still curious about cash rewards for good grades? Then watch this video about merit-based scholarships below!

Cash rewards for good grades aren’t just incentives for education. They can greatly help ease the burden of staggering student loans and fees. Financial aid becomes easier to get with a higher GPA. So, start searching for the right program or deal for you!

Do you have any experience or questions about cash rewards for good grades? Then comment them below!

Up Next: How to Pay Off Student Loans

Editor’s Note: This article was originally published in September 21, 2017. It has been updated for urgency and relevance.

Leave a Reply