Thinking about consolidating your student loans? It’s a good idea to do so, but where do you start?

Here at USSLC, we talk about student loans a lot. Almost every day we write about student loans.

But one thing we always have to keep in mind is the WIIFM factor.

OR

“What’s in it for me?”

Because we know that’s what you’re asking yourself. And you should… it means you’re smart.

So we’ve put together the top 5 benefits of student loan consolidation here.

Note: If you’re more interested in refinancing your student loans you can read more about that here.

The idea of consolidating your student loans is a pretty easy one.

Consolidation is the process of taking multiple student loans and combining them into one loan, and there are several advantages to doing this.

So if you ever catch yourself asking, “Should I consolidate my student loans,” take the following benefits of student loan consolidation into consideration.

5 Benefits of Student Loan Consolidation You Should Know

In this article we’re going to cover the following (Click To Scroll):

- Pay Less Interest

- Lower Your Monthly Payments

- Reduce the Number of Bills You Pay Each Month

- Eliminate a Cosigner

- Look For A New Servicer

(Note: ‘Should I consolidate my student loans?‘ is a question we get all the time here. That’s why we created this easy guide you can download for free to help you understand if a Student Loan Consolidation is the right choice for you. Click here to learn more.)

Student Consolidation Loan In A Nutshell

The student loan industry is blowing up with popularity and loan balances at an all-time high. Every day, thousands of people are moving out of college into the workforce and they have to start paying back their student loans.

There’s a problem though. The rate at which they are required to pay back their loan is too high when you compare it to the average income.

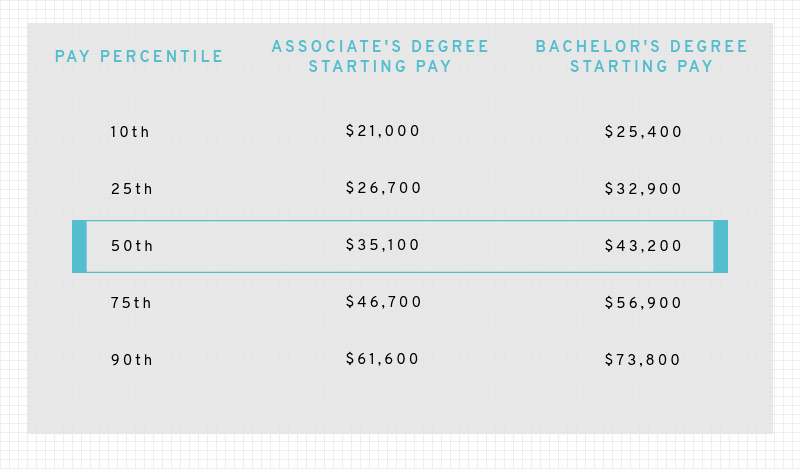

According to Payscale.com, the average 4-year degree earns $43,200.

That’s $3,600 a month.

But, when you factor in taxes, healthcare, 401K, and insurance, you’re probably looking at roughly $3,000 a month in take-home money.

Then you look at the cost of living:

- Rent

- Food

- Utilities

- Car payment

- Car insurance

- Gas

- Personal Expenses

It’s no wonder people are struggling to make a $400 a month student loan payment. In fact, in a recent study, more than 3,000 a day default on their student loan payments.

3,000 a day… That’s a pretty scary number when you think about the big picture.

Luckily though, the government provides student loan borrowers with a few options when it comes to repaying their student loans.

Benefit #1 – Pay Less Interest

Let’s look at an amortization schedule to start with the benefits of student loan consolidation:

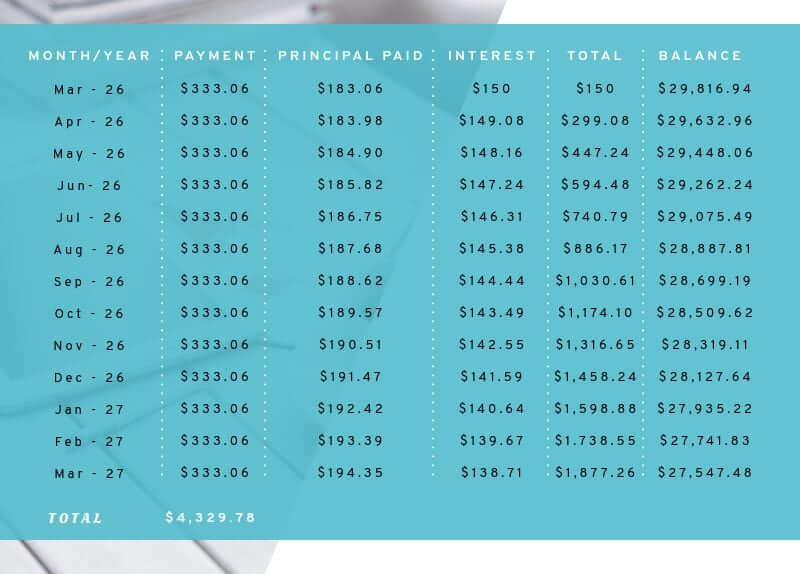

Below are two pictures. There are columns in each including month, payment, principal paid, interest paid, the total interest, and the balance left afterward.

We’ve used the easy numbers to simulate what an average student repayment schedule would look like.

- $30,000 in debt

- 6% Interest rate

- 10-year term

When you start making payments it looks like this:

You can see in the beginning that a large portion of your payment goes towards paying off your interest. Which means your servicer gets paid a healthy amount once payments start.

In fact, after paying $4,329.78 in your first year, you’ve only paid $2,452.52 towards a $30,000 balance. But as time goes on, your principal accelerates.

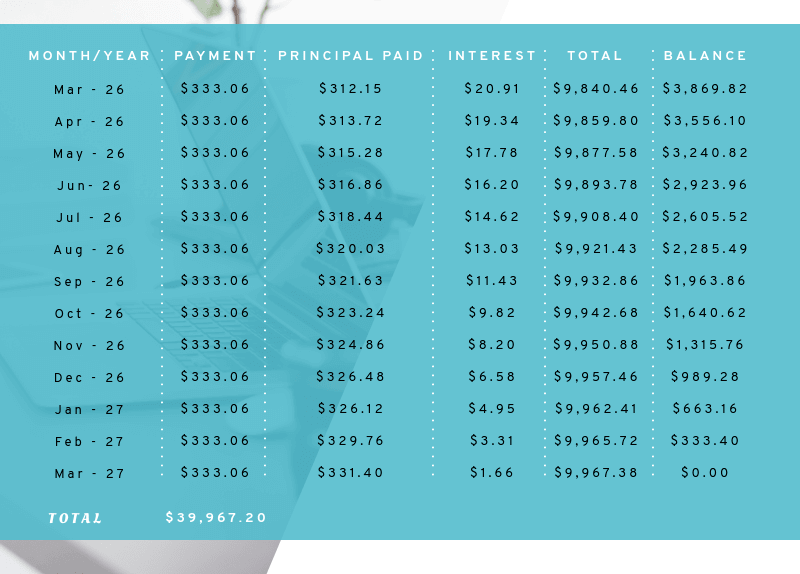

This is what the last year of your payment schedule would look like:

You can see the amount of interest towards the loan dramatically falls in the later stages of the loan. And at the end, you end up paying $9,967.20 in interest on a $30,000 loan, or a 1.33 factor.

Among the main goals of student loan consolidation is to lower your student loan payment. One way that is accomplished is by paying less interest on your new loan.

When you consolidate, you have the ability to switch out older, variable-rate federal loans for one fixed rate loan. This can potentially give you protection from having to pay higher rates in the future if interest rates go up. And it looks like interest rates are already going up.

Simply put, the lower your interest rate, the more your money goes towards principal.

You pay down your loans faster and your servicer (the entity holding the note) keeps less of your money.

Up until 2006, the Federal Government was issuing variable rate loans. If you do have a variable interest student loan, you’ll want to consider getting with some student loan consolidation companies to help you.

Benefit #2 – Reduce Monthly Payments

Do you think you have several monthly payments that are too high? Are you barely able to afford them? Do you feel like you have to choose between paying your student loan bill or your car payment?

You can reduce your monthly payments by:

- 1) negotiating for a lower interest rate

- 2) increasing your repayment term

(Note: ‘Should I consolidate my student loans?‘ is a question we get all the time here. That’s why we created this easy guide you can download for free to help you understand if a Student Loan Consolidation is the right choice for you. Click here to learn more.)

However, it’s worth noting that when you choose to lengthen your repayment term, you’ll end up with more interest. But on the other hand, it will give you breathing room to save more, and live a little easier. Think about it the same way you think about a car payment.

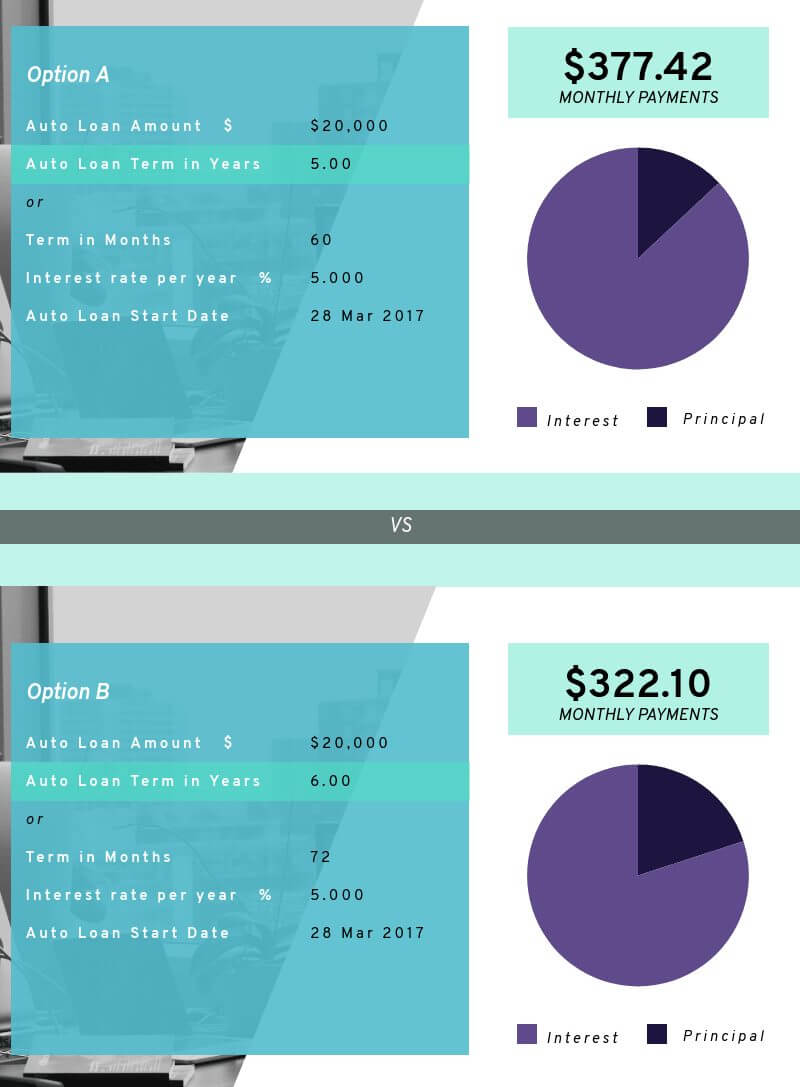

Let’s say you’re buying a car and it’s $20,000 with a 5% interest rate (for ease of computation).

And let’s say you’re considering paying back the $20,000 over 5 years or 6 years.

It looks like this:

If the car dealer asks you whether you want to pay it back over 5 or 6 years, you can save $50 a month by extending your term.

But when you do the math, you actually pay back $546 more over the life of the car note.

In option A) $377.42 X 60(months) = $22,645.20

In option B) $322.10 X 72(months) = $23,191.20

Some people prefer the lower monthly payment to keep more cash in their pocket short term. Others prefer to pay less interest and take the higher payment for a shorter term.

When you consolidate your student loans, many times you stretch the term out to 30 years as opposed to the 10 years that the government issues student loans. This lowers your monthly payment.

If you’d like a reference to a federal student loan calculator, you can go here.

Benefit #3 – Reduce Your Monthly Bills

When you consolidate your student loans, you are combining many loans into one loan. This makes your repayment easier.

In fact, the average student borrower has 8 various student loans in 3 different servicers.

That’s 8 different loans. Each one has its own term, interest, and monthly payment.

Think about it, each semester you probably took out a new Federal Student loan.

Every semester, if you’re a student loan borrower, you received a lump sum of money into your checking account. That’s an individual loan.

Many times student graduate without knowing how many “lump sums” they received. Some don’t even know who is holding the note and when they are required to start paying them back. So when students default, many times it’s a factor of ignorance.

We’ve put together a great resource for finding out what you actually own in student loan debt. It’s a step by step guide that shows you how to pull this information from the federal database.

Should you consolidate your #studentloans? Good credit is immensely helpful to your other future needs. https://t.co/8AuG8XWeQ0 #college #education #money #finance #student #usslc pic.twitter.com/IIhYOPURdX

— USStudentLoanCenter (@USSLC1) June 14, 2018

Benefit #4 – Eliminate a Cosigner

When you graduate college, your parents may want to spare themselves from your financial responsibilities.

We know… bummer.

Something that happens frequently is upon graduation, your parents no longer want to be a co-signer on your loan.

Typically parents are cosigners on student loans because students have no income, generally limited credit history, and lenders don’t know whether or not they’ll get paid back.

Hmmm, wonder if that’s part of the reason 3,000 student loan borrowers default each day…??? (sarcasm) That’s another story.

This is called a Direct PLUS loan. You can read about it right on the studentaid.ed.gov site here.

So, if you’re a parent and want to remove your personal responsibility from your child’s student loan OR if you simply want to eliminate a cosigner from your loans, you can consolidate it into a new loan.

When your old loan is paid by the new lender, the cosigner will no longer be liable for the new loan.

By this time, the (then) student now has a job, a bit more credit history, and is a more of an “attractive” lending risk to the new servicer.

Which leads me to….

Benefit #5 – Look for a New Servicer

There are a lot of student loan servicers.

Some are good. Some are not.

In fact, if Navient is your student loan servicer, make sure you read this article about how Navient defrauded millions of students by being accused of the following:

- Knowingly giving student loan borrowers incorrect information

- Ignoring complaints and requests

- Processing payments inaccurately

- Steering students towards a repayment plan that worked better for them as opposed to the student.

The Consumer Financial Protection Bureau is currently suing them. That’s just one example of what a nightmare it can be if you’ve got the wrong servicer.

That said USSLC only works with the best servicers in the country. We have great relationships with our lenders and they treat our members like family. This means better communication, more transparency, and a higher likelihood of success in getting those student loans paid off in a timely manner.

Each month thousands of students consolidate their student loans. Some of them may not even know about the benefits of student loan consolidation.

One thing to keep in mind when considering a consolidation is remembering that over time you will end up paying more towards that loan. But, if this allows you to live a little easier each month or prevent wage garnishment or default, it’s a no-brainer.

Above we’ve detailed out the top 5 benefits of student loan consolidation.

If you’ve got student loans, I encourage you to check out the resources in this post as they’ve been responsible for helping thousands of students here at USSLC.

(Note: ‘Should I consolidate my student loans?‘ is a question we get all the time here. That’s why we created this easy guide you can download for free to help you understand if a Student Loan Consolidation is the right choice for you. Click here to learn more.)

Now that you know more about benefits of student loan consolidation, what’s the best one for you? Let us know in the comments below!

Up Next: How Do I Consolidate My Student Loans?

Editor’s Note – This post was originally published in March 28, 2017 and has been updated for quality and relevancy.

I have an amount that is owed to the school and I want to know if it is possible to put that into consolidation so I can finish my degree. Here is what happened the school put into my account that my student loan was approved only to find out later that was not the case. At this time I am not able to finish my degree until this amount can be removed.

What about private student loans….can those be consolidated?

Hey Trisha,

Private student loans can be consolidated. However, at USSLC we can only consolidate federal student loans.

If you’re looking for other options when it comes to your private student loans, I’d suggest you contact our in house specialist, Jesse. He can be reached at 813.579.6863.

Good luck, Trisha!

The information looks like a better deal than what i have now.

Awesome! I’m so glad that you have come across our article. We can definitely help you consolidate your student loans.

Feel free to give us a call at 877-433-7501 or simply click this link to schedule a time that works for you: https://bit.ly/2nIykTH

I would like to consolidate my student loans from UHEAA, Navient, and Nelnet. Can you help me?

Hey Abigail!

We can most certainly help you consolidate your student loans!

Give us a call at 877.433. 7501 or simply click this link to schedule a time that’s convenient for you: https://bit.ly/2nIykTH

I’m looking for assistance in consolidation my student loan I’m not working right now

Hi Alvera!

We can definitely help you with consolidating your student loans!

Give us a call at 877.433.7501 to speak with a Senior Student Loan Consultant, or simply click this link to schedule your consultation: https://bit.ly/2nIykTH

We look forward to hearing from you and helping you consolidate your student loans.

Would like to setup a time to talk tomorrow.

We’d love to talk to you, and see how we can help with your student loan debt, James!

Please give us a call at 877.433.7501 or click this link to schedule your consultation: https://bit.ly/2nIykTH

We look forward to hearing from you!

I have two loans. One is with Nelnet, which is 110.00 per month. The other one is Sallie Mae. The monthly payment on that one is 429.00, but the interest is 300.00 per month. I’ll never pay it off.

Can I refinance?

$300 in just interest is a lot of money, James! I can understand where your frustration is coming from, and I think we can definitely help you.

Have you spoken to one of our Senior Student Loan Consultants? I’d suggest calling us at 877. 433.7501 or simply clicking this link to set up an appointment for a consultation: https://bit.ly/2nIykTH

Once you do that, we’ll be able to look at your loans and figure out the best plan to lower your monthly payments!