There’s a lot of reasons why student loan forgiveness makes sense.

But there’s always another side…

The negatives of student loan forgiveness range from financial woes to practicality and decisions when it comes to your life plans.

Despite the relief loan forgiveness offers, one should always remember the student loan forgiveness pros and cons.

Here we’re going to point out some of the biggest disadvantages of student loan forgiveness you must be wary of.

Disadvantages of Student Loan Forgiveness and Downsides

1. Student Loan Forgiveness Disadvantage #1 – Large Taxable Income

Most student loan forgiveness programs require student loan repayment plans.

Usually, this means the borrower is enrolled in one of the income-driven plans.

While this helps the borrower pay less every month, it comes back to haunt the borrower at the end of the repayment term.

Let’s say you qualify for Public Student Loan Forgiveness (PSLF), a program where your student loans can be forgiven after 120 consecutive payments.

The forgiven amount after the repayment term becomes taxable income.

Consider this example:

-You make $50,000 a year as a nurse

-You graduate with $40,000 in student loan debt.

-You’re eligible and apply for PSLF.

-Over 10 years you make 120 $125 payments all based on your income, tax status, number of dependents and several other factors.

If the above were true, you would make $15,000 in payments over the course of your loan. (120 times $125)

The $25,000 difference ($40,000 principal minus the $15,000 payments) will be taxed as income.

Instead of being taxed on your $50,000 income, the IRS will treat it as a $50,000 income tax bill plus taxes on the $25,000 when the final application is processed.

In this case, your lender would send both you and the IRS a 1099-C form, stating the amount of debt forgiven.

And the IRS will hit you with a surprise tax bill.

Note: The total amount forgiven is not necessarily equivalent to the amount of tax.

(Bonus Tip: Want all the pros and cons of student loan forgiveness all in one easy and accessible spot? The Definite Guide To Student Loan Forgiveness will go over each type of forgiveness program and weigh your options for you, so you don’t have to. Click here to get more info on the free guide.)

2. Student Loan Forgiveness Disadvantage #2 – Limiting Career Tracks

Buried in #student #loan #debt? Your career may qualify you for student loan forgiveness in #NewYork state! https://t.co/2UfigRP3ME #college pic.twitter.com/CVIvmPMaVf

— Chris Johnson (@GrantFundingExp) April 5, 2017

One of the disadvantages of student loan forgiveness is limiting job options. In order to qualify you must work one of the Public Student Loan Forgiveness acceptable fields.

According to studentaid.ed.gov

Qualifying employment for the PSLF Program is not about the specific job that you do for your employer. Rather, it is about who your employer is. Employment with the following types of organizations qualifies for PSLF:

- Government organizations at any level (federal, state, local, or tribal)

- Not-for-profit organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code

- Other types of not-for-profit organizations that are not tax-exempt under Section 501(c)(3) of the Internal Revenue Code, if their primary purpose is to provide certain types of qualifying public services

Public Student Loan Forgiveness is only available to a limited number of jobs.

Becoming, say, a financial analyst or engineer, will not grant you student loan forgiveness.

In contrast, teachers, nurses, and public servers can qualify.

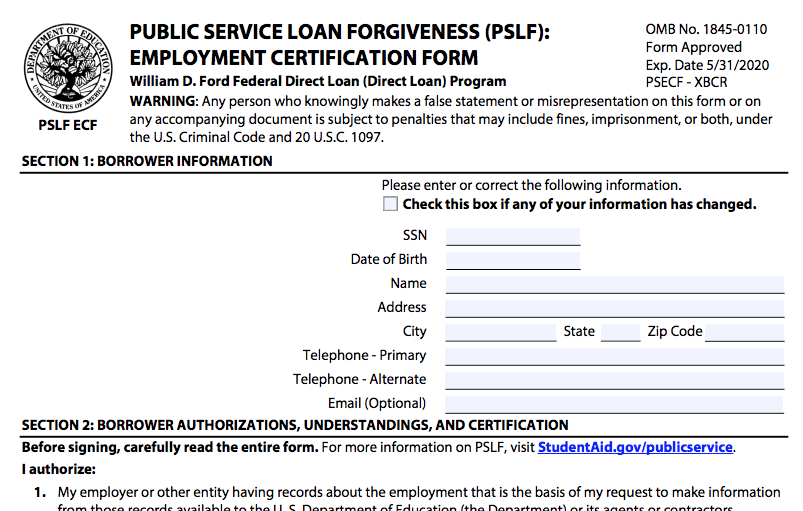

3. Student Loan Forgiveness Disadvantage #3 – Annual Recertification and Paperwork… Can’t Miss

The amount of paper work is also one of the disadvantages of student loan forgiveness.

For example, public service loan forgiveness requires the borrower to submit an employment certification form every year couple with in income driven plan (if you’re enrolled in one).

Missing paper work could mean the end of your student loan forgiveness.

While many borrowers may not stress too bad about yearly recertification, missing your recertification can be costly. There’s a lot of red-tape and unwilling-to-help Servicers out there.

Think of it this way…

By you enrolling in PSLF you’re going to be paying less on your loan.

That’s bad for the Servicers because they collect less money.

Therefore, they aren’t always willing to go out of their way to help you comply with the rules in place to qualify.

In our experience of processing tens of thousands of applications for student loan borrowers seeking student loan forgiveness, this has always held true.

Unless you’re vigilant about completing the process, it won’t be done… as they don’t go out of their way to help you.

4. Student Loan Forgiveness Disadvantage #4 – Long Commitment to Job

Student loan forgiveness programs have stringent requirements.

One of them is the commitment to the job. Such ensures that the borrower will not bail.

Moreover, it makes up for the repayment period on a regular repayment plan.

For instance, student loan forgiveness for teachers requires at least five years of service.

This can be a downside if you plan on exploring other career possibilities.

RELATED: Student Loan Forgiveness has a Price

5. Student Loan Forgiveness Disadvantage #5 – The Unknown… The Program May Be Terminated

Why Betsy DeVos Halted Student Loan Forgiveness For These Students via @forbes https://t.co/lrWslb10Tc

— Steven Flanders (@steven_flanders) August 1, 2017

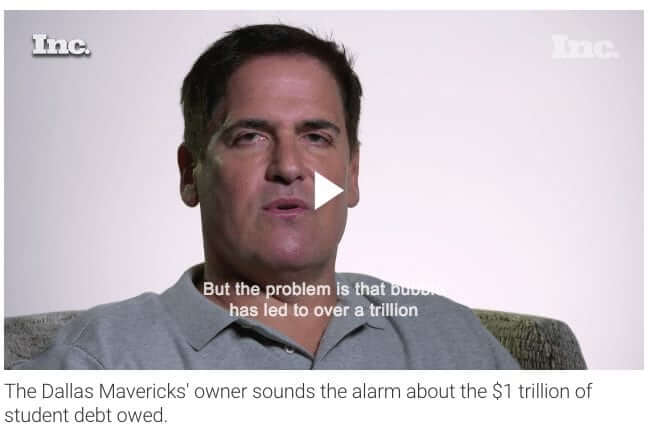

With so much talk and chaos in today’s administration, some student loan forgiveness programs may be in jeopardy.

One can never be too sure about these programs anymore.

While they do offer comfort, they are still at the mercy of legislative actions.

There’s a lot of talk in Washington now on what to do with student loans.

Many believe it’s the next bubble:

Just listen to Shark Marc Cuban on the student loan bubble:

If he’s right we’re in big trouble and Washington will have to do something to outset all these loans forgiven.

One of the potential options is terminating the program altogether.

That would be disheartening (to say the least) if you’re 7 years into a 10 year loan forgiveness program and the program vanishes.

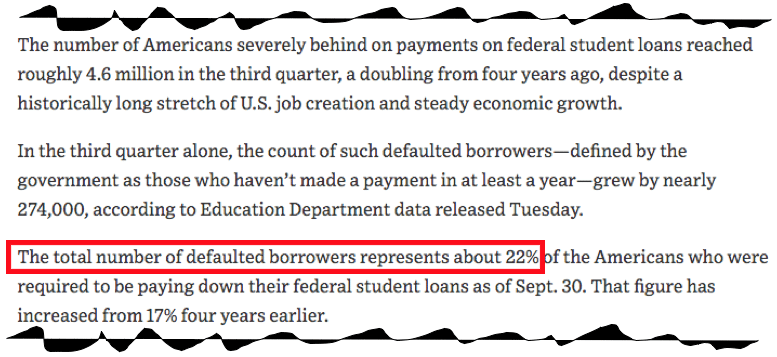

6. Student Loan Forgiveness Disadvantage #6 – Can Lead to Default

Interesting alternative to loan bubble-“Student Loan Default Crisis Is Being Caused By Promises Of Debt Forgiveness” https://t.co/WNNgyJVk83

— Nate Dillon (@NateDillon_KY) July 12, 2017

According to reports, the promise of student loan forgiveness is a factor in the rising number of defaults.

Because borrowers expect to be granted student loan forgiveness, they forget about payment and simply wait for a cancellation to arrive.

Or even worse, coupling PSLF with an income driven plan where you qualify for a $0 payment and you fail to recertify.

This happens so often it’s scary.

Just check out some of the numbers The Wallstreet Journal posted on the number of student loans defaulting:

Moreover, defaulting on your student loans has significant impacts on your credit score. Being most students have limited credit history, when a default occurs early in a credit lifecycle, it’s damages are lasting.

7. Student Loan Forgiveness Disadvantage #7 – Limited to Direct Consolidated Loans

Before applying for student loan forgiveness, borrowers are advised to consolidate their loans first into one Direct Consolidation Loan.

This makes everything easier since the borrower only needs to keep track of one loan.

One of the disadvantages of student loan forgiveness is only a Direct Consolidation can qualify.

This means if you have private loans or are in need of private refinancing, student loan forgiveness is not to your rescue.

Watch Out: If you’re under an income-driven repayment plan or have made qualifying payments toward PSLF, consolidating your loans will cause you to lose credit for those payments.

So you want to make sure you understand what you’re doing before you take advice from a servicer…

Student loan forgiveness is still here to help.

It can only be helpful if your financial situation calls for it.

Conclusion

Be sure to assess its pros and cons first before applying.

You might be committing your life to a plan you are not capable of living.

There are other options to get out of student loan debt.

The right one is always the one that meets your needs in the best way possible.

(Bonus Tip: Want all the pros and cons of student loan forgiveness all in one easy and accessible spot? The Definite Guide To Student Loan Forgiveness will go over each type of forgiveness program and weigh your options for you, so you don’t have to. Click here to get more info on the free guide.)

Do you have any other thoughts on the disadvantages of student loan forgiveness? Let us know in the comments below.

Up Next: Careers That Forgive Student Loans

How do I get hired by the government to get this? I am willing to do it.

PSLF forgiveness is tax-free. Other forgiveness programs are taxable though.