When you want to consolidate your Federal and private loans, a student loan consolidation calculator might come handy.

Do you know how this debt consolidation calculator works? It’s easy!

Not only will it help you get an estimate of your new interest rate and payment plan, but it also can help you determine how much you can save if you consolidate your loans.

Finding out how much you’ll pay has never been simpler if you use a student debt consolidation calculator.

Student Loan Consolidation Calculator: The Basics

1. What is a student loan consolidation calculator?

A student loan consolidation calculator will show you how much you will pay after combining your student loans.

Your payment will be based on the following:

- How much your loans are

- What the interest rate is

- How long you want to pay your loans

2. Where can you find a student loan consolidation calculator?

The Department of Education and private lenders have student loan consolidation calculators on their websites.

Listed below are some of the top student loan providers.

Department of Education Repayment Estimator

- Provides payment estimates for different federal repayment plans

- Shows amount that can be forgiven if you qualify for student loan forgiveness

Social Finance, Inc.(SoFi) is an online finance company that refinances student loans. It also provides personal loans and mortgages.

- Rates: 2.61 %- 6.54 % for variable rates; 3.35 %- 6.74 % for fixed rates

- Terms: 5, 7, 10, 15, 20 years

Citizens Financial Group, Inc., founded in 1828, is one of the country’s oldest banks. It has assets of over $150.3 billion, making it one of the largest banks in the U.S.

- Rates: 2.77 %- 8.62 % for variable rates; 3.74 %- 8.24 % for fixed rates

- Terms: 5, 10, 15, 20 years

LendKey is a lending platform. It doesn’t lend directly to borrowers but works with community banks and local credit unions.

- Rates: 2.52 %- 6.06 % for variable rates; 3.25 %- 7.26 % for fixed rates

- Terms: 5, 7, 10, 15, 20 years

Earnest uses “Precision Pricing” technology to provide flexible loans. However, Earnest does not serve in six states: Rhode Island, Nevada, Alabama, Delaware, Kentucky, and Mississippi.

- Rates: 2.79 %- 6.46 % for variable rates; 3.35 %- 6.49 % for fixed rates

- Terms: 5 to 20 years

CommonBond is a socially-conscious company. It finances the tuition of an in-need student for every loan it provides.

- Rates: 2.61 %- 6.54 % for variable rates; 3.35 %- 6.74 % for fixed rates

- Terms: 5, 7, 10, 15, 20 years

3. How do you use the student loan consolidation calculator?

For federal student loan consolidation, you can only use one type of calculator.

This is the Repayment Calculator.

You have to fill in the blank spaces with information such as:

- Amount of your loan balance

- Type of loan (REPAYE, PAYE, and others)

- Interest rate

- Tax filing status

- Income

- Family size

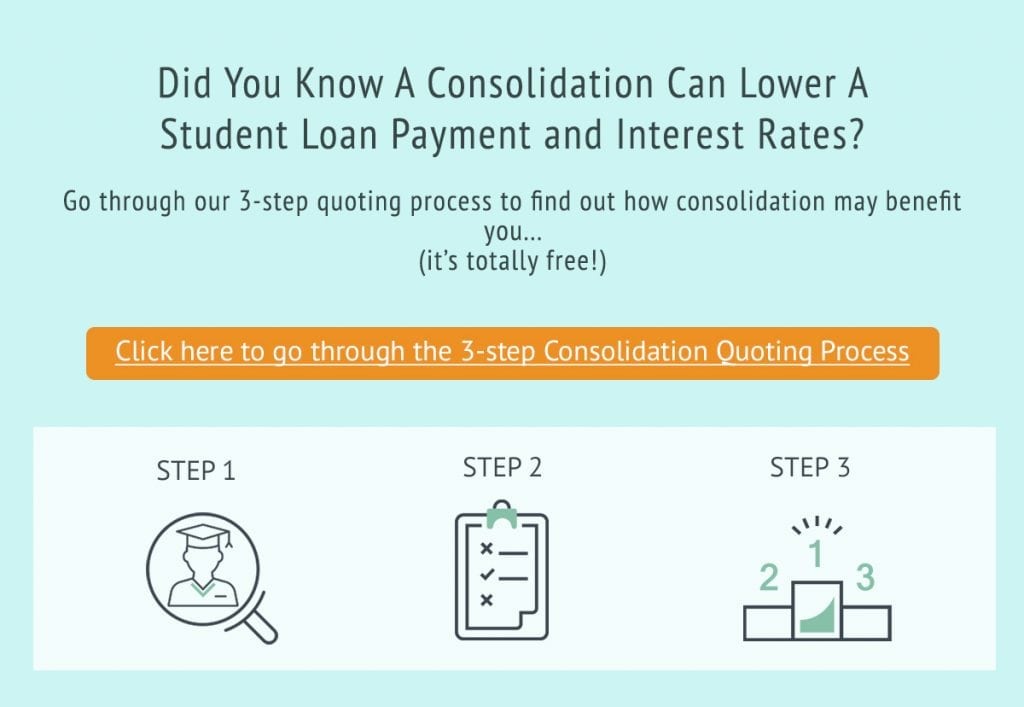

For private student loan consolidation, you can combine your private and federal loans.

Choose your preferred loan provider from SoFi, CommonBond, LendKey, etc.

Then go to the website of that lender and look for the calculator.

The student loan consolidation calculators of top lenders are pretty easy to use.

You just have to provide the basics first: name, email address, and mobile number. Then you will be asked about your education and finances.

The lender will then provide you the rate based on the information you provided.

4. Private and federal student loan consolidation pros and cons

Private and federal student loan consolidation have their own pros and cons.

Compare the differences between the two types of loan consolidation.

Lenders usually give a lower interest for student loan consolidation.

This means that when you combine your loans, you could end up paying a lower monthly fee.

Private loan student loan consolidation

PROS:

- Better interest rates

- Lower monthly fees

CONS:

- Shorter payment periods (maximum of 20 years)

- No federal benefits such as loan forgiveness

Federal student loan consolidation

Wondering how your federal student aid gets calculated? We’re glad you asked: https://t.co/qAa55DA6yz pic.twitter.com/cj8a8cGvux

— Federal Student Aid (@FAFSA) July 7, 2017

PROS:

- Longer payment terms (up to 30 years)

- Department of Education benefits such as loan forgiveness

CONS:

- Higher monthly payments

- Bigger interest rates

5. Comparing interest rates and payment fees

Should you choose a lender that gives the lowest interest rates?

Actually, there’s a lot more to consider than just the interest rates.

You need to ask yourself:

- How long do I want to pay my loans? Up to 2022 or 2047?

- How large of a monthly fee can I afford?

- What benefits do I want to get?

This is why student loan consolidation calculators are important.

You will see the estimated monthly dues depending on the following:

- Total amount of all your current loans

- Interest rate

- Length of time you want to pay your consolidated loan

Are you thinking of consolidating your federal loans? Check out this refinancing guide from Federal Student Aid:

If you’re thinking of consolidating your student loans, it’s best to try different student loan calculators.

You will see the estimated amount you’ll pay and you will even get tips on how to pay off your loans.

Have you tried using student loan consolidation calculators? Which one worked best for you? Tell us in the comments below!

Leave a Reply