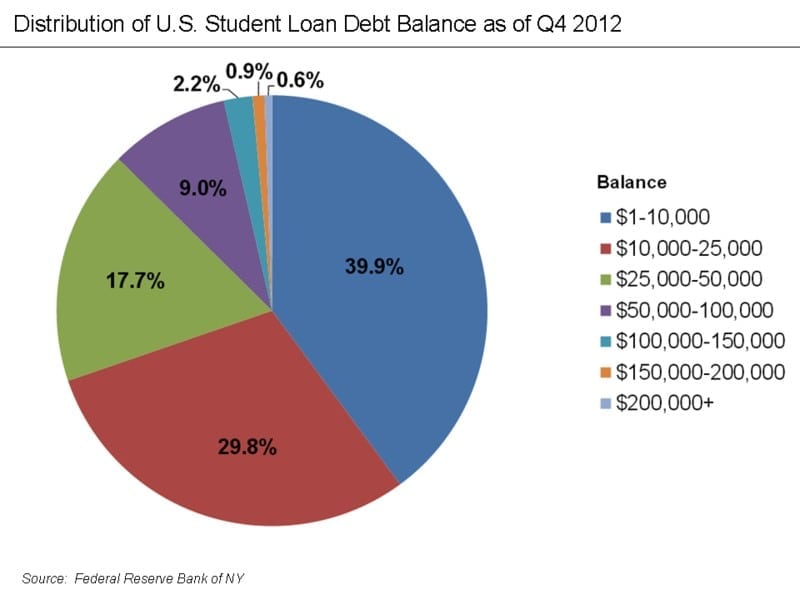

Student loan repayments can be a source of worry for many of us.

Especially since most of us have several thousands of dollars’ worth of debt (see chart below).

If you’re looking to gain more control over your student debt, you may be considering refinancing or consolidating your loans.

Which method would work best for you?

What can I do?

A very popular method of simplifying repayments is to consolidate or refinance the student loans that have been taken out.

Although many people use these terms interchangeably, there are several differences between the two.

The option you choose will depend on your financial situation and your aims for your student loans.

What is consolidation?

Consolidation involves combining several student loans into one loan.

It is possible to consolidate with the federal government, or with a private lender.

What are the advantages?

If your loans are all with the federal government, you can consolidate all your student loans with several advantages:

- Instead of several smaller bills or repayments each month, this will result in just one payment.

- It is possible to change a variable interest rate loan into a fixed rate loan, offering protection if interest rates go up.

- You could get lower monthly repayments by lengthening your payment term (although this would result in you paying more interest)

- These loans can be prepaid at any time with no penalty

- The government offers several possible alternate repayment plans to support a range of financial situations. Borrowers can switch between these as and when they need to (although this can have disadvantages)

The interest rate on the new, consolidated loan will be the weighted average of the old loans’ rates, so no money savings will accrue to the borrower, although the rate cannot be higher than the highest old interest rate.

Private loan consolidation offers many of the same benefits as federal loan consolidation, with the added advantage that the interest rate is not based on a weighted average.

Instead, the individual lender will make a decision based on the borrower’s financial information and how they have handled debt in the past.

(Bonus Tip: Want the complete guide to knowing whether or not you should consolidate your loans? Here are the 17 Most Important Factors To Help You Decide If You Should Consolidate or Not. Click here to learn more and get the free download.)

What are the drawbacks?

Consolidating loans with certain borrower benefits (including interest rate discounts, principal rebates, and loan cancellation benefits) may result in the loss of these benefits.

It is important to check which, if any, benefits apply to your loan, and if their loss would negatively affect your repayments.

Any private loans, as well as federal Private Education Loans, can’t be included in federal consolidation and so would have to be consolidated with a private lender.

What is refinancing?

Student loan refinancing involves applying for a new loan under new terms, which is then used to pay off one or more existing student loans.

What are the advantages?

Refinancing is most useful if the borrower’s financial situation has improved since they took the original loan.

In this case, it may be possible to refinance at a lower monthly interest rate with the following advantages:

- Monthly repayments will be lower

- It may be possible to shorten the loan term, to pay it off more quickly, thus saving money on total interest across the loan term.

- You could choose a loan with a variable interest rate, which would save money if you are in a position to pay the loan off relatively quickly.

- As with consolidation, refinancing will result in just one monthly bill, rather than several.

Furthermore, depending on the lender, it may be possible to refinance both federal and private loans at the same time.

If this were useful to you, it would be beneficial to carry out research into several lenders, before making contact with them, to see if they offer this service.

What are the drawbacks?

As with consolidation, many benefits and protections that are part of federal loans will not transfer to private lenders.

You should check carefully if any of these apply to you.

If they do not, refinancing could result in significant savings on your loan repayments.

Additionally, private lenders are generally less flexible about repayment options.

If this is likely to be an issue, it may be worth considering consolidation with the government as a way of avoiding problems.

Which should I choose?

The answer to that question depends on many factors.

You should base your decision on what is best for your situation.

Factors to consider include: how high your student loan balance is; how many loans you have; and if you are having trouble making your monthly payments.

Whichever option you are considering, bear in mind that once you have refinanced or consolidated, there is no going back, as the original loans will have ceased to exist.

This means that you should not make any decision without thorough research into all of the possibilities, to avoid a situation you might regret in the future.

You may be concerned about your student loan repayments right now, but, if you carry out thorough research and ensure that you know all your options, it is possible to set your mind at ease.

(Bonus Tip: Want the complete guide to knowing whether or not you should consolidate your loans? Here are the 17 Most Important Factors To Help You Decide If You Should Consolidate or Not. Click here to learn more and get the free download.)

Hey Crystal,

That’s a great question! Refinancing together would make perfect sense.

Unfortunately, married couples are not able to combine their loans through the refinancing process. If you’d like some more information about how being married affects your student loans, i’d suggest checking this article out: https://usstudentloancenter.org/marriage-and-student-loans-what-are-the-affects/

Can my husband and I refinance all of our student loans together instead of him having his payments and me having mine?

Hey Crystal,

That’s a great question! Refinancing together would make perfect sense.

Unfortunately, married couples are not able to combine their loans through the refinancing process. If you’d like some more information about how being married affects your student loans, i’d suggest checking this article out: https://usstudentloancenter.org/marriage-and-student-loans-what-are-the-affects/