If you’re looking for a way to have some of your Federal student loan debt forgiven, you may want to look into Public Service Loan Forgiveness (PSLF).

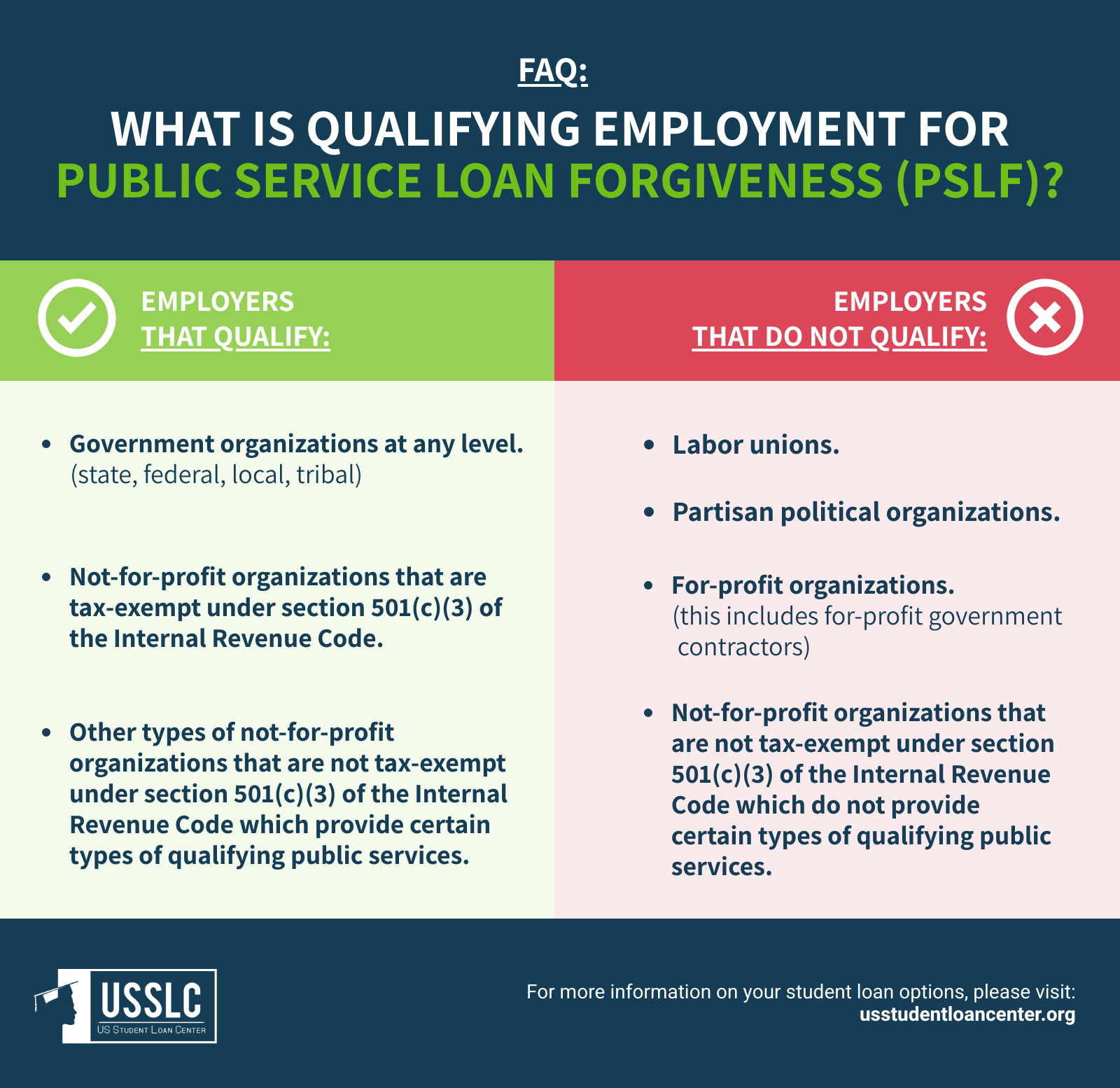

In order to qualify, you must be employed by a U.S. federal, state, local, or tribal government or not-for-profit organization that is tax-exempt under Section 501(c)(3) of the Internal Revenue Code.

You may be surprised at how many jobs qualify for PSLF.

Public Service Loan Forgiveness Program: What Is It?

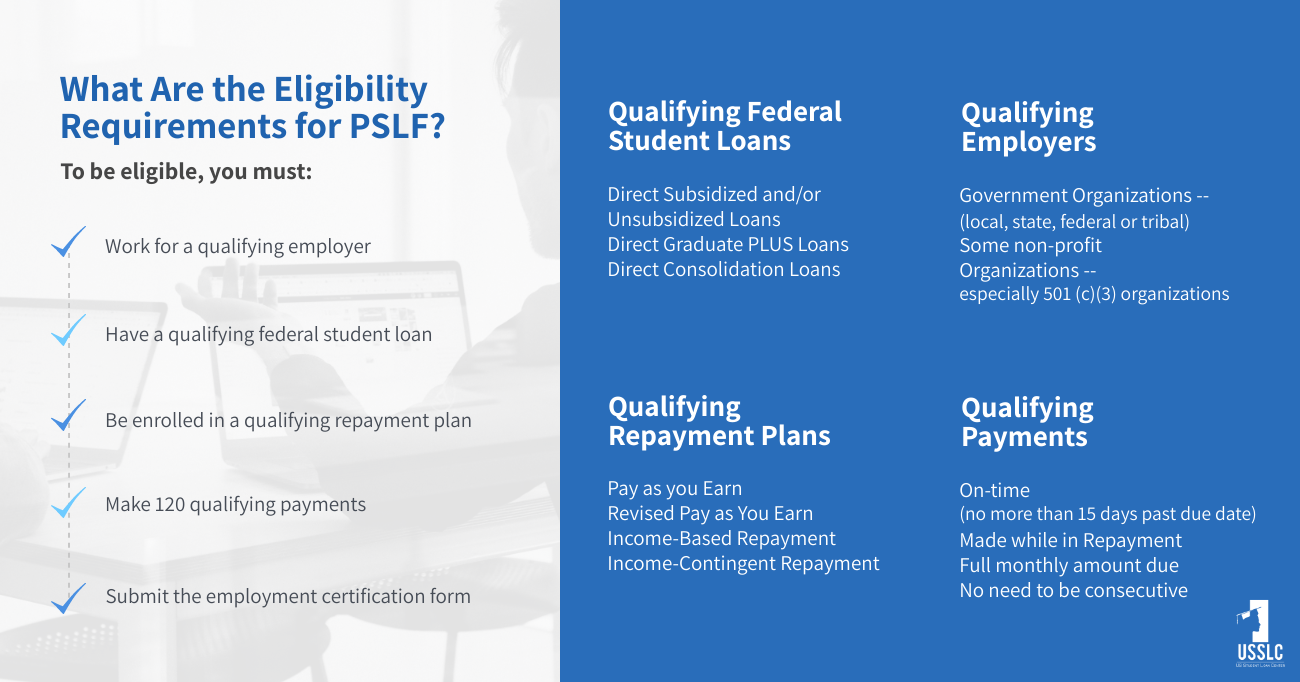

The PSLF Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

So what does that mean for you?

Your specific job with a qualifying employer does not matter, just that you work for a government organization at any level or a non-profit organization. Employers like labor unions, partisan political organizations, and for-profit organizations do NOT qualify for PSLF.

The full-time requirement can be met by working 30 hours per week at one qualifying job, or by working more than one qualifying part-time job with a combined average of at least 30 hours per week. Any religious instruction, worship services, or proselytizing cannot be counted towards your 30 hour requirement.

The loans that qualify for PSLF are Direct Loans. This does not include FFEL or Perkins loans. If you consolidate all of your federal student loans into one Direct Consolidation Loan, they can become eligible for PSLF. Private loans do not qualify for PSLF.

If you do choose to consolidate your loans, only payments made on your new Direct Consolidation Loan count towards the payments required for PSLF.

In order for your 120 payments to qualify for PSLF, you must be on a qualifying repayment plan and pay every single payment in full and on-time. There is no requirement for these qualifying payments to be consecutive. If you switch employers, your previous payments will still be counted towards PSLF.

You cannot pay extra each month to shorten the time until forgiveness.

Qualifying repayment plans are all of the income-driven repayment plans, which base your payment off of your current income. Not included are the Standard Repayment Plan, Graduated Repayment Plan, Extended Repayment Plan, or the Alternative Repayment Plan.

One important detail about PSLF is that you must complete and submit the Public Service Loan Forgiveness: Employment Certification Form (ECF) every single year. You must also submit an ECF form if you change employers.

Another great perk of the PSLF program is that the forgiven amount is not considered taxable income. So after making payments for 10 years, your debt is forgiven free and clear.

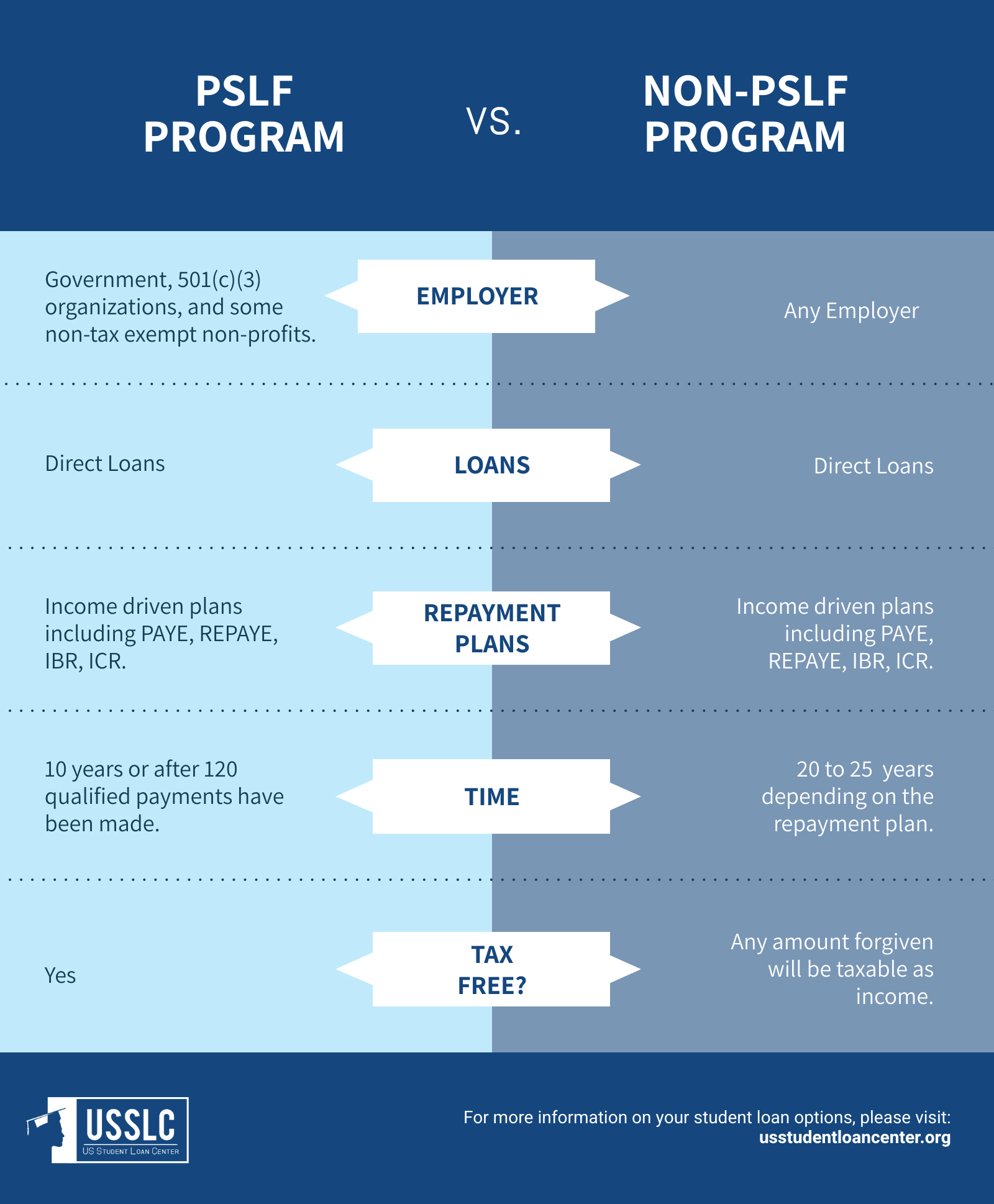

Public Service Student Loan Forgiveness vs Student Loan Forgiveness

PSLF forgives the remaining balance of your loan after 120 payments, or at least 10 years, and the forgiven amount is not taxed.

Student loan forgiveness can be achieved by making your payments on an income-contingent plan for 20 or 25 years. The forgiven amount is treated as taxable income in the year that it is forgiven, and you will pay taxes on it.

How Do I Qualify?

You must make 120 on-time, full, scheduled, monthly payments on your Direct Loans. Only payments made after October 1, 2007 qualify.

These payments must be under a qualifying repayment plan.

You must work full-time at a qualifying public service organization.

Which Loans are Eligible for Forgiveness?

Only loans you received under the William D. Ford Federal Direct Loan (Direct Loan) Program will be eligible.

The following loans are not eligible for the public service loan forgiveness program:

- Federal Family Education Loan (FFEL) Program

- Federal Perkins Loan (Perkins Loan) Program

- Any other student loan program

If you have FFEL Program or Perkins Loans, then merge them into a Direct Consolidation Loan to take advantage of PSLF.

Payments on a Direct Loan do not count once it’s merged into a Direct Consolidation Loan. Once merged, you must make another 120 payments.

You should learn more about merging your public loans.

If you don’t know what type of federal student loans you have, check the National Student Loan Data System.

You can browse through the database.

What are On-Time, Full, Scheduled, Monthly Payments?

Payments made 15 days after the scheduled payment due date are not on-time.

Furthermore, payments less than the required amount are not full. So these late, incomplete payments are not part of the required 120 qualifying payments.

Several payments totaling the required monthly payment are considered as one payment.

Scheduled payments are those made after you’ve been billed for the month’s payment.

Notably, they do not include payments made during the following periods:

- In-school

- During the grace status

- During the deferment or forbearance period

Advance payments do not count as qualifying payments. Lump sum payments do not qualify as well. If you are with AmeriCorps or the Peace Corps, there are special rules for lump sum payments.

Which are Qualifying Repayment Plans?

The public service loan forgiveness program considers the following three repayments plans:

- Income-Based Repayment (IBR) Plan

- Pay As You Earn Repayment Plan

- Income-Contingent Repayment (ICR) Plan

The 10-Year Standard Repayment Plan also qualifies. PSLF also considers any plan with repayments amounts like the above-mentioned plans.

Before selecting a repayment plan, it’s important to understand its implications and costs.

If you make the required 120 qualifying payments of the 10-Year Standard Repayment Plan, there will be no remaining balance.

The longer you make PSLF-qualifying payments, the lower your remaining balance.

Under the IBR, Pay As You Earn, and ICR plans, your monthly payment amount will likely be lower. It will also result in a longer repayment period.

As a result, additional interest will accrue on your loan. So, you will be left with a higher loan balance that could be forgiven.

If you are not ultimately eligible for PSLF, you may face difficulty. You must repay the entire balance of your loan, including accrued interest.

What is Qualifying and Full-Time Employment?

Qualifying employment is any employment with a federal, state, or local government agency, entity, or organization or a non-profit organization. The Internal Revenue Service (IRS) must designate it tax-exempt.

For public service loan forgiveness purposes, the type of employment does not matter.

A non-tax exempt, non-profit private organization can still qualify. It just needs to provide certain public services, such as the following:

- emergency management, military service, public safety, or law enforcement services

- public health services

- public education or public library services

- school library and other school-based services

- public interest law services

- early childhood education

- public service for individuals with disabilities and the elderly

The organization must also not be a labor union or a partisan political organization.

You must meet your employer’s definition of full-time.

However, for PSLF purposes, that must be at least be 30 hours per week. This does not include time spent participating in religious instruction, or religious services.

If you work under contract for at least eight out of 12 months, you should still meet 30 hours per week. You must also receive credit from your employer for a full year’s worth of employment. You can work in multiple qualifying part-time jobs provided you work at least 30 hours per week.

How to Submit PSLF Forms

PSLF Loans are serviced by FedLoan Servicing. If your ECF is approved, your loans will automatically be transferred to FedLoan.

In order to submit your ECF, send the completed ECF form with your employer’s certification to FedLoan Servicing. You may mail the form to this address:

U.S. Department of Education

FedLoan Servicing

P.O. Box 69184

Harrisburg, PA 17106-9184

You may also fax your PSLF application or ECF to 717-720-1628.

If FedLoan Servicing is already your servicer, you may upload your PSLF

When Should I Make My 120 Qualifying Payments?

You must make your payments while you work full-time at the qualified organization.

In addition, you should be an employee once you apply for the program.

You should still be working there once forgiveness is granted.

How Can I Track My Eligibility?

The Employment Certification for Public Service Loan Forgiveness form (Employee Certification form) helps you with this.

It will take you at least ten years to complete the 120 payments. Therefore, a process will also guide you in this program.

The form allows you to get your certification of employment from your employer. The process allows you to receive confirmation of qualifying employment. You’ll also receive confirmation of your Direct Loan payment eligibility.

Use of this form and process is not required. But to track your progress in meeting the PSLF eligibility, follow the steps below:

- Complete the Employee Certification form annually and whenever you change jobs. It must also have your employer’s certification.

- Submit the completed form to FedLoan Servicing (PHEAA), the PSLF servicer.

- FedLoan Servicing (PHEAA) will review your Employment Certification form.

- FedLoan Servicing (PHEAA) will notify you if information is incomplete and give you an opportunity to provide additional information.

- When PHEAA can’t make a decision, they may ask you to give more information, like an IRS Form W-2, pay stubs, or other documents.

- Should you qualify, all federally held loans will be transferred to PHEAA.

- PHEAA will ultimately notify you if you are qualified, and tell you how many payments qualify, and how many payments you need to make.

7 Steps Towards PSLF

There are certain steps you must take to ensure that you don’t delay your forgiveness or become ineligible during the process. If you follow all of the steps, you can have the remaining balance of your loans forgiven in 10 years!

1. Verify That Your Employer is Eligible

Be absolutely certain that your employer is:

- A government organization, AmeriCorps, or Peace Corps

- A 501(c)(3) non-profit organization

- A non-profit, non-501(c)(3) organization that provides qualifying services [This is very rare.]

In addition to your employer qualifying, be certain that you are working the required 30 hours per week, or teaching full-time.

2. Determine if Your Loan(s) are Eligible

Not all loans qualify for PSLF. The ones that do are:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans

- Direct Consolidation Loans

If you have other loans that do not qualify for PSLF, like FFEL or Perkins loans, you may want to consider consolidating them into one Direct Consolidation Loan so that they can qualify.

Keep in mind that if you have already made qualifying payments on your Direct Loans, you do not want to include them in your Consolidation loan – you will lose credit for those payments.

3. Switch to an Income-Driven Repayment (IDR) Plan

To get the maximum benefit from PSLF and to ensure your repayment qualifies for forgiveness, you must be on an IDR plan. These are:

- Revised Pay As You Earn (REPAYE)

- Pay As You Earn (PAYE)

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

If you have a Direct PLUS loan for parents, you won’t be able to switch to an IDR plan. You’ll want to consolidate into a Direct Consolidation Loan so that you can switch your repayment plan.

4. Submit Your Employer Certification Form (ECF)

Your ECF must be filled out by you and your employer to ensure that your payments and employment are eligible for PSLF. This form should be resubmitted every single year and any time that you change employers.

5. Stay on Top of Your Payments

In order for your payments to count towards PSLF, they must be on-time and in full. Payments made during school, your grace period, deferment, forbearance, or default do not count towards PSLF. You cannot pay ahead to complete the payments in less than 10 years, although you can pre-pay up to 12 months of payments at a time.

6. Track Your Progress

Each year when you submit your ECF, you will be able to track your progress with PSLF. It will take at least 10 years to make 120 qualifying payments.

7. Fill Out the Forgiveness Application

When you have completed your 120 qualifying payments, you must fill out the application for forgiveness. This can be done online.

What Should I Do after Getting PSLF?

After making the 120th qualifying payment, you have to submit the PSLF application to receive loan forgiveness.

The application was made available in October 2017.

When you submit the application, you must be working at a qualified public service entity.

What To Do If Your PSLF Application is Denied

Even if your PSLF application is denied, don’t freak out! You may still be eligible for forgiveness through Temporary Expanded Public Service Loan Forgiveness (TEPSLF).

The Consolidated Appropriations Act, 2018 provided specific conditions in which payments that were made on a non-qualifying repayment plan can be applied towards PSLF.

You must have already submitted your application for forgiveness and made 120 payments while working for a qualifying employer in order to be eligible for TEPSLF. The only reason for denial of your application can be that some or all of your payments were not made on a qualifying repayment plan for PSLF.

Still have questions about the public service loan forgiveness program? Watch the video below!

The public service loan forgiveness program provides a great opportunity for those with debt. It lets you help society while easing the burdens of your student loans. So, check out this plan to see if it’s right for you!

FAQs about Public Service Loan Forgiveness

Q: Is Public Service Loan Forgiveness taxable?

No, the forgiven amount of your student loans is not considered taxable income.

Q: Is Public Service Loan Forgiveness real?

Yes! You must work for a qualifying employer full-time, be on a qualifying repayment plan, fill out and submit your ECF each year, and make your payments in-full and on-time.

Q: Can Public Service Loan Forgiveness be backdated?

No. If you make payments on your loans prior to submitting your ECF, those payments will not qualify. If you consolidate non-qualifying loans into qualifying Direct Consolidation loans, prior payments on those loans also will not qualify.

Q: Will Public Service Loan Forgiveness go away?

Anyone who is currently eligible for PSLF will continue to be eligible. However, President Trump has proposed ending the PSLF program in the future. This would impact anyone entering college in the near future.

Q: Do Public Service Loan Forgiveness payments have to be consecutive?

No. If you switch employers during your repayment term, you can take a break from qualifying payments and then return to them.

Q: Can nurses get Public Service Loan Forgiveness?

Yes. Nurses who work for a nonprofit or for the government can qualify for PSLF.

Q: Can teachers get Public Service Loan Forgiveness?

Yes. All teachers are in public service and should qualify for PSLF.

Q: How does Public Service Loan Forgiveness work?

You will want to follow the 7 steps towards PSLF to ensure that you meet all of the requirements of the program to qualify. Ultimately, if you work in public service for the government or a non-profit, you have the opportunity to have some of your loans forgiven after 120 on-time payments.

Q: How to recertify Public Service Loan Forgiveness?

You will need to submit an ECF every year to certify that your payments qualify and are counted towards PSLF.

Do you have any more questions about the public service loan forgiveness program? Then comment them below!

Not all teachers who work for public schools qualify for PSLF. There are many of us who teach at non-profit public charter schools, but get paid by for-profit companies that oversee these schools. We don’t qualify for PSLF.

I wanted to go back to school but I can’t because of the student loan I try to pay but I can’t

Hey Rose,

I’m sorry to hear of the trouble you’re having. Unfortunately, that is a common scenario! But, there are ways to lower the repayment of your current loan to get you in a better position. Please give us a call at 877.433.7501 so we can see what we can do to help!

Wanting to pay off my student loan. It will take forever to do so. The interest is really putting a crunch on how I can pay this off.

Hey Kevin!

We know how frustrating it can be trying to pay off your student loan while the interest just accrues each month. Have you evaluated the different repayment plans to see which one might be the best fit & help you pay off the debt fastest? Our experienced student loan counselors would love to walk you through this! Please give us a call at your earliest convenience at 877.433.7501

Wanting to pay off my student koan. It will take forever to do so.

I need help. I’m a 50% disabled veteran and my payments will start next month at 735.

I’m 50k in credit card debt, I pay 1,680 a month in child support. Plus 15-16k for a car. I’m heart broken. I need help

Caleb

Is the student loan forgiveness program income driven? I applied for PSLF via my Government job. After I transferred my loan from Nelnet to FedLoan. After my loan transferred, I was then informed that my income was to high, based on taxes.

Customer Service suggested that I apply for income driven option, this drove my payment up to $1090 per month.

How long is it taking to process the PSLF application for forgiveness? Mine was submitted over four months ago and I can get no information about it other than it can take as long as 180 days. They are unable or unwilling to tell me anything else about it.

Is there a time limit (number of years) you pay and then it can be forgiven?

Great question, Fred!

Loan forgiveness will be granted at the end of your repayment plan term.