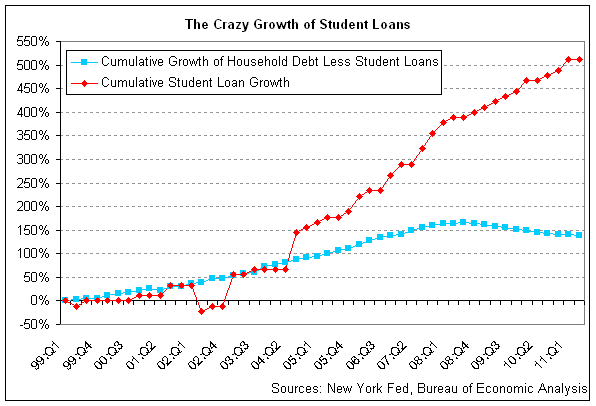

As more and more students take loans each year, and tuition costs rise while income declines, student debt is becoming more of a problem…

Just check out the crazy rise over the years…

Dealing with paying to multiple lenders for many different loans is confusing, and leads to late or missed payments.

Some people don’t know, but loan consolidation can also be done with student loans.

And in many cases, it is actually much easier than your typical loan consolidation of credit cards.

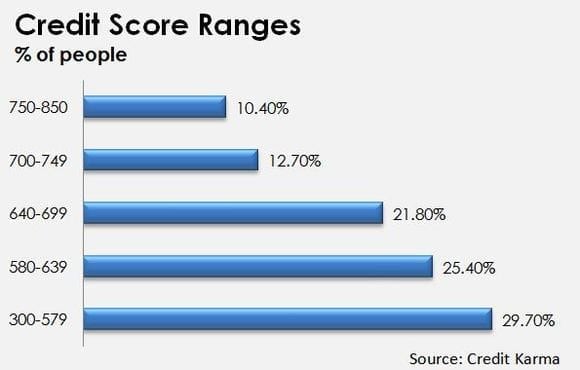

However, it is worth asking: What will this do to my credit score and history?

Especially since, as the graph below shows, the average credit score has become very low since so many people are in debt.

In this post, we’re going to go over all the pros and cons of loan consolidation and the impacts it could have on your credit score.

So let’s dive in…

Benefits of Student Loan Consolidation

It is often seen as a win-win situation when students with debt consolidate their loans into one payment plan.

This is because lenders get paid back the money they are owed, but students in debt are able to pay the loans back with lower monthly payments.

Especially for recent graduates who have had trouble finding a job, this can be a major lifesaver.

By lowering your monthly payment, you avoid missing payments and really messing up your credit score in the long run.

If you do ruin your credit score, you may find it difficult to get a loan or mortgage.

Consolidating also extends the life of the loan usually, so if needed, you have more time to pay back the loan (although keep in mind that this means accumulating more interest over the years).

Positive Impacts on Credit Rating

Number of creditors

Your credit score is not just determined by the amount of debt you carry.

It also reflects the number of creditors to whom you owe your various debts.

By consolidating your loans, you now owe the same amount of debt to only one lender, increasing your credit score.

When you owe too many creditors, you have many monthly payments, all with different interest rates.

Essentially, this makes you appear to have a very high debt to credit ratio.

However, by consolidating, that ratio goes down.

The monthly payment will be lower than the sum of the previous multiple payments, including interest.

In some cases, it could increase your credit score by up to a hundred points, making a huge positive impact on the appearance of your credit history.

Improvements in Your Payment History

Your credit score is also heavily impacted by whether or not you pay your bills on time.

This includes basic things like rent, utilities, and other revolving debts like hospital bills and credit cards.

However, paying back your student debt in a timely manner also factors into your credit score.

If you are having trouble making your monthly payments on time, this can have a major negative impact on your credit score, leading you to have higher interest rates on future loans.

By consolidating, the monthly payments are lower, and thus easier to keep up with.

Logistically, it is much easier to remember one payment due date than five or six, so it decreases the likelihood that you will accidentally forget a payment.

By continuing to make payments on time, you will build up your credit score and create a positive credit history each month.

Appearance of Paying Off Loans

Ok, so technically you may not have paid off your loans.

But for example, if you have five or six loans and consolidate them, it looks like you have paid them all off and gotten a new loan.

Your credit history and score are impacted positively by reducing the number of loans you have, so going from five to one is a huge win.

The number of lines of credit has decreased, therefore you have the appearance of much better credit behavior.

Leave a Reply