Having excessive student loans can be stressful, overwhelming, and downright frightening. Amazingly, many Americans do not even know how much they owe in student debt.

The average graduate in the United States has almost $30,000 in loans. Many students have problems paying loans back, primarily due to a lack of information and available strategies for repayment.

This article will help you understand your debt and finalize a plan for the future.

Misunderstandings About Student Loans

There are many things that people don’t know about student loans.

For instance, many people don’t know that if they don’t graduate from college, they still have to pay back their student loans. This leads many students into a cycle of debt where they’re unable to find work or pay their loans.

Similarly, a cosigner of a student loan is responsible for the student loan just as much as the student is.

Many people also underestimate the trouble which is caused by student loans, because they believe that there’s no collateral on student loans. However, the collateral is actually the entirety of your future earnings. If you do not pay off your debt, a lender can garnish your wages and even take your tax refund.

Many people become overwhelmed by student loans, and never realize that it is possible to refinance them.

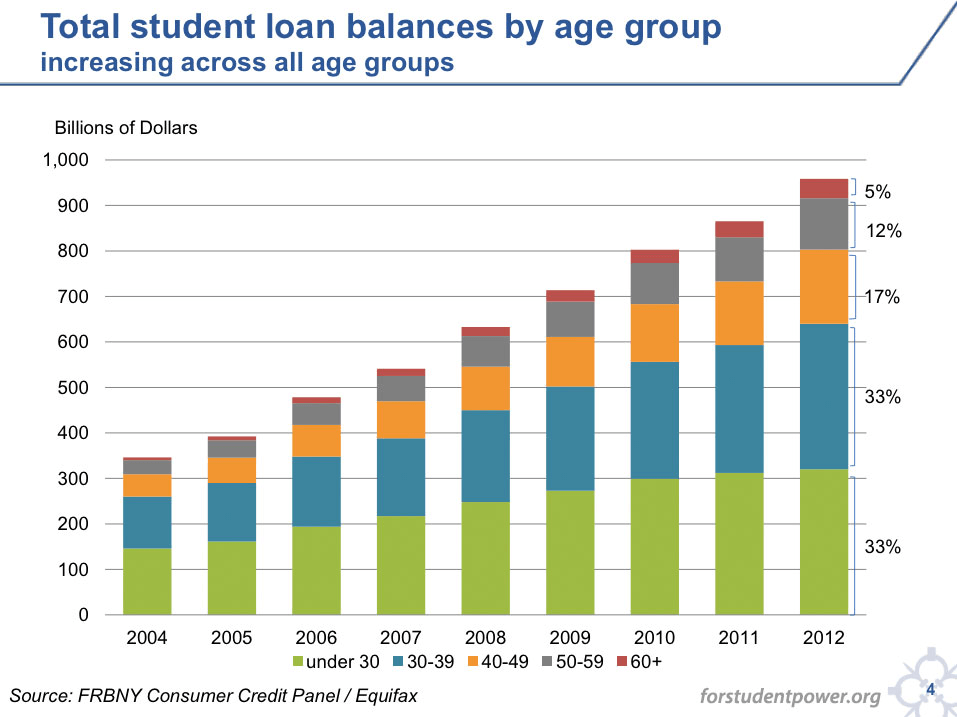

Current data shows debt is increasing

An important fact is that the average student that graduates from a four-year university has around $30,000 in debt. The problem is that many people underestimate the total amount of debt that they owe.

One recent study showed that families will accidentally minimize their debt by up to 37% on average.

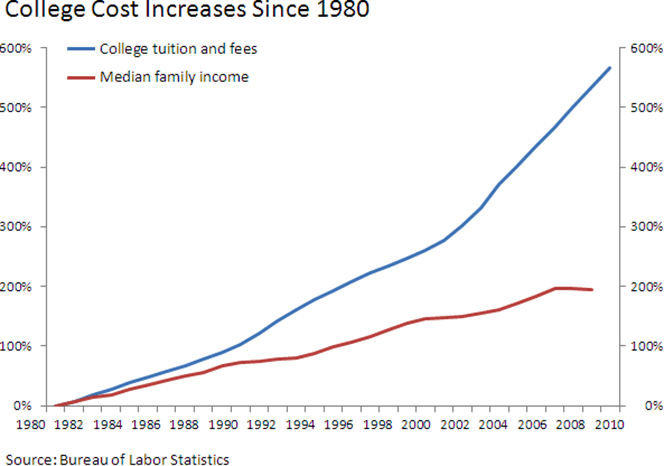

Tuition is rising steadily each year. Some private universities cost more than $60,000 per year. Although many of these private institutions offer substantial financial aid, half of those students still pay full price.

Students are encouraged to take out high-interest loans. The biggest problem is that many students do not realize how much debt they are in until after they graduate and it’s time to repay it. The interest rates for many private loans get up to 8% or 9%, which is double the 4% current interest rate for a mortgage.

Many students attempt to refinance their loans, and get on what is called an income-based repayment program. But some borrowers still have issues paying off the loans. Most students graduate expecting that they will be able to pay off their loans in 10 years, because this is the track which most lenders put their borrowers on.

However, recent studies have shown that the average person with a bachelor’s degree takes 21 years or more to pay back all of their loans. This is surprising when you consider that under federal law, people on an income-based repayment program have their debt forgiven after only twenty years. That means that in some ways, the average student is defaulting on a portion of their debt.

The difference between public and private loans

Many people do not understand the differences between public and private student loans. However, the difference is crucial when it comes to paying off your debt.

The unfortunate truth is that many students simply take out whatever loan is offered to them, regardless of whether or not they know the terms. Private loans are often easier to acquire, but much more difficult to pay back. Meanwhile, public loans are much easier to pay back, but not everyone can qualify to cover the whole cost of their tuition using public loans.

Government Subsidized or Not?

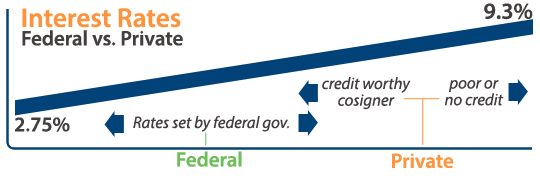

The major and most important difference between public and private loans is that public loans (otherwise known as federal loans) are subsidized by the government. This means they have a lower interest-rate and easier terms of repayment. Private loans are not subsidized by the government. They are provided by banks or other private lenders, and often at a higher interest rate than public loans.

Lenders understand that financing four years at an university can be very difficult for students. That’s why they often try to take advantage of students, giving them loans which will be very very difficult for them to pay back. Another big difference is that federal loans are disbursed to the university. Private loans are given through banks and go directly to the student, but they usually arrive to the student at the same speed nonetheless.

Loan interest rates: public vs private

One big way in which federal loans and private loans are very different is in terms of interest rates. Federal loans come with what’s called a fixed interest rate. That means that the student agrees to one particular interest-rate at the beginning of the term of the loan, and that rate is carried on throughout the entire repayment process. Private loans and have a variable interest rate which can fluctuate as things change. The rate often increases over the term of the loan as inflation occurs.

How does the accrued interest match up between federal and private loans?

The two types of loan are also different in terms of accrued interest. The longer you take to pay off the loan, the greater the value of the accrued interest cost will be.

Many federal loans delay the beginning of the repayment process until after the student has graduated, mostly after a period of six months, which is called a grace period. That means federal loans overall have less accrued interest. Federal loans can also be counted as a write off on your taxes and can save you a lot of money in the future.

As for private loans, interest begins accruing as soon as you take out the loan. This means if you take out the loan at the beginning of your four years in college, the loan will have accrued four years of interest costs by the time you graduate. Private loans are also usually not eligible for a tax write off.

Repayment is a very different story depending on whether your loan is public or private.

The repayment process is another aspect in which the two types of loans are different. As we mentioned above, public loans do not need to begin being repaid until after graduation. Private loans require you to start paying off the loan as soon as you receive the loan amount.

Some other things can also make it more difficult to pay off private loans. If you try to pay off your loan sooner than is necessary and avoid interest by making increased monthly payments, many lenders may penalize you. Therefore, holders of private loans are often held accountable to much higher payments, both regarding interest and the actual loan amount per month.

It is much easier to “get out” of paying a public loan in the future. For example, many people go into the military, the Peace Corps, or other public service jobs to get their loans forgiven. Similarly, if the student becomes disabled or dies, the loan is usually cancelled.

The bad part about private loans is that there are none of these benefits. They have very few options for refinancing and getting loans forgiven, even in the event of disability. In the case of death, the cosigner can be held responsible, which is bad because most private loans require a cosigner.

Unless absolutely necessary, students should not take out private loans, unless they know they will be able to pay them back. However, people end up taking out private loans because not everyone can qualify for federal loans. And when they do, it usually only pays for part of tuition, especially in the case of a very expensive private school.

How can I tell if my student loan is a public loan or a private loan?

The answer to this question may seem pretty basic, however many people still struggle with it. The bottom line is that if a loan is issued by the US government (The Department of Education), it is a federal or public investment. If it is released by anyone else, it is a private loan.

Are you still unsure?

Use the process of elimination to figure it out. If your loan has a cosigner, then it’s almost certainly a private loan. Federal loans are not based on your existing credit, so they do not usually require a cosigner.

Also, a simple solution is to check on your bill, or call the lender and ask. It is better to feel a little silly than to go about paying your loans with the wrong strategy.

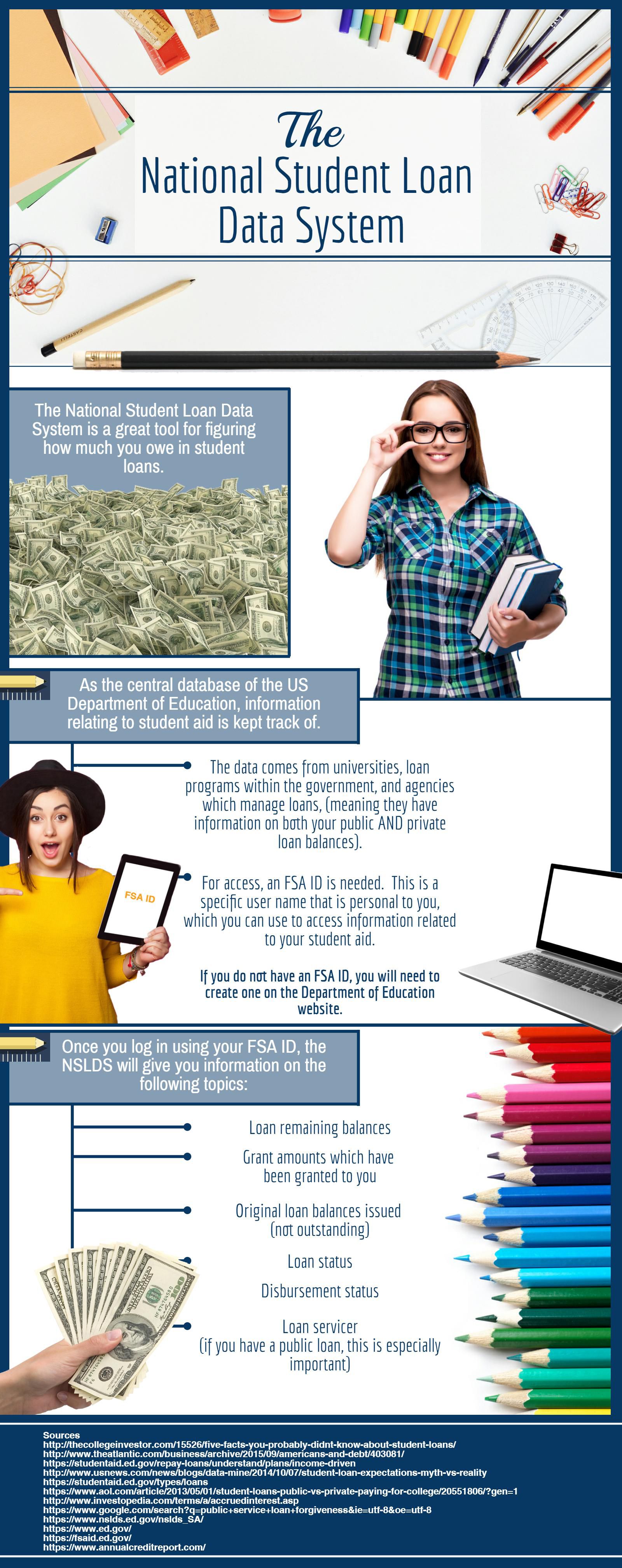

How can I find out my loan balance? What is the National Student Loan Data System and Why should I use it?

A great tool for figuring out how much you owe in student loans is using the National Student Loan Data System to find your balance. The NSLDS is the central database of the Department of Education. They use this database to keep track of all information relating to student aid. The data for this website comes from universities, loan programs within the government, and agencies that manage loans.

To access this database, you will need what is called an FSA ID. Your FSA ID will allow you to access information related to your student aid. It gives you access to many different departments of the education website. If for some reason you do not have an FSA ID, you will need to create one on the Department of Education’s website in order to access the information in the NSLDS.

The NSLDS will give you information on the following topics:

- Loan remaining balances

- Grant amounts which have been granted to you

- Original loan balances issued (not outstanding)

- Loan status

- Disbursement status

- Loan servicer (If you have a public loan this is especially important)

What are the Pros and Cons of using the National Student Loan Data System to find out your loan balance?

The benefit of this database is that is comes directly from the Department of Education. So if they have information on something, you have it too. It is an easy to use site with a simple interface and clear information.

However, there may be problems when it comes to information regarding private loans, since they are not issued from the department. The NSLDS depends on private lenders such as banks to report information accurately to them, which they don’t always do. They also depend on the individual college or university for up to date information. For the most part, the data is reliable. If in doubt, it helps to go to your college or university’s financial aid office and ask them for help.

How Can I Find My Balance for Private Loans, then?

With all this confusion about private loans, you may be wondering how you can find the total balance of your private student loans. In reality, the only tried and true way of figuring this out is to contact each of your loan servicers individually and add up the total to find the sum your entire loan balance.

Unfortunately, you will not find a single website that aggregates all of the data for each of your private loans, especially if they are from different servicers.

Another great way to figure out a private loan balance, or your public loan balance for that matter, is to request your free yearly free credit report. Any student loan which you have taken out will go on your credit report. This makes it a good way of figuring out how much you owe on your student loans. Additionally, it is a useful habit to get into early in life, as your credit score is a very strong reflector of your financial health and your credit history.

Student loans are considered a “good” type of credit to have on your report. That’s because it increases the length your credit history and number of accounts. This demonstrates that you can pay off a loan in a timely manner. This type of credit history shows future lenders that you have good financial responsibility.

What Should I Do Next?

After you find out the balance on your student loans, focus on how and when you will finally be paying them off. First of all, finding a steady and reliable job will be crucial in your ability to pay off your loans. Many graduates have hundreds of dollars in loan payment each month. Without a steady job it will be almost impossible to pay this off.

A good strategy is to treat your loan almost as if it is a mortgage. This means making higher monthly payments than you are required to. But you will thank yourself in the long run for doing this. By paying off more of your loan sooner, you avoid paying more money in interest each month.

Learn To Budget

Getting a long-term plan and budget is also one of the most important factors in your ability to pay off your loan. Sit down for a few hours and set up a spreadsheet with all of your projected financial needs and income. This way you can figure out what your disposable income is, and how much you can ideally contribute to paying your student loans each month.

A budget is your best friend for being debt-free. This can also significantly reduce the amount of anxiety you may experience in trying to figure out when you will pay off your debt. Make sure to continue updating your budget as your financial situation changes. The budget you have in school will be different once you’re not a student anymore.

Finally, cutting out unnecessary expenses is the best way to save up money towards paying off your debt. It is ok to splurge every once in awhile. But, it is best to put this money to good use and reduce your debt.

Becoming debt-free is one of the best investments you can make. The sooner you pay off the entire balance of your loans, the quicker you can save yourself time and money.

Getting rid of debt is proven to reduce anxiety and depression.

So plan ahead now to make your life easier in the future.

I want to go back to school but have a out standing loan what do I need to do

Thank you for this information. I am so frustrated with all the calls coming to me for people to help me with this. But now I don’t trust any calls. Mine credit has been ruined by NELNET for non payment. I also paid some callers money to help me. But I called off their payment through the bank. It is so frustrating. I don’t really know how to work the computer but I am trying. I would like honest additional help if that is possible. Thank you for this information. I want the FORGIVENESS program.

Lorraine, there are many different programs available. The forgiveness program has strict guidelines. Remember, these are government programs and they are very specific about who qualifies for each program. We’d love to help. You can message us on Facebook if you’d like to speak with a professional, no obligation:-) Here’s the link: https://m.me/usstudentloancenter

I would like this student loan to be vanish!!! Because this have long awaited!!! So I’m willing and able to pay what I can afford, And I’m willing to work with you. Thank You!!!! (Curt)

Hey Curt,

We’d be happy to help you out.. the best way to start is to figure out exactly how much you owe in student loan debt. So if you haven’t already, go ahead and sign up for this free download for How To Figure Out How Much You Actually Owe In Student Loan Debt In Less Than 10 Minutes

https://usstudentloancenter.org/LP-LM3-how-to-find-out-what-you-actually-owe-in-student-loans

It’s totally free and it will help you figure out exactly where to start. After you’ve downloaded and gone through your free guide, go ahead and give our team of Student Loan Consultants a call at 877.433.7501 option 3. They’re there to help you find the best option for repayment and monthly payment.

Cheers

KB