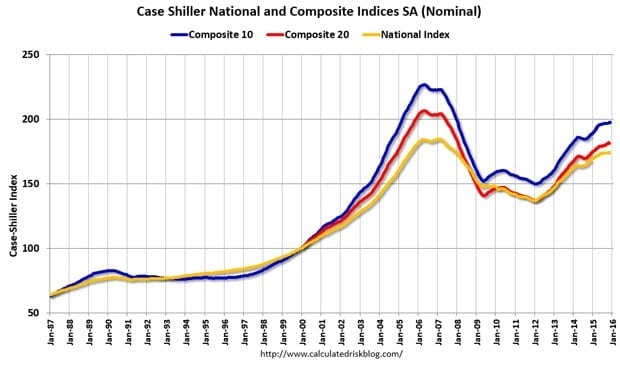

The average home price has increased by more than 80% since 2000.

However, the median income of millennials is down 10%.

Wages may be stagnant or even lower than previously.

This alone puts millennial house hunters in a tough situation.

When you add student loan debt, those under 35 years of age just cannot afford to buy a house.

The housing market has not fully recovered from the 2008 crash, but the current level is still well above the 2000 level.

However, with the economic uncertainty, buying a house is not a guaranteed investment.

Prices may continue to rise, or they may stagnate.

[tweet_box design=”default” float=”none”]The average student loan is around $37,000. [/tweet_box]Paying that back takes top priority amongst millennials.

Adding more debt in the form of a mortgage payment is not a pleasant thought, as most are uncomfortable with the idea of adding more debt to their name.

Should Millennials Rent Forever?

Frankly speaking, they don’t have to. In fact, owning a home has many benefits.

But before you go and purchase a house, consider the following points.

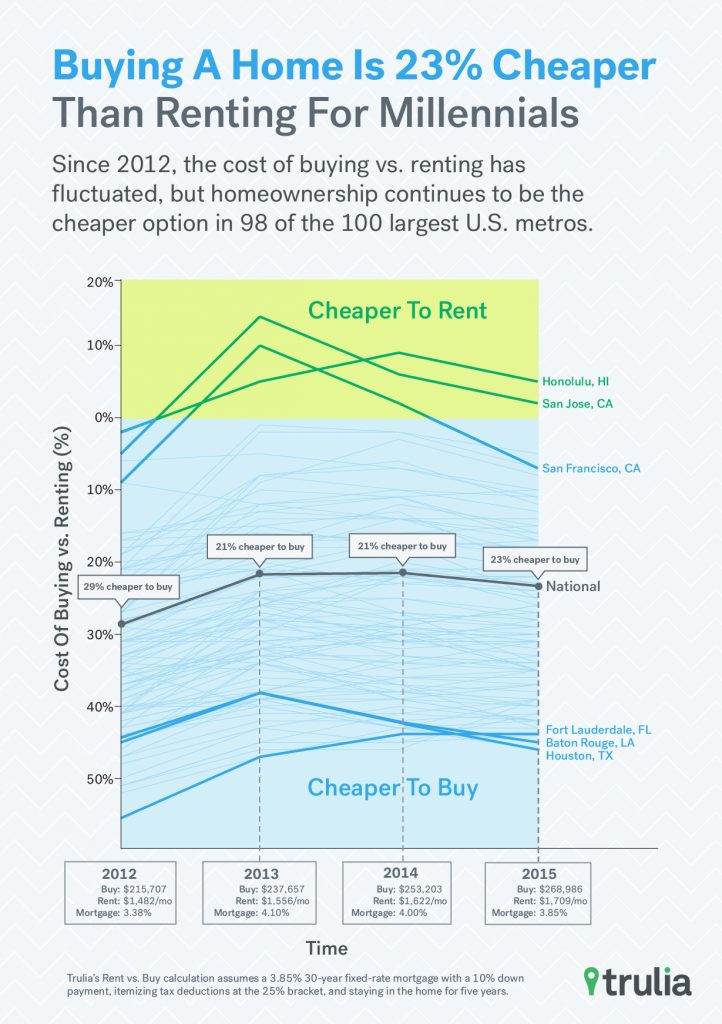

Buying a home and paying a mortgage can be cheaper than renting for the same length of time as the mortgage term.

With a 10% down payment, the difference can be upwards of 20%.

While it is true that buying a house incurs maintenance and utility costs, there are benefits to owning a home.

As the buyer pays off the mortgage loan, they are creating equity on the home.

Additionally, when selling the home, owners can claim a tax deduction on mortgage interest rate or capital gain exclusions.

In 98 urban cities in the United States, it is cheaper to buy a home than to rent.

Houston, TX ranks number one for savings, as it is 46% cheaper than renting.

While the difference in cost has decreased by about 20% in some California cities, some are still at or above the national average.

Cities that saw an increase in pricing difference only saw a slight increase, generally 2-4%.

If Millennials have the flexibility to move, buying a home in an advantageous area will save money on their mortgage.

Student Loan Forgiveness Plans

For graduates of certain programs, employees in particular fields or residents of certain states, loan forgiveness plans can be set up to help manage the debt.

- The Public Service Loan Forgiveness program is for full-time employees of federal, state, or local government agencies. Some non-profit workers also qualify. When a participant with an eligible loan has made 120 payments (the equivalent of 10 years), up to the full amount of the loan may be forgiven.

- Several options are available for teachers. For those who work in low-income schools, up to $ 5,000 may be forgiven after five years of work. If a teacher has a Federal Perkins Loan, the entire loan may be forgiven in 5 years if they work at a low-income public or non-profit school. Some states have unique programs, with loan forgiveness ranging from $ 2,500 in Texas to $ 24, 000 in New York City.

- Doctors and lawyers may also qualify for loan forgiveness depending on the state they work in.

- Income-based repayment caps the monthly payments at 10-15% of the worker’s discretionary income. The remaining loan balance after 20-25 years is forgiven.

- The Pay As You Earn program caps the payment at 10% of the discretionary income for 20 years. After that, eligible loans are forgiven.

- For graduates making less than $80, 000, up to $ 2,500 of student loan interest can be deducted on tax forms.

A recent trend in the recruitment process is employers who pay student loans for their new hires.

However, the money set aside to that effect is taxable.

Companies may or may not set a cap on the value of the debt they will pay back.

Either way, it is up to the employee to determine if the plan is worthwhile.

Sometimes, a higher pay is better than loan repayment help.

Loan Refinancing and Consolidating

If loan forgiveness plans do not look promising, graduates have the option of consolidating or refinancing their loans.

When consolidating more than one loan, the graduate only has one payment every month.

However, they must have a decent credit score and the bank consolidating the loans usually requires collateral.

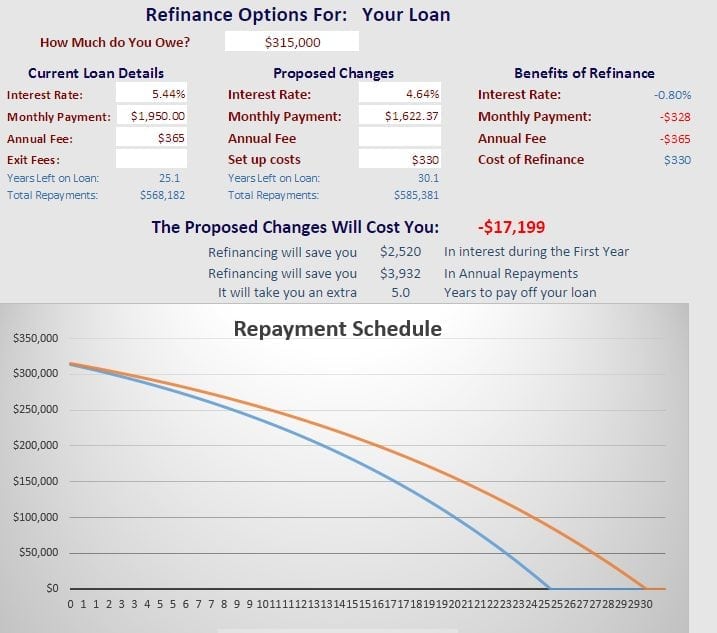

Refinancing could allow for lower interest rates, lower monthly payments, or both.

In the event of a raise, the repayment schedule can be increased to pay off the debt sooner.

A shorter loan reduces the interest paid.

If finances are tight, a longer-term loan will decrease the monthly payments.

The loans can be private or federal, depending on the bank that is refinancing them.

Some banks require a minimum loan value, while others require a minimum income.

Student loan interest rates can vary between 3.75% and 12%.

The average savings account has a mere 0.06% interest per year, with high-interest savings accounts having 1%.

The interest income on a graduate’s savings account is not enough to cover the interest from the student loan.

However, if they can find a little extra cash to invest, for example, short or long term stocks, the interest rate can be up to 10%.

That can be used to pay off debt much faster than the interest from a simple savings account.

Down Payment Requirements Have Changed

Millennials may think that they are not eligible for a traditional bank loan.

After the 2008 market crash, many lenders do not want to make loans to those who cannot provide a large down payment.

Doing so is too much of a risk for them.

Banks will likely refuse borrowers whose debt payments are close to 40% of their income.

However, for buyers with good credit, getting a less than 20% down payment can be easy.

The compromise is a higher interest rate.

Lenders like the Federal Housing Administration insure loans with a down payment as low as 3.5%.

Veterans Affairs also offers home loans, and these do not require a down payment.

Owning a home allows for a few innovative income opportunities.

For example, renting a room can provide extra cash that can be dedicated solely to repaying student loan debt.

This option is not available to renters.

Thank you for posting this discussion it is very difficult to manage a mortgage and student loans I know several people who are under water in their mortgage and just struggling with college degrees with low paying jobs I average about $30,000 a year and my husband it has no degree and it is difficult for us to manage but we do own a home fighting with the mortgage company the best thing that I could suggest is just work with your mortgage company and your student loans

Yes, many families struggle to get out of student loan debt after college. Lower incomes and a higher cost of living isn’t helping anyone.

That’s a great tip. If people don’t know they can work with their mortgage company, their situation will continue to get worse.

Thanks for the insight!

Hola! Voy a comprar un apartamento en Puerto Rico y necesito una carta de verificación del préstamo estudiantil para presentarlo en el Credit Beureu…..enviame información a mí email.

Thanks! Liz Mercado ( Lawyer)

Hi want to buy home but how