I’m sure you’ve heard horror stories about student loan debt. But sometimes hearing about it on the news makes it seem like more of an abstract problem. We forget that that it’s something that is affecting the daily life of millions of people across the country.

Let’s look more closely at the current student debt situation. Then, I’d like to tell you about how my loan debt is affecting my life.

The statistics

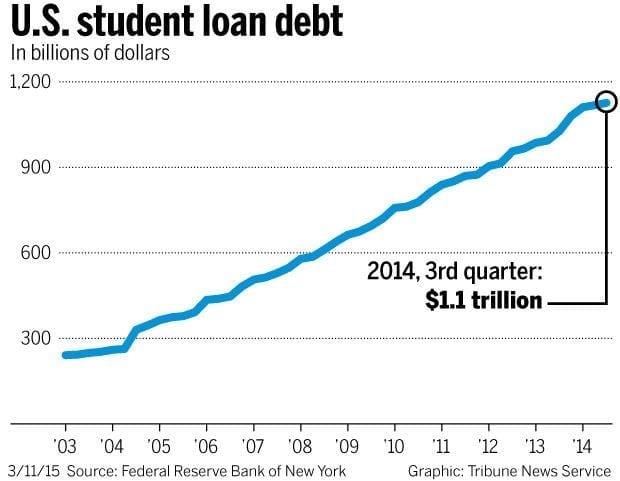

As the chart shows, the total amount of student loan debt in 2014 was $1.1 trillion. Current data shows that this has now risen to more than $1.2 trillion.

This makes student loans one of the highest levels of debt in the country, second only to mortgages. Most of this money is owed to the federal government. Although many students also take out a private student loan as well.

Approximately 70% of people graduating with a bachelor’s degree have had to take on debt at some point in their studies.

Currently, the number of Americans who have an outstanding balance on their student loan is 40 million. To put that into perspective- that’s around an eighth of the population.

About one in four of these borrowers has missed payments or is in delinquency.

The average amount of debt of a person who graduated in 2015 was $35,051.

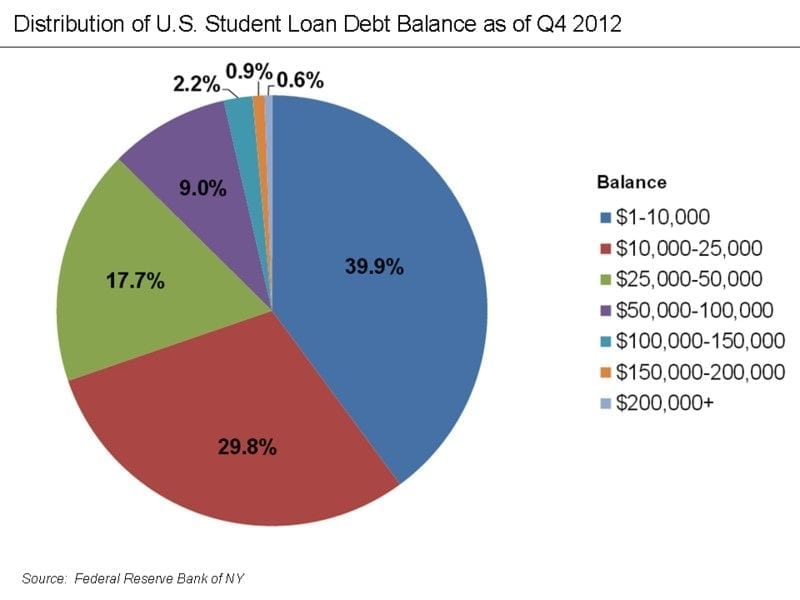

As the chart below shows, many people are struggling with much greater outstanding balances than that average.

Source: https://en.wikipedia.org/wiki/Student_loans_in_the_United_States

Currently, the average cost of a year’s tuition is $10,000 for those studying in-state. Up that to about $23,000 if you choose to go out-of-state.

Don’t forget to add in the cost of board, textbooks and materials. See how quickly it all adds up? And this just covers a student’s basic needs. Money for anything else will have to be found a different way.

Many students find that they are eligible for a grant to help with the costs, but it’s not enough to let them avoid taking on debt. The majority also have to get a job to support themselves.

Once you graduate, you’ll have to start paying your loan back. With a typical debt of $30,000, you’ll likely be paying around $300 a month. Obviously, this will depend on your personal circumstances.

According to recent statistics, the average starting salary for recipients of a bachelor’s degree in 2016 was $50,556.

This is likely to be a little higher for those with a major in Engineering ($64,891), or Math and the Sciences ($55,087). It’ll be a little lower in other fields, such as the Humanities ($46,065).

Some loan repayment plans are linked to salary, and those with higher incomes may wind up making much higher monthly payments.

There comes a point where facts like these can become a little meaningless, especially taken out of context.

So, instead of continuing to talk about the ‘average student’ and the ‘average data’, it’s time to put the student debt situation back into context.

I’d like to tell you more about my experience with the student debt crisis.

The dream

Ever since I was a little kid, I’ve had two real passions: sports and words. Growing up in New Jersey, I divided my time between the two. I’d watch any sports team that was playing nearby. Baseball was always my favorite, but i’d watch just about anything. Or i’d be reading about anything and everything- fact or fiction.

I discovered quite early that I also loved to write. A series of great teachers helped me to grow more confident, and I entered a series of writing competitions, often winning them. During high school, I got involved with the student newspaper – mainly reporting on the school’s sporting successes and failures. This is when I realized I had found what I wanted to do with my life.

I knew I would need to keep studying if I wanted to pursue this further. After a lot of research, I decided on my local school – Rowan University – as the best place to go. They offered a very popular journalism course with the option of doing an internship and gaining valuable practical experience.

The advice

I didn’t know much about the financial options available for students when I started applying. I soon discovered that things were going to be harder for me since I didn’t qualify for any grants. This meant that I was going to have to take out loans to fund my whole education.

At the time (2006), this seemed perfectly reasonable, and nothing to worry about. Yeah, I would have a lot of debt at the end. But I’d be able to get a good job and pay it down quite quickly. I was always told that your education is too important to miss out on just because you have to borrow some money.

Knowing what I know now, I’d love to be able to tell my friends to be more wary of this advice and to explore other options.

The most sensible decision I made at this time was to choose a local school. One well-meaning teacher suggested I look around for other journalism courses – going out-of-state if I needed to. I decided that paying for an out of state school entirely through loans was not a great plan.

I obtained a federal loan at an interest rate of 6.8% and started out just using that. After my freshman year, I decided that the income from this and a part-time job still wasn’t quite enough. So I also took out a smaller private loan to cover the shortfall. Unfortunately, this was at a higher interest rate – 8.5% . But, I decided that I needed the money, and, after all, I was sure I would have a good salary after graduation.

The reality

My time at college was everything I hoped it would be, and I graduated with a good degree. Things seemed like they were on track for what I had planned during high school.

Then reality began to set in.

I took a closer look at my finances. I realized that, besides my degree, I had also graduated with around $80,000 of debt.

$75,000 was my federal loan, while the remaining $5,000 was the higher-rate private loan. Around half of that, $41,500, had been used for my tuition costs.

Given the financial situation when I graduated in 2010, I realized that my prospects weren’t quite as rosy as I had hoped they would be. Sure enough, it took me a few months to find a job. And so I missed a couple of loan repayments.

With some help from my parents, I got back on track and finally managed to find work as a sports reporter for my hometown newspaper. It was quite a junior role, so the salary wasn’t the highest. But it was a job, and, with the experience I was gaining, I was sure that would soon improve. Again, things seemed like they were starting to head in the right direction.

The nightmare

I soon realized how wrong that impression was! I took home about $1,500 each month. By the time my loan repayments, over $900 across the two loans, had gone out, I didn’t have that much left to cover my expenses.

To make matters worse, I had to buy my own car. Otherwise, my job would have been impossible to keep. That meant more money was disappearing from my account each month, even though I bought second-hand and found the best deal I could.

Thankfully, I was still able to live with my parents. By doing this, I didn’t have to worry about mortgage or rent payments.

Even so, I found it difficult to manage each month and ended up having to use plastic more than I wanted. I have always tried to keep my balances low, but at times my situation is so bad that I end up having to use credit to pay for essentials.

I now owe almost $3,000 on credit cards.

To pay down my credit card balances, I’ve had to start working in my local grocery store on my days off. I don’t make much doing that, but it’s better than adding ever-growing credit card debt to my list of financial worries.

Between stress about money and the fact that I haven’t had a day off in months, I’m starting to have problems with my health. I feel as though I can’t escape my financial situation and the stress is like constantly carrying a heavy weight around my neck. It’s affecting the way I do my job. I can’t even begin to imagine what would happen if I reached the stage of no longer being able to work because of it.

This feeling got worse when I looked more closely into the interest I was paying.

Assuming my monthly payments don’t change, I will pay $28,500 in interest on my federal loan, and almost $2500 on my private loan.

In total, for a loan of $80,000, I will repay more than $110,000.

The solution?

As far as I can see, there are three main ways of improving my situation. But, all of them have problems associated with them.

One possibility is to change my payment plan. There’s a lot of different repayment plans available for federal loans. I could potentially switch to one that would lower my monthly payments. This is a great option for most students. But in my situation, that would mean repaying around $156,000 in total. Not only that, but it wouldn’t even halve my monthly payments- they would be $521 instead of $863.

I’ve also investigated the possibility of refinancing my loans to see if that would improve my situation. Unfortunately, the repayments I had missed before I got a job have affected my credit rating. This means that every lender will only offer to refinance my loan at a higher interest rate, which would only make my situation worse.

The only other alternative is to find a job with higher pay. I had always assumed that this wouldn’t be an issue, but that was before the economic downturn. Suddenly, there isn’t the same amount of money available, and people aren’t changing jobs as much. There is now so much competition in journalism that applications rarely lead to an interview, let alone an offer.

I’d have a better chance of earning a higher salary if I lived in a bigger city, but there is no way i’ll be able to do that. The only way I’m managing to keep going right now is thanks to my parents’ support – I’m still living with them to save money. Getting my own place isn’t really an option. I certainly can’t afford a mortgage, and my low credit score could make the cost of renting too high.

The future

Right now, I can’t see past my financial situation. The thought of being able to own my house, afford a family, or even just work one job instead of two seems impossible. That kind of thing only happens to other people.

Mine is not the only horror story – there are many graduates out there with much higher levels of debt than I have, and many others with no job and no way to make their payments.

The thing that all of us have in common is that our debt is currently the thing that defines us.

So many of us are struggling to stay afloat, always worried that next month will be the one that pushes us under.

It seems clear to me that things can’t go on the way they are.

The student loan crisis is getting worse with each year that passes. As schools continue to raise tuition, students have no option but to borrow increasingly huge sums of money to pay for their education.

I can’t help feeling that we need to find a way to ensure that anyone can achieve the education they desire, without having to start their adult life with a crippling amount of debt.

Leave a Reply