There are several reasons as to why somebody may be unable to meet the repayments on their student loans. If you’re one of those people, you may be wondering, “Should I defer my student loans?” It is important to note that deferment is not right for everybody. On this page, we are going to help you to decide whether deferment is the right choice for you or not.

What are the reasons people defer?

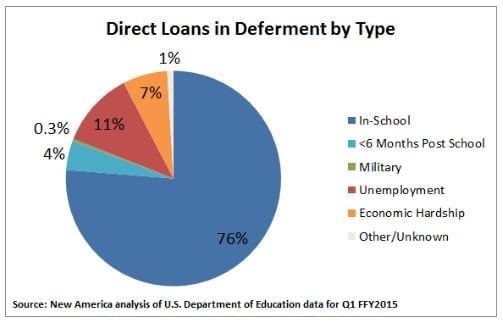

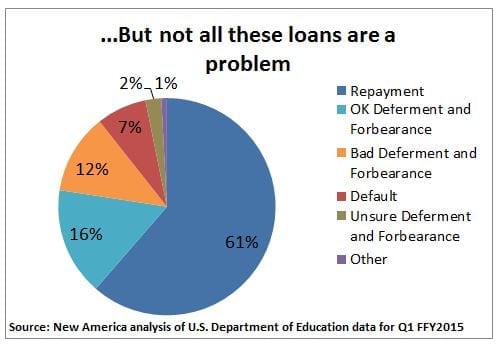

Before we help you to decide whether deferment is right for you or not, it is worth looking at these two charts. The first highlights the main reasons as to why people defer their student loans. The second shows the status of these loan deferments. If you do wish to find out more about the reasons why people defer their loans, then it is probably worth checking out CitizensBank.com.

As you can see, the main reasons as to why people defer their loans include:

- If they are still in school. You do not have to attend school full time to defer your loans. Part time is enough.

- Economic hardship. Basically, if you do not have the funds available to cover your loan payments.

- Unemployment: this ties into economic hardship. Remember that eventually you are going to need to pay off your loans, so if you do defer, it is important that you obtain a job as fast as possible.

- In most cases, you will not need to start paying off your loan for at least six months after you have finished school.

What is Student Loan Deferment?

Loan deferment allows people to pause repayments on their loan for a specified amount of time. Your account will continue to accumulate interest during this time, but you will not be required to make any payment on your loan during this time.

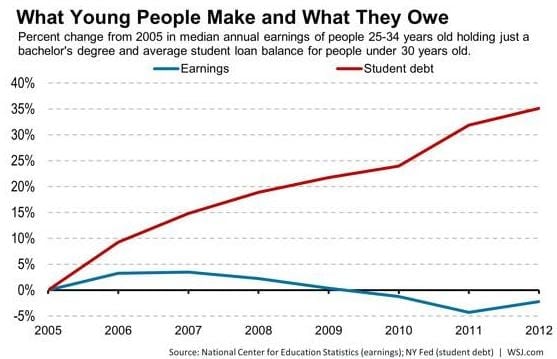

One of the main reasons as to why people defer their loans is because of low income . If you look at this chart, you will see that while student loans have increased over the years, the average wage of a graduate has fallen. This makes it tough for people to afford to make payments on their loans.

The Pros of Student Loan Deferment

According to Student Loan Hero, there are a few pros to student loan deferment. It is worth bearing these in mind when you consider whether this service is right for you or not:

- Payments that you need to make will stop immediately. For the most part, it is a quick process.

- You will free up funds that you can use for other financial obligations in your life.

- You will not default on your loan, which can damage your credit score.

The Cons of Student Loan Deferment

There are also a few cons to student loan deferment. This includes:

- Interest will continue to accrue. This means that you will be paying more over the lifetime of your loan.

- You can only defer the payments for so long. Therefore, you are only going to want to use this system when you genuinely can’t meet financial obligations.

- You may lose some rights under loan forgiveness programs. Many ask you to make at least 120 payments on your loan. Deferring the payment will mean that it takes far longer to get to the point where you can ask for forgiveness on your loan.

Can you apply for loan deferment if you are unemployed?

If you are entitled to unemployment benefits, you will be able to apply for loan deferment. However, it is worth noting that you can only defer your loan for so long. For most loans, you will be able to apply for up to three years of deferment. However, you will need to do this in three month increments. This means filling in a few form each month.

Are there alternatives to student loan deferment?

Yes. There are. In fact, student loan deferment should always be taken as a last resort. The first thing you should do is talk to your lender. They would rather work with you to establish a payment plan as opposed to you stopping payments altogether. However, this solution may not work for you if you don’t have any income coming in.

Leave a Reply