With the cost of tuition constantly going up these days, it is a rarity that I speak to a recent graduate who is not in student loan debt of some kind.

In fact, the most recent statistics show that over 70% of all college seniors have found themselves in student loan debt upon their graduation date.

In 2014, the average debt accumulated by these graduates is estimated to reach $30,000 per borrower; for some private colleges, it is about that per school year!

That means the average cost for just one four-year degree will be $132,000.

- At the time these graduates took out these student loans, did they know what they were signing up for?

- Did they know what their rates were going to be and if their lender could change those rates without their knowledge?

- Did they know who their lenders even were?

- Did they know if the loans were federally backed or privately backed and what the difference was?

- And most importantly, did they know what their options were after graduation?

For most graduates the answer to these questions, along with many more, is a resounding NO.

The reality is the majority of these graduates are blind and completely uneducated when it comes to their student loans; and this isn’t because they are dumb or simply do not care.

They were simply never told how to pay off student loans…

So it is no surprise when I hear that these graduates fall behind on their payments, go into default, or more commonly, continue to make higher payments every month while the balance seems to stay motionless.

To make sure that you can get the lowest payment possible and that you are not getting ripped off by student loan servicers (Sallie Mae/Navient, anyone?), you need to know a few basic tricks and ensure you are in the most beneficial student loan situation for your specific needs.

And because student loans are usually a pretty large piece of a person’s overall debt, having your student loans squared away can really take some financial weight off your shoulders.

After speaking to more than 25,000 graduates struggling with high monthly payments everyday, we have compiled a list of the 9 most useful pieces of information that we share with our clients for lowering their student loan payments.

Here are 9 tips to lowering your student loan payment:

1. Know the kinds of loans you have

There are so many different kinds of loans out there that it can be pretty overwhelming and confusing to sort them out.

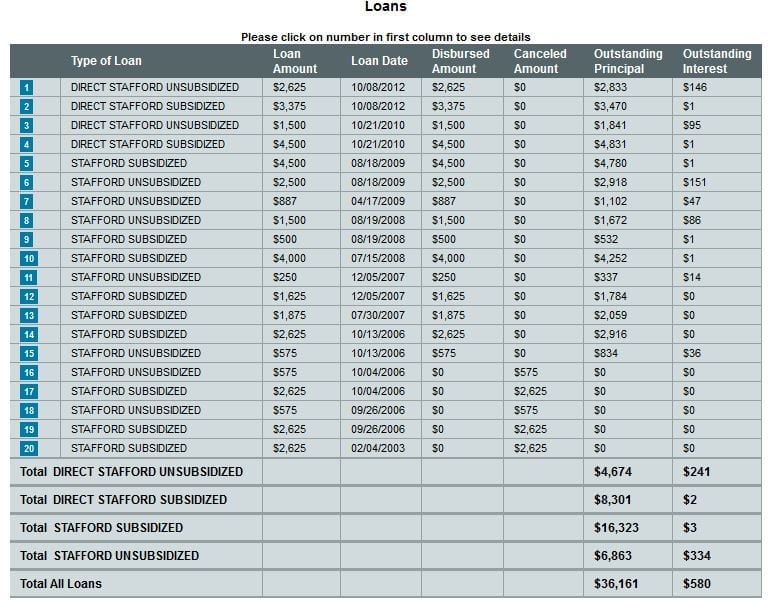

By using the National Student Loan Data System (NSLDS) and your FAFSA pin, you will be able to look at every single kind of federal student loan that you have.

It is important to know what kinds of loans you have because different repayment options are often based around this information as well as the origination date of the loan.

Be sure to double check the statements you are receiving and the amounts of the loans.

If you have looked at your overall principal on your statement and it differs from what you see on the NSLDS, chances are you have private loans too.

In this case, you may need to contact your lender of the loan or your financial aid office to find out exactly what kind of private loans you have.

2. Stay in touch with your lender or your loan representative

It may sound strange, but some kinds of lenders will never contact you in regards to collecting payment.

This does not mean that you are free to go- even though that is what we would all hope for! Those lenders are almost hoping that you run late and fall into default.

Why?

Because those lenders are backed by the federal government and they will get paid back on that loan one way or another.

In fact, if you do happen to fall into default, not only will they be paid back by you (the borrower), but through interest, regular payments, and being paid back by the government, those lenders will receive about 3x’s the amount of your original balance.

Does that seem right?

Probably not…so whenever you have a change in your financial situation, contact information, or you anything else pertaining to your loans, give your lender or representative a call and let them know.

When you do this, ask them any pending questions you may have and reconfirm some of the basics you have already established with them.

Never assume that they will contact you to keep you in the loop!

(Bonus Tip: Want even more of these tips to lower a payment? Own all these 9 tips and more in the newest and extended version of this guide below. We break down all 9 tips even further so you know the best ways you can obtain a more affordable payment FAST. Learn more and get the download here for free.)

3. Know your student loan repayment options and fully educate yourself about them

There are several different kinds of repayment options and programs available for students.

Not only were they invented to keep you on track to pay off the loan but by finding the right program for you, they can help alleviate the struggle of a high payment. While the repayment programs are there to benefit students, they can be confusing to understand and therefore are underutilized.

If you do not feel confident in sorting through the confusion by yourself, your lenders are supposed to be there to help you.

However, as I mentioned earlier, some lenders are not particularly helpful. It’s a good idea to get professional help if you want to find out more about repayment programs or if you are experiencing the aforementioned “un-helpful helpers”.

4. Find out if you can qualify for a forgiveness program.

Some of the programs available to students also offer Student Loan Forgiveness.

As forgiveness programs are mainly based off of the type of loan, the origination date, your occupation, and your income these too can get confusing. Be sure to consult with your lender or representative to ask questions about obtaining forgiveness.

This is where knowing the types of loans that you have accumulated will really come in handy.

If you are unsure of the next steps to take to acquire forgiveness, you can speak to a student loan representative, who can help you out with a free audit of your loans.

5. Find out what consolidating your student loans can do for you.

A consolidation is taking the accumulation of all your student loans and bringing them together to make one new loan, with one new, fixed interest rate.

You must be careful if you have both private and federal student loans when consolidating.

You probably do not want to consolidate your federal loans into a private loan for the reason that you would lose any deferments or forbearances you might have left in your loan term.

If you only have federal loans then there are several factors you will want to take a look at before moving forward with a consolidation.

While a consolidation can open up a range of benefits for you, every situation is different, so you will want to get the facts and consult an expert to find out how a consolidation can help you.

6. Be aware of your grace period and when it ends

After you graduate, usually you are given about six to nine months “grace” with federal loans in order to find yourself a job and some financial stability.

The grace period for private loans varies, so you will want to contact your lender and take note of important dates.

Many times student loan companies will contact you immediately following graduation to try to collect your payment.

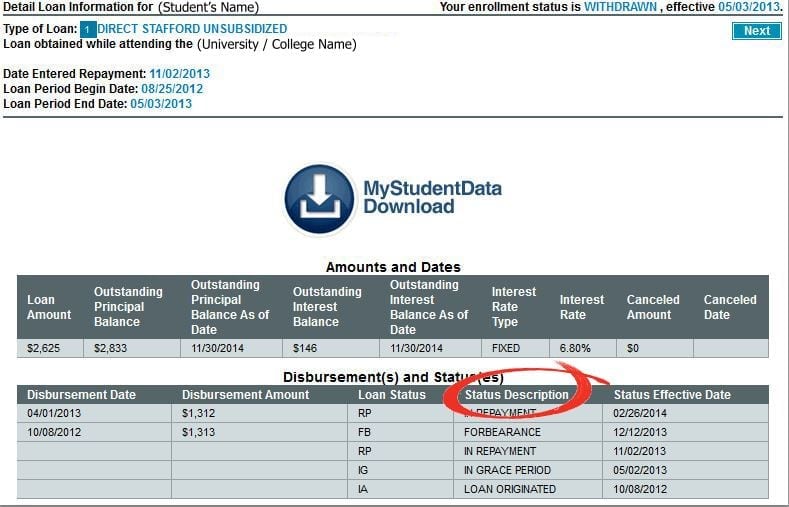

Make sure you check the status of your loans by logging into the NSLDS.

It can show you if you are still in grace period, default, or in repayment.

If the system shows that you are in grace period and your lenders are asking you for payments, you may wish to bring this up to them or contact a loan representative if you have one.

You also need to be aware of when your grace period ends.

This is very important, as you don’t want to miss your first payment date and start off on a bad foot.

Which leads us to my next tip…

(Bonus Tip: Want even more of these tips to lower a payment? Own all these 9 tips and more in the newest and extended version of this guide below. We break down all 9 tips even further so you know the best ways you can obtain a more affordable payment FAST. Learn more and get the download here for free.)

7. Do not miss your payments

Running late on your student loan payments not only leads to a damaged credit score, but it can also result in a defaulted status on those loans that are late.

Once the loans are in a default status it becomes very difficult for lenders and the US Department of Education to work with you as far as coming up with an affordable repayment program or sometimes even consolidating those loans.

It’s almost as if you have lost the Department of Education’s trust at this point and until you can prove to them that you are a capable, payment-making citizen again, you are put into a dicey and questionable collections period.

If you continue to avoid paying on your loans throughout default status the government will come after you through your employer and your taxes.

The Department of Education can garnish up to 15% of your wages or collect your tax refunds, leaving you with little options.

Please, do yourself a favor and do not let it get to this.

As you can see, not making some kind of payment towards your student loans creates a long snowball effect to a huge financial mistake.

8. Learn how taxes can impact your student loans

Not only could there be tax breaks available to graduates with student loans, but income taxes are also factored in when qualifying for certain repayment programs, such as the Income Based Repayment Program (IBR).

As it is one of the repayment options that offer student loan forgiveness to graduates, the IBR program looks at a graduate’s household income.

Moreover, if you default on your student loans, the government can keep tax refund to pay for the defaulted student loans.

To read more about how to stop student loans from taking your taxes read this.

For this reason and if applicable, a graduate may want to look into filing their taxes separately from their spouse.

Note that making the change to file your taxes separately can affect other areas of your finances, so you will want to make this decision carefully and even get with your accountant if you need to.

9. If you can afford to pay extra, do it

Putting more money towards your loans each month can help to directly attack the principal.

Since each monthly payment covers any fees you might have accumulated and also the interest, only a little each month is going towards actually bringing down your principal balance.

Most of the federal loan repayment programs offer a no pre-payment penalty.

Meaning that anything extra that you pay each month will go towards the principal.

Whether you are able to do this every single month or just a little here and there, it is a good idea to get a written statement saying that the extra amount that you put down each month is to be applied to the principal- not your future payments!

The essential understanding about the above tip is the “if you can afford to” part.

Yes, paying off your student loans is extremely important, but you shouldn’t put everything you own and have into paying them off quickly.

This can hurt you in other areas of your life; from your long run financial stability to even your emotional health.

However, when all of these 9 tips are followed to lower your student loan payment, you can find that both your long run finances and your happiness will both improve.

(Bonus Tip: Want even more of these tips to lower a payment? Own all these 9 tips and more in the newest and extended version of this guide below. We break down all 9 tips even further so you know the best ways you can obtain a more affordable payment FAST. Learn more and get the download here for free.)

Still need some help with your student loans?

That’s OK.

We get it, they’re confusing (and pretty annoying)!

That’s why we’re here- to help you out with any questions you may have and try to lower your payments along the way. Download the extended and updated version of this post for free, here or simply give us a call at 1-813-775-2058

I graduated with an Associates degree from Sanford Brown, a college that no longer exists. I was lied to by the “counselors” about the accreditation and what my salary would be in my chosen field. Are there STILL no loan forgiveness plans for people who were taken advantage of by predatory for-profit colleges? I was trying to do something to help my family and ended up screwing us up even more. Any advice?

Hey Cathryne,

Unfortunately, we hear stories just like yours everyday when it comes to Sanford Brown. I’d suggest taking a look at this article for a little more information on the situation: https://usstudentloancenter.org/whats-next-for-sanford-brown-students/

If you’d like some guidance when it comes to your student loans and what options you may have for repayment plans or forgiveness, a talk with an experienced student loan consultant would be best. Give us a call at 877.433.7501 or simply click this link to book a consultation: https://bit.ly/2nIykTH

Good luck and we hope to hear from you soon!

Hi, I graduated in January 2012 and I have a boat load of student loans I’m repaying but I cant get a job I don’t think my degree states that I’m RMA and I went back for associates I don’t think my credits transfer anywhere, and most important when I show my degree I don’t think its honored.

I graduated in 2010, MBC program. During the time it was a horrible experience. No teachers for teaching the class etc…. is it too late to try and get assistance? I reached out to the school and it was a waste of time. I don’t want the harassment calls for student loan forgiveness from other people out of the country (I get that daily)MBC isn’t offered to even go back and sit during class to learn the new ICD-10 as promised. Where to I start, I need something forgiven off so I can get out of the $20g debit. I’ve googled and seen there was a payout in 2012, sure do wish I knew about that just to get help with the loans.

Tabatha, please give our student loan counselor, Dawn Wolff a call at 813-579-6588. She would be happy to go over your options you may have for acquiring student loan forgiveness for the loans you received while attending your MBC program. This is where you start. Find out today what can be done with your $20g in debt!

How can I find out if I can get my loan eliminated

Hello Tia,

The best way to find out if you can have your loans eliminated is to review your current loan situation with a Student Loan Counselor. This is a quick and easy conversation and by having it, you can receive some very useful and beneficial information regarding your loans. Please give us a call toll-free at 877-433-7501 to speak to a counselor today.

Tengo mi préstamo estudiantil con prórrogas de pago, la acumulación de intereses es espantosa y deseo saber si por mi situación económica cualifico para un perdon de deuda…auxilio…

Buenos Dias Marggie, gracias por comunicarte con nosotros. Me puedes proporcionar tu numero de telefono por favor? Para que asi uno de nuestros representantes de habla hispana se comunique personalmente contigo en cuanto antes, para discutir tu caso y tus opciones con tus prestamos estudiantiles?

Actualmente hay varios programas que basan tus pagos mensuales dependiendo de tus ingresos anuales. El programa de pago mas comun se llama IBR, que significa Income Based Repayment (Programaba de pago basado en ingresos).

Si quieres enviame tus datos a mi email personal, me llamo Carla, y mi correo es cdubis@usstudentloancenter.org

Yo me encargo de que alguien te contacte rapidamente.

Gracias Marggie.

Escríbame al correo proporcionado,deseo evaluar mis préstamos para saber si cualifican para algún tipo de condonación.

Wendie, me llamo Carla. Voy a mandarte un correo ahora mismo. Mi direccion es cdubis@usstudentloancenter.org por favor chequea tu inbox durante el dia, y si no te llega chequea tu spam folder, a veces se van para alla.

Gracias por comunicarte con nosotros, te estare enviando un email en un par de minutos. Gracias

Cuanto cobran ustedes por los servicios?

Herminia, el precio de nuestros servicios depende de tu caso individual; si estas interesada en una consolidacion de prestamos, si estas buscando aplicar para algun plan de pago basado en tus ingresos, o si estas interesada en el perdon de pago para trabajadores del sector publico (public service loan forgiveness). Si quieres me envias tu numero de telefono al cdubis@usstudentloancenter.org y yo felizmente transmitire tu informacion a una de nuestras representantes que te podra asistir con tu caso.

Muchas gracias, espero escuchar de ti pronto.

Nesecito ayuda para saldar mi préstamo estudiantil. Agradecería que se comunicaran conmigo al teléfono (787)433-6268

Hola Karla, muchas gracias por comunicarte con nosotros. Voy a transferir tus datos a nuestra gerente de préstamos estudiantiles que habla español. Ella se pondra en contacto contigo cuanto antes para hablar de tu caso.

Gracias nuevamente!

Necesito información. Tengo 3 préstamos estudiantiles y su hace difícil pagarlos

Buenas tardes Neyla, gracias por comunicarte con nosotros. Si nos das tu numero de telefono, uno de nuestros representantes de prestamos de estudiantes se pondran en contacto contigo en la mayor brevedad posible. Si prefieres, puedes llamarnos tu directamente. Nuestra linea directa y gratis es la 877.433.7501

Tenemos representantes que hablan tu idioma, y estaran felices de poder ayudarte a reducir tus pagos mensuales.

Gracias!

Tengo prestamos estudiantiles y se me ha hecho dificil cumplir con los pagos

Buenas tardes Ivette, gracias por comunicarte con nosotros en relacion a tus prestamos de estudiantes. Si se te esta haciendo dificil realizar tus pagos, pues no te preocupes, aqui te ofrecemos varias opciones que pudieran ayudarte a disminuir tu monto mensual. Podemos inscribirte en un plan de repago que se ajuste a tus ingresos. Pero primero necesitamos comunicarnos contigo, hacerte unas preguntas relacionadas a tu caso, y ver en que programa te podemos inscribir para que tus pagos seas mas manejables. Si deseas que nos comuniquemos contigo, por favor mandanos tu numero de telefono. Uno de nuestros representantes se comunicara contigo cuanto antes, o si prefieres, llama de forma gratuita al 877.433.7501 y pregunta por Marissa Luchetta, ella es una de nuestras expertas en prestamos y habla tu idioma.

Gracias y espero que podamos ayudarte.

Quisieraaa reducir pagare ya q por mi situacioness economicas no he podido y Los intereses suben.

Hola Brenda! Muchas gracias por comunicarte con nosotros. Deseas que uno de nuestros agentes se comunique contigo a traves de tu email o por telefono? Si pudieras ser tan amable, me distribuyes tu número de telefono? Para asi mandarle su informacion de contacto a uno de nuestros consultores de préstamos estudiantiles. Ellos estarán felices de ayudarte y se pondrán en contacto contigo cuanto antes! O si prefieres, puedes llamar de forma gratuita a nuestra linea telefonica. Nuestro numero es el 877.433.7501. Pregunta por Marissa Luchetta, ella habla tu idioma y podra ayudarte. Gracias por su confianza, y espero que podamos encontrar una solucion a su problema.

Llevo mas de 10 años (1998) tratando Dr pagar mi préstamo de estudiante y todavía no veo el final. Tengo ya

62 años y con una enfermedad terminal. Necesito ayuda.

joneruda@yahoo.com.

Buenas tardes Jose, gracias por comunicarse con nosotros. Lamentamos mucho escuchar sobre su caso, parece ser que sus prestamos estudiantiles le han estado causando problemas desde hace mucho tiempo. Afortunadamente, creo que podemos ayudarlo con su caso. Hemos tenido varios casos en los cuales nuestros clientes no encuentran como realizar sus pagos, y han encontrado una solucion con nosotros. Si usted puede mandarme su numero telefonico, uno de nuestros consejeros de prestamos de habla hispana se comunicara en cuanto antes con usted. O si usted prefiere Jose, puede llamarnos de gratis. Nuestro telefono directo es el 877.433.7501. Pida hablar con Marissa Luchetta, ella habla su idioma y estara feliz de poder ayudarlo con sus prestamos. Gracias!

Hola tengo una deuda de prestamos estudiantiles y deseo que me informen como puedo reducir la deuda lo mas bajo possible por que los intereses son muy caros y a elevado la deuda drasticamente. Gracias

Hola Delia, muchas gracias por comunicarte con nostros. Deseas que uno de nuestros agentes se comunique contigo a traves de tu email o por telefono? Si pudieras ser tan amable, me distribuye su número de telefono? Para mandarle su informacion de contacto a uno de nuestros consultores de préstamos estudiantiles. Ellos estarán felices de ayudarte y se pondrán en contacto contigo cuanto antes! Gracias por su confianza, y espero que podamos encontrar una solucion a su problema.

Saludos recientemente culmine el grado de maestria soy maestro de educacion fisica llevo 17 anos trabajando para el departamento de educacion la cual 8 de ellos de maestro mi prestamo es de 16,000 mi situacion economica no es la mejor.mi casa prestataria me dio la opción de pagar el minimo por servicios publicos de 50 dolares por 10 años.y luego de esto todo lo que deba quedara saldada la deuda me gustaria saber si esta bien o hay otras opcines de menos tiempo.

Necesito mas información para saber como puedo darle un deferment al préstamo que tengo, gracias.

Se pueden comunicar al 787-202-7045.

Hola Angel, me distribuye su número a uno de nuestros consultores de préstamos estudiantiles. Ellos están felices de ayudar a usted y se pondrán en contacto contigo en breve! Gracias por comentar usted!

I have a students loans

Hi Odalis, Thanks for commenting. Are you struggling with your student loans or is your monthly payment too high? If you would like help with your student loans or lowering your payment, please contact us Toll-Free at 877-433-7501 and one of our Student Loan Counselors will be more than happy to help you out. You may also provide me with a phone number to reach you at and we can give you a call at your convenience. Let us know!