It’s extremely easy to fall victim to bad money habits. Especially if you’re fresh out of college and have had little guidance. Follow these 6 personal finance tips for new college grads to start yourself off on the right foot financially.

Financial tips for new college grads

It may not seem like it, but the financial decisions you make now can have a long-term impact on your fiscal situation in the future. To ensure you get the most out of your money, there are a few things you can do now.

- Watch your spending

- Responsible use of credit cards

- Pay off debts

- Build savings

- Create a budget

- Future-proof your finances

Spend for the job that you have, not the job that you want

Most graduate’s first mistake is spending for the salary they want, rather than the one that they have. The majority of graduates will not necessarily obtain a high paying job as soon as they graduate. You should never spend more than you can currently afford, as you have no idea what is around the corner. There is the possibility that you may manage to get a multi-million-dollar job, but there is equally a possibility that an illness or accident may prevent you from earning.

Use credit cards responsibly

If used correctly, credit cards can be a convenient way to make purchases. However, you need to be careful that you do not start accruing credit card debt. An easy way to ensure that you avoid credit card debt is by asking yourself could you afford this purchase without a credit card? If you cannot afford to buy something without using your card, then be extra cautious.

There are severe consequences to accruing too much credit card debt as it will damage your credit score. Credit cards are beneficial as long as they are used responsibly, so you should try to ensure that you can pay off your credit card in full each month.

Pay off debts as quickly as you can

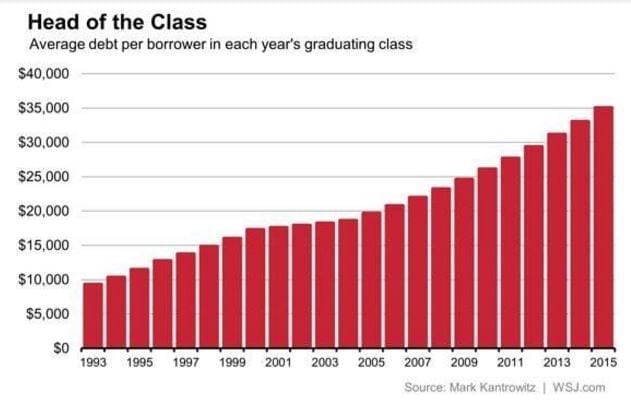

Student debt in particular is becoming more and more common. A recent survey found that 42% of millennials feel overwhelmed by their debts. And rightfully so. Take a look at the chart below to see just how much debt the average student leaving college has.

If you do find yourself in debt, then the best thing you can do is try to pay off as much of your debt as quickly as possible. Keep up with repayments and make sure you never pay late.

Build up your savings

You should aim to start saving as soon as possible. Ideally, you will have two savings accounts: one for general savings and one for an emergency fund.

If you are unable to put saving towards the two accounts then at least start saving money for an emergency fund. Ideally, an emergency fund will contain enough to cover at least three months of living expenses. However, once you reach three months, if you can continue putting money into the account, then try to build as much of an emergency fund as you can.

If you can only afford a small amount, then this is better than nothing. You will be amazed how quickly even $5 per month can build up. If possible, set up an automatic transfer to ensure the money goes straight into savings.

Create a budget

A budget is an extremely important financial tool but also the easiest to overlook. The key to managing a balanced budget is earning more money than you spend. Creating and maintaining a budget is a good financial habit to get into as early as possible. Don’t forget that it’ll need updating when your financial situation changes.

A budget can let you know exactly what money you have coming in and exactly how much you have going out. This means that you can clearly see how much money you have and where this money is going. A budget will also quickly alert you if you find yourself spending more money than you have. The sooner you identify this, the easier it will be to adjust your finances to rectify this.

Plan for the future

Do not underestimate the importance of future planning. What would happen if you became ill or if you lost your job?

To future-proof your finances, you should aim for :

- An emergency fund

- A retirement fund

- Health insurance

An emergency fund should be a top priority. Try to build up at least three months worth of living expenses, more if you can afford it.

You should look into a retirement fund as early as possible into your employment. Even if you do not plan to stay with an employer for long, it is worth looking into the retirement plan they have to offer. Try to resist the temptation to dip into a retirement fund early, as the longer the money stays in your fund, the more money you will have in retirement.

Health insurance is incredibly important, as you never know if or when you will need it. If you do find yourself in need of medical attention, then you will need to be able to afford any treatment required. It is a good idea to see what, if any, medical insurance is available through your employer.

Leave a Reply