Unless you are exceedingly fortunate on a financial level, you will probably need to take out student loans to cover the cost of your education. Unfortunately, the world of student loans is incredibly complex.

It seems that no matter how much research you put in, you will never grasp the intricacies of just how student loans work.

Fret no more, we are going to cover the basic elements.

These are the things that you absolutely must know when you take out a loan.

However, always talk to the lender to ensure that you understand the service that they offer, before you sign on the dotted line.

How much can you borrow on your student loan?

Student loans are not unlimited.

There are fixed limits in place when you take out a student loan.

Limits do differ from one loan company to another, but they tend to fall into the following categories:

– Annual loan limits: this is the amount that you can borrow each year.

– Aggregate loan limits: the amount you can borrow over the entirety of your education.

– The cost of education limits: the amount that you borrow must be less than how much it costs to attend the school minus any additional financial aid that you are receiving.

There may be further limits depending on the loan that you take out:

Private student loans:

These will normally have an annual limit that is equal to the cost of attendance.

Any financial aid shall be subtracted from this.

Depending on the course you take, the ceiling may be $120,000 over the cost of your education.

Federal limits:

These are slightly different because the limit can change.

The school will choose how much you are entitled to, based on a number of factors.

This includes your dependency, your loan program, your year, and what type of course you have taken up.

Direct subsidized loans and direct unsubsidized loans:

The first will be dependent on your overall financial need, while the latter does not require you to prove that you are in need of the cash.

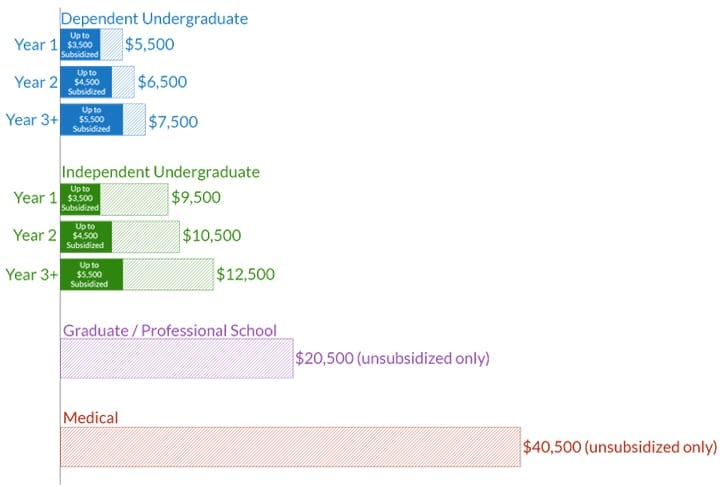

This chart gives you a good overview of the borrowing limits for direct subsidized and unsubsidized loans:

Source: https://www.edvisors.com/college-loans/terms/loan-limits/

Source: https://www.edvisors.com/college-loans/terms/loan-limits/

Reducing the amount you need to borrow

Of course, your student loan will need to be paid back at some point.

It is, therefore, in your best interests to borrow as little as possible.

In fact, with a bit of effort, you can reduce the amount that you need to borrow by a drastic amount.

You will need to make sacrifices, but those sacrifices will be worth it from a financial standpoint.

This list comes from TheBalance.com:

– Take advantage of grants and scholarships

– If you believe it will not have an impact on your education, you should try and work part time

– Go to less expensive schools or study in the state. This is where you may need to make a sacrifice, sadly

– Purchase used books and equipment wherever possible

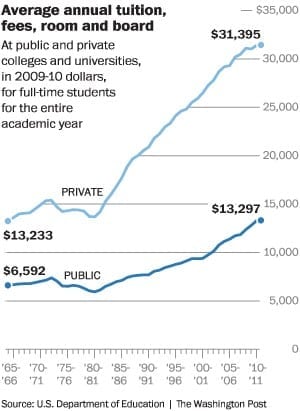

Just to show you the impact that less expensive schools can have on your borrowing, this chart demonstrates the difference of annual fees between private and public education.

This includes room and board:

Source: https://www.washingtonpost.com/news/wonk/wp/2013/08/26/introducing-the-tuition-is-too-damn-high/

Source: https://www.washingtonpost.com/news/wonk/wp/2013/08/26/introducing-the-tuition-is-too-damn-high/

Why student loans over other loans?

There are a few benefits for opting for a student loan. These include:

– Lower costs: these tend to be low-risk loans and, as a result, have lower interest rates.

– Easy approval: you can get approved for decent student loans, even with a lower credit score.

– Repayment: there are some features in place which will make repayment easier. For example, a grace period.

If you can, opt for federal loans as these tend to have more advantages.

However, always consider private options if you have a good credit score, as you may be able to get significant savings with them.

How to apply for a student loan

The financial office of your college or university will provide you with the information that you need.

You will be asked to complete a form known as the FAFSA.

This will need to be completed each year.

This form covers your financial needs i.e. it determines how much you genuinely need to borrow.

Once you have handed in the form, your school will get back to you with how much you can borrow.

If you are opting for a private loan, then you will need to find a private lender.

Approach them directly and complete the application process.

What types of student loans are available?

There are a few different student loans available. Each has its own pros and cons:

Perkins Loans:

These are the first choice for many students. They have low interest rates, and you can obtain them even with lower credit. The downside is that they are ‘need based.’ Not everybody will be able to qualify for them.

Stafford loans:

These can be applied for by everybody and are easy to qualify for. They have a slightly higher interest rate, but you can borrow more.

PLUS loans:

These are similar to traditional loans. You will need to undergo a credit check, and you will need to start paying back almost as soon as you finish college. The loan will be disbursed to the parents and not to the student.

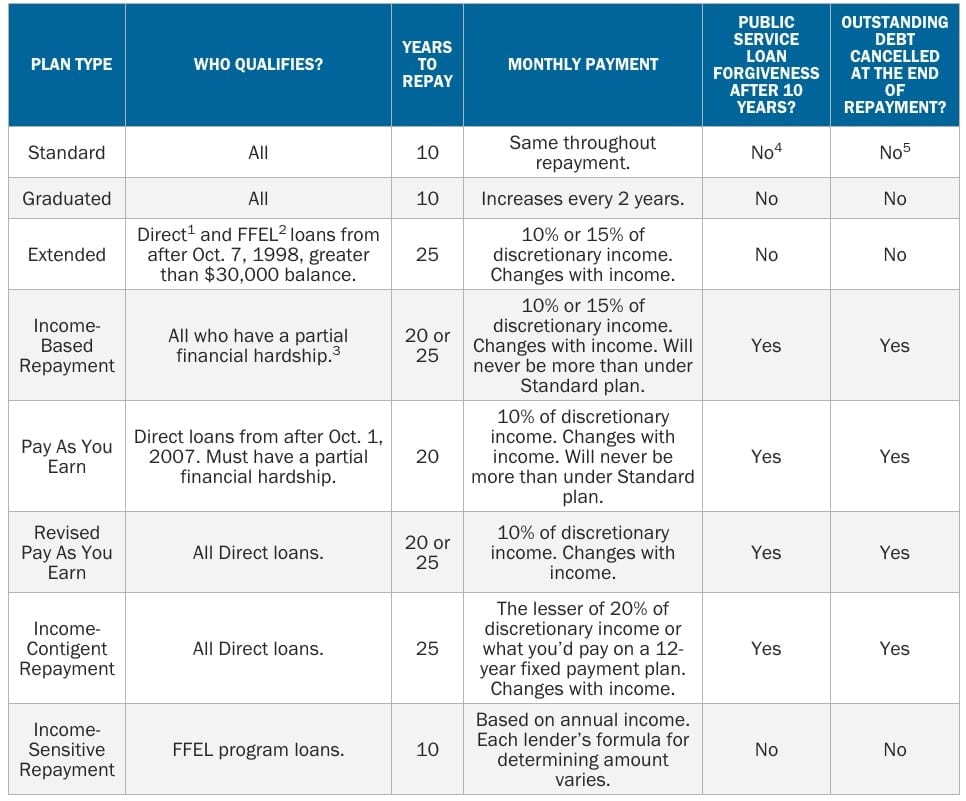

This handy chart shows the various federal loans available to you and the eligibility requirements for each:

Leave a Reply