Students headed for college and undergraduates across the country are increasingly turning to student loans to finance the furthering of their education.

Not many tertiary educated learners can depend on family, or other connections, to fund their schooling or even take on the obligation of cosigning for the student loan itself.

This leaves the option of navigating the various choices available out there for personal and federal student loans that do not require a cosigner.

The difference between a federal student loan and a private or personal loan is that federal student loans are more likely to be approved.

[tweet_box design=”default” float=”none”]Private loans for the purpose of education may provide more borrowing power, but they have hidden costs involved like fees, changing interest rates, and more stringent credit checks.[/tweet_box]

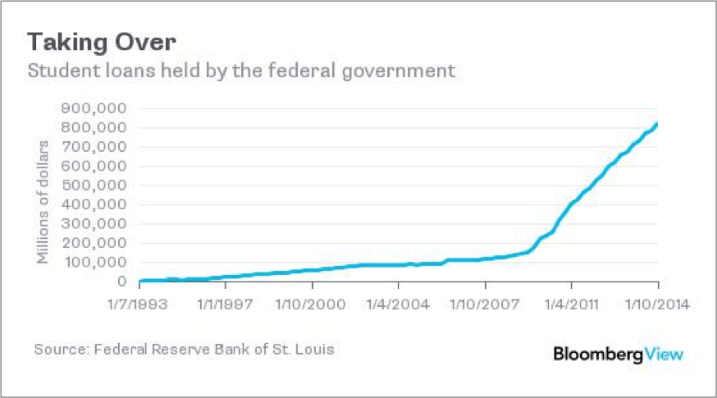

As can be seen in the chart below, federal student loans are increasing in popularity as the most balanced method of educational finance.

In the United States, the Department of Education offers Direct Loans that are also commonly known as Stafford Loans.

This form of Federal Student Aid can be further divided into two categories:

- Subsidized Stafford Loans

- Unsubsidized Stafford Loans

These loan types do not usually require either a credit check or a cosigner.

The application process is free, but involves a fair amount of information exchange or approved parental information exchange, if the student is a dependent.

Unsubsidized Stafford Loans are student loans that are offered to both graduate and undergraduate scholars without assessment of the level of financial need.

The educational institution itself decides the loan amount that the student qualifies to receive based on information gained from other funding sources.

The loan applicant must continuously settle the interest that is accrued on the loan amount during the time the studies last and beyond.

The financial aid sources that are used to calculate the student’s financial need for the Unsubsidized Stafford Loan are:

- The individual’s financial needs.

- The cost of attending the chosen institution.

- The student’s expected a family contribution.

The next form of student loan that is available without a cosigner is the Perkins Loan.

The next form of student loan that is available without a cosigner is the Perkins Loan.

These also do not demand a stringent credit check.

The Department of Education in the United States makes this loan type accessible to professional students, graduate and undergraduate students.

The exceptional financial need must be demonstrably in evidence to qualify.

Eligibility qualifiers do vary from institution to institution, however.

Not all schools participate in the federal program either.

Full or part-time enrollment is one necessary criterion for eligibility and funding for this type of loan is limited, so early application is highly recommended.

This credit format is on offer primarily for the parents of students.

Eligibility requirements include credit checks, but not necessarily a cosigner.

The cost involved in attending the higher education institution will equal the maximum amount of the loan.

All other financial assistance forms used during the PLUS loan period are subtracted from the total loan amount.

Loan repayment schedules

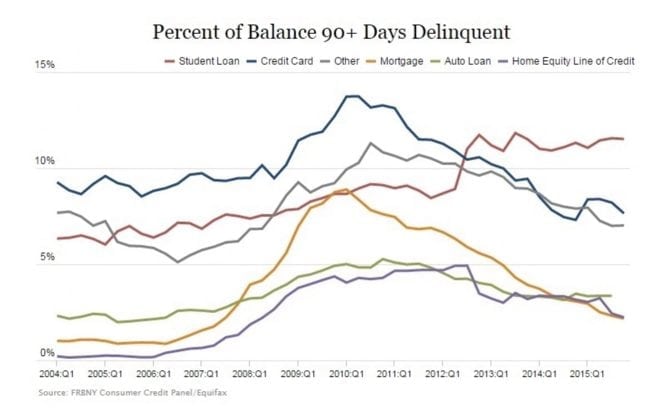

As can be seen in the chart used below, student loans are the most common debt that people fall behind on in America.

This is despite the fact that many alternative repayment plans are continuously being offered.

Several repayment schemes can suit the individual student’s needs.

Some even have forgiveness clauses which cancel the debt balance outstanding after a set amount of time.

What must be considered outside of the student loan obligation is how, taking the loan without a cosigner safety net, can benefit the party taking on the debt?

It is an opportunity to establish a good credit history very early in life.

This will reflect positively in later life.

It is in the Federal Loans section’s best interest to offer beneficial payment flexibility, low-interest rates, and payment assistance options.

This, in itself, makes them more desirable than private loans.

The opportunity of being able to take on a student loan without seeking out a cosigner first is a positive way to embark on a more comfortable life as a student.

It prepares the student for the discipline that is needed in any financial transactions.

The only downside is that the amount that is borrowed may not be as significant as those on offer from private loan companies.

Leave a Reply