Student loans have sky-rocketed in recent years.

According to CNBC, around 90% of private student loans are co-signed by a parent, or somebody that has a close relation with the student.

If you have been asked to be a co-signer on a student loan, then you probably have a few questions spinning about in your mind.

Read on to have a better understanding about how things work when you become a co-signer.

How does a co-signer help?

According to SallieMae.com, there are a few benefits to being a co-signer to a loan.

These includes:

- A greater chance of the applicant being recommended for a loan.

- It gives the applicant the ability to boost their credit history. This will also have an impact on the future loan applications of the loan applicant.

- It will boost the credit history of the co-signer.

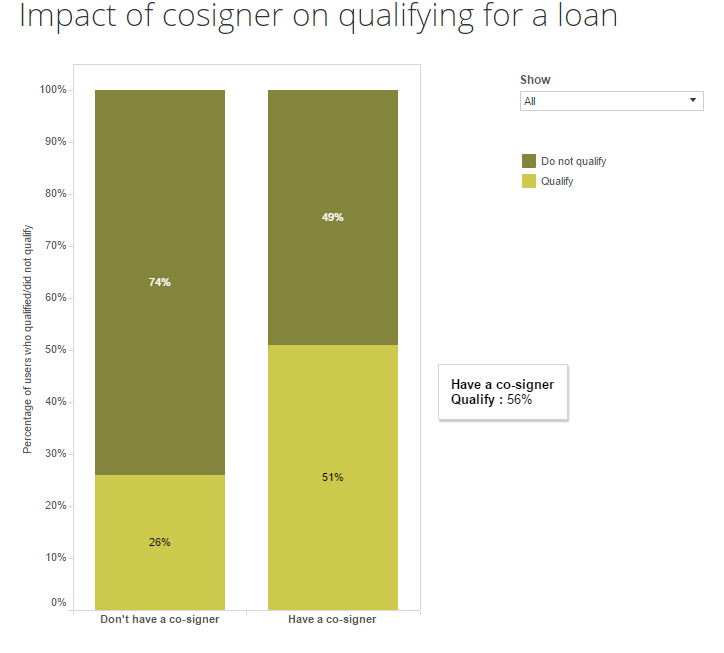

Here is a chart which shows that those who have a co-signer are more likely to be approved for a loan:

Better interest rate

Those that have a co-signer on their loan will benefit from a better interest rate.

This means:

- Average interest rates of 5.37% for those applying with a co-signer.

- Average interest rates of 7.46% for those applying for a loan on their own.

- Those following ‘advanced’ degrees will experience an even bigger drop in interest rates.

Who can co-sign a loan?

Anybody with a close relationship to the applicant can co-sign a loan.

This chart shows who is more likely to be a co-signer.

The chart suggests that the most popular category to become co-signer are the applicant’s parents(more than 75%).

Next comes relatives at 11%.

Risks of co-signing for a student loan

According to MoneyCrashers.com, there are some risks that you should be aware of when it comes to co-signing a student loan.

It is important that you consider each of these to ensure that you are doing the right thing not only for your money situation, but also for the financial status of the applicant.

You are responsible for the loan

If you co-sign a student loan, then you need to know that you are responsible for it.

Hopefully, the loan applicant is going to be able to pay back the loan on time each and every time.

However, if they are unable to do so, then the ball is going to fall into your court.

You will have to pay it.

If the applicant is late with their payments, it will have an adverse impact on your credit report.

It is worth noting that there have been many court cases, some of which have been highlighted in the New York Times, which state that even if the original applicant of the loan dies, the person who co-signs the loan would still be required to pay it back.

Your salary can be garnished

If you co-sign a student loan, it would not be pleasing to know that your salary may be garnished if the loan is not paid back.

In addition to this, the money may be deducted from your tax refund.

In case you get into money issues, you will find that the student loan cannot be discharged through bankruptcy.

Once you have them, you are always going to have them.

You can be released from your obligations

If the primary loan applicant agrees to do so, and they have the credit score and income to show that they can afford the loan, then they will be able to discharge the duties of the co-signer.

It’s a fairly straightforward process once you get in touch with your lender.

However, you have to make sure that the following conditions have been fulfilled:

- Primary loan applicant agrees. You can’t be discharged without their consent.

- They have a good credit score.

- They clearly have the money that is required to pay back the loan on time.

Should you co-sign for a student loan?

It is entirely up to you.

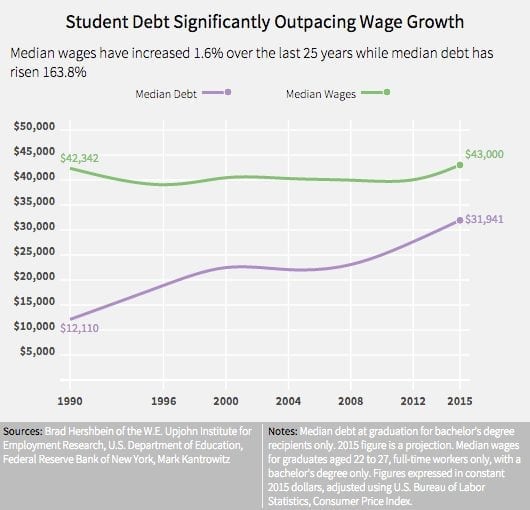

However, it may be worth looking at this chart.

The ratio of growth of debt to the wage increase is alarmingly high.

As you can see, while student loans have gone up in recent years, they are not climbing at the same speed that wages are.

They are rising at an even faster pace.

This means that, overall, student loans are becoming more and more difficult for people to be able to pay back on time.

You also have to be aware that student loans take a while to pay back.

In fact, they take years to pay back.

History has demonstrated time and time again that the economy is cyclical.

While we are currently recovering from a pretty big recession that occurred a few years ago, sooner or later another recession is going to come along.

This will make it even harder to pay back the loans that are due.

People lose their jobs; interest rates go up etc.

To make matters worse, the longer length of a student loan means that it is likely that a few recessions will come along, some big, some small.

This means that you are going to be constantly exposed to risk.

If you can afford to co-sign the student loan, and you are fairly confident that you will be able to pay it back on time, it really is going to help the student.

Once they start earning money, they will be able to remove you as a co-signer anyway.

However, you have to remember that relationships get affected when loans are not paid back on time.

So, be ready to face ugly situations in such a case.

Essentially, if you are willing to take the risk and co-sign a loan then by all means do so.

However, you have to remember that things may not necessarily work as planned.

It is vital to have a frank talk with the student applicant before you co-sign a loan, be it your own children or grandchildren.

It’s risky, but if both parties have clarity about their commitments, it’s going to be a smooth affair.

[…] there is a co-signer on the loan, then that person must resolve the remaining […]