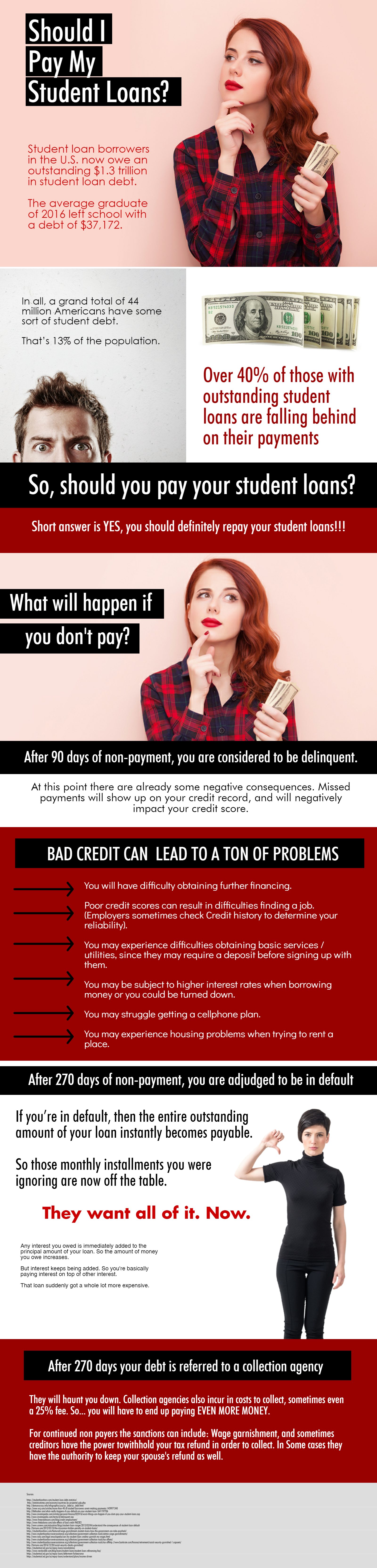

Student loan borrowers in the U.S. now owe an outstanding $1.3 trillion in student loan debt. It’s an incomprehensible number.

To try to put it into perspective, there are only eleven countries on earth with a GDP higher than the amount of money held in student loan debt in the U.S.

Terrifying, right?

Well, more understandable numbers are the amount of debt that the average graduate has. But it’s still a pretty chunky figure.

The average graduate of 2016 left school with a debt of $37,172.

How do you stack up against the average? Do you owe more? Less?

It’s a good thing to find out, since knowing what you owe is the first step to knowing how to tackle your loans next.

In all, a grand total of 44 million Americans have some sort of student debt.

That’s 13% of the population.

And not everyone’s managing; over 40% of those with outstanding student loans are falling behind on their payments.

With statistics like this, it’s not surprising that many people are opting not to pay at all.

(Did you know? One of the biggest reasons borrowers fall behind on their monthly payments is because they cannot afford the high monthly payments their servicers are requiring them to pay. But there are several ways to lower your student loan payment to make it more affordable. Here are 9 ways to lower a student loan payment. Click here to learn more and get the free guide.)

So, should you pay your student loans?

Not paying your student loans can seem an enticing option. The thought of that cash not disappearing every month is enough to tempt anyone.

But you really should repay your student loans.

The consequences of not doing so can be pretty bad, and can have long terms effects on your financial future.

What will happen if you don’t pay them?

Well, the thing that you really need to remember when it comes to your student loans repayment, is that there’s no ducking them. Other debts will disappear off your credit report after seven years. And other debts can be discharged by bankruptcy.

Neither of these applies to student loan debt.

There’s no getting rid of them. If you don’t pay, they will come looking to collect.

After 90 days of non-payment, you are considered to be delinquent. At this point there are already some negative consequences. Missed payments will show up on your credit record, and will negatively impact your credit score.

The results of this can be far reaching. It isn’t just the difficulty in obtaining further finance. Poor credit scores can result in difficulties finding a job, as prospective employers will search your credit history in order to determine your reliability. They can even lead to difficulties with utilities as basic services might want a deposit before you sign up with them.

Bad credit can lead to a host of problems.

You may be subject to higher interest rates when borrowing money, or you could be turned down. You might struggle to get a cellphone plan or rent an apartment. All of these require a credit check before they approve you.

One thing to remember about student loan delinquency is that it doesn’t disappear from your credit report after seven years as most debts do. It stays on there forever. The only way to remove this stain on your financial good name is to pay up.

Sounds bad, but not the end of the world… is it?

No, that bit comes next. Well, okay, not quite the end of the world, but the next stage is pretty bad.

After 270 days of non payment, you are adjudged to be in default, at which point things start getting serious.

If you’re in default, then the entire outstanding amount of your student loan instantly becomes payable.

So those monthly installments you were ignoring are now off the table.

They want all of it. Now.

All those options are lost by being in default. Any interest you owed is immediately added to the principal amount of your loan. So the amount of money you owe increases.

But interest keeps being added. So you’re basically paying interest on top of other interest.

That loan suddenly got a whole lot more expensive…

After 270 days, your debt is referred to a collection agency; which will do everything it can to make you pay up. Their sole purpose is recovery of that money.

But if it’s got to this stage, then it’s already costing you money. The collection agencies have running costs to consider, and these costs are added to the amount that you owe. All of a sudden that money you’ve not been paying back has increased.

(Pro Tip: Not paying on your student loans only causes you’re principal balance to increase. If you need to lower your payment to make it more affordable, this guide is the best place to start. Here are 9 Tips To Lower Your Student Loan Payment. Click here to learn more.)

Sometimes it can be as much as 25% extra.

Yes, you read that right. 25% can be an astronomical extra cost for you.

Extra costs include collection fees, attorney’s fees, court costs, and late payment fees. Basically your unpaid loan is putting money into a lot of other people’s pockets, and eventually it’ll be you that pays for it.

Stop for a second and think about that.

You’re an average graduate with a debt of $37,000. That debt has now increased to over $46,000. For nothing.

This is the penalty for doing nothing.

But what can the debt collection agencies actually do?

The powers of the debt collection agencies are wide-ranging, and they have a number of their tools at their disposal in order to get that money back. Before they even do anything concrete, the experience of being chased can be a pretty miserable one. You’ll get regular letters and phone calls demanding repayment.

For continued non-payers, the range of sanctions will then be deployed.

This includes wage garnishment. This is a collection method where the government simply takes a portion of your pay check before you even receive the money. There’s nothing you or your employer can do about it.

Wage garnishment can consist of up to 15% of disposable pay. This is your “take-home” after federal and state taxes have been deducted.

So essentially, for every $10 you had to live on, you now have $8.50.

Creditors don’t need a court order to start garnishing your wages. You do, however, have the power to appeal. You’re given 30 days notice that it’s going to happen before the garnishment commences.

Whatever happens, you get to keep 30 hours pay at federal minimum wage. So legally your creditor has to leave you with $217.50 per week, even if your disposable income minus the 15% falls below this figure.

What else will happen if you don’t make your student loan repayments?

There are a few other tricks up their sleeve. Your creditors have the power to withhold your tax refund in order to repay the debt. So if you were expecting a refund to provide a few little extras as they do for so many, you can forget that.

The government’s keeping it. In some cases they have the power to use your spouse’s refund as well.

I bet that’s not a conversation that you want to be having with your other half.

They even have the power to garnish your social security. In 2015, there were 115,000 Americans over the age of 50 who had this happen to them.

Student loan debt cannot be avoided. It must be confronted, and it must be dealt with.

Are you not paying your student loan debt because you can’t afford it? This is the case for many people. But as we’ve seen, you have to pay it.

(BORROWER WARNING: Not paying on your student loans only causes you’re principal balance to increase. If you need to lower your payment to make it more affordable, this guide is the best place to start. Here are 9 Tips To Lower Your Student Loan Payment. Click here to learn more.)

No-one said it was going to be easy. But if you’ve fallen into delinquency or default there are repayment of student loans options for to you to rectify the situation.

You may not be able to afford to pay under your current plan, but it’s highly possible that you’ll be able to change the terms of your repayment. So let’s look at some options on how to do that.

Have you heard of Consolidation?

The vast majority of student loans are able to be consolidated. A consolidation loan is in essence a new loan that you take out to pay off the outstanding debts. The idea is to simplify your repayment so you only have the one loan to worry about.

When you consolidate your loans, you’ll be given the option to extend your repayment period. The downside to this is that if you decide to pay back over a longer period, while your monthly payment will go down, you will over time end up paying far more in interest.

What about Refinancing?

Refinancing is not entirely dissimilar to consolidation. If you refinance your loan you are in effect also taking out a new one to pay off the old.

The key difference is that since you’re heading into the private market to refinance, you may be able to negotiate a better interest rate. Consolidation is often a move required by those with fewer options.

Refinancing is available only to those with better credit scores.

In order to refinance, you do need good credit and a decent income. But, refinancing is more flexible than federal solutions, and often has a lower interest rate, making it a cheaper option in the long term.

Do you qualify for Deferment and Forbearance?

If making any sort of payment at all is currently not doable for you, then you may wish to go down the route of deferment or forbearance.

Deferment is in essence a break from payments. Even better, during this time the government may actually pay the interest on your loans. The catch, of course, is that qualifying for deferment is pretty hard.

You need to be able to prove beyond a shadow of a doubt that your finances are in no fit state to continue paying. While it may sound like a good idea, that debt is still owed; and when you emerge from your period of deferment, it will still be there.

Forbearance is deferment’s little brother. If you can prove you can’t pay, then you may get the option of paying a reduced amount for a while, or maybe even nothing at all. If you don’t qualify for deferment then forbearance is the next best thing. But be warned, interest is still accruing on your loan, and someday you’ll have to pay it all back.

Are you on the right repayment plan?

These are probably a more sensible solution to your student loan debt problems. If you’re struggling to meet the monthly payments, why not have a word with the creditors themselves?

It’s highly possible that you may find yourself negotiating a lower repayment.

Income-driven repayment plans are becoming increasingly popular, where you only pay what you can afford. Income-driven repayment plans offer you peace of mind in that you know you’ll only be repaying what you can afford. But don’t forget that the longer it takes you to clear your debts, the more expensive it will be in terms of interest.

Conclusion

We can’t stress enough the importance of paying your student loans on time. Even if you fall behind, don’t ignore the situation. You’re only going to dig yourself a deeper hole by ignoring the problem.

So if you’re not able to make payments, and you’re wondering, “Should I pay my student loans?” The answer is yes, you absolutely have to pay your student loans.

Regular dialogue with your creditors will make it easier. They’re as intent on making it work as you are.

There are a number of options available to you if you’re unable to pay your student loans. Don’t be afraid to research them further and make sure you’re on the right repayment plan. Just remember that not paying isn’t an option.

(Pro Tip: Not paying on your student loans only causes you’re principal balance to increase. If you need to lower your payment to make it more affordable, this guide is the best place to start. Here are 9 Tips To Lower Your Student Loan Payment. Click here to learn more.)

Leave a Reply