Many private college loans FAQs do not have definite answers because of the confusion surrounding them. You will only get the right answers, or at least closer to the right answers if you consult a financial advisor.

However, with our frequently asked questions’ answers, your confusion will be cleared up. Whether you are looking for the best private student loans, or already have one (or more), check out our list of private college loans FAQs and our answers to each of them.

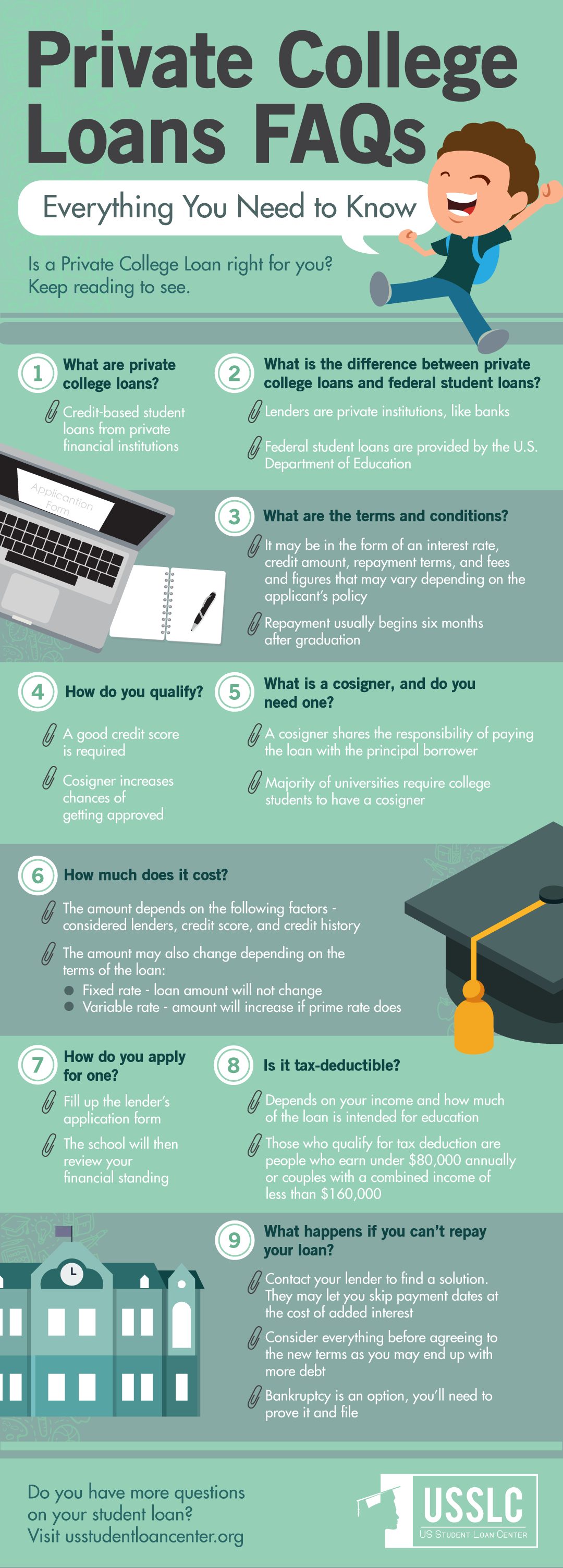

Private College Loans FAQs: 9 Things You Should Know

In this article:

-

- What Are Private College Loans?

- What Is The Difference Between Private College Loans And Federal Student Loans?

- What Are The Terms And Conditions?

- How Do You Qualify?

- What Is a Cosigner, And Do You Need One?

- How Much Does It Cost?

- How Do You Apply For One?

- Is It Tax Deductible?

- What Happens if You Cannot Repay Your Loan?

1. What Are Private College Loans?

Private college loans are the alternative to federal student aid. Banks, private lenders, and other private financial institutions grant these credit-based student loans to cover your college education costs.

2. What Is The Difference Between Private College Loans And Federal Student Loans?

Simply put, private institutions and lenders grant private student loans. In contrast, it is the US Department of Education that grants federal loans.

(Did you know? Consolidation and Refinancing are some of the best ways to tackle down Private Student Loan Debt since they open up better repayment options borrowers can take advantage of. Learn how you can use a Private Student Loan Consolidation to get better options with the 6 Things To Consider Before Consolidation Private Student Loans. Get the details and free download here.)

3. What Are The Terms And Conditions?

Since these loans are granted by different private financial institutions, the terms and conditions vary for every lender. For example, the interest rate, credit amount, repayment terms, and fees are all variable depending on the lender’s policies.

Bear in mind that even though you are given a grace period of six months before repayment starts, interest immediately starts to accrue as soon as you receive the loan.

The repayment term can also vary, depending on the amount borrowed.

If you cannot fulfill the terms and conditions you agreed to, it can damage both your credit score and that of your cosigner, if you have one.

4. How Do You Qualify?

If you want a higher chance of getting approved, having a good credit score is a must. If you do not have a great credit history, or if you want extra security, having a cosigner can also help.

Remember, not all private lending institutions provide student loans at all schools. Regardless if they are two-year colleges or a four-year college. You have to choose a lender who will work with your school. Also, not everyone gets approved for a private student loan.

5. What Is a Cosigner, And Do You Need One?

A cosigner is a person who cosigns a loan with you. They share loan responsibilities with the principal borrower. If you cannot repay the loan, the cosigner will assume the equal liability for the loan.

While there are financial institutions who provide student loans without a cosigner, most college students still need one to get loan approval.

As mentioned above, borrowers without a good credit standing will also likely need one.

6. How Much Does It Cost?

The amount you can borrow from your loan depends on your lenders, credit score, and credit history.

It also varies based on the length of the term and if it is a fixed or a variable rate. A fixed rate means the loan amount will not change. A variable rate, on the other hand, means the amount will increase if the prime rate does.

7. How Do You Apply For One?

Typically, you need to complete your lender’s application form and inform your school. The school will then confirm if you have exhausted all available financial options.

8. Is It Tax Deductible?

Whether or not your loan is tax deductible depends on your income. How much of the loan you use purely for education is also a consideration.

Right now, only single people earning up to a maximum of $80,000 and couples with a combined income of less than $160,000 qualify for tax deduction.

9. What Happens if You Cannot Repay Your Loan?

If you get into financial trouble and cannot repay your student loan, you have to let your lender know. Ask for help right away. Depending on the terms and conditions, you can agree on repayment options that work for you.

Some lenders will let you skip payments but with interest. Beware though, because, through these negotiations, you may end up with even greater debt than before.

If you plan to file for bankruptcy, keep in mind that you have to prove in a bankruptcy court that you are unable to repay your debt because of undue hardship.

Watch the clip below from US Student Loan Center to learn more about private college loans:

With these private college loans FAQs, you will know where and how to start your loan.

If you do not have enough funds for college, you can always apply for private college loans. But, like any other loan, these entail responsibility.

Still, with discipline, focus, and the will to achieve financial freedom, loan payments are manageable.

(Did you know? Consolidation and Refinancing are some of the best ways to tackle down Private Student Loan Debt since they open up better repayment options borrowers can take advantage of. Learn how you can use a Private Student Loan Consolidation to get better options with the 6 Things To Consider Before Consolidation Private Student Loans. Get the details and free download here.)

Do you have other questions you think should have been included in our private college loans FAQs? Comment below!

Up Next: Everything You Need to Know About Student Loans A-Z

Editor’s Note: This post was originally published in January 2018 and has been updated for quality and relevancy.

Leave a Reply