The Obama student loan forgiveness left a considerable positive impact on borrowers.

However, since Trump’s election, the program has been the target of many discussions, prompting revisions at best and elimination at worst.

Changes that could possibly take effect this year will affect student loan repayment options and student loan forgiveness options.

This article traces the development of the Obama student loan forgiveness program under the two administrations.

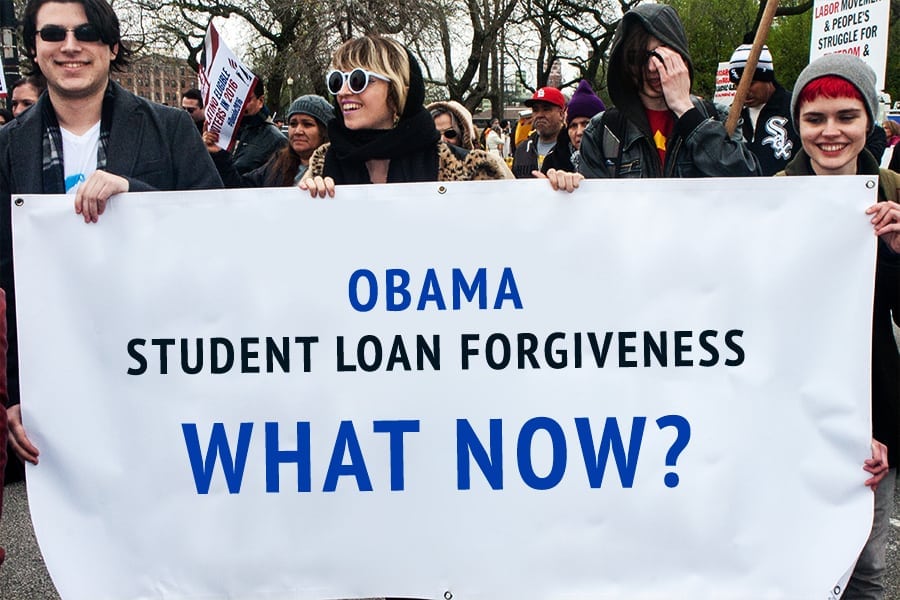

Obama Student Loan Forgiveness Program | What Now?

Obama Student Loan Forgiveness

When Barack Obama became President of the United States in 2009, the student loan forgiveness program underwent significant changes.

Some praised the modifications, while others were more critical of it.

These alterations are indeed polarizing.

The past administration left provisions to the Obama student loan forgiveness program which many still deem valuable today. They are:

- Providing complete loan forgiveness after 10 consecutive years of payment, no matter how much balance the borrower has left

- Introducing a repayment plan called the Pay As You Earn repayment plan or PAYE

- Allowing forgiveness of loans Under the Federal Student Loan Forgiveness after 20 consecutive years of payments

Unaffordable Efforts

You can still apply for ‘borrower defense to repayment’ under the existing law.https://t.co/qQPsWO7qV6

— StudentDebtCrisis (@DebtCrisisOrg) July 3, 2017

Despite how good Obama’s laws appeared, they were not safe from criticism.

On the wake of his term, various parties protested against his programs for costing more than they should.

According to reports, Obama’s efforts cost about twice than it should.

This adds to the billions already doled out by the federal government every year solely for student loans.

Furthermore, Obama’s budget reportedly also had several inaccuracies, causing the government to make amends in the midst of the implementation of the law.

Budget Trumps Everything

The importance of the budget is evident in the backlash the Obama administration received.

It is not surprising, then, that Trump began his efforts to revise the Obama student loan forgiveness program with a budget revision.

It has been reported that Trump’s new budget scheme affects Obama student loan forgiveness across four aspects: Pell Grants, federal involvement, repayment options, and Public Service Loan Forgiveness.

The argument for this budget plan is the belief that only those who truly need financial help will get it.

The administration, however, remains vague and indiscernible when it comes to the criteria to determine immediacy and urgency.

Trump’s Student Loan Forgiveness Program

EDITORIAL: Donald Trump’s budget correct to eliminate student loan giveaway https://t.co/B2jKrWGGWi

— Social In Las Vegas (@SocialNLasVegas) July 1, 2017

There are no laws in effect yet. But the actions of the Trump administration are telling.

Some concrete changes may be underway.

For instance, instead of a period of 20 years, borrowers will only have 10 consecutive years to make their payments.

The biggest blow Trump’s administration will make on the Obama student loan forgiveness program is ending the Public Service Loan Forgiveness program.

This means public workers, social workers, teachers, and nurses will no longer be eligible for loan forgiveness.

The College Investor breaks down the four types of student loan forgiveness in this video:

At present, everything is still in the works.

But one cannot ignore the signs.

The Obama student loan forgiveness program is on the cusp of change.

Whether such change is for better or for worse, only time can tell.

What are your thoughts on the developments surrounding the Obama student loan forgiveness program? Let us know in the comments below.

Up Next: Careers that Forgive Student Loans

Leave a Reply