The American population collectively owes $1.3 trillion in student loan debt.

On average, new graduates owe over $37, 000 in student loan debt, which is up 6% from last year.

Approximately 70% of graduating students took out loans to pay for their education.

Make Smart Financial Habits

Student loan debt is important to repay.

Graduating with debt can sometimes delay traditional adult milestones, like buying a home.

However, finding a balance between saving and repaying debt is possible.

First, look at your finances and goals.

Is your goal pressing, or can you pay down debt for a few years before tackling it?

Analyze your current spending habits.

Are you spending excessive cash in an unnecessary area?

For example, a daily coffee can put you off hundreds of dollars every year.

Brew your coffee at home and make sure that extra cash goes towards your goals.

If you come into unexpected money, for example, tax refunds or birthday money, save it!

It’s always tempting to use the extra money for fun purchases, but if you are trying to get your finances back on track, saving it will be more beneficial.

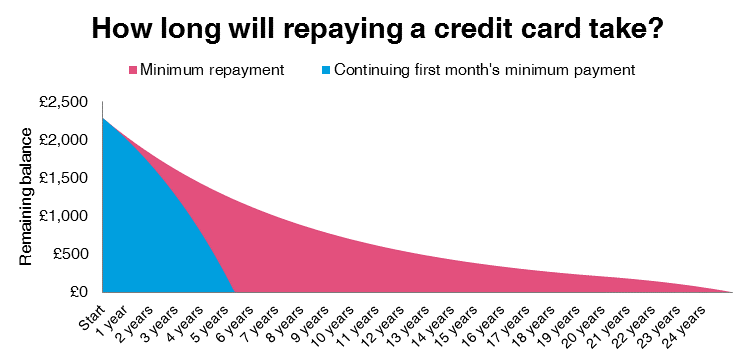

Let’s Talk About Repaying Debt

One way of tackling debt is by paying off the highest interest debt first, and making minimum payments on the other loans.

By paying off the debt with the highest interest first, you are freeing up a larger sum to use for paying off other debts, or to save.

Alternatively, pay off the smallest balance first.

You will see your success sooner, and this will keep you motivated.

Look at options for refinancing your student loans.

In an ideal situation, you will be able to decrease monthly payments while keeping the same interest rates.

Alternatively, change the payment plan to an income-based program.

This can reduce your monthly payments while maintaining a low interest rate.

Keep in mind that if you are having problems making your loan payments, you likely will not be able to get a mortgage loan.

During the time when you are trying to save for a down payment, consider making minimum payments on student loans.

In the case where your predicted mortgage payments will be lower than your rent, this could be useful.

Know that you will be saving money once you buy your house, and plan on putting that extra money towards repaying debt.

If you are not saving for a large purchase like a down payment, try to pay more than the minimum on loans.

Paying off a significant debt can free up your money and help in saving.

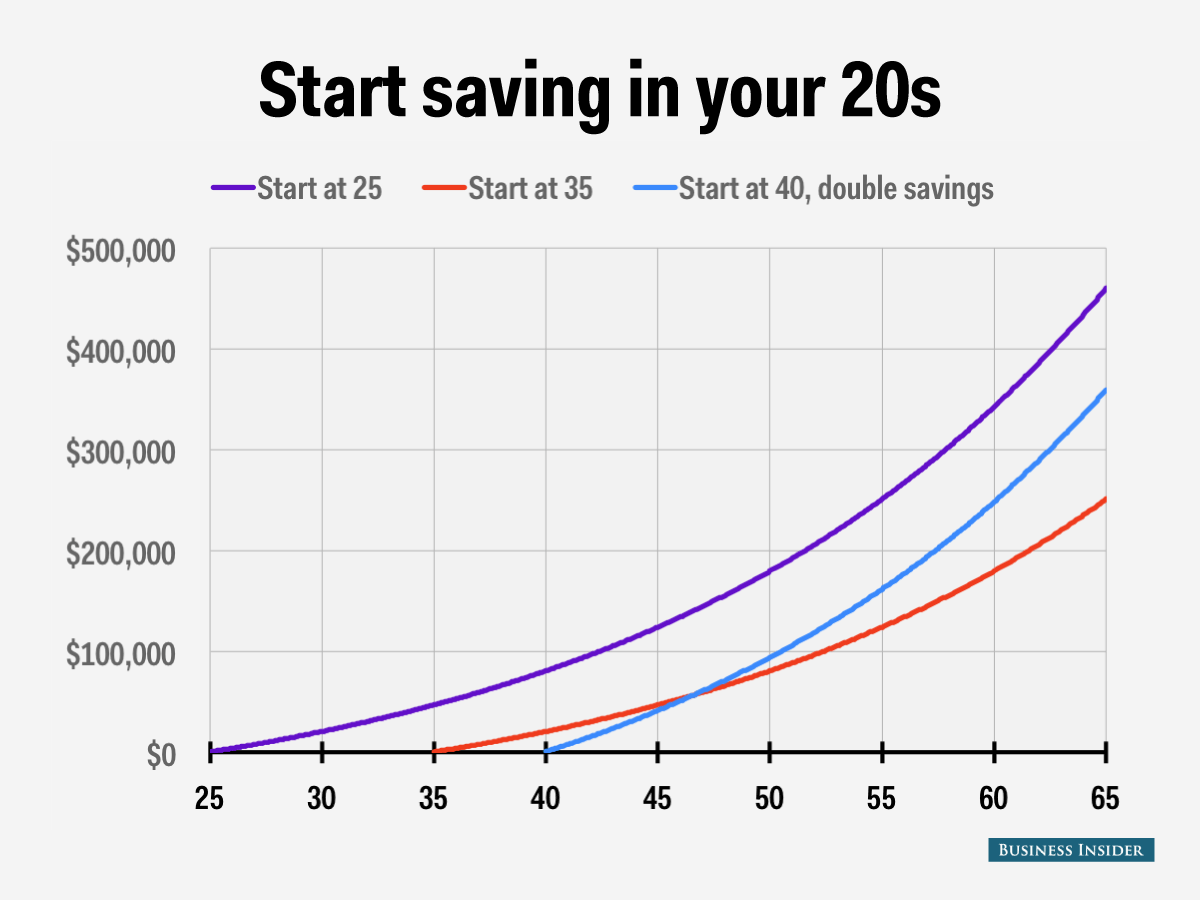

Plans to Boost Your Savings

Roth IRA investments are retirement funds where the funds are taxed when they are deposited instead of when they are withdrawn.

In some situations, the savings are tax-free.

Contributions added to a Roth IRA can be withdrawn at any time without penalty.

In particular, first-time home buyers can make withdrawals up to $10, 000 for the purchase.

Eligible individuals are determined using the modified adjusted gross income (MAGI).

Eligible single individuals can contribute up to $5, 500 per year if their MAGI is less than $117, 000.

Married individuals filing jointly can contribute up to $5, 500 per year if their MAGI is less than $184, 000.

Some employers offer sponsored savings programs, where they will match the contributions by their employees.

Funds in retirement plans are taxed when they are withdrawn from the account.

Funds in retirement plans are taxed when they are withdrawn from the account.

Employees also have control over how their money is invested.

Some suggest investing as much of your paycheck as you can, but a safe bet is investing the full amount to match that of your employer’s.

This will maximize the growth of your savings.

[tweet_box design=”default” float=”none”]

When you are saving for several goals with different timelines, consider this trick: open a savings account for each goal.

[/tweet_box]

Set up automatic bank transfers to move money from your checking account to the savings account when your paycheck is deposited.

Automatic transfers will make savings part of your budget without needing to spend time planning and fussing over money.

Leave a Reply