If you are struggling to pay your student loans, you may have several options available to you to ease the financial pressure.

Depending on the longevity of your specific situation, and if you qualify, you may be able to choose from enrolling in an income-driven repayment plan, student loan deferment, or student loan forbearance.

What Is Student Loan Forbearance?

If you are unable to make your scheduled student loan payments, your loan servicer may be able to grant you a forbearance.

Student loan forbearance will halt your payments for up to 12 months at a time. It is not an optimal long-term solution because interest will continue to accrue on your subsidized and unsubsidized loans (including all PLUS loans) during the entire forbearance.

On the plus side, forbearance will not have an impact on your credit score.

There are no specific qualifications that you will need in order to be granted forbearance; it is at the discretion of your lender.

Student loan forbearance can help you avoid going into default on your loans, and is a secondary choice if you do not qualify for deferment. If your financial hardship is anticipated to be temporary, forbearance will allow you at least several months without payments in which you can get your finances back in order.

There are two types of forbearances:

- Discretionary

- Mandatory

Discretionary Forbearance

For discretionary forbearances, your lender decides whether to grant forbearance or not.

You can request a discretionary forbearance for the following reasons:

- Financial hardship

- Illness

Mandatory Forbearance

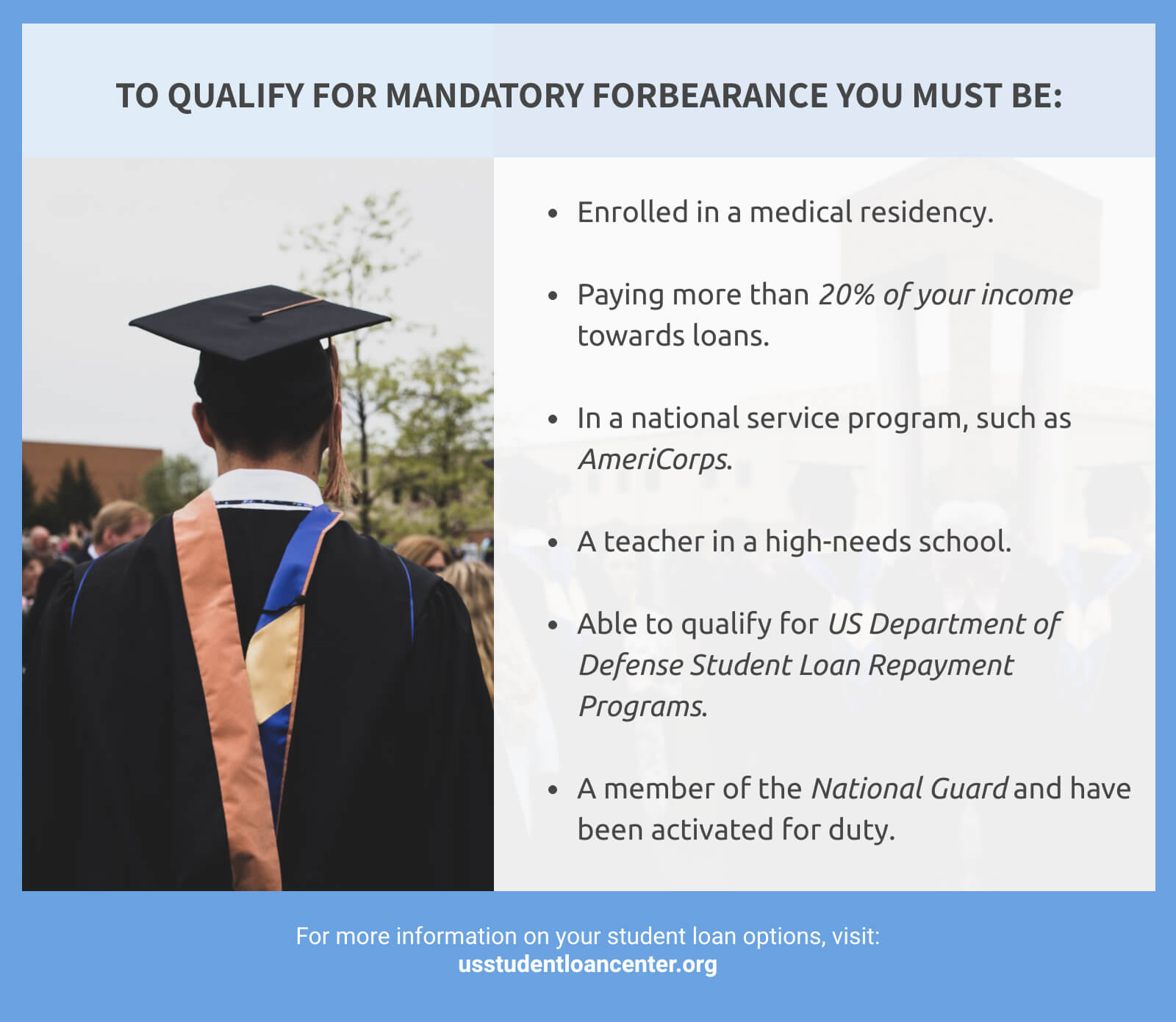

For mandatory forbearances, if you meet the eligibility criteria for the forbearance, your lender is required to grant the forbearance.

You can request a mandatory forbearance for the following reasons;

- You are serving in a medical or dental internship or residency program, and you meet specific requirements.

- The total amount you owe each month for all the student loans you received is 20% or more of your total monthly gross income (additional conditions apply)

- You are serving in a national service position for which you received a national service award.

- You are performing teaching service that would qualify for teacher loan forgiveness.

- You qualify for partial repayment of your loans under the U.S. Department of Defense Student Loan Repayment Program.

- You are a member of the National Guard and have been activated by a governor, but you are not eligible for a military deferment.

Deferment vs Forbearance

Deferment is considered a better choice than forbearance if you qualify for a deferment. This is because interest does not accrue on your subsidized loans for the course of the deferment.

Deferments can last as long as 3 years, or as long as you qualify.

If you think you may qualify for deferment due to a specific event or reason, you should apply for one with your servicer.

Situations that would qualify you for a deferment are:

- Attending school at least half-time

- Being unemployed

- Receiving state or federal assistance — for example, through the Supplemental Nutrition Assistance Program or Temporary Assistance for Needy Families

- Earning a monthly income of less than 150% of your state’s poverty guidelines

- Being on active military duty or in the Peace Corps

- Undergoing treatment for cancer

If you are eligible for a deferment, one must be granted by your loan servicer; with a forbearance, it is their choice to grant one.

For unsubsidized Stafford loans, PLUS loans, SLS loans, or unsubsidized consolidation loans, interest will continue to accrue during a deferment as well as a forbearance.

Neither deferment or forbearance will have an impact on your credit score.

Pros & Cons

Pros of Forbearance

- At a time when you are unable to make full loan payments and do not qualify for a deferment, forbearance will allow you to take a break from full loan payments for up to 12 months at a time.

- Your credit will not be affected and there is just one form you need to fill out.

- A forbearance can help you keep your loan from going to default.

Cons of Forbearance

- Interest will continue to accrue on your loans unless you choose to pay the interest each month during the forbearance.

- It is up to your loan servicer whether or not they will grant you a forbearance.

Eligibility

Your eligibility for forbearance will be determined by your loan servicer.

If you work an internship, perform certain types of community service, or find yourself experiencing financial hardship, you may be qualified to postpone payments with forbearance.

There are several types of forbearances that you may qualify for:

- Active Military Duty Forbearance – For those serving in the National Guard

- Corporation for National and Community Service (CNCS) Loan Repayment Program – For those performing national service that qualifies for partial repayment of your loan under the National and Community Service Trust Act of 1993

- Department of Defense (DoD) Loan Repayment Program – For those serving in the DoD and participating in its student loan repayment program

- Disaster Forbearance – For those affected by a disaster

- Hardship Forbearance – For those willing but temporarily unable to make scheduled payments

- Internship/Residency – For those working in a medical or dental internship or residency

- Student Loan Debt Burden – If your payments total more than 20% of your gross monthly income

- Teacher Loan Forgiveness Program – For teachers performing qualifying teaching service at an eligible elementary or secondary school or educational service agency

What To Do if You Don’t Qualify for Forbearance

If your loan servicer rejects your request for forbearance, research the income-driven repayment plans available to those with federal student loans.

There are several programs that could all lower your payment even if it isn’t paused.

You can also look into refinancing your student loans to lower your payments if you have good to excellent credit.

When Student Loan Forbearance Makes Sense

Student loan forbearance makes the most sense when your financial hardship is temporary and you expect your situation to improve.

If your situation does not qualify you for a deferment, forbearance will keep your loan from going into default.

What Happens to the Interest on My Loan During Forbearance?

The interest on all of your loans and loan types will continue to accrue during forbearance, even on subsidized loans.

You can choose to continue paying just the interest during forbearance, or you can allow it to accumulate.

If you choose not to pay the interest during forbearance, it can be added to your principal balance, and the amount you pay in the future will be higher.

How to Get a Student Loan Forbearance

Receiving a loan forbearance is not automatic. You must apply by making a request to your loan servicer.

In some cases, you must provide documentation to support your request.

To apply for forbearance using one of the federal government forms, follow these steps:

- Head to the government student aid website and download the appropriate form.

- Complete your forbearance form and gather any supporting documents if required.

- Contact your student loan servicer and submit your forbearance form.

- Continue with regular payments until forbearance is approved.

- If you need to continue after 12 months, reapply before your current forbearance term expires.

- If you have any specific questions related to your loan accounts, call your loan servicer directly for assistance.

Click the name of each servicer below to learn the process of how to apply for a forbearance with them:

How do I request a forbearance with Great Lakes?

How do I request a forbearance with NelNet?

How do I request a forbearance with Navient?

How do I request a forbearance with FedLoan?

How do I request a forbearance with ED Financial?

How do I request a forbearance with AES?

How do I request a forbearance with ACS?

FAQs about Student Loan Forbearance

Q: Is student loan forbearance automatic?

No, you have to apply for a forbearance through your loan servicer, and you cannot stop making payments until your request is approved. The Covid-19 administrative forbearance is automatic.

Q: Does student loan forbearance hurt your credit?

No, student loan forbearance does not have a negative impact on your credit. In fact, it can help you keep your loans from going into default.

Q: How long does student loan forbearance last?

Your loan servicer will issue a forbearance of up to 12 months a time, which can be renewed for up to 36 months.

Q: What does a student loan forbearance do?

A forbearance allows you to stop making full payments on your student loans while you are experiencing a temporary hardship. Your loans will still accrue interest, so you will want to make interest-only payments during the forbearance if you can.

Q: Why are my student loans in forbearance?

If you are referring to the administrative forbearance that began on March 20, that is because of the Coronavirus pandemic. The CARES Act, and a subsequent executive action issued by President Trump, allowed all federal student loan payments and accrual of interest to be halted until December 31, 2020.

Up Next: