The cost of a college education has risen dramatically in recent years.

According to U.S. News & World Report, the average cost of tuition and fees for the 2019–2020 school year was $41,426 at private colleges, $11,260 for state residents at public colleges, and $27,120 for out-of-state students at state schools.

Unless you are independently wealthy, or choosing your institution of higher learning based only on scholarships or affordability, you will likely take out some student loans. And you won’t be alone – there are currently 45.5 million Americans paying off $1.56 trillion in student loans.

The average student loan balance upon graduation is $32,731. And that’s just federal student loans!

Private student loans make up another $7.8 billion.

With so much money going into student loans, it’s important to first figure out, how do student loans work?

Once you do that, you’ll be better equipped to make sure you’re handling yours effectively.

We’ll explain it all below, but here’s a quick video to give you a brief overview:

What are Student Loans?

Student loans are issued by both the federal government and private financial institutions.

In order to qualify for student loans, you must prove that you will be enrolled at least half-time at a college or university, and the bulk of the money will be used towards your educational expenses.

Student loans issued by the federal government do not require you to have good credit, or to prove your earnings like traditional loans do. Instead, they use your future earning potential as collateral on your loan.

Because of this, many students borrow the maximum amount that they are approved for, even if they don’t need that much for school. However, because your loans are held by the government, their powers to recoup their investment are far-reaching.

If you stop paying and default on your loans, the government can garnish your wages and take your tax returns until they have been paid in full.

Federal student loans have interest rates that are set and announced for each year. They come with benefits like eligibility for Public Service Loan Forgiveness, deferments, forbearances, and a variety of payment plan options.

Private financial institutions like banks, schools, and credit unions also issue student loans. Many students taking out private student loans will need a cosigner in order to be approved.

Financial institutions require high credit and proof of income like any traditional loan does.

Private student loans can sometimes be eligible for lower interest rates, but lack the other benefits of federal student loans, like flexible payment options.

(Bonus Tip: Liking these tips so far? Take 10 more for free! The Ultimate Student Loan Resource Library has 10 of the most important things to know about student loans so you can pay off your loans the smartest and easiest way possible. Click here to learn more and to get the free guide.)

How Do Student Loans Work?

The first step towards taking out student loans is the FAFSA – the Free Application for Federal Student Aid. You and your parents will input your financial information into the FAFSA, and it will be sent to every school that you apply to. Each school will run the numbers, and then send you your Award Letter.

Your Award Letter from each school will break down all of the financial aid that you qualify for: grants, scholarships, subsidized loans, unsubsidized loans, and work-study programs.

You can choose to accept or decline any part of the financial aid you are offered.

Keep in mind that grants and scholarships don’t need to be paid back, and should always be accepted. Work-study programs require you to work on campus to earn income, and are also preferred aid.

Then there are the student loans, which include subsidized and unsubsidized direct loans.

You can also seek out additional loans by contacting financial institutions for private student loans.

What Types of Student Loans are Available?

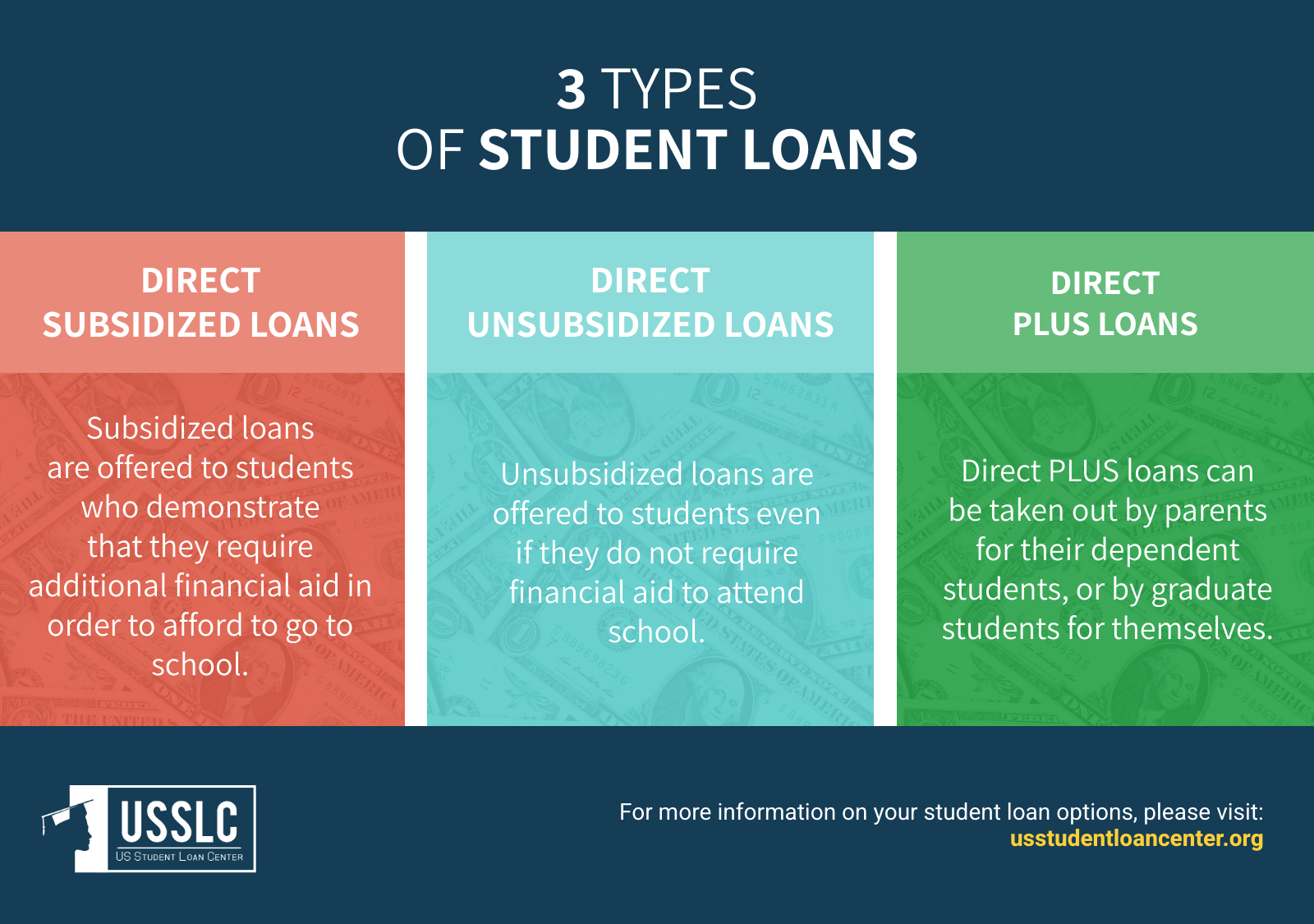

There are several types of student loans that you should be familiar with. Among federal student loans, there are Direct Subsidized, Direct Unsubsidized, and Direct PLUS loans.

Direct Subsidized Loans

Subsidized loans are offered to students who demonstrate that they require additional financial aid in order to afford to go to school.

Subsidized loans do not accrue interest until repayment begins, six months after graduation. This means that your loan balance when you start school and your loan balance when you leave school, will be the same.

Direct Unsubsidized Loans

Unsubsidized loans are offered to students even if they do not require financial aid to attend school.

Unsubsidized loans begin to accrue interest as soon as money is disbursed. This means that unless you make interest-only payments during school, your loan balance when you graduate will be much higher than your loan balance when you began school.

Direct PLUS Loans

Direct PLUS loans can be taken out by parents for their dependent students, or by graduate students for themselves.

In order to qualify for a PLUS loan, you will need to fill out an additional application and have a qualifying credit score.

Private

Private student loans can help to fill in the gaps that your financial aid leaves. Because some loans can only be used for direct school expenses, such as tuition and room and board, you may require additional loans for things like transportation or childcare.

How Does Interest on Student Loans Work?

No matter how you slice it, you will end up paying interest on your student loans – the question is just how much. Depending on your interest rate and repayment terms, you may end up paying almost as much in interest, as you do on principal!

You can use a Student Loan Calculator to see how much you will pay in interest over the course of your loan.

For example, let’s use the average loan balance of $32,731 and the Standard Repayment term of 10 years.

The current undergraduate unsubsidized interest rate is a record-low of 2.75%. Even with the lowest interest rate and shortest repayment term, you would end up paying $4,743.78 in interest.

Your monthly payment would be $312, and in total you would pay $37,474.78 over the 10 years.

It’s incredibly important that you know the terms and interest rates of your loans, and that you stay on top of any options to improve your situation – that includes refinancing and consolidation.

(Bonus Tip: Liking these tips so far? Take 10 more for free! The Ultimate Student Loan Resource Library has 10 of the most important things to know about student loans so you can pay off your loans the smartest and easiest way possible. Click here to learn more and to get the free guide.)

Repayment Options

How quickly you pay off your loans is up to you. Depending on your particular situation, you may choose to extend your repayment terms. With private student loans, your lender will determine the repayment terms and you will have to follow them.

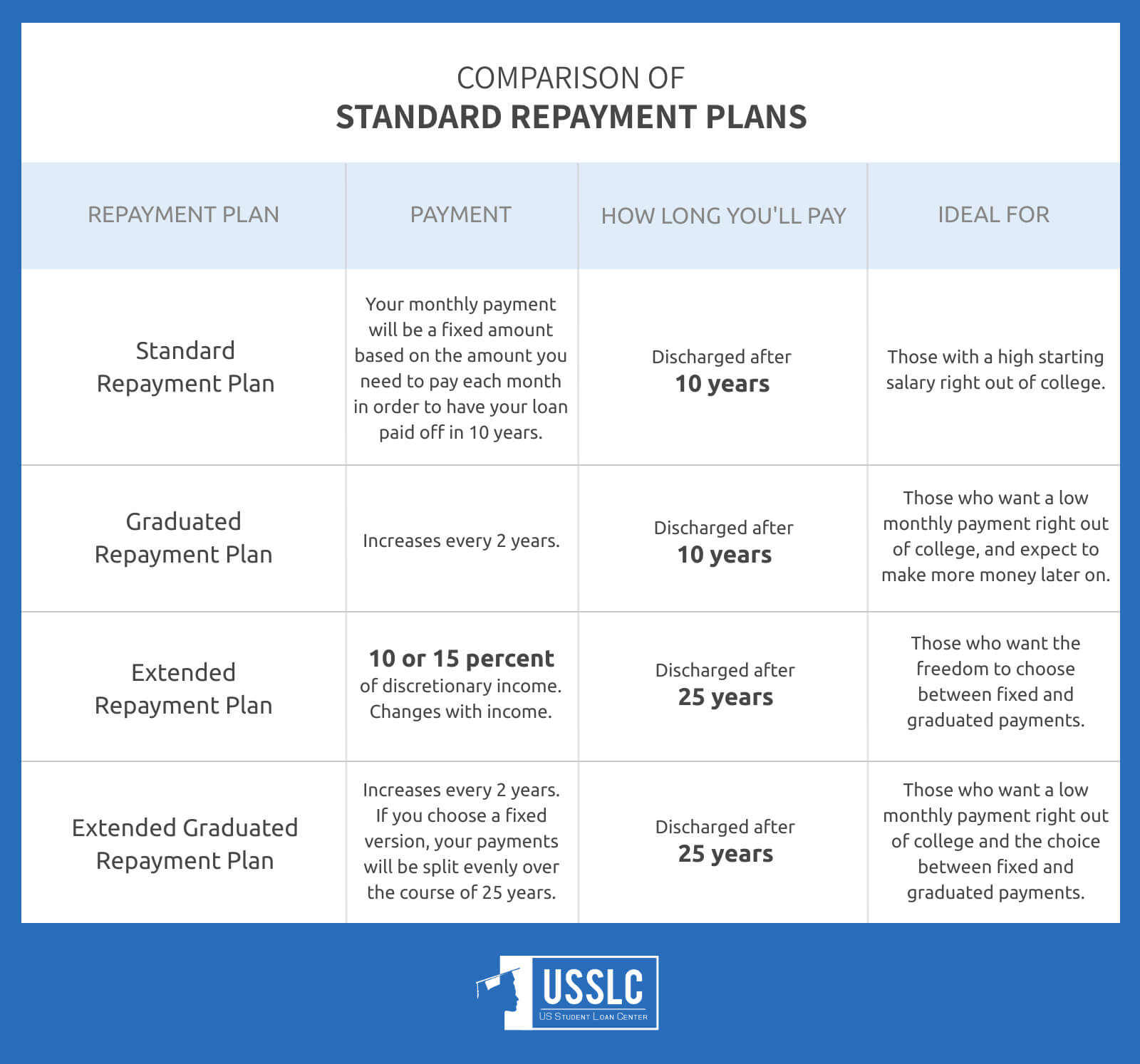

With federal student loans, you have 8 choices for repayment plans. 4 are considered Standard Plans, while the other 4 are Income Driven.

Standard Repayment Plans

Standard Repayment Plan

Upon graduation, you will be placed on the Standard Repayment Plan. This plan guarantees that your loans will be paid off in 10 years, and your payments will be the same each month. Staying on the Standard Repayment Plan also means that you will pay the least interest out of any of the 8 repayment plans.

Graduated Repayment Plan

Another option for all borrowers is the Graduated Repayment Plan. This plan assumes that your income will increase over time, and mimics this with your payments. Payments start out lower and increase every two years.

On the Graduated Repayment Plan, your loans will also be paid off within 10 years, but you will pay more in interest than on the Standard Repayment Plan.

Extended Repayment Plan

If you have more than $30,000 in Direct Loans, you can opt for the Extended Repayment Plan. You may have monthly payments that are all the same, or you may have payments that increase over time. Either way, your loans will be paid off within 25 years.

This plan will keep your monthly payments lower, but you will pay more interest over the course of the loan.

Extended Graduated Repayment Plan

On the Extended Graduated Repayment Plan, your payments will increase every 2 years. However, you are able to choose a fixed plan, where your payments will be split evenly over the course of 25 years.

On this plan, your loans will be paid off within 25 years and will be discharged after that amount of time if there is any remaining balance.

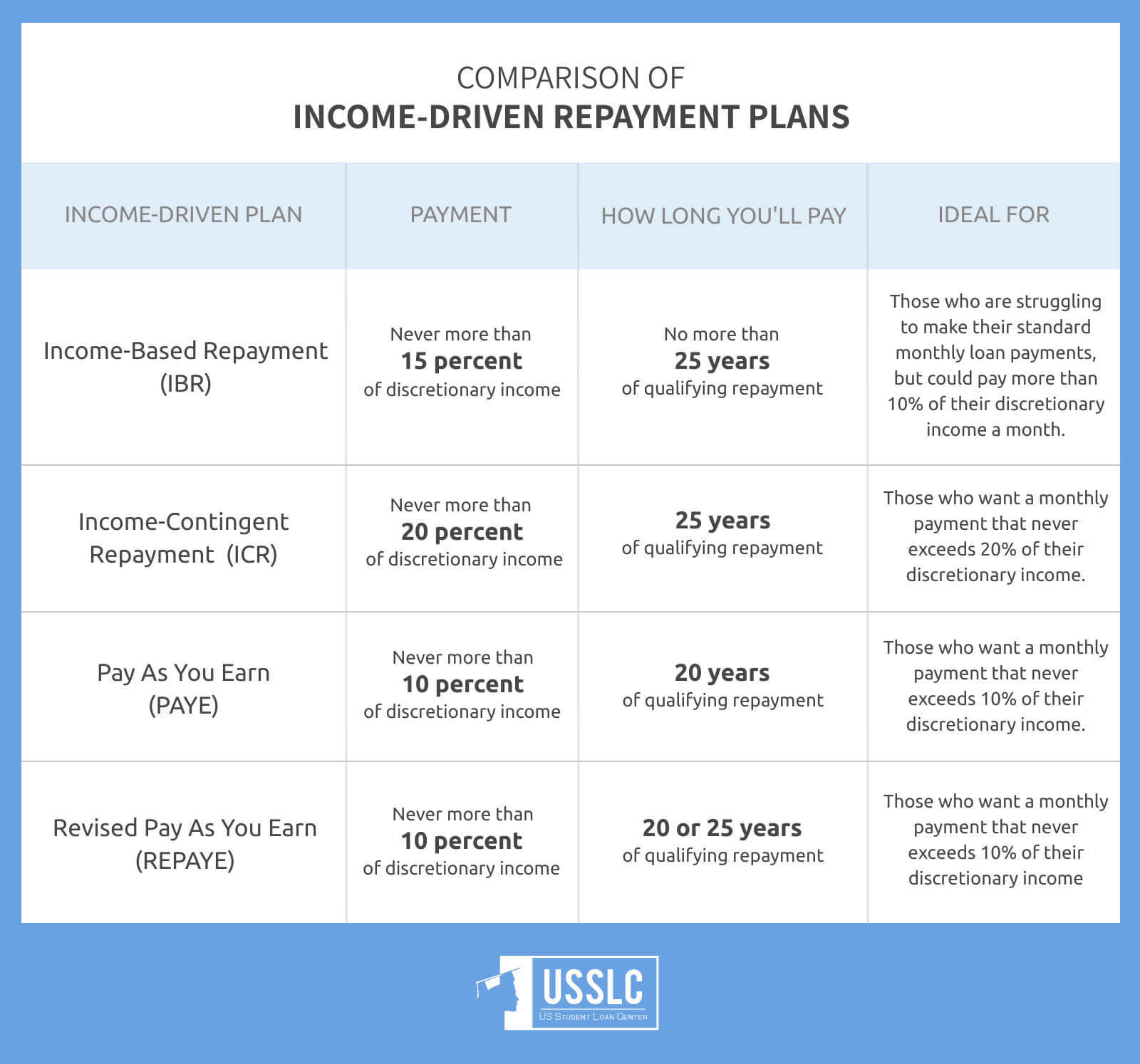

Income Driven Repayment Plans

Pay As You Earn Plan (PAYE)

On the Pay As You Earn Plan, you’ll have a monthly payment that never exceeds 10% of your discretionary income. This is a great option for those who would like a more manageable payment right out of school.

After 20 or 25 years of payments, the outstanding balance on your loan will be forgiven – but can be treated as taxable income.

Revised Pay As You Earn Repayment Plan (REPAYE)

Not all loan types qualify, but if yours do, you can select the Revised Pay As You Earn Repayment Plan (REPAYE). Your monthly payments on REPAYE will be 10 percent of your discretionary income. Your monthly payments can change each year and are based on your updated income and family size.

If you’re married, both your and your spouse’s income and loan debt will impact your monthly payments.

After 20 years of payments, the outstanding balance on your loan will be forgiven – but can be treated as taxable income.

Income-Based Repayment Plan (IBR)

If your debt-to-income ratio is very high, you may qualify for the Income-Based Repayment Plan (IBR). Your monthly payments on IBR will be 10 or 15 percent of your discretionary income, but never more than what you would have paid on the Standard Repayment Plan. Your monthly payments can change each year and are based on your updated income and family size.

If you’re married, both your and your spouse’s income and loan debt can impact your monthly payment amount.

After 20 or 25 years of payments, the outstanding balance on your loan will be forgiven – but can be treated as taxable income.

Income-Contingent Repayment Plan (ICR)

If your loan qualifies for the Income-Contingent Repayment Plan (ICR), your monthly payment will be the lesser of: 20 percent of discretionary income, or the amount you would pay on a repayment plan with a fixed payment over 12 years, adjusted according to your income. Payments are recalculated each year and based on your updated income, family size, and the total amount of your Direct Loans.

Any outstanding balance after 25 years of payments will be forgiven, but can be treated as taxable income.

FAQs on How Do Student Loans Work

Q: How do student loans work when you get married?

Any student loans that you took out prior to marriage remain your sole responsibility to pay off. If you default on your loans, it will only negatively affect your credit, not your spouse’s credit.

If you file your tax return jointly with your spouse, your payment amount may be affected by their income and their student loan debt – but only if you select a repayment plan that takes into account their income and debt.

If you return to school and take out student loans after you are married, and your spouse co-signs on your loans, he/she does take on responsibility for your loans. If you default on these loans, it will impact both your credit and your spouse’s credit.

Q: How do student loans work when buying a house?

When buying a house, a lender will look at your income, your credit score, and your debt-to-income ratio. Your student loan debt will influence both your credit score and your debt-to-income ratio, but doesn’t need to prevent you from qualifying for a mortgage. If you stay on top of payments, your credit score will not be negatively affected. When you receive your pre-approval amount, it will take into account your student loan payments and what you can truly afford. As long as you stick to a budget in your everyday life, and stick to the pre-approved amount for a mortgage, you should be able to purchase a home.

Q: How do student loans work for parents?

If you take out Direct loans, you are on the hook for paying them back in full – not your parents. However, if your parents took out a PLUS loan, or cosigned for you, they are then responsible for the balance of the loan.

Q: How do student loans work for graduate school?

Unfortunately, not all of the loans available to undergraduate students are available for graduate students. If your plan is to fund your education with federal student loans, you can choose between Unsubsidized Stafford Loans and Graduate PLUS Loans. You can also take out private student loans.

For graduate school, you can borrow $20,500 per year in Stafford loans with a total limit of $138,500 – which includes any Stafford loans that you borrowed as an undergraduate. With Graduate PLUS loans, you can borrow up to the cost of attendance, but at a higher interest rate.

Q: How do student loans work for part time students?

Finding loans for less-than-half-time students can be difficult. Very few private lenders will even provide student loans to part-time students. However, if you can maintain half-time status at your school, you can still qualify for federal student loans. Typically, if you fall below half-time status (less than six credits per semester), your loan will enter repayment.

(Bonus Tip: Liked these tips? Take 10 more for free! The Ultimate Student Loan Resource Library has 10 of the most important things to know about student loans so you can pay off your loans the smartest and easiest way possible. Click here to learn more and to get the free guide.)

Up Next: Student Loan Repayment Plan For Doctors: Do You Know Your Options?

Leave a Reply