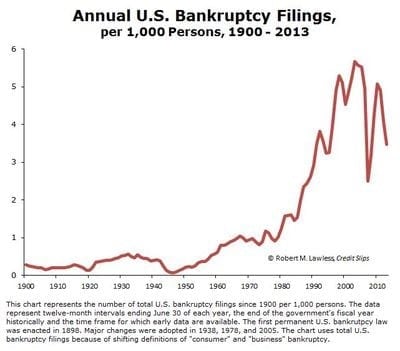

Annual bankruptcy filings are steadily decreasing as you can see in the chart above.

However, things like national economic changes or shifts in the job market can cause bankruptcy rates to skyrocket.

With so many students carrying extraordinary loan debt (the chart below demonstrates the average loan debt over time), many students wonder if an unfortunate bankruptcy filing can actually help them with their loans.

The answer is: sometimes yes.

It depends on your level of debt and other aspects of your financial situation.

Read on to find out ways filing for bankruptcy will affect your student loan debt.

Filing Student Loan Bankruptcy

Filing for Student Loan Bankruptcy can help those in the direst of financial situations to overcome their debt.

Nearly 40% of debtors who file for bankruptcy with student loans are approved.

Many students filing bankruptcy never seek loan discharge, a major reason why so many people filing for bankruptcy end up retaining their student loan debt.

However, to do this, you must prove “undue hardship” to get these loans treated the same as consumer debt is treated.

Getting Loan Discharge

First, you must file for chapter 7 or 13 bankruptcy.

It is difficult to get student loans discharged by typical means, but first, you must file for normal bankruptcy to initiate the process.

Then, you must undergo the Brunner test to determine if you have “undue hardship”:

- If you are forced to repay the loan, you could not retain a minimal standard of living

- If you are forced to repay, your financial hardship will remain for most of the duration of the repayment term

- You have made what is called a “good faith effort” to repay the loan for a time before you applied for bankruptcy

This involves lawyers and lawsuits, and many additional expenses, plus the risk that your lender may fight the suit and you do not win the ability to file bankruptcy.

Consider Other Options

Bankruptcy suits can be very costly and not always effective.

This means that you should make a serious effort to get the debt discharged without filing for bankruptcy first, using it only as a last resort.

Some options include:

- Income-Based Repayment, a way to refinance your debt to a reasonable interest rate and monthly payment amount based on your current income

- Public Service Loan Forgiveness, if you work in a particular industry such as public service or nonprofit work.

- Other industry-based debt repayment options. For example, most public schools and universities will help teachers or professors repay or refinance their loans.

Things to consider if you choose to include student loan debt in your bankruptcy filing

There are many different factors at play when it comes to whether or not your student loans can be discharged via bankruptcy.

The first step is hiring a good lawyer.

Even if you are under financial duress, it is crucial not to skimp out on a cheap, ineffective lawyer, because you can guarantee that your lender will have an effective one.

Second, make sure you pass the Brunner test.

That way, you can ensure that you will at least be eligible for filing a normal bankruptcy claim, and at least get some benefit from the time and effort of your claim.

Recall and document what exactly your loan was used for.

For loan debt to be considered as part of a loan forgiveness settlement in a bankruptcy claim, it must have been used entirely for the university’s actual cost of attendance (as described in the cost calculator).

This means you may be able to get loan forgiveness if you truly did use your loan towards university costs like tuition, food, housing, and books.

However, if you used your loans towards car payments or other non-educational costs, your entire suit will likely be declined, making you waste a lot of time and money.

Essentially, the key to getting loan forgiveness through bankruptcy comes down to two things.

First, try to avoid the bankruptcy filing if at all possible, and look into other avenues for refinancing your debt.

Second, organize carefully and make sure you truly have a good chance at winning your claim before you jump in headfirst and dedicate resources to the suit.

(NOTE: Defaulted loans can lead to lower credit scores, pestering collections, and a worried mind. Avoid default and learn how to turn a “Default” status into a “Current” status in under 90 days by using our Road Map to Getting Student Loans Out of Default. Click here to learn more and get the free map – before your next payment date!)

I need a person who talk in spanish…Thanks!!!

Buenos Dias Mariangelez, me puedes mandar tu numero de telefono al cdubis@usstudentloancenter.org ? y dame la mejor hora para comunicarnos contigo 🙂 alguien que hable espanol te llamara al telefono y la hora que digas.

Gracias

I dont know if i have it or not. I realle dont understand about it.

I would like to see if I qualify for the bankruptcy for my student loans.

I filed ch 7 bankruptcy

Hello! Thanks for the information. I need a person who talk in spanish…Thanks!!!

Buenos Dias Jeannette, por favor mandame tu numero de telefono y la mejor hora para llamarte a cdubis@usstudentloancenter.org

Mi nombre es Carla, y yo personalmente te pondre en contacto con alguien que hable tu idioma para ver si podemos ayudarte.

Gracias