Best and Worse Debt To have: Student Loan Debt

We all know that Student Loans represent one of the main ways in which students pay for their higher education. It has become a fact of life in the American higher education system, but sadly the majority of the student loan borrowers do not really understand all the risks behind piling up on these loans. Student loans can seem as a quick and easy way to pay for that college degree, but they are also the worst kind of debt that a borrower can have.

Let’s say you are planning on borrowing some money for college, or if you are a parent you are going to help your kids to go through college, well then you really need to understand several key fundamentals of student loan debt, and run the calculations below. This could potentially help you make sure that student loans are good debt for you, and don’t spiral you and your family into a financial nightmare.

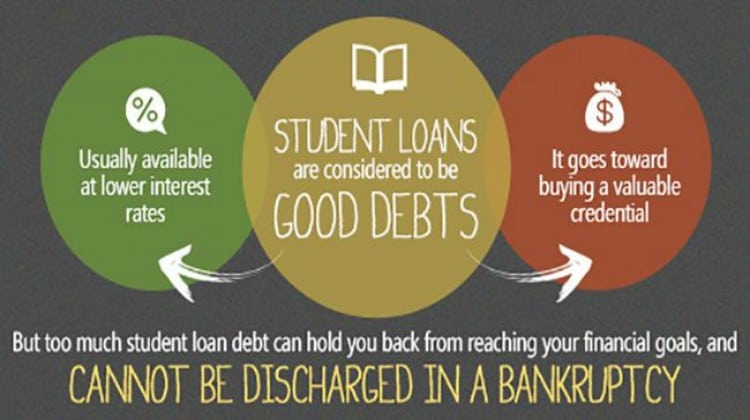

When Student Loans Are Good Debt

If it helps you improve your financial future, then student loans are a good debt to have. Remember, that getting a higher education degree should be a real investment for you, and you need to make sure that you will get a solid return on this investment. If getting a degree will help you earn more money after graduation, then it is definitely a good debt.

On average, getting a college degree will see your initial earnings jump at least 25% compared to high school graduates.

Check out this recent study from the U.S. Department of Education that shows the gap from high school to college graduate earnings:

BUT! It goes beyond just going to college and getting a degree, it is also about making sure you choose an appropriate degree that will in fact boost your earnings after graduation.

According to a recent survey by the National Association of Colleges and Employers, engineers have the highest starting salary among college graduates, earning on average $62,062 in their first year. In contrast, humanities and social science majors have the lowest starting salary, just around $37,791. That’s almost a $25,000 difference between starting salaries – and it starts to paint the picture of where student loans stop being good debt, or where that humanities degree was a really good idea.

If you’re going to take out student loans, the #1 goal should be to maximize the return on your investment. That means getting the highest salary possible for the lowest amount of student loan debt.

How Student Loans Become Bad Debt

When you fail in keeping this in mind, then this is how student loans rapidly become a bad debt. Look at it this way, a student loan is a mortgage on your future earnings. When you buy a house, the collateral for the loan is the house. When you buy a car, the collateral for that loan is the car…If you do not repay these loans, the lender will take the house or the car. When you borrow money for your education, the collateral is your future earnings. If you do not repay your student loans, the government will garnish your future earnings.

You have probably heard stories of how some borrowers had their tax refunds taken from them to pay what they owed from their student loans, or even had their Social Security checks taken to repay their student loan debt. The bottom line is simple, if you do not repay your student loans, the government will take your earnings from wherever they can and repay the debt for you.

The smartest way to prevent this situation is by avoiding to take on too many student loans from the very beginning. If the starting salary isn’t going to be high enough, it’s simply not worth pursing the degree to go into debt. Trust us, if you’re 18, it will save you from decades of financial pain later in life.

The Key Calculation Every Student Loan Borrower Needs To Do

The key to keeping your student loans as good debt, and not letting them spiral into bad debt, is this simple equation: The Student Loan to Salary Ratio.

Here’s how it works – you want to look at the amount you have to borrow to achieve a given starting salary. You should take the initial starting salary, and divide by the amount you would have to borrow to pay for that degree from your target school.

Let’s go back to the average starting salaries and look at some debt ratios. We’ll also combine that with the latest data from College Data on the costs of private and public education. We’re going to assume $30,094 per year for private school (for a total $120,376 for 4 years), and $8,893 per year for a public school (for a total of $35,572 for 4 years).

Engineer: $62,062

Public School Ratio: 174%

Private School Ratio: 52%

Business: $55,635

Public School Ratio: 156%

Private School Ratio: 46%

Education: $40,337

Public School Ratio: 113%

Private School Ratio: 34%

Humanities: $37,791

Public School Ratio: 106%

Private School Ratio: 31%

The goal should be to have the highest ratio possible. Any ratio below 100% should raise some concerns about the amount of student loan debt you need to borrow. Remember, this calculation is based simply on costs and amount borrowed. Getting a scholarship or other type of financial aid could change the amount you need to borrow and improve the equation.

Another Important Student Loan Debt Calculation

A second equation involves calculating your student loan debt payments and comparing that to your monthly income after graduation. The goal should be that your student loan debt payments never exceed 10% of your take home income from your after-college job.

For example, if you’re an engineer earning $62,062 per year, your take home pay per month would be roughly $3,550. That means that you should not be paying more than $350 per month towards your student loan debt. To make that work, you should not borrow more than $38,000 if you plan on using the standard repayment plan. There are other repayment plans options that can help with this ratio, but remember that you will always need to repay the debt whether you do it over 10 years or 30 years.

The goal is to make a smart financial decision about student loans. No matter which calculation you decide to use, the point is to simply consider the return on your investment. You don’t want to be investing thousands of dollars into a degree that will improve your earnings by hundreds of dollars. That doesn’t make financial sense and it will turn your student loans into bad debt.

Makes you reconsider your college plans doesn’t it? Or at least that humanities degree…think about it!

Leave a Reply