Are you a student who has taken out loans to fund your education?

If so, you may be wondering how those loans could impact your tax refund.

In this comprehensive guide, we will explore the relationship between student loans and tax refunds, providing you with all the information you need to know. Student loans can have both direct and indirect effects on your tax refund.

Depending on your specific situation, you may be eligible for certain deductions or credits related to your student loan interest payments. Understanding these tax benefits can potentially save you money and help you maximize your refund. Furthermore, the amount of student loan debt you have can also impact your tax refund indirectly.

Heavy debt burdens may influence other tax-related decisions, such as your filing status or your eligibility for certain tax breaks. Being aware of these potential implications is essential to financial planning and making informed decisions.

Whether you’re currently repaying student loans or considering taking them out, it’s important to understand how they can affect your tax refund.

By diving into this comprehensive guide, you’ll gain valuable insights and strategies to navigate the complex intersection of student loans and taxes. Stay tuned for expert advice and tips to make the most of your tax situation

How to Stop Student Loans from Taking Your Taxes: What You Should Know

In this article:

- What Effect Does COVID-19 Have on Student Loan Tax Garnishment?

- Student Debt at a Glance

- The Government Wants Their Money Back

- What Happens if Your Loan Goes Into Default?

- Consequences of Defaulting on Your Loan

- Will My Spouse’s Refund Be Garnished, Too?

- Tax Refund Offset Reversal

- How Does the Treasury Offset Program Work?

- How Do I Know If My Student Loan Will Cause My Tax Refund To Be Taken?

- How Can You Stop the Government from Taking Your Taxes?

- What Can You Do if Your Refund Was Seized?

- Conclusion

What Effect Does COVID-19 Have on Student Loan Tax Garnishment?

If your federal student loans are in default, meaning you’re past due on payments for at least 270 days, the Department of Education can typically garnish your tax refund. However, the CARES Act temporarily halted this practice.

From March 13, 2020 – December 31, 2020, the Department of Education has ceased all collections processes on federal student loans. This includes garnishment of your tax refund.

The CARES Act was signed on March 27, but was effective from March 13. If your tax refund was garnished, or scheduled to be garnished, on or after March 13, it will be returned to you. However, if your refund was garnished prior to March 13, it will not be returned to you.

If you have questions about whether your federal tax refund was withheld, you can call the Education Department’s Default Resolution Group at 1-800-621-3115 (TTY for the deaf or hearing-impaired 1-877-825-9923).

Student Debt at a Glance

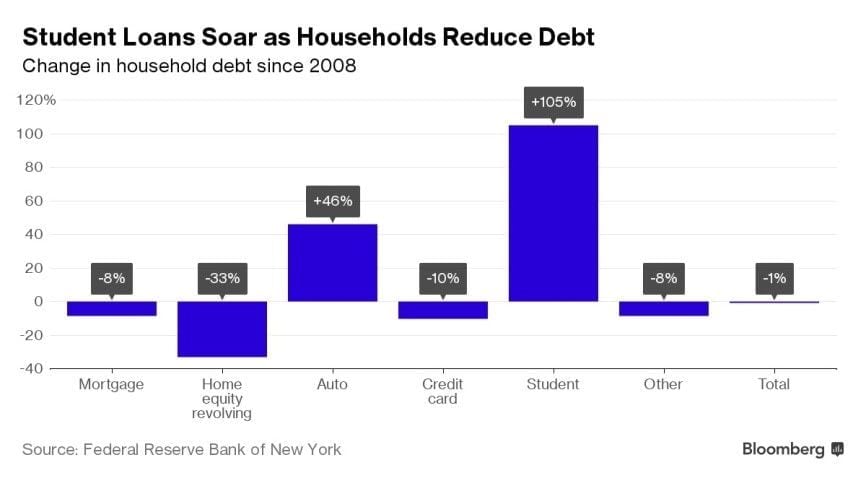

Did you know that student loan debt is the second-highest consumer debt? It’s second only to mortgage debt.

Reports suggest there are 44 million borrowers in the United States. They owe a combined total of $1.7 trillion in student loans.

Student loan debt has skyrocekted since 2009. Meanwhile, other household debts haven’t seen similar increases. In fact, total household debt has fallen by 1%.

The last thing you should do is ignore your student loan debt. Instead, deal with the debt you already have then taken steps to avoid creating new ones.

More debt means less financial security, and to have more financial security, you must know how to stop student loans from taking your taxes.

Avoiding debt can have long-term repercussions. It will continue to increase until your creditors take steps to seize the money you owe them.

Your federal student financial aid debt is no different. The government will want to recover the money owed to them. The federal government will use student loan garnishment to recoup their losses.

The Government Wants Their Money Back

If you default on your federal loans, the government will legally try to reclaim the money you owe them. The Federal Government will try to use the Treasury Offset Program.

The U.S. Department of the Treasury uses this to seize federal payments owed to you. They do this to pay off your federal student aid owed to other federal agencies.

So, the U.S. Department of the Treasury can seize up to 100% of your income tax refund. They use this to pay off your defaulted federal student loan. They don’t need your permission to seize money owed to them, but they are required to give you notice that these funds will be seized.

What Happens if Your Loan Goes Into Default?

If you fail to keep up with the payments on your loan, then you will be at risk of defaulting. As a result, you risk having your income tax refund taken. Tax offsets and student loans sometimes go hand-in-hand.

Perhaps the safest way of settling your private student loans is to sign up for an income-based repayment plan once you secure a job. That way, the deduction will immediately apply, and you will not be tempted to spend the money somewhere else.

(Did You Know? The IRS can seize your tax refund if you’re running late on student loan payments.)

Let’s Lower Your Student Loan Payment

It’s super simple to see what you’re eligible for, and our trusted team can get you set up today

Consequences of Defaulting on Your Loan

You can default on your student loan if you have not made a payment in 270 days. You can expect some of these things to happen:

- The entire balance, including interest, is due for payment immediately.

- You lose eligibility for financial assistance, including financial aid and forbearance.

- A collection agency will handle your loan.

- The default status will have a negative impact on your credit score.

- The effects of default will be felt for years while you try to repay your debts and rebuild your credit score.

You will receive notice that the creditor has submitted the debt for an income tax offset. This notice will be sent to the address held on record by your loan servicer. It may also be sent to the address you last used to file your taxes.

Will My Spouse’s Refund Be Garnished, Too?

If you are married and file your taxes jointly, you may be able to have your spouse’s part of the federal tax refund spared from garnishment by submitting an injured spouse allocation form (IRS Form 8379).

You can file this form along with your taxes, or afterward if you weren’t aware of the offset at the time of filing. You may have up to three years from the due date of your original return to submit an injured spouse allocation form.

You may also be able to prevent student loan tax garnishment for your joint state return, but that depends on where you live. Your state’s department of taxation can give you more information.

The best way to stop your tax return from being garnished due to student loans is to keep from defaulting in the first place. You can look into loan forgiveness programs, income-driven repayment plans, deferment, forbearance, and debt consolidation. USSLC can help you get your student loans under control.

Tax Refund Offset Reversal

If I owe federal or private student loans, will I get a tax refund? You might be asking yourself this question. You can appeal the tax offset. Here are the grounds for doing so:

- You’ve paid off the debt.

- You don’t believe the loan is in default.

- There is cause for discharge or refund.

- Disability or death

You must submit your appeal 65 days after the date of the notice. It shall be made in writing to your creditor.

If you submit an appeal after 65 days, they will not suspend the offset process. If your appeal is successful, they will return your money.

How Does the Treasury Offset Program Work?

The Bureau of the Fiscal Service’s Debt Management Service (DMS) administers the Treasury Offset Program (TOP). The Fiscal Services DMS handles collecting money owed to federal agencies.

Fiscal Services also distributes federal payments (such as tax rebates) to individuals. They do so on behalf of agencies making federal payments (such as the IRS).

Payment vouchers are prepared, certified, and then sent to Fiscal Services (FS). The vouchers contain vital information, so they include the name of the borrowers and their Tax Identification Number (TIN).

FS will cross-reference the recipient’s name and TIN with their delinquent debt database. If the recipient’s name and TIN match the name the TIN the creditors have, then the disbursing officers will withhold (all or part) payment.

FS will then offset and distribute payments to the recipient’s creditors. The goal is to clear the recipient’s debts. This information will be held on record. Payments will also continue to be offset until the creditors suspend or terminate further payments.

Payments are suspended in the event of bankruptcy or other reasons the creditor feels justifies the suspension. They are also terminated for the following reasons:

- You’ve paid off the debt.

- Debt is discharged or compromised.

- Other reasons the creditor feels justify the suspension.

The best way to avoid this is to not default on your loans. To avoid defaulting on your loan, you will need to:

- Keep up with your loan repayments.

- Keep your creditors informed.

- Consider debt consolidation or rehabilitation

- Contact the Internal Revenue Service (IRS)

Let’s Lower Your Student Loan Payment

It’s super simple to see what you’re eligible for, and our trusted team can get you set up today

How Do I Know If My Student Loan Will Cause My Tax Refund To Be Taken?

Under normal circumstances, your student loan servicer will not automatically or immediately garnish your tax refund. You must be in default on at least one federal student loan. Defaulted private student loans cannot garnish your tax refund.

Once you are in default, your loan servicer can move to garnish your tax refund. If they do so, you will receive an offset notice months before you file your taxes. This notice comes from the Treasury Offset Program (TOP).

Once you receive an offset notice, you can take several steps to try and prevent your loan servicer from taking your tax refund. If you are in default, make sure that all of your contact information is up-to-date with your loan servicers so that you receive the offset notice. Not receiving your offset notice is not considered a viable reason for disputing tax garnishment.

Once an offset notice is sent, you will have 65 days to formally contest it. If you believe that the garnishment is based on inaccurate information, you have 20 days to ask for your student loan records. Once your loan servicer sends your records, you have 15 additional days to request a formal review.

Your offset notice will contain instructions for setting up a formal review. If you have questions about the review process, you can also contact TOP directly at 800-304-3107.

Until the tax offset stops, your student loan servicer will be able to seize your refunds.

How Can You Stop the Government from Taking Your Taxes?

There are several suggestions on how to stop student loans from taking your taxes. Keep these in mind when dealing with your finances:

Keep Up with Loan Repayments

The key to staying out of debt and avoiding default is to make loan repayments on time each month. To stay on top of your repayments, you will need to prioritize your debts. Your federal student loans shall be the topmost priority.

Once you have sorted out your priority debts, concentrate on making payments to other creditors.

Ideally, you will keep up with repayments with all your creditors. But, if you have to choose between paying your mortgage and paying off a credit card, you must aim to pay your mortgage first.

Another thing to consider is always paying your social security. You can always contact the creditors you are struggling to pay. You can discuss your options with them.

As long as you keep up payments on your student loan, the government will not be able to take your tax refund.

Keep Your Creditors Informed

If you do find yourself unable to keep up with your loan payments, contact your creditors. Discuss your options with them.

If you are struggling to keep up with your student loan payments, then you have a few options.

Consider changing to an income-contingent repayment plan. If you qualify, you might reduce your monthly payments.

You can also consider deferment or forbearance. Deferment delays payment and interest on your student loan providing you meet the eligibility. Forbearance allows you to stop making payments or reduce your payments for a period of up to 12 months.

Consider Consolidation or Rehabilitation

Consolidation is the process of paying all your current debts off with one single debt. You can do this via a debt consolidation loan.

This way you will only have to keep track of one monthly payment. To be eligible, you must make payments under an income-driven payment plan. This way, you can make three separate payments on your loan.

Consolidation makes repaying your student loan more manageable. In effect, you only have to deal with one creditor.

Rehabilitation is more complex than consolidation. You will have a repayment plan where you will make monthly payments equating to 15% of your discretionary income. To rehabilitate your loan, you will need to make nine consecutive on-time payments.

Consolidation and rehabilitation can help get your student loan out of default. By getting your loan out of default status, you won’t have to worry. They won’t garnish your wages or withhold your tax return.

Contact the IRS

The TOP allows the federal government to seize payment of your tax refund. They do so to clear your federal debts. But, you will receive notice before they offset your tax. Once you receive notice, you have 65 days to appeal to a tax offset.

To appeal the tax offset, you will need to contact your creditors directly. If you do not receive notice of the tax offset or you have any questions, then you can contact the IRS directly.

If you are successful at appealing your student loan garnishment, then you will be able to receive your tax refund.

What Can You Do if Your Refund Was Seized?

If you missed your opportunity for a review or your refund was already seized, you can still contact your loan servicer to see if you can receive some or all of your money back. Loan servicers have their own policies in place for how to handle these situations.

If your loan is shown to be in default by mistake, you can contact the Department of Education to have your tax refund returned. You will also be able to have any errors corrected.

If your loans are in default but you cannot afford to not receive your tax return because of financial hardship, you can apply for a hardship refund. Unfortunately, only certain situations will qualify you for a hardship refund. These include:

- Being in active bankruptcy that includes the student loan

- The loan doesn’t belong to you, to begin with

- You’re permanently disabled

- The loan isn’t actually enforceable

Ask your loan servicer for a student loan tax offset hardship refund form or call the Treasury Offset Program at 800-304-3107 to begin this process.

Conclusion

Federal student aid debt is becoming an increasingly worrying crisis. The total amount of student loan debt has skyrocketed since 2009.

You must avoid debt at all costs. But if you do find yourself with debt, learn how to manage it.

Never ignore your debts. Creditors will do everything they can to recover their losses. The federal government has many methods available to recover your federal student loan debt; tax garnishment is one.

To protect yourself from these repercussions, make sure your loan stays out of default. Following these guidelines, you will know how to stop student loans from taking your taxes.

Let’s Lower Your Student Loan Payment

It’s super simple to see what you’re eligible for, and our trusted team can get you set up today

You must have wondered how to stop student loans from taking your taxes.

Well, with the right information and processes, you can do just that. Today, start the road to a debt-free future!

Do you have questions or advice on how to stop student loans from taking your taxes? Comment them below!

Up Next: Student Loans Sallie Mae: Everything You Need to Know

Editor’s Note: This post was originally published in December 2017 and has been updated for quality and relevancy.

Hey Shaqueena! That sounds like a super frustrating situation, i’m sorry you’ve had to deal with that!

We’d love to help you get your student loans back on track. The easiest way to do this would be through a quick phone consultation so we can fully understand what’s going on with your loans.

Please feel free to call us at 877.433.7501 or simply click this link to pick a time: https://meetme.so/kristinvogel

Hey William. We’d love to help you pick out a repayment plan. The quickest way to get started is to simply give us a call and go through a short consultation. The number is 877-433-7501 or you can click this link to set up an appointment: https://meetme.so/kristinvogel