One key issue for the 2016 US election, is the default of debt by over 7 million students.

Lenders have trapped many with the financial burden, mainly because the careers they studied for, never came into existence once they were qualified.

Example:

If a firm lends out $200,000 for a qualified anthropologist, but there are not many job openings in the field, then the student still carries the debt, while not achieving the dream career they had hoped.

The Overall Consequence

At the moment, there’s an estimated 44 million Americans who are up to $1.3 trillion in debt (an average balance of $30k for each student).

16% of students have now defaulted on their loans – with costs of up to $125 billion so far in the nation’s budget.

The problem only seems to be getting worse.

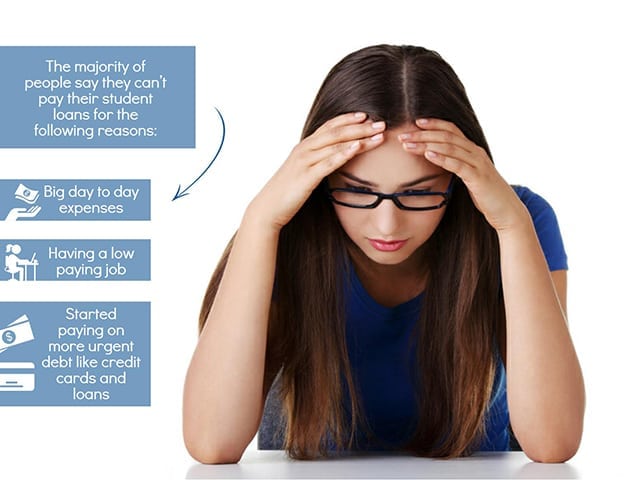

Why can’t the borrowers pay it back?

Some cases have been deliberate, where students felt angry and cheated from the situation, however for others the scenario is unavoidable due to the following factors:

- Not getting the desired salary and job, and instead turning to unskilled and low paid work.

- Many have just remained unemployed and moved back with their parents.

- The rise in the cost of living means they can’t afford to meet all their financial obligations.

One example of an angry student is Mr. Osborne, who studied to be in the health-care industry, and is now 45 with still no hope of getting his ideal career choice.

He stated, “Why should I give them a cent, for not delivering on a job promise that won’t ever happen?”

Effects on economy

Signs that high numbers are going to default on debt inevitably meant a much-weakened economy and was a similar story for the bankers in 2008 when the biggest recession during peace time was caused – since the 1930s depression.

These factors mean a large hole in taxpayers money, damaged credit that can spread across many markets, and citizens having little to no opportunity of saving and spending for their future (causing large and small businesses to suffer from low profits too) – effectively causing stagnation and no growth.

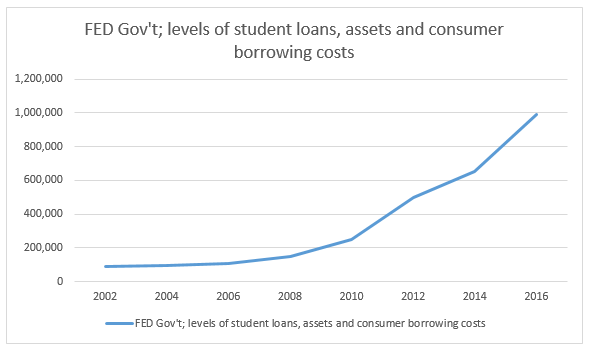

A graph analysis:

A look at the figures:

Since the 2007 financial crash, you can see that the burden of borrowing has increased drastically for the taxpayer, with no signs of a drop – even through times of economic austerity and recovery.

What the Fed has tried to do

The Obama administration has provided programs to help students by offering discounted monthly repayments and providing help to get their finances back on track (in some cases, even reducing the debt amount owed).

Also, for those who can prove of being defrauded by misleading school advertisements, the program can write off debt as well.

A more controversial move

The Fed has also made subsidiaries for borrowers’ wages, which has cost a further $515 million in the last nine months – meaning more excessive costs to the general taxpayers.

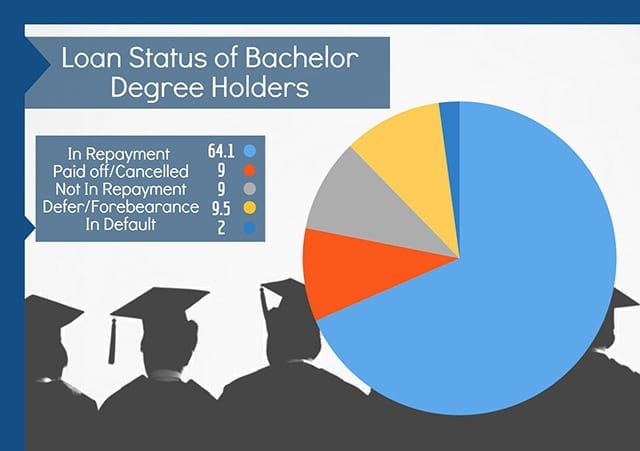

A pie chart showing the loan status of Bachelor degree holders, from 2009

Analysis:

This chart only displays a small slither of loan defaults, who would’ve been students that started studies around 2003-04 (and the data collected was only a year after the course had finished).

But another survey conducted another four years later didn’t show much change in the situation – which found only a small 2.4% of degree holders had defaulted.

These figures show that…

Although the fear of 7 million students being in debt has been hyped up in headlines, the problem could potentially be a case of fear-mongering with no basis, and for those who have defaulted could’ve also been for these reasons:

- Students may not have passed exams to achieve the degree.

- Many may have had high expectations, to begin with, and thought could walk into a high-end job – with no efforts to start at the bottom and climb the career ladder.

- The career choice didn’t match their expectations.

- Others may have just chosen not to repay their loans.

- Left in the middle of studies to work full-time or care for a sick relative.

Each person’s circumstance can’t necessarily be generalized into one problem, which can make it much more problematic for the Fed to resolve.

Behavioral scientists

The education department has witnessed a little change in loan defaults over the last few years and has now hired experts to get answers on getting information from borrowers, by testing things like time of day to send messages and the language used in emails.

Even the deputy secretary, Sarah Bloom Raskin, has engaged with students, to get ideas of what new policies can help the situation.

She says that patterns are all too similar to homeowners from the last recession, which needs urgent attention.

How much debt do students default on?

Collectively there’s a huge chunk owed between students.

The average student loan debt per head is $8,900.

If we go back to the Osbornes’, they studied at Abdill Career College Inc. (a school in Medford, which makes a small profit).

After they graduated as medical assistants in 2011, even though they had certificates, they were unable to find work.

Mr. Osborne was unhappy with the exaggeration of job likelihood and that the classes were of low-quality.

“They should have extended the debt, or been more honest about the jobs that are in weak demand,” he stated.

He trained to be a phlebotomist, who typically earn $32,000 a year (said by the Labor Department), and 1 in 5 borrowers from Abdill have defaulted on their loan in 3 years.

This brought up the default rate to around 20%, whereas usually, the national average is 12% from colleges.

The owner from Abdill refused to comment, but did confirm the Osborne’s did study at the school – privacy laws restrained her from discussing details of their time there.

She stated, “We have now lowered tuition fees, and now prioritize students for finding jobs at the end of the course.”

Mr. Osborne currently…

He works for a solar-power firm, and earns $13 hourly in sales; his wife is a maid.

Although there are loads of reasons to be angry at the situation, officials are still very unsure on how many students are refusing to pay or just simply cannot afford it.

Another student story…

Jim Lopko, from Illinois, said that his interest skyrocketed on his balance, and wasn’t able to pay it back.

His student debt is over $122,000, which is a combination of federal and private loans.

He graduated from one course, but dropped out of the other (a bachelor’s program).

He could no longer do the second course as he had maxed out on his federal loans while being denied access to private borrowing.

Jim is now in default on both federal and private loans, with debt collectors now calling him daily – the stress and anxiety make him ignore calls.

Living in a Chicago suburb, and now on $32,000 a year salary as a customer-service agent.

He says: “I would only resolve this situation by either finding a job paying over $300,000 annually, or winning the lottery.”

Jim defended his splurging spending habits, though:

“I can’t have a life and never go out because I got to pay these loans?”

As he recently took out a new loan for a Subaru WRX and a one-bedroom apartment.

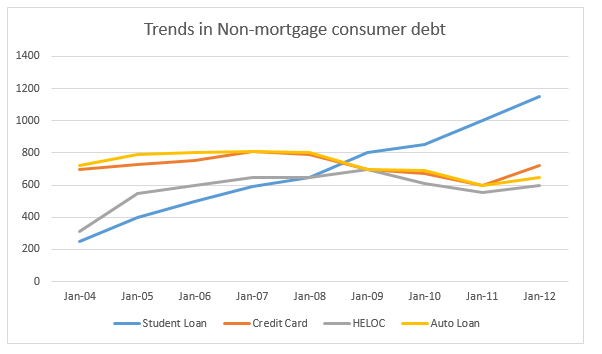

Comparison of Student debt vs non-mortgage consumer lending sources:

As you can buy the chart trends, Student debt has risen solidly through the recession, whereas other lenders lost growth through the credit crunch in comparison.

Looking at policy review:

Seeing both sides of the argument, from students and the Fed, you can see many students were duped onto some courses and are then weighed down by a lifetime of debt.

The policy should ensure that schools are very honest with regards to the outcome of their courses, and for those that can prove they been misled should have the student loan written off.

However, each would be different in how they approach education, and should take the responsibility to do thorough research on their subject choices before going on the course.

Ways to research a course before getting started:

- Always check the state of the industry you are hoping to get into.

- Most markets have a form of online presence, so sign up to blogs and websites to get independent information; it won’t be biased in the schools favor when advertising places.

- Read and ask questions on forums; there’s many online who will share their experiences.

- Check the school’s website and look for any feedback from previous students (they may even disclose where they are now, after attending their Bachelor’s).

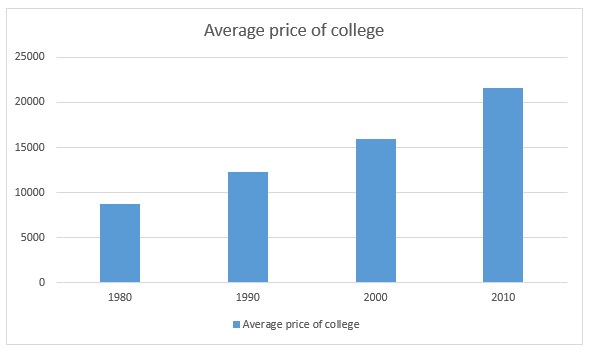

Average price of a 4-year college course:

Graph Analysis:

There’s no question that student debt has risen drastically over the last few decades, and it doesn’t look like it’s going to come down anytime soon.

In conclusion

Cases like this should not put you off on going to college, instead, do your homework and know what’s going on in the market exactly – at least we can learn from the mistakes of the past.

What are the qualifying requirements for student loan forgiveness? I am a chiropractor and work for a privately owned clinic. I am on an IBR plan on my federal loans, and stuggling with my private loans. I am trying to find a legitimate company to consolidate my private loans and better manage my finances. Can you help or direct?

Hi Raul,

The best way to get to know your options and if you qualify for loan forgiveness or not based on your type of loans and current place of employment is by talking directly to one of our expert credit counselors about your case. They will be able to provide all the information you need. Please contact us at 877.433.7501 whenever you can 🙂 we are located in Tampa, FL. Our hours of operation are: Monday-Wednesday-Friday from 9am-6pm EST and Tuesday-Thursday from 9am-8pm EST

If we are unable to consolidate your private loans, we will gladly direct you to someone / another company that could help you. Just give us a call and hopefully we can get you all the answers you need.

Thank you!

Carla.

Sera posible que esta información este disponible en español.

Hola Selena, buenas tardes!

Gracias por tu mensaje… lamentablemente la mayoria de la informacion que tenemos en nuestra pagina esta toda en ingles, pero tengo buenas noticias.

Yo soy Venezolana, y hablo espanol, y puedo ponerte en contacto con varios de nuestros representantes de habla hispana que trabajan aqui y ellos pueden responder cualquier de tus dudas y preguntas. Tenemos gente de Puerto Rico, Costa Rica, Argentina… de todas partes… que estarian felices de hablar contigo y aconsejarte y darte opciones de como manejar tus prestamos de estudiantes federales, y si necesitas, ayudarte a calificar a programas de pago que disminuyan tus montos mensuales. Por favor comunicate con nosotros al 877.433.7501 y pide hablar con alguien en tu idioma… o si prefieres, mandame un correo a mi directamente, con tu nombre, numero de telefono y la mejor hora para llamarte 🙂 mi nombre es Carla y mi email es cdubis@usstudentloancenter.org

Muchas gracias

If the interest rates weren’t so ridiculous, maybe it would be easier to pay back. Better yet just drop all interest off and give us a chance to pay it back. It’s killing my credit rating. I just can’t afford to pay it back.

Hi Connie! Thanks for your message,

I am so sorry to hear about your credit taking a hit from your student loans, this is actually something we see all the time, and even though here at USSLC we focus mainly on student loans, we also help people like yourself improve their credit score by directing them to our trusted partners of NCF :)… Our trusted sister company “National Credit Federation”, handles cases like yours on a daily basis. If you want to check out their results page, you will find over 1,000 testimonials from happy clients, some that were on your same position, that they helped with their finances and improve their credit scores in record time :).. check it out here: https://nationalcreditfederation.com/results-2/ their direct line 877.720.7587… You should call them sometime, and ask for either Joe G., Monique or Krista, they are a kick ass team of credit counselors that handle stuff like this on a daily basis 🙂

If you have any questions about your student loans on the other hand, contact us at 877.433.7501 …

Thank you so much and I hope we can help out somehow!

How does this work with NAVIENT?

Hi Debra! Thank you for your message,

Each case is different, all your options and availability for income based repayment programs or loan forgiveness depend on your individual circumstances and type of loans…

I suggest you get in touch with one of our student loan counselors, who will ask you a few questions to get to know you and your particular situation and will be able to suggest the best options for you depending on your specific needs… Please do not hesitate to call us at your earliest convenience, our main line is 877.433.7501

We are located in Tampa, Fl and our hours of operation are the following:

Monday-Wednesday-Friday

9am-6pm EST

Tuesday-Thursday

9am-8pm EST

If you prefer, you could email me directly, send me your name, email, phone number and the best time to call you and I will personally make sure one of our reps calls you asap. My name is Carla and my email is cdubis@usstudentloancenter.org

Thank you and have a wonderful day

In other occasion I Call for información and never complete the process. Send me information about the different option to resolver this.

Hi Andrea! Thank you for your message

Do you want us to get in touch with you sometime today or this week to resolve this issue or do you prefer to call us to discuss this matter?

You can call us directly at 877.433.7501 and ask to speak to a student loan counselor who can help you with your case…. our hours of operation are:

Monday-Wednesday-Friday

9am-6pm EST

Tuesday-Thursday

9am-8pm EST

If you prefer someone from our office to call you directly, please send me your name, email and phone number with the best time to call you to cdubis@usstudentloancenter.org and I will make sure someone reaches out to you as soon as possible.

*We do have Spanish speaking reps, just in case you would rather speak to someone in Spanish 🙂

Thank you! Hope to hear back from you

I have the same problem. Because my ex didn’t pay my loans for 3 years, so much was added in fees that the minimum payment can’t be met but I do pay something which doesn’t matter to them. My loans are still in default and I am single. I work for the government and hope I can get on the public service program with a payment I can afford. Is should allow us to deduct all and nit limit the amount.

Hi Connie,

Thanks for sharing your story, I am sorry you’re going through all of that and I hope you can find the student loan debt relief you need! We help people with similar stories like yours on a daily basis, we not only assist our borrowers qualify for income based repayment programs, but we also help them apply for public service loan forgiveness programs if they qualify… Each case is different and your options vary depending on your individual circumstances. If you have any questions and need assistance, please do not hesitate to contact us :)… Our reps would gladly direct you on the best path to achieve some relief from your student loans.

Our main line is 877.433.7501 … we are located in Tampa, FL and our hours of operation are the following:

Monday-Wednesday-Friday

9am-6pm EST

Tuesday-Thursday

9am-8pm EST

Just reach out whenever is convenient for you!

Thank you so much, good luck with everything and have a wonderful day!

I went to a certificate school for welding. I graduated and had issues finding jobs in my area. I currently pay my private loans of nearly $300 per month, but can’t afford to also pay my federal loans of over $300 per month on top of a car loan, mortgage, utilities, and keeping food on the table for the family. I’ve tried to consolidate those loans into one payment per month, but nobody will consolidate unless it’s a degrees course. Going to school was the worst financial decision of my life.

Hi Nathan,

Thanks for sharing your story, I am sorry you’re going through all of that and I hope you can find some financial relief soon!

I can totally sympathize with you! I was going through something similar, and add to that almost $500 a month car insurance after 5 car accidents in 3 years! Which 4 were not my fault, but since FL is a no fault state I was equally penalized… so I hear you with having so many debts every month that makes it hard to …well…live! But on the positive note, there are ways you can reduce your Federal Student Loan payments…

We help people with stories similar to yours on a daily basis… We help them qualify for Income Based Repayment programs, which base the amount of money they pay a month on how much money they make… I think you may benefit by looking into some of these programs…. in only some cases, if the person works for a non for profit or government organizations or they are in the public service, they could qualify for a special loan forgiveness program…

Each case is different and your options vary depending on your individual circumstances. If you have any questions and need assistance, please do not hesitate to contact us :)… Our reps would gladly direct you on the best path to achieve some relief from your student loans. Maybe we can find a way to consolidate those loans… don’t give up yet! Talk to us first please…

Our main line is 877.433.7501 … we are located in Tampa, FL and our hours of operation are the following:

Monday-Wednesday-Friday

9am-6pm EST

Tuesday-Thursday

9am-8pm EST

Just reach out whenever is convenient for you!

Thank you for your message Nathan, good luck with everything and have a wonderful day!

Thank you for sharing this information. Have you heard of a program called student loan Forgiveness, If so, is a legitimate company? I was told by a representative of student loan Forgiveness that my payment on a 90, 000 dollars student loan would be 45.00 a month for 10 years. Once I’ve paid on my loan for 10 years, my student debt would be forgiven. Is this possible?

Hi Victor!

Thank you for your message and we’re happy our information was helpful to you.

Let me start by saying, that you need to be careful with what kind of representatives you are speaking with trying to offer you “loan forgiveness”. We hear so many people telling us that someone out there offer them “obama’s loan forgiveness program” just to try to scam them …First of all there is not such a thing like Obama’s forgiveness, and even though THERE IS something called Public Service Loan Forgiveness, it is not for everyone who has student loans… so if someone is making you promises, please be careful, and talk to us first before making any decisions.

The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. But you need to know if you are working for a qualifying employer… We can help you.

Public Service Loan Forgiveness is very complex, there are many loopholes, and even though it is tricky is definitely NOT impossible to qualify… but you have to meet a lot of requirements in order to qualify.

Please call us to discuss your individual case and your options. We will answer any of your questions and give you the best option for you based on your individual circumstances.

Our main line is 877.433.7501 … we are located in Tampa, FL and our hours of operation are the following:

Monday-Wednesday-Friday

9am-6pm EST

Tuesday-Thursday

9am-8pm EST

Just reach out whenever is convenient for you!

Thank you and good luck with everything. Have a wonderful day!