Wells Fargo was accused of charging illegal late fees to student loan borrowers and has been ordered by the CFPB to pay a settlement of $4.1 million.

Wells Fargo’s student loan settlement

Wells Fargo has faced accusations that they have charged student loan borrower’s illegal late fees, a charge which the bank has yet to confirm or deny.

While students are given a 6-month grace period before they are required to start payments, Wells Fargo issued borrowers with a late fee on the last day of their grace period.

In addition to the illegal fees, there are also accusations that Wells Fargo failed to provide critical information to borrowers as well as failed to report inaccurate credit report information.

The $4.1 million settlement includes $410,000 fund for borrowers and a $3.6 million penalty.

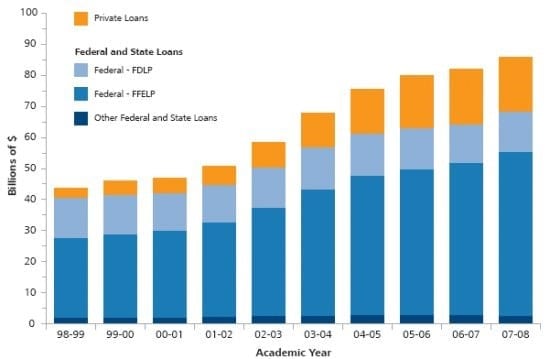

The following graph gives a basic comparison between the various student loans:

Investigation by the Consumer Financial Protection Bureau

The CFPB found that last year 8 million student loan borrowers are in default on their loans at a total of $100 billion.

Student loans are currently the second largest debt held by consumers with a total of $1.3 trillion now owed by borrowers of federal and private loans.

The CFPB found that Wells Fargo processed payments made to them in a way that left their borrowers paying more in fees.

The system that they used meant that if payments did not cover the amount due for all loans held, then it would divide payments amongst all loans held.

This dividing in payments was done in a way which increased fees, rather than pays off money due.

The CFPB stated that borrowers should be able to rely on their lenders to process payments and provide accurate information.

Wells Fargo has assured that they have corrected the problem and that the fees applied were due to an error in the systems coding.

Private Student Loans

Students will typically turn to private loans when they continue to need funds but they are no longer eligible for a federal student loan.

Federal Loans offer interest rates in comparison to private loans, as well as providing increased protection and are available to all regardless of financial circumstances.

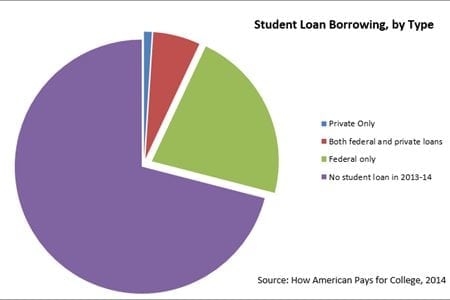

Student loans by private lenders only accounted for $100 billion of the total $1.3 trillion of student debt owed.

However, students mainly turn to private lenders when they already have a high level of debt via federal loans.

To understand the comparison between the various kinds of student loans, here is a graph:

Federal vs. private student loans

Federal student loans are funded by the Government whereas private student loans are funded by a school, bank, agency, or credit union.

Federal student loans:

- You will not be required to start repaying your loan until you either change your enrollment status to half time or leave education/ graduate

- Interest rates are fixed and often lower than private lenders

- Undergraduate who has financial needs can apply for a subsidized loan which means the interest is paid by the Government

- A credit check is not required for federal loans and can help increase your credit score

- In the majority of cases, you will not need a co-signer

- Interest might be tax deductible

- Loans can be consolidated

- If you struggle with repayments, you may be able to lower your payments or freeze your loan

- No prepayment penalty fees

Private student loans:

- Some private lenders will require you to make payments while still in education

- Interest rates will vary amongst lenders and can be as high as 18%

- Private loans are never subsidized

- Some private lenders will require borrowers to have a good credit rating; your credit score will have an impact on the total cost of your loan

- A co-signer may be required

- Interest might not be tax deductible

- Loans cannot be consolidated

- If you struggle with repayments, you might not be able to lower your payments or freeze payments

- There might be prepayment penalty fees

Conclusion

Wells Fargo is facing accusations of illegal fees, not giving out information, and not reporting inaccurate credit information.

Wells Fargo has been charged $4.1 million as part of a settlement by the CFPB.

The $4.1 million settlement fees are split into two parts, $3.6 million is a penalty fee, and $410,000 will be given as refunds to borrowers.

[tweet_box design=”default” float=”none”]The CFPB has found that a significant amount of students defaulted on their loans last year, and student loans are the second highest debt held by consumers.[/tweet_box]

Wells Fargo systems processed payments in a way that increased the total fees paid by borrowers instead on maximizing the amount of their loan they paid off.

Wells Fargo has stated that they have resolved the issue that they have blamed on a coding error.

I felt like a school is not accredited should be sued by the students for misrepresentation, and I am a victim of ATI COLLEGE OF MIAMI.

Can you help me with my student loan

Hey Tracy,

We have plenty of experienced loan counselors that can help! Give us a call at 877-433-7501!

How do I sign up, I have many students loans that there is how way I can pay back. Help.

Our loan counselors can help steer you in the right direction Velva! Give us a call at 877-433-7501

Yes I too have been a victim of unrealistic debt. I was told that a ridiculous 60% of what my agreed payments go to are just for the interest part of paying back the loan through Direct loan which are by what I understand to be named something else now. That means less than 40% pays for the principle. I have no way of paying this back and have no assets either. I do know what to do.

I am also a member of a Wells Fargo branch that for now I’m also not on good terms with all because of how I believe those corporate executives create policies to hide behind saying that they can hang on to our money for several days if there is an issue with the third party signature, (Hang on to my hard earned money because there is something wrong with a signature that happens to come from the largest electrical contractor in the nation……..You can just appreciate the IRONY!!!)

WOW , I mean really guys if you’re not busy taking peoples money one way you’re happy to hold on to peoples hard earned money another kind of way. What kind of bank are you people running

I went to school & I now have 65,000.00 debt that I can’t pay. My credit is shot

go check into student loan forgiveness

How do I find out if this affects me?

Here is the Press release from the CFPB and the actual report: https://www.consumerfinance.gov/about-us/newsroom/cfpb-takes-action-against-wells-fargo-illegal-student-loan-servicing-practices/

I wonder if I am apart of this because I have loans with them.

Hey Alicia,

Here is the Press Release from the CFPB and the full report. I hope this helps with answering your questions!

https://www.consumerfinance.gov/about-us/newsroom/cfpb-takes-action-against-wells-fargo-illegal-student-loan-servicing-practices/

Student loans are bad enough for low income families. Then the banks rip you off even more. So done with 5he poor getting poorer while the rich get even richer

I wish I’d never gone back to school. I never got what I was told I would receive and now my credit is shot. I’d love to be out of default but not working isn’t letting that happen as well as my health has declined as well.

How do I make sure I get a refund?

Hey Lori,

Here is some more information on the settlement: https://www.consumerfinance.gov/about-us/newsroom/cfpb-takes-action-against-wells-fargo-illegal-student-loan-servicing-practices/

If that doesn’t answer your questions, try contacting Wells Fargo and see if you are eligible for a refund.