If you plan on going to school to become a doctor, then you will be ‘enjoying’ some of the heftiest debts in the world.

Medical courses are expensive, and you’ll be in school for an exceedingly long time. While being in the medical industry does pay a substantial salary, there is no guarantee that you will be able to score yourself a job quickly.

This means that you are going to be dealing with debts that may take a while to pay back.

One of the biggest favors you can do yourself is to get on the right repayment plan. By doing this, you ensure that you’re paying back your student loan debt in the most efficient and timely way possible.

Let’s take a look at some of the things you should expect in terms of student loan debt when you graduate medical school. Then, we’ll dive into your best options when it comes to repaying those loans.

Student loan debt is different for doctors

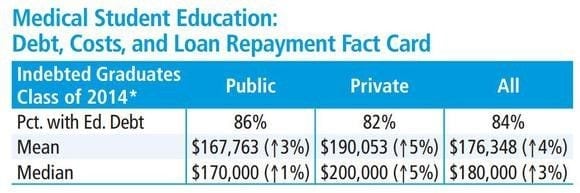

The chart below demonstrates just how much debt a person who studies medicine will have when they graduate.

Take a look at the numbers.

It’s a phenomenal amount.

Of course, you can go on to earn plenty of money, but it is still going to take a while to pay back the money that you have borrowed.

Remember: most medical students do not finish their education the second they leave medical school. They will need to obtain additional qualifications, and the cost of these will start to add up rather quickly!

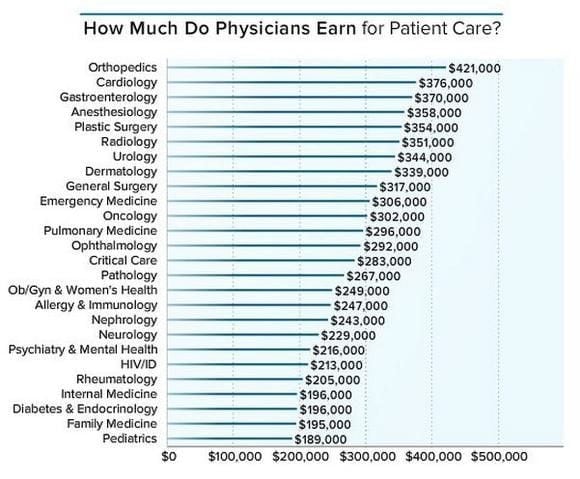

The chart below demonstrates the average salary that a person in the medical industry can expect to earn. However, it is worth noting that it is going to take a while for a student to even come close to the figures detailed here.

According to Chron, the average starting salary for a student is $177,000. A GP can expect to earn roughly $90,000. Which, when you compare it to the average student loan debt, is not actually all that much.

Generally speaking, with this amount of medical debt, and a 10-year plan on the loan, you can expect to be paying back $2,000 per month. As a result, many students are really going to be struggling to make ends meet for the first few year or two.

Salaries will go up eventually, and you will find it easier to pay back your loan. But during those first few months, you are going to have to count your pennies.

What are your options when it comes to paying back your student loans?

Of course, there are plenty of different options at your disposal when it comes to paying back your student loans. It would be particularly advantageous to reduce your student debt as quickly as possible. This will ensure that your interest does not get out of control.

Basically, life is going to be a whole lot easier for you!

An income based plan might be your best bet

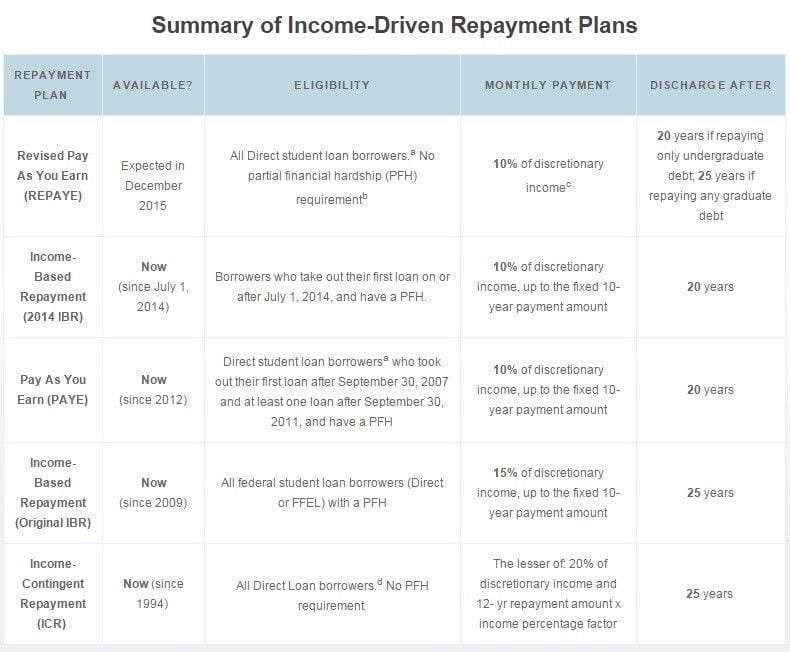

One of the most common methods for paying back any student loan, and we are not just talking about student loans for doctors here, is to look into an income based plan.

This repayment plan determines your monthly payment based on the amount you are earning.

You may need to talk to your loan provider to see how this will work for you. Here we’ll give you a brief overview of the options.

(Bonus Tip: Want to know even more about how to take advantage of Income Based Repayment Plans? Snag the free 8-Plan Cheat Sheet to go over all the Income Based plans in depth and compare them to the rest so you know you’re in the right plan for you and your lifestyle. Click here to learn more.)

Pay as You Earn (PAYE)

This is one of the new methods for paying back student loans. If you can prove that you need assistance paying back your student loans, then you will be paying back a percentage of your income each month.

You need to meet the following requirements:

- You must have obtained the student loan after October 2007.

- You must be able to prove that you need assistance.

- Your repayments will be calculated at 10% of your discretionary income each month.

Revised Pay as You Earn (REPAYE)

This is actually an updated version of the previous form of PAYE. However, it is worth noting that if you are married, then the REPAYE will be based upon the combined income of you and your spouse. It will also look to see whether your spouse has any student debts. This may not be the right option for everybody.

The loans that qualify under the REPAYE scheme are:

- All direct loans

- Stafford Loans

- Graduate PLUS loans

- Federal student loans if they have been consolidated into direct loans.

Income Contingent Repayment (ICR)

One of the major benefits of ICR is that your income is not going to be a basis for your eligibility. If you have been rejected for other income plans, then this is probably the best route to go down. You will be paying back 20% of your monthly income. This may be slightly higher than a plan you have in place already, so do make sure that you check.

The benefits are:

- Easy to qualify

- Repayment period is 25 years. After that, the loans will be discharged.

- You may be eligible for loan forgiveness

Income Based Repayment (IBR)

With this method, your repayments will be capped at 10-15% of your discretionary income. This will be based on when you obtained the loan. After 25 years, you may be able to qualify for loan forgiveness.

It is worth noting that your payments will be reevaluated every year.

This is great if you are a doctor as your income is going to change regularly. You want to make sure that you are always paying the right amount. This ensures that you have your debts cleared up quicker.

Source: https://www.ibrinfo.org/what.vp.html

Have you considered refinancing?

Refinancing means that you are going to get a new loan from a different lender. This loan will pay off your existing loans. So in the end, you’ll only have to keep track of one loan payment a month.

This might be a great option for you if you have a good credit score. It means that you are going to be able to obtain a fantastic interest rate on the loan.

However, if you have not been financially responsible, then you may find that refinancing your student loan may actually cost you more in the long term. The repayments may be more each month. If you fail to meet the payments on the new loan, then you are also going to have less options at your disposal for rectifying the issue.

Do you qualify for loan forgiveness?

Did you know that roughly 40% of medical students are planning to take advantage of loan forgiveness?

But, there are a few downsides and restrictions when it comes to forgiveness. You will need to work in certain public institutions. The amount of money that you can make will be limited, too.

However, many people love the fact that they are able to ‘help’ others, which makes this option brilliant.

In order to qualify for student loan forgiveness, you will need to meet the following requirements:

- You will have to work in an area of high need of medical practitioners.

- If not, then a public hospital.

- You will need to make 120 consecutive payments on your loan (10 years)

It is worth noting that this program, particularly in the medical industry, is new. The details are not quite ‘set in stone’ yet.

A Physician Sign On Bonus can be super helpful

With top physicians being in high demand at the moment, there are many hospitals who want to get their hands on you. They will offer a ton of incentives to have you work for them.

One of the main incentives, at least in relation to student loans, is a physician signing on bonus.

With this bonus, you will be given cash for accepting the job. This may be around the $25,000 mark, but some people (well, top physicians) have been able to negotiate up to $100,000. This is going to take out a good chunk of your student loan debt and, as a result, will be highly beneficial!

Would you ever work as an Army physician?

The military offers a plethora of different repayment options for those who choose to work for them. You are able to find out more about working in the military as a medical expert, as well as details of the financial assistance, on the army website.

Of course, it is worth noting that the salary you receive while in the military will be less than you could earn as a doctor. However, many people out there will not mind this!

There are three different options available to you when you work as an army physician:

- Financial Assistance Program: You will need to know you are joining the army before you sign up to medical school. If you enrolled in an accredited school, you will get up to $45,000 per year from the military. They will also give you up to $2,000 per month.

- Active Duty Health Professions Loan Repayment Program: Under this program, you will receive up to $120,000 for your loans. You must be in active duty. You will receive $40,000 each year.

- Health Professions Special Pay: This is for those people in the Army Reserve. You will receive up to $25,000 over the course of three years.

Navy Physician Options

It is not just the army who offers a program that you can benefit from.

The navy also has a few options:

- Health Professions Loan Repayment Program: Receive $40,000 per year towards your medical school loans. This is open to all medical students.

- Navy Financial Assistance Program: Medical residents can receive up to $275,000 over the course of years. There will be a grant of $45,000 each year. This comes in the form of monthly stipends at $2,200 per month.

Air Force Medical Loan Assistance

This program is similar to the Navy program.

You get a $45,000 per year grant for each year of your residency.

There is a monthly stipend of $2,000 per month.

Indian Health Services Loan Repayment Program

This is for American Indians and those native to Alaska. You will need to commit yourself to working at least 2 years in HIS facilities.

You will receive up to $40,000 towards your student loans.

However, you can renew your contract up to the point your loans are paid off.

National Institutes of Health Loan Repayment Programs

For this, you will need to work a 2-year contract at a non-profit research organization in the U.S.

You will be able to obtain up to $35,000 per year towards your student debts.

NHSC Loan Repayment Program

For this program, you will need to commit yourself to working 2 years on an NHSC-approved site.

You will receive up to $50,000 towards your student loan.

This is a tax-free sum and will paid out at the start of the contract.

Medical Loan Repayment Assistance – State

There are some states which offer loan assistance. You will need to look into how your state deals with this to find out more.

A good starting point is the NHSC website.

Conclusion

As you can see, there are several methods at your disposal when it comes to minimizing your student loan debt from medical school.

The last thing you want to do is drown in debt after you’ve graduated.

Your best bet is to thoroughly research your options and pick a repayment plan and career path that will help you become debt free.

What about other types of Doctors that went through the same amount of schooling and financial burden. I am a chiropractor. With the interest every month, i can never catch up. I owe over 300,00.

Hey Dr. Andrea A,

I can understand your frustration! The interest on your student loans can make it a very tricky situation. We’d love to see what we can to do help! Please give one of our experienced Student Loan Consultants a call at 877.433.7501