As expected, most people head onto a four-year university and apply for student loans.

The average of $35,000 takes quite a while to pay off.

During this time, many people will rack up other debts too.

All of this is very common.

You most likely have a debt of your own.

And so does your other half.

Under all the romance, marriage is law-binding.

So the question is, will you be marrying your fiancé(e)’s student loans and debt as well?

The Short Answer

No.

In most cases, you aren’t financially responsible for your spouse’s loans if they were incurred before marriage.

On paper, you won’t be affected.

Special Circumstances

If you sign as a joint account holder after marriage, the debt will become a joint debt (more on that later).

If the debt incurred is for a family necessity (i.e. food, medical care or shelter), it might also become a joint debt.

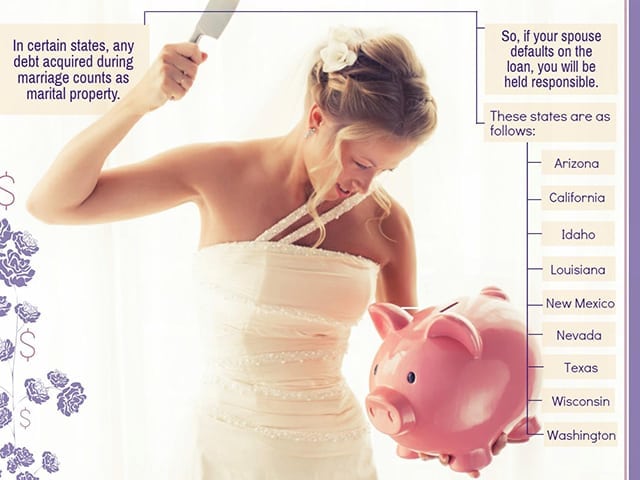

Some states have slight variations to the rules.

Community Property States

Researching your state laws is important.

In Alaska, you can choose to sign an agreement, turning assets into community property.

Marrying Into Bad Credit

Contrary to popular belief, credit histories remain separate after marriage.

What will be the effects on your credit history?

- Opening joint accounts: your score won’t be directly affected, unless your spouse has bad credit habits

- Applying for joint credit: your partner’s credit score might increase your interest rate.

- Co-signing a loan for your spouse: only co-sign if you are fully able to make the payments, when needed.

- Becoming an authorized user: your score will be hurt if the account was in bad standing initially.

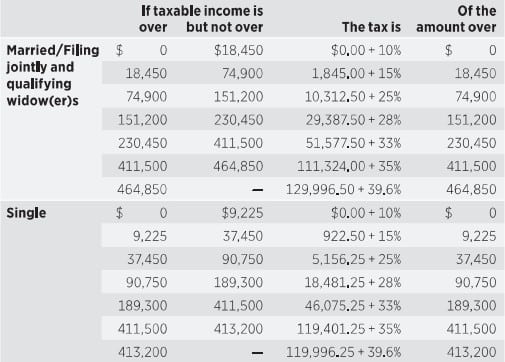

Filing Joint Income Tax Returns

There are benefits to joint income tax returns.

By filing jointly, many couples save by paying less.

Refinancing Or Consolidating Loans

Maybe you want to refinance or consolidate loans with your spouse into one account.

That was possible before 2006.

Now, it is prohibited by federal law due to problems during divorce.

Your loans must be refinanced or consolidated individually.

What About Nuptial Agreements?

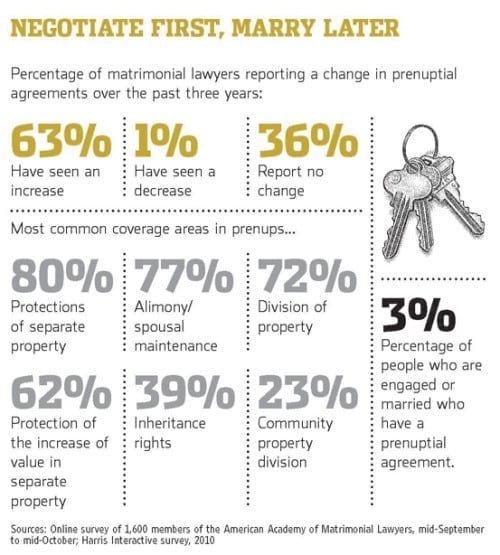

Prenuptial (before marriage) and postnuptial (after marriage) agreements are a controversial topic.

However, it’s on the rise and for good reason.

These are signed to exclude debts and assets from marital property.

You can agree on how to deal with debt and income.

The above chart shows the most popular areas covered in a prenuptial agreement.

An attorney should definitely be consulted for this.

A well-written nuptial agreement can provide a good foundation for your marriage.

It will also protect you in the case of a breakup.

A tax or consumer debt lawyer can also be of great help with loans and marital property laws.

Worst Case Scenarios

You might not want to think about these, but it’s still good to know what can happen.

After a divorce, both might still be responsible for joint debts.

Even if the other was ordered to pay, the creditor might still come for you.

You can return to the divorce court and receive a reimbursement if that is the case.

If your spouse passes away, loans with death discharge clauses will end.

All federal student loans have this clause.

Some private lenders do as well.

Otherwise, the widow or widower will be responsible for the debt.

More To It Than Responsibility

Even if you aren’t responsible, debt from either one will affect your budget and lifestyle.

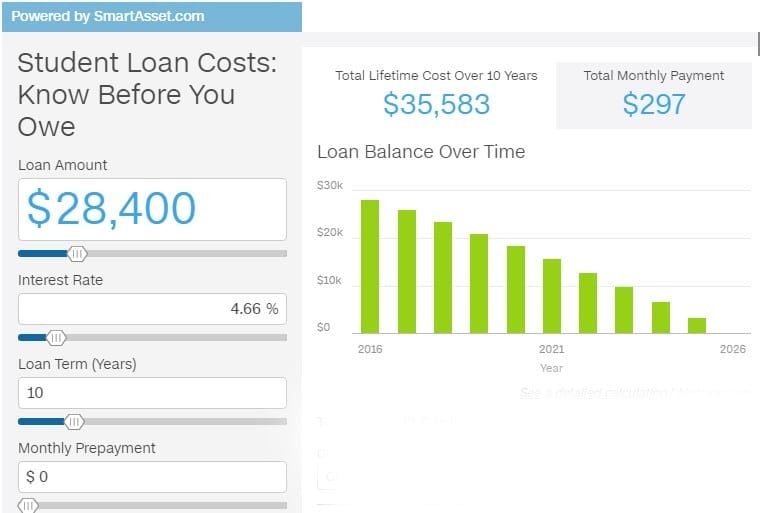

Below is a representation of student loan debt balance over 10 years.

Large chunks of money will need to be set aside for monthly repayments.

You might be the one responsible for monthly expenses during that time.

This might mean a lower standard of living until the debt is paid off. (Which will take years!)

Having The Financial Talk

It might be awkward to start this conversation, but you’ll be thankful you did it.

Look over each other’s credit history and reports.

Discuss whether the priority is paying off debt quickly, or having a higher monthly budget.

Learn about each other’s financial attitudes and habits.

Money is one the top reasons for fights.

It’s crucial for both you and your partner to be aware of your responsibilities.

Communicate with each other.

Plan and budget well and enjoy a loving and healthy marriage!

(Did You Know? The IRS can seize your tax refund if you are running late on student loan payments. Go through this BEFORE filing your tax return this year and see How To STOP Late Payments From Taking Your Tax Refund. Click here to learn more and get the free guide.)

[…] Individual debt such as college fees should remain separate. […]