Education Department Sued Over Student Loan Collection Agencies

The Department of Education, currently under the Obama Administration, is being sued because they refused to disclose important information and data on student loan debt collectors.

Let’s give President Obama a little bit of credit though, he has in fact tried to take several positive steps over the past few years to address the current $1.2 trillion and growing student loan debt.

He has pushed loan forgiveness and pay as you earn programs in an effort to help student loan borrowers reduce their high monthly payments. But then, he’s gone back and modified the policies, cut back funds, and put caps on the program after the amount of people that started signing up for the programs sky-rocketed.

Related: Obama’s Cuts To Education Funding

One thing that did not factor into Obama’s plans, though, was the amount of abusive debt collecting angencies that the Education Department hires to collect student loans debt when the borrowers are struggling and can’t pay.

According to a March report from the Government Accountability Office, over $94 billion of the nation’s student loan debt was in default as of September 2013. And the percentage of people defaulting on school loans has increased steadily for six years in a row.

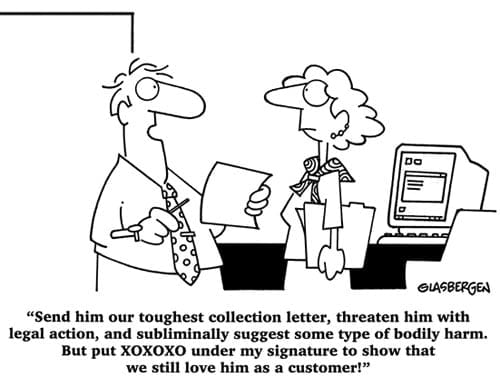

In 2011, the Department of Education paid private debt collectors $1 billion to try to collect on that debt—a number that is expected to double by 2016. The tactics used by those debt collectors range from harassing to downright abusive. In March 2012, Bloomberg reported that three of the companies working for the Department of Education had settled federal or state charges that they’d engaged in abusive debt collection.

In 2011, the Department of Education paid private debt collectors $1 billion to try to collect on that debt—a number that is expected to double by 2016. The tactics used by those debt collectors range from harassing to downright abusive. In March 2012, Bloomberg reported that three of the companies working for the Department of Education had settled federal or state charges that they’d engaged in abusive debt collection.

Consumer advocates have found that the debt collectors routinely violate consumer protection laws when trying to collect on student loan debt, which is especially problematic given that some of those firms are supposed to be helping borrowers “rehabilitate” their loans to reduce their debt burden. The student loan collectors have vast power, including the ability to garnish wages and seize tax refunds—tools not normally available to companies collecting ordinary consumer debt.

In March 2012, the Department of Education said it was reviewing the commissions it paid debt collectors in the wake of complaints that the contractors were abusing borrowers. But so far, there’s not much evidence that anything has changed. The GAO report found that the Education Department still does little to oversee student-loan debt collectors, and has done little more than provide “feedback” when alerted to abuses.

The National Consumer Law Center has been highlighting the problems with student-loan debt collectors for a few years now, and watchdogging the Department of Education’s work in this area. Or at least it’s been trying to.

Since 2012, the non-profit advocacy group has filed multiple Freedom of Information Act requests for information about the government’s relationships with student-loan debt collectors. But so far, the Obama administration has stonewalled the requests.

On Monday, after more than year attempting to peel back the secrecy around the debt collection contracts, the National Consumer Law Center filed a lawsuit demanding that the Department of Education comply with the Freedom of Information Act and release the data.

“Collection agencies routinely violate consumer protection laws and prioritize profits over borrower rights,” says Persis Yu, an attorney with NCLC. “Abuses by these debt collection agencies cause significant hardship to the millions of students struggling to pay off their federal student loans. Taxpayers and student loan borrowers have a right to information about the impact of the Education Department’s policy of paying outside debt collectors on the rights of borrowers. The Education Department should not insulate itself from public scrutiny.”

VSAC is a predatory lender. They raised my pmt from $40 income based repayment to over $370 in one day! I cannot afford this as I am on a fixed income and yet the feds do not care. The USDE should cease to exist. They serve no useful purpose in helping the public who is struggling with this economy and trying to pay back student debt. Fire the USDE!!!

Pam,

I am sorry to hear about this. I wouldn’t know for sure until we had a good look at your loan situation, but from what it sounds like, you have been mislead and they have raised your income-based payment illegally. This happens more often than you may think. That program is designed to give you affordable payments reflected off your current income, so the fact that they raised your payment by over $300 per month definitely raises some red flags. You have the opportunity now to get real help. We are not affiliated with the USDE and we have experts that have worked in the student loan industry for over 20 years. So, we know how to get through the mazes the USDE often puts students through. We would love to help you. Call us toll free at 844-345-4335 to speak to an expert loan officer today