There’s been a lot of noise from the media in regards to student debt being a bigger burden than ever on our society.

This burden could potentially harm any possible growth of the U.S. economy.

Those of you that have taken out a student loan know how crippling it can be for your future:

- A bad credit rating, which can stop you from taking out a mortgage or any further loans

- Unable to afford big purchases, like a new car or big TV

- Relocating to a new state

- Unrealistic circumstances for starting a family

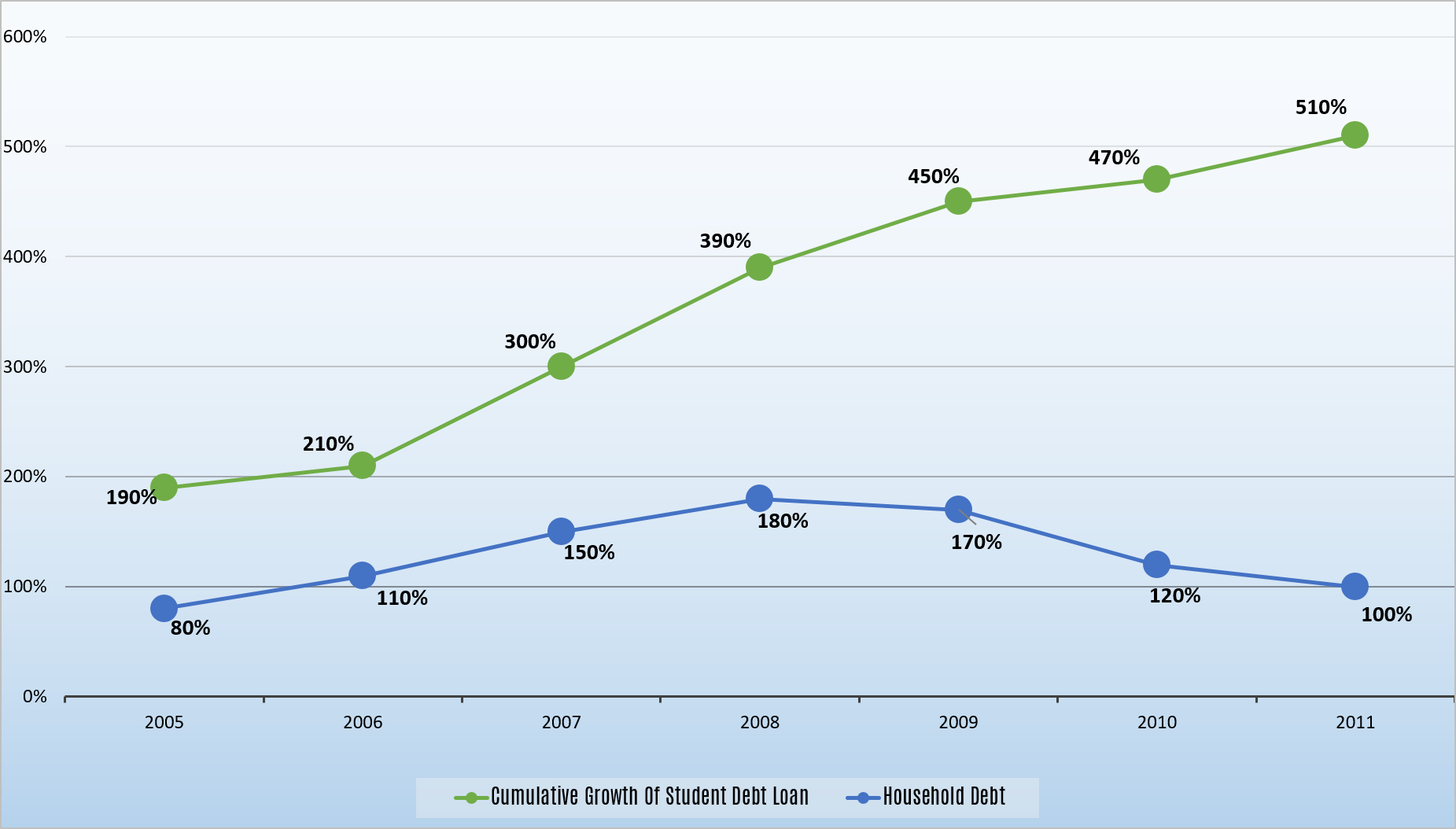

To highlight how things have gotten out of control, here is a graph that shows the amount of student loan debts compared to overall household debts from the years 2005 to 2011:

Unlike household debt, which begins to fall when the recession hit, student debt continued to surge in growth.

In Summary

Although this situation spells out disaster for the economy as a whole, the good news is that if you find yourself in heavy student loan debt, then there are some ways to get yourself out.

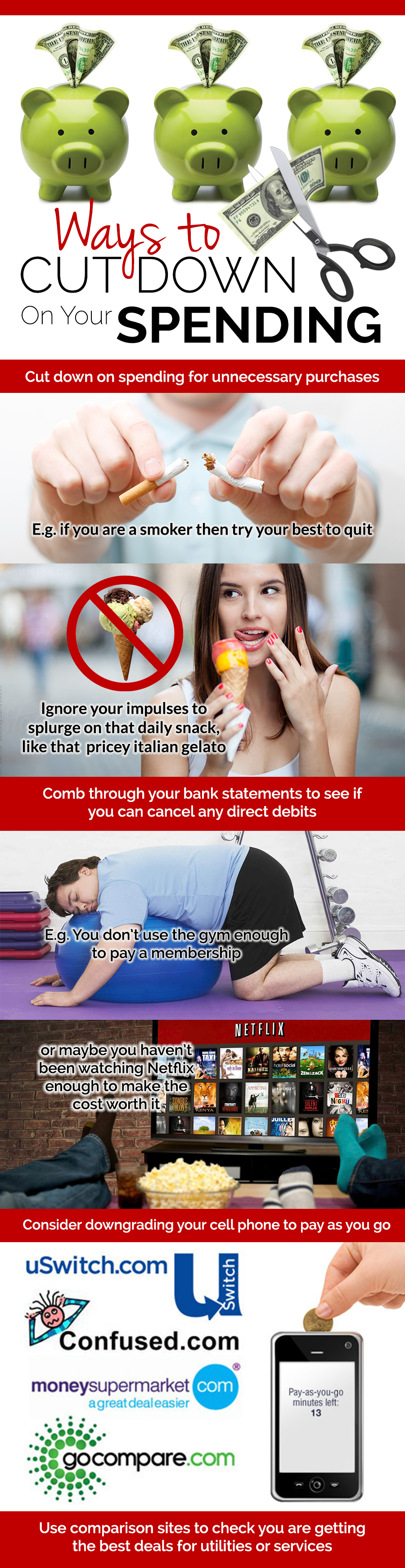

1. Make Cutbacks on Spending

There are so many ways you can do this, and it will all depend on your personal circumstances.

For example, if your cost of living is too high, then it’s feasible to consider moving back home so you can start fresh and begin to make real savings.

By looking deep enough, you’ll be sure to find ways of reducing outgoings.

2. Pay More than the Minimum

By paying more than the monthly minimum requirements, you’ll be able to repay your debts quicker.

If you follow rule #1 and cut back on your spending, make sure to put that extra savings towards your loan payments.

3. Use a Finance Calculator

Finance calculators are a great tool that can really help you see where your money is going.

Recommended Tool:

Finding where to make cutbacks or ways to find savings doesn’t mean spending hours with a calculator; this tool will do all the hard work for you, and in only a matter of minutes.

This platform will enable you to make financial goals, provide automatic comparisons for cheaper utility bills, and even tell you what age you can retire.

The best benefit is that you can turn financial goals into an engaging, fun activity – there’s no better fulfillment than hitting your targets and knowing you are getting closer to economic prosperity.

4. Increase your Earnings

If you’ve drastically cut your spending, but still aren’t quite reaching your target, then it may be a good idea to think about additional income.

If you aren’t happy in your primary job, then your secondary income may even advance to a new career change.

There are plenty of opportunities to earn extra money from the internet.

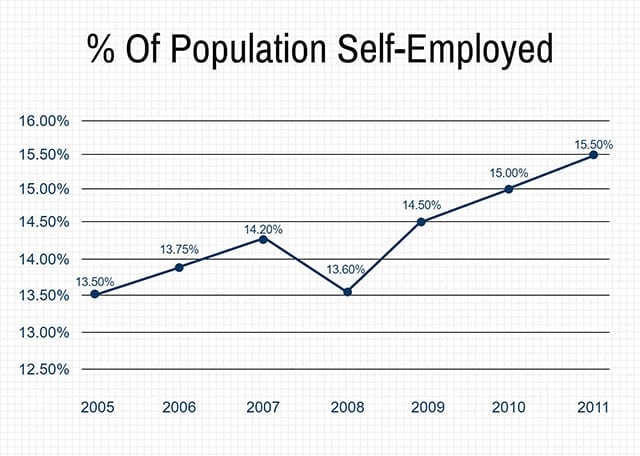

Since the popularity of online opportunities have exploded, being self-employed has hit record numbers over the last few years.

Here’s a graph showing the data for the USA:

Graph Analysis:

The line shows a dip where the recession occurred, but starts growth in popularity from 2009 and onward – mainly due to the population getting fed up of redundancies, and instead creating their own financial destiny.

5. Pay off Loans with Higher Interest Rates First

[tweet_box design=”default” float=”none”]

If you have numerous loans, then prioritize those with the highest interest rates to be paid off first.

[/tweet_box]

You could also consider a debt consolidation loan, which can reduce all your loans into one.

This can benefit you by simplifying all your repayments into one direct debt a month.

This will reduce your outgoings per month, plus it can bring down your interest rates.

Conclusion

Following these ideas will help to get you on the right path to being debt free by the time you are 30.

One more critical factor is your well being and state of mind – making cutbacks shouldn’t reduce your happiness.

Otherwise you will lose your motivation.

It is important to reward yourself whenever you hit a certain progress point.

E.g. If you saved over $400 in a month, then treat yourself to something special.

Leave a Reply