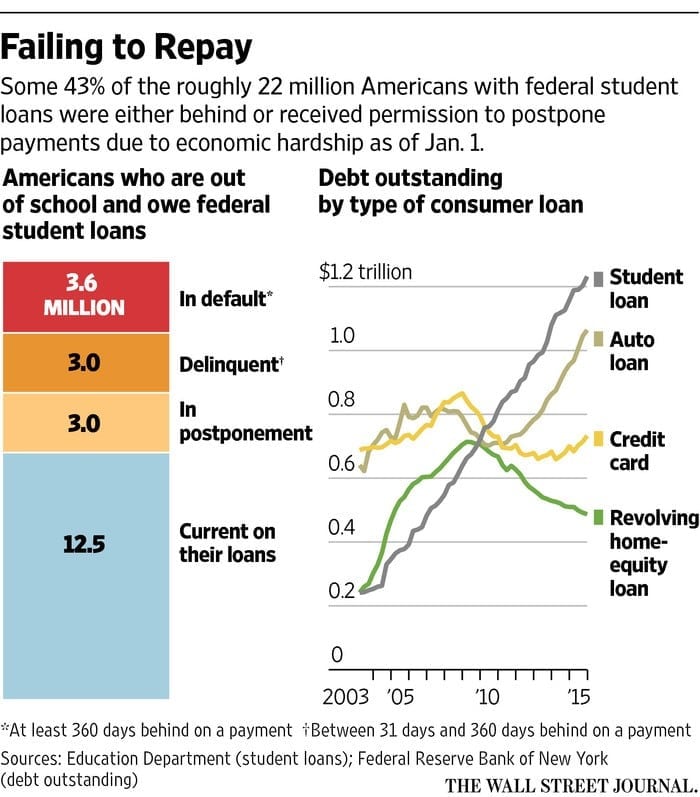

Some 40 million Americans have student loan debt.

Together, this amounts to approximately $1.2 trillion.

In 2015, the average graduate had $35,051 in debt.

However, not all borrowers make their payments on time.

The Cost of Post-Secondary Education

The cost of college has increased, but government grants have not increased proportionally.

As such, families are left with the responsibility and obligation to pay for college without the support of the government.

With household income being stagnant, students have two choices: borrow more or attend a low-cost college.

Depending on the study and the definition of excessive debt, more than 25% of students are graduating with excessive loans from their studies.

These graduates are more likely to delay major life events because of their debt.

Additionally, they are more likely to say that their education was not worth the cost.

Students who do not finish their degree are worse off than graduates, but studies are scarce on the details.

Changes in Delinquency and Loan Defaults

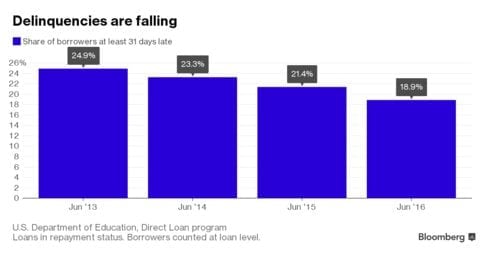

In the past three years, delinquency rates have fallen from 25% to 19%.

This is largely due to the introduction of income-based loan repayment programs.

However, 40% of monthly payments are still not made on time.

These loans are either late, in default, being postponed, in disability, or in bankruptcy.

Unfortunately, new defaults outpace the enrollment in the new income-based payment plans.

A delinquent loan does not automatically mean that it has defaulted.

The latter will only occur if no payment is made for 361 days.

[tweet_box design=”default” float=”none”]

Even though the delinquency rate is falling, the student loan default rate is up 2.7% from the beginning of the year.

[/tweet_box]

If a borrower has trouble making repayments, there are a few options available.

By switching repayment plans, the borrower can have a lower monthly payment.

Borrowers can consolidate several loans to have a lower interest rate.

The borrower may also ask for a deferment or forbearance in the case of an emergency.

What Loans are Available to Students?

Subsidized and unsubsidized loans are the primary types of federal loans.

Subsidized loans are available to undergraduate students, but only if they have demonstrated financial need.

The government pays the interest on the loan while the students are in school, during the grace period immediately after graduation, and, if applicable, during a deferment period.

Unsubsidized loans are available to all students, whether or not they have a financial need.

The student is responsible for paying the interest during all periods, including while in school and during grace periods.

PLUS loans are eligible to students and parents of students, granted they have a positive credit history.

The interest rate on the loan is fixed for the life of the loan.

When parents borrow on behalf of their children, the parents are legally responsible for repayment.

The Federal Perkins Loan is offered at eligible schools.

The loans have low interest rates and are available for students with financial need.

Undergraduate students can borrow up to $27,500, and graduate students up to $60,000.

Repaying or Forgiving Student Loans

Student loans have a grace period before the repayments begin.

The term and conditions of this period will depend on the loan.

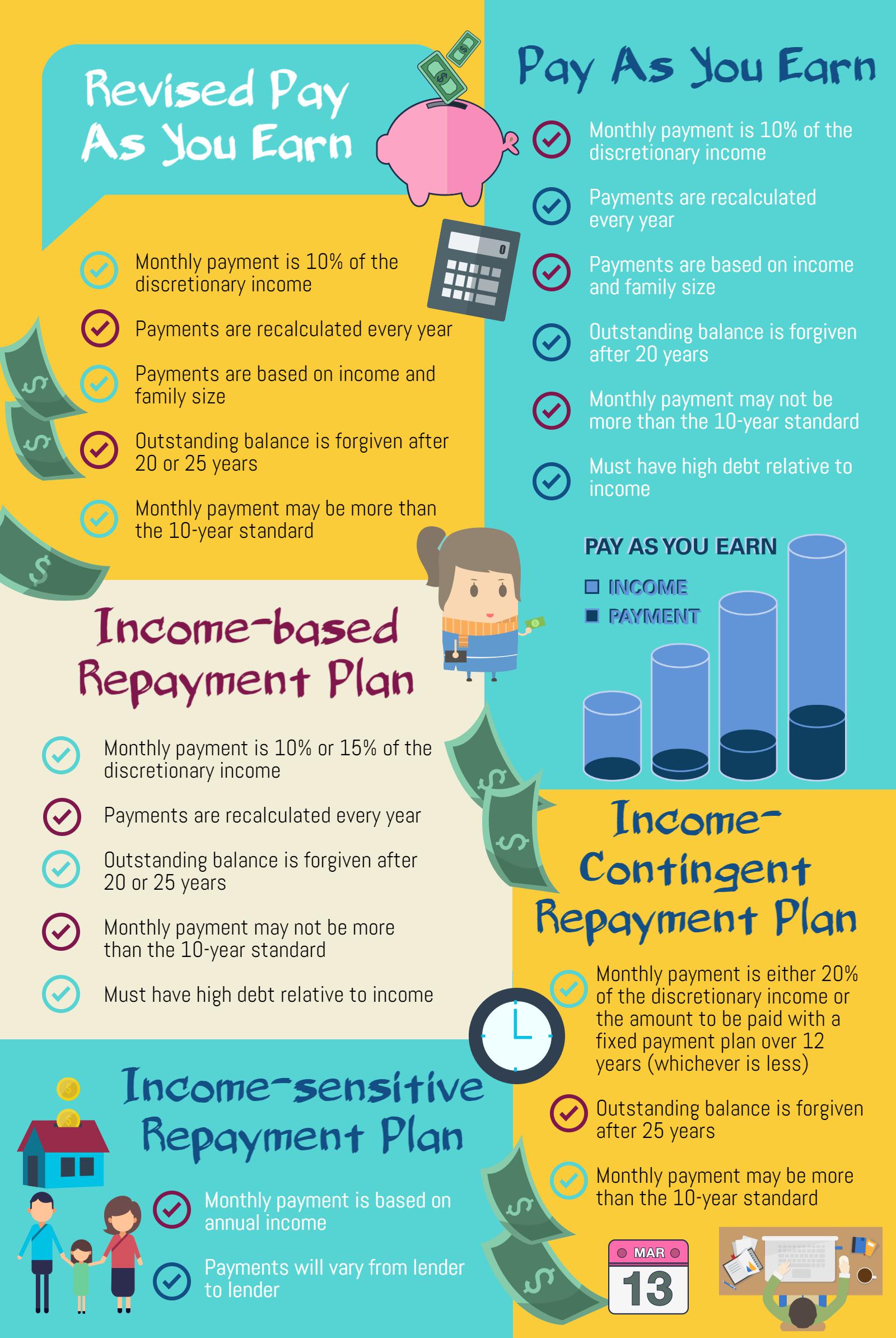

Additionally, the borrower can choose the repayment program that they would like to use.

To take part in an income-based repayment program, borrowers need to share their income with their loan providers annually.

However, for one of many reasons, some borrowers do not share the information.

As a result, those borrowers may be paying more monthly than they can pay, putting them at risk for default.

Income-based repayment programs require more time to repay loans.

Payments are generally made for 20 to 25 years, instead of 10.

As such, student debt is carried longer.

This can lead to lower household consumption, as well as a reduced number of new loans.

For some graduates, loan forgiveness may be a possibility.

Teachers are eligible for special loan repayment programs when they work in low-income schools for five years.

Some public service employees can have the remainder of their loan forgiven after 120 payments.

A Perkins Loan can be forgiven in full for Peace Corps volunteers, U.S. armed forces members, nurses, social workers, law enforcement officers, and others.

Take a look at the features of some Income-based repayment programs.

Bottom Line: Borrowers Need to Understand Their Debt

National awareness of student borrowing is the first thing required to encourage students to restrain their spending.

It is up to the government and schools to track the debt of graduating students.

With this information coupled with the known challenges of finding well-paying jobs, counselling should be improved to encourage students to limit borrowing.

Additionally, colleges should help students understand the implications of their debt.

Some experts suggest colleges limit the loans available to students based on their enrollment status and degree program.

Leave a Reply