Tuition costs are on the rise each year, far outpacing the rise in average annual income and inflation. Because of the rising cost of education, most students are taking out loans to pay for their education. This year, 66% of college graduates had some form of loan.

The U.S. collectively owes over $1.3 trillion in student loans.

If this number seems extraordinarily high, it is. And it’s always increasing.

That’s why it’s so important for students to understand what their loans will actually cost them in the long run.

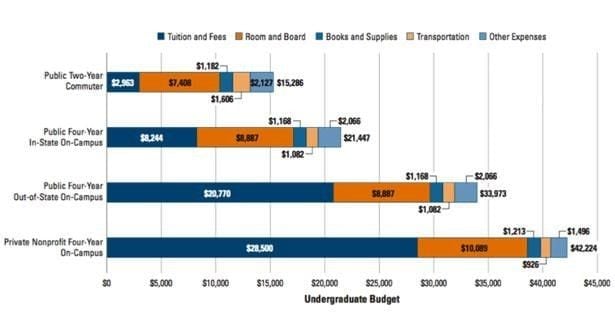

Understanding the Cost of Tuition for Public vs Private Universities

Both public and private universities offer financial aid, some more than others. It truly depends on each student’s financial situation and the resources available in their state and at their university. However, the average ballpark estimate of costs is a good metric to familiarize yourself with.

The average cost of a private school this year was almost $33,000.

You can expect a similar price if you’re attending a public school in another state.

For students in their own state, the cost is much less, usually around $10,000.

Grant money from the government and university itself will help cover some tuition costs, but not everything.

Students have three options for paying the rest of their tuition costs:

- Private loans. The interest on these will be high, but vary depending on the lender.

- Subsidized public loans. These are usually the best option, but aren’t always accessible.

- Unsubsidized public loans.

Costs and Benefits of Subsidized Loans

One of the pros of a subsidized loan is that the government will pay the interest during your deferment or forbearance period. You’ll also get a grace period of 6 months after graduation where no payments are due on your loans.

One of the cons is that not everyone will qualify for these loans. Graduate students and students of professional schools cannot qualify. Neither will students whose parents are determined eligible to pay for their tuition via FAFSA, but are not doing so.

The amount of money you can borrow annually is also lower than the limit for unsubsidized loans. For example, the limit is usually around $23,000 for your entire college career, but it varies annually depending on which year of school you are in.

Costs and Benefits of Unsubsidized Loans

Unsubsidized loans have higher annual loan limits than subsidized loans. This means you can borrow more money each year and overall throughout your college career, as needed.

Undergraduate, graduate, and professional school students can all apply for this type of loan. It is not great in comparison to a subsidized loan, but the interest rate is still much lower than the industry average for a private student loan.

An obvious downside is that you’ll have to pay interest while you are in school, and even during the grace period.

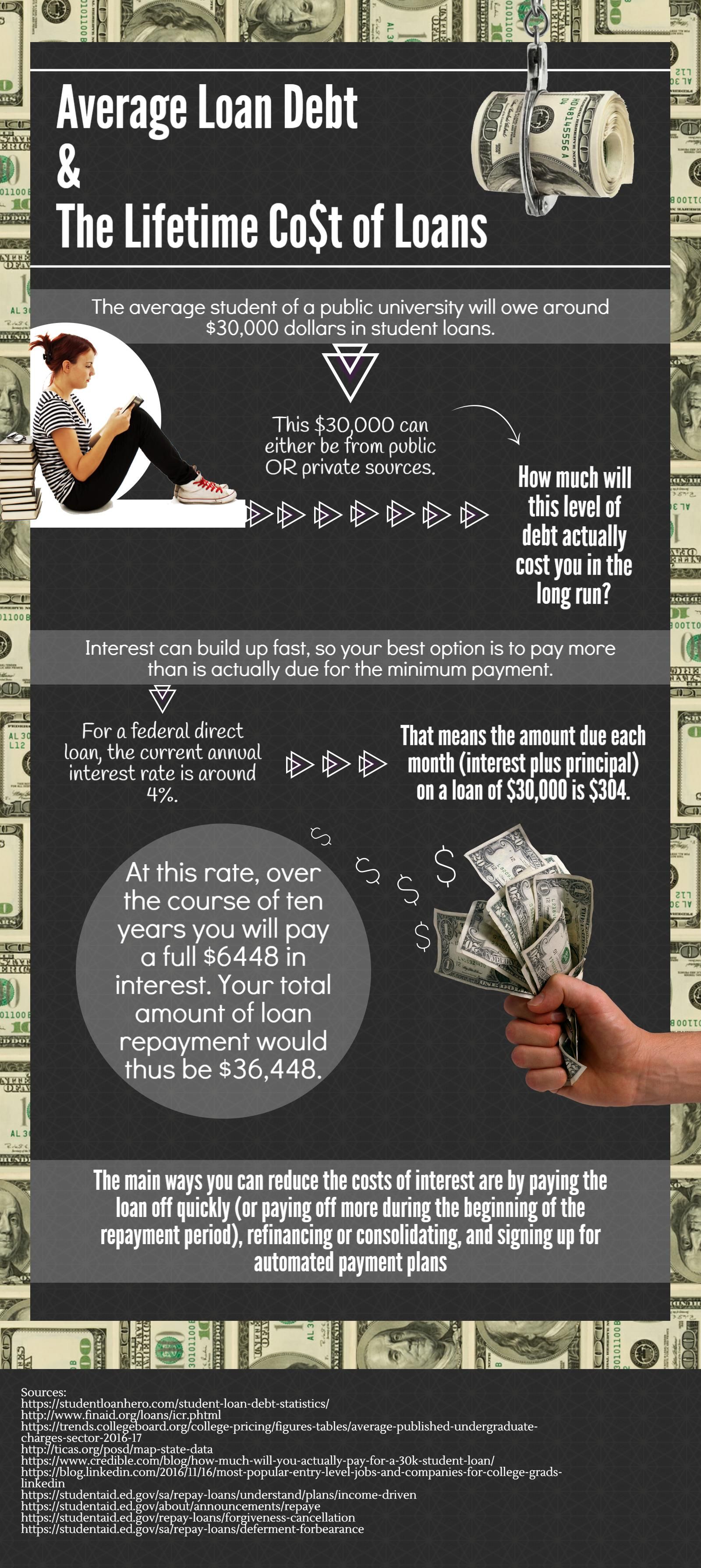

Average Loan Debt and Lifetime Cost of Loans

The average student of a public university will owe around $30,000 dollars in student loans, either from public or private sources.

How much will this level of debt actually cost you in the long run?

Standard repayment plans usually have a minimum payment of around $50. However, since interest can build up fast, your best option is to pay more than the minimum amount. The standard length of a typical repayment plan is ten years.

For a federal direct loan, the current annual interest rate is around 4%. That means the amount due each month (interest plus principal) on a loan of $30,000 is $304.

What does that mean for you over the course of 10 years?

You’ll be paying a full $6,448 in interest alone.

Your total amount of loan repayment would be $36,448.

Of course, the less you initially borrow, the less total interest you will pay over time. Also, if you pay off your loan before the full ten years is up, you will pay less interest. This is because interest accrues with time and total balance due.

When you begin repaying your loan, your payments are going mostly towards interest, with not much going towards the principal. The main ways you can reduce the costs of interest are by paying the loan off quickly (or paying off more during the beginning of the repayment period), refinancing or consolidating, and signing up for automated payment repayment plans.

Entry Level Jobs: How much of my salary will go to paying off my loans?

If you have a decent-paying job right out of college, consider yourself extremely lucky. The unemployment rate for recent college grads is high, which makes paying off loans difficult. Listed below are some of the most common entry level jobs for 2016 graduates with a bachelor’s degree.

Let’s take a look at how far their starting salaries go when you take into account the average student loan debt which is $30,000 and a monthly payment of $304.

- Accounts Manager

- Salary: $50,000

- Percentage of income (before taxes) going towards your student loan: 7.3%

- Software Engineer

- Salary: $80,000

- Percentage of income (before taxes) going towards your student loan: 4.5%

- Business Analyst

- Salary: 60,000

- Percentage of income (before taxes) going towards your student loan: 6.1%

- Customer Service Representative

- Salary: $35,000

- Percentage of income (before taxes) going towards your student loan: 10.4%

- Administrative Assistant

- Salary: $40,000

- Percentage of income (before taxes) going towards your student loan: 9.1%

Obviously, the more you are making each month, the less proportion of each month’s earning will be going to your student loans if you are paying a constant amount. If you are making less money, it can be harder initially to pay off your debts. Luckily, there are many different options for managing your loans, including income-based repayment plans which can help you make lower monthly payments while you are getting your footing in a new career.

So what are all the options when it comes to repayment plans?

Income-Driven Repayment Plans

Income-based plans base your monthly payment off of your current income and family size.

The income-based plan requires you to pay 10% of your discretionary income each month towards your loan balance. This means money which is not going towards rent, childcare, or other necessary expenses.

Even if your income goes up, you will never be required to pay more than you would under the standard repayment plan. So if you get a raise, you can rest assured that you will still not be paying more than you would under a different plan.

REPAYE Plan

The revised pay as you earn plan is always 10% of your discretionary income, regardless of the level of your earnings.

This may exceed the monthly payment under a standard plan, depending on your income.

ICR Plan

The Income-Contingent Repayment Plan charges you whatever is the lower value of the following two totals:

- 20% of your total discretionary income (not including rent, etc.)

- What you would be paying on a fixed repayment plan over the course of a 12 year repayment plan.

Standard Repayment Plan

This plan has fixed payments for 10 years.

The monthly payment will be the same each month, and will depend on your total loan amount.

Graduated Repayment Plan

Under this plan, you pay more over time than you would on the standard plan. However, you have the benefit of making lower payments for the first two years, before the monthly payments increase.

The downside of this benefit is that you will be paying more interest over time. But it is useful for people who cannot find a job right out of college and therefore will struggle with monthly payments on a high loan balance.

The Extended Repayment Plan

These payments can be fixed or graduated, and the repayment period can be extended up to 25 years. This is helpful if you have an extremely high loan balance, but be aware that you will accrue much more interest over time.

Additionally, you’ll only qualify for this repayment plan if you owe over $30,000 in federal loans.

What is student loan forgiveness?

Some people qualify for student loan forgiveness by the federal government. In order for your student loan to be forgiven or discharged, you must show proof that an extenuating situation has arisen and disabled you from repaying your debt. Click here to learn more about student loan forgiveness.

In order to qualify, you must meet one of the following qualifications:

- Borrower is permanently disabled or dead

- The school closed before you were able to graduate

- You were unfairly scammed and took out loans to attend a for-profit university

- Bankruptcy (but this is a very rare case and will negatively affect your credit in a major way)

- Teaching in a qualifying public school for multiple years

- Working in public service or non-profit work for multiple years

- Serving in the military

What is forbearance?

If you are unable to make on time monthly payments, you may qualify for forbearance. This is when you ask your lender for more time to make loan payments during times of financial hardship or illness. It is up to the lender to decide whether or not to grant forbearance.

You can also earn mandatory forbearance by attending dental or medical school residency, serving in public service or the military, teaching, or holding other public service jobs that would qualify for forgiveness.

You may also qualify for deferment, which happens automatically. Forbearance usually happens when you do not qualify for automatic deferment. Deferment occurs when you are enrolled half or full time in undergraduate studies, enrolled in graduate studies, enduring a period of economic hardship, serving in the peace corps or military, the year following return from the peace corps or military, or during unemployment.

Student loans can be tricky to understand. But, with the cost of tuition rising and the average student loan debt increasing, it’s in your best interest to learn all the options.

After all, who really wants to pay an exuberant amount of interest?

Leave a Reply