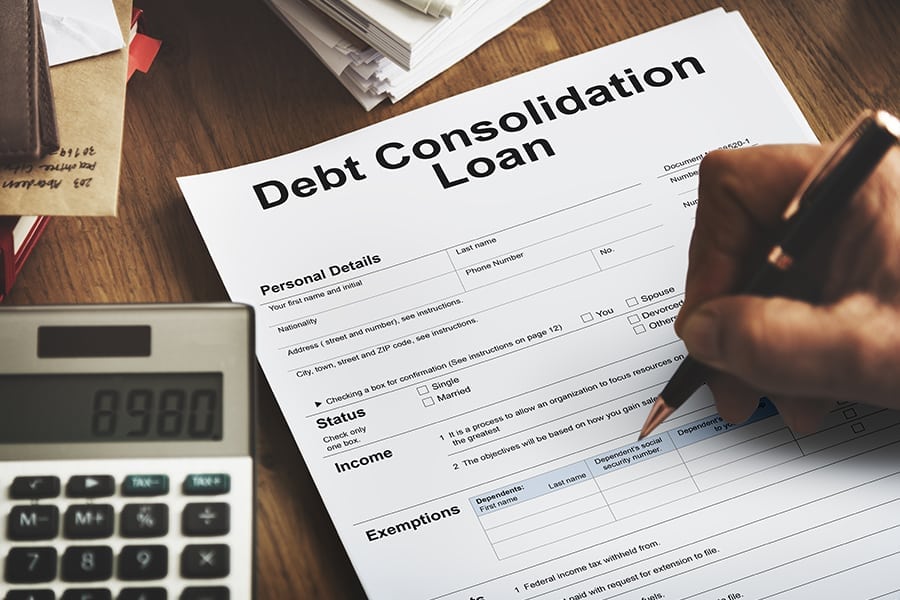

There are many debt consolidation programs any borrower could easily enroll in today.

Debt consolidation and other debt relief programs can tremendously help one manage their finances.

Therefore, these programs are quite popular.

However, because of this, fraudulent debt consolidation companies become harder to spot and they get away with their illegal services.

So, you must know which debt consolidation programs are right for you.

Here are the best debt consolidation programs from the best student loan consolidation companies in the country.

Best Debt Consolidation Programs

This post was originally by FinancialWellness.org and shared with permission

1. SoFi | Student Loan Refinancing

Sofi is one of the few finance companies that offers debt consolidation programs while simultaneously refinancing your student loan, whether they are federal or private loans.

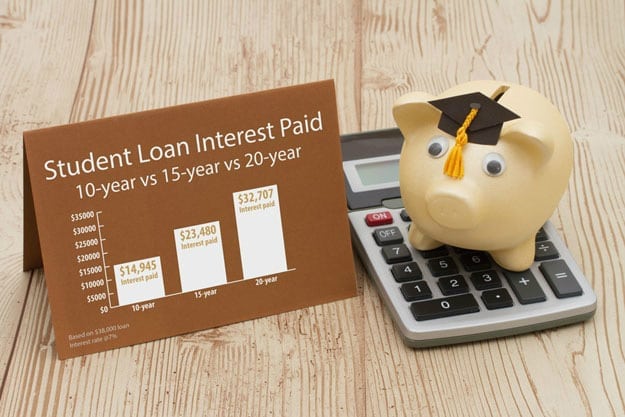

(Did You Know? A Consolidation can lower monthly payment, reduce a loan term, provide forgiveness benefits, and average out high-interest loans. Find out if you should consolidate your federal student loans with the complete 17-page guide of the most important factors to consider. Click here to learn more and get the free guide.)

With a growing community of 350,000 and trust and security of $20 billion, the company continues to attract new members for this program.

- Variable Rate: From 2.815% to 6.740% APR

- Fixed Rate: From 3.350% to 7.125% APR

- Highlights: Federal and Private Loans | Unemployment Protection | Career Support | Refinance Parent PLUS Loans

- Drawbacks: Not Available in Nevada | No Co-signer Release Option

2. Common Bond | Refinance Student Loans

With three refinancing programs, CommonBond allows debt consolidation loan for your student loans for lower interest rates on your payments.

Besides the variable and fixed rate programs, this company also offers hybrid rate loans where the first five years will be based on a fixed interest rate, and the remaining five will be converted into a variable rate.

The edge of a hybrid program is to reduce monthly payments and total interest due.

- Variable Rate: From 2.81 to 6.74% APR

- Fixed Rate: From 3.35 to 7.12% APR

- Hybrid Rate: From 3.77 to 6.22% APR

- Highlights: Personalized Competitive Rates | Protection Through CommonBridge Program | Co-signer Release Available

- Drawbacks: Not Available in Idaho, Louisiana, Mississippi, Nevada, South Dakota and Vermont

3. LendKey | Refinance Student Loans

LendKey is another company that provides a consolidation-refinancing program for student loans.

Like SoFi, they can combine federal and private student debts into one account with lower interest rates.

- Variable Rate: From 2.67% APR

- Fixed Rate: From 3.25% APR

- Highlights: Flexible Options | Lowering payments | No Origination Fees

4. Citizen’s Bank | Education Refinance Loan

Citizen’s Bank is another company that offers fast and easy application of student loan refinancing with the option of consolidating your federal and private debts.

The main edge of their program is they do not charge extra charges for prepayment penalties, application and disbursement fees.

- Variable Rate: From 3.63% to 7.63% APR

- Fixed Rate: From 5.44% to 7.64% APR

- Highlights: Loyalty Discount | Automatic Payment Discount | Co-signer Release Available

Want to see the full article?

Click here to read the full article on FinancialWellness.org

Whatever your financial situation is, do not be afraid to explore different student debt consolidation programs and management plan from your trusted consolidation company.

Many borrowers have done it and have achieved debt relief from these student loan consolidation companies.

Although finances should be dealt with immediately, it does not help if you deal with it the wrong way.

Finding the right debt consolidation program with the repayment plan which suits you will ease the burden or repayment to your lenders.

Your minimum payments will definitely help as soon as you continue doing so. Soon, you will not even notice that you are already free of debt and far from bankruptcy.

(Note: ‘Should I consolidate my student loans?‘ is a question we get all the time here. That’s why we created this easy guide you can download for free to help you understand if a Student Loan Consolidation is the right choice for you. Click here to learn more.)

Which debt consolidation programs do you recommend? Let us know in the comments section below.

Up Next: How To Consolidate Private Student Loans

Editor’s Note: This post was originally published on October 18, 2017 and has been updated for quality and relevancy.

Leave a Reply