You might have realized that student loans are becoming more and more expensive each year.

Interest rates are rising, and people are borrowing more cash than ever before.

You could have a good paying job, and still be crippled by your student debts.

Thankfully, there are a few ways in which you will be able to save money on your student loans.

And we’ll start you off by giving you 6 ways to save money on student loans.

These methods will not eradicate your entire loan, but by using these techniques you may be able to shave just enough off to make your life more comfortable.

Rise in student loans

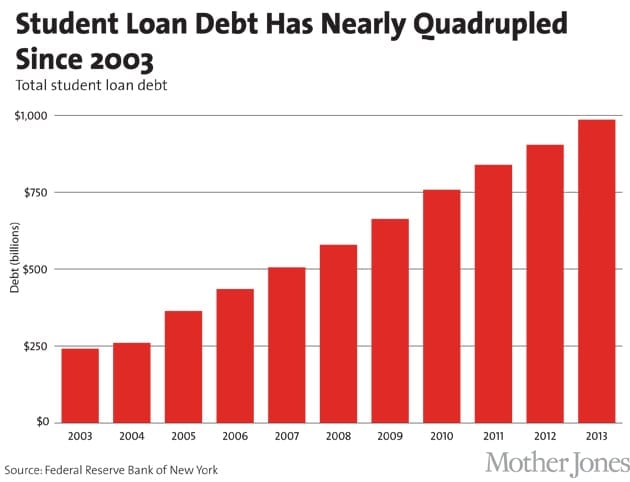

Does it shock you to find out that since 2003 the amount of student debt has quadrupled?

Yes, we said quadrupled.

And the problem is only going to get worse.

People are borrowing more money than ever before.

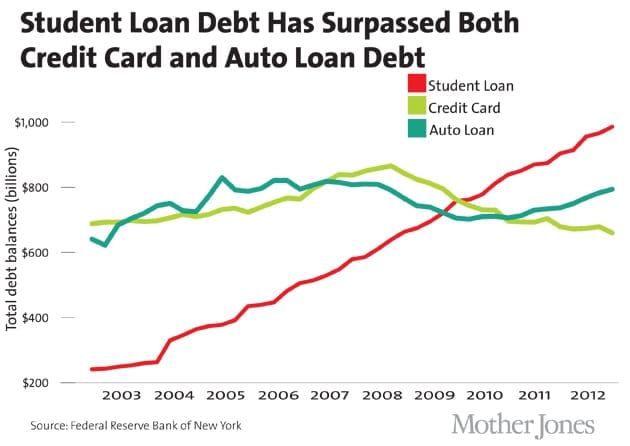

Student loan debt is quickly surpassing credit card and auto loan debt.

This means people owe more to student loan companies than they do to their credit card companies.

This is the first time in history that this has happened.

Of course, student debts are always going to be higher than credit card debts.

They usually amount to tens of thousands of dollars.

However, when you realize that just a small fraction of the American population have student loans, and the majority of the population has credit card debt, the issue becomes clear.

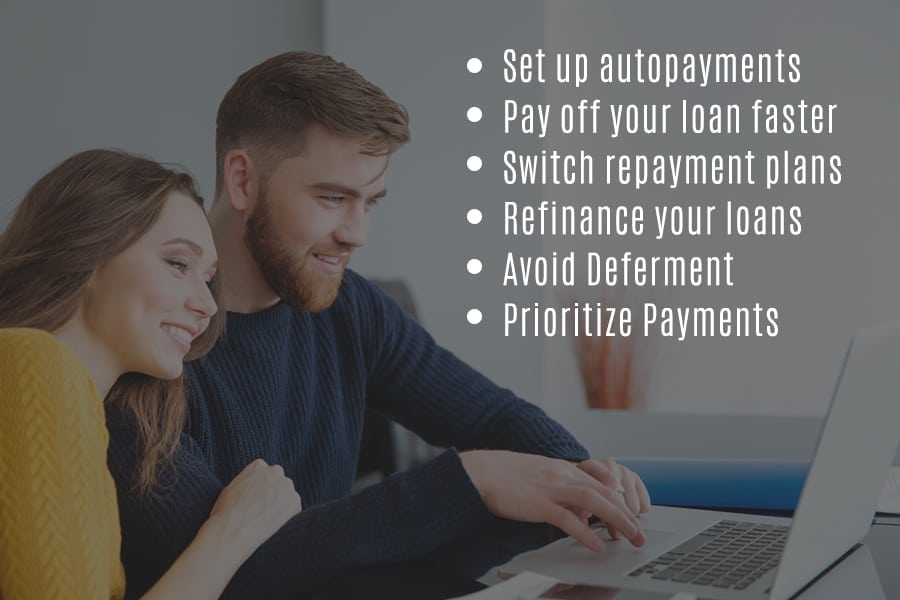

Here are some ways to save on student loans

Auto payments on your loan

According to the Huffington Post, you should try and set up a system where your student loans are paid each month automatically.

There are a few benefits to doing this:

– The system will make sure your bills are paid on time each month. This means that you will never have late payment fees.

– Some lenders will give a small reduction in interest rates if you set up an auto payment on your loan. They’re able to do this because auto payments are a reassurance that they’ll get their money back on time.

– It makes budgeting easier as you know when money is going to leave your account to pay your debts. If the money is set up to leave your account automatically, you know you can’t touch that cash.

Pay off your loan faster

If you can make larger payments towards your student loan, then do so.

Yes, you will need to spend more cash in the short term, but the quicker you pay off your loan, the less interest you will be paying.

You will be surprised at how quickly you can break free from your student loan debt when you just pay a couple of hundred extra dollars a month.

In fact, just one hundred dollars a month will go a long way.

Change your repayment plan

Most lenders will put you on a default 10-year repayment plan.

In entry level positions, the cost of paying your loan back this quickly may be a bit expensive.

This is why you should talk to your lender.

In many cases, they may be able to extend their repayment plan for you.

In fact, in many cases, it will be in their best interest.

It increases the likelihood that they are going to get paid, and they will earn more from you in the long run.

Refinance your student loans

When you refinance your student loans, you will most likely be reducing your interest rates.

This is a new process in relation to student loans, and thus very few companies offer it right now.

But it is always worth researching.

The process has been designed to be as simple as possible and involves the following:

– You can refinance both federal and private loans. You can do both, or just one.

– The lender will pay off your old debts.

– You will be given a single, monthly payment to make. This will be easier to manage.

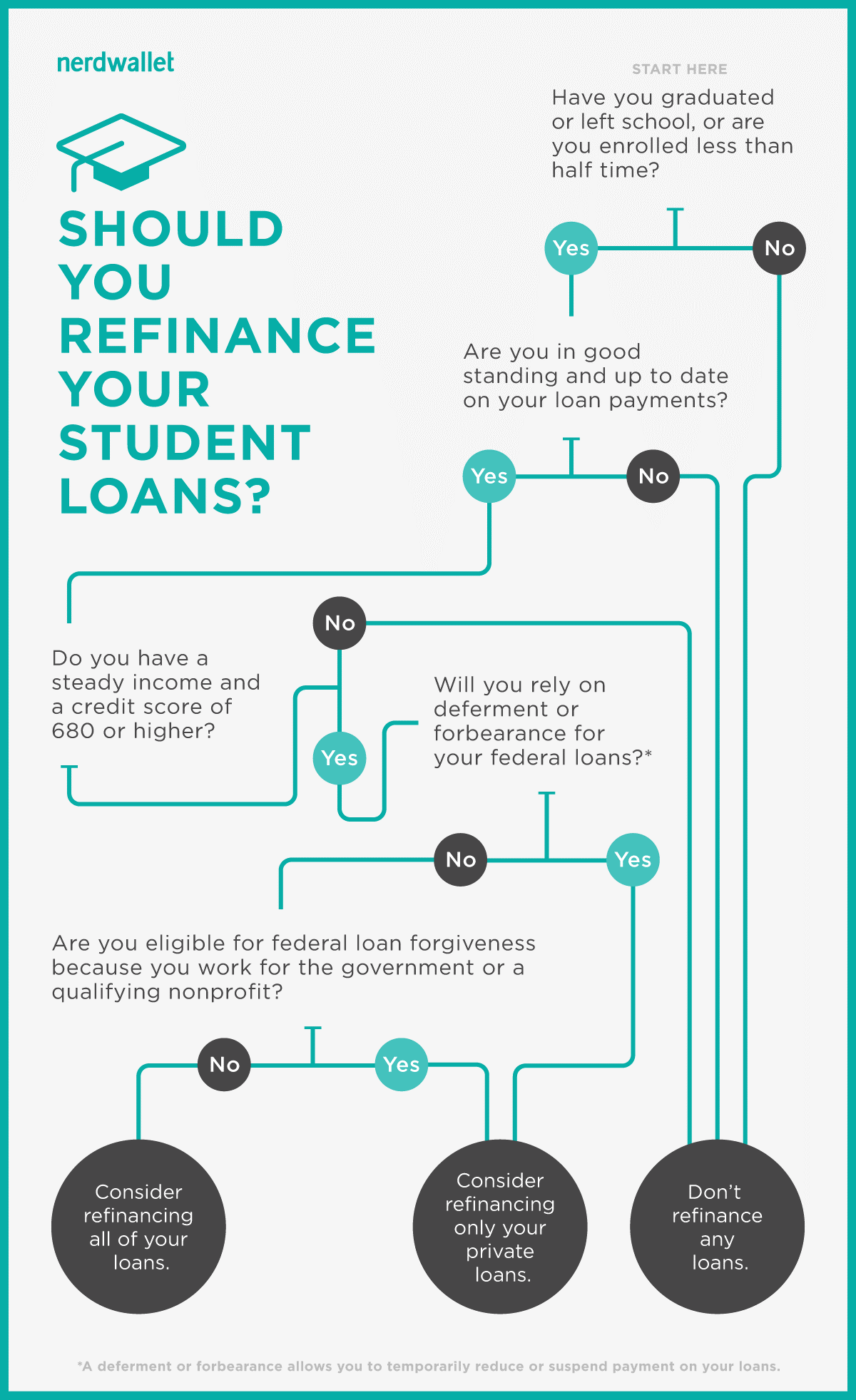

It is worth noting that not every person out there will get benefit from refinancing their student loans.

This handy infographic from Nerd Wallet will help you to decide whether this method will be right for you:

Source: https://www.nerdwallet.com/blog/loans/student-loans/student-loan-refinancing-2015/

Try to avoid loan deferment if possible

It can be tempting to get a bit of ‘breathing room’ from your loans from time to time, and some people may need that.

However, only use loan deferment if you have no other option.

If you can afford your loans, do not go down this route.

Why? Well, for the following reasons:

– Loan interest is still going to continue accruing. This will increase the cost of your loan.

– You may start to tie yourself up in other types of credit. As a result, when you need to start paying your loans again, you don’t have the spare cash that you need to cover them.

– You will end up with a far bigger balance when the loan starts again, which is just going to make the problem worse, particularly if your circumstances have not changed.

A better option would be to see if you can lower your student loan monthly payment.

Prioritizing payments

Always aim to pay off the student loan with the highest interest rate first.

Of course, spread the payments over the loans, so you are covering them each month.

But, if you have any spare cash, you should always put it towards the highest interest rate loan.

It will save you a lot of money in the long run.

This loan is my nephew but I am the cosigner do u know how sallie mae works at all?